CME Group

@CMEGroup

CME Group is the world’s leading derivatives marketplace.

What’s driving the surge in crypto trading activity? 📈 Q2 saw record daily volumes and a massive jump in Ether futures trading. Our report analyzes the key drivers, from institutional adoption to new product liquidity. Get the full story ➡️spr.ly/6017fyq7N

CME Group Inc. Reports All-Time Record Revenue, Adjusted Operating Income, Adjusted Net Income and Adjusted Earnings Per Share for Q2 2025. Click below to read more ⬇️ spr.ly/6016fyc0Q

EUR/USD's rally: is the U-turn coming? ↩️ Rich Excell explores fundamental and technical indicators, suggesting a potential reversal or downside for the EUR/USD pair. spr.ly/6013fHYcB

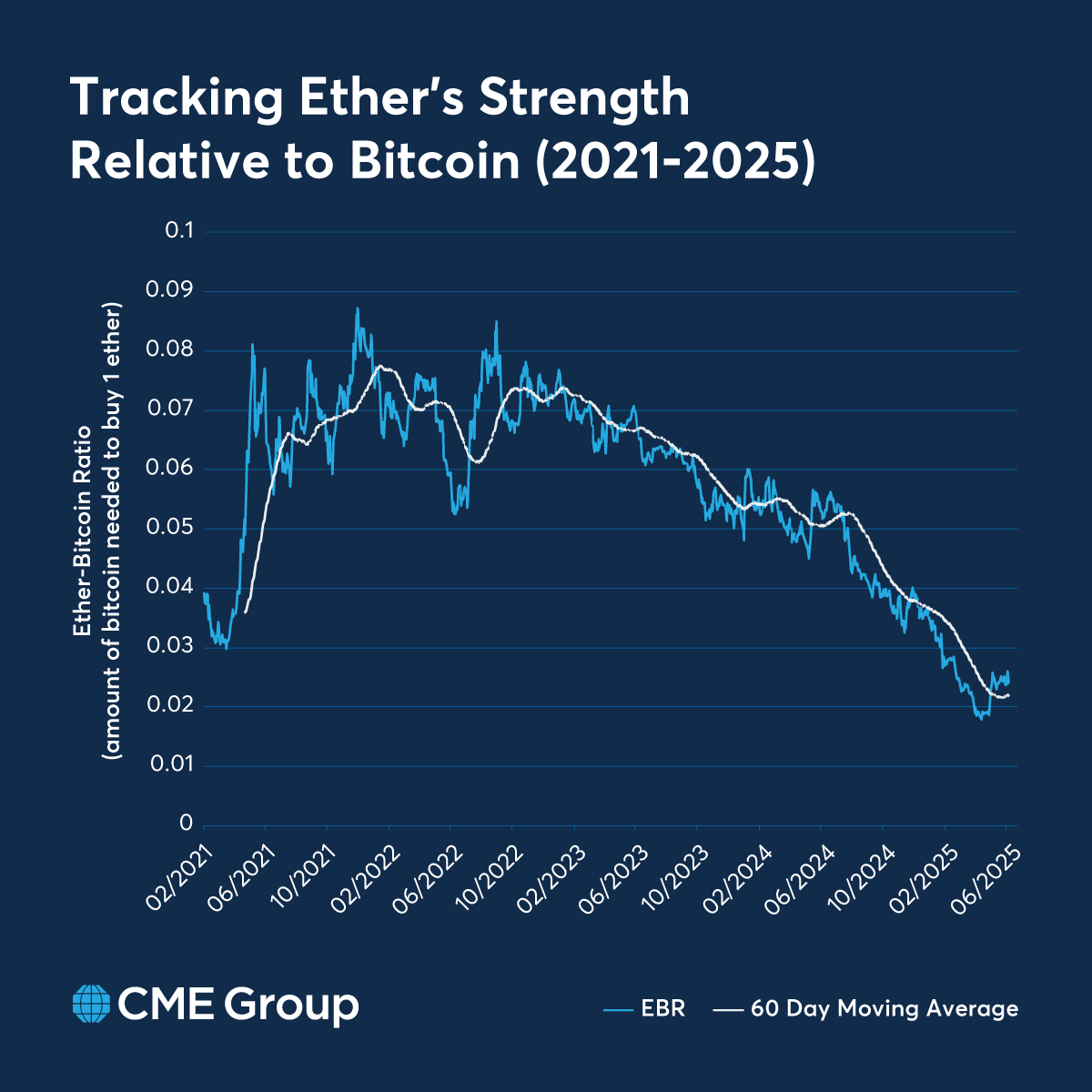

ETH/ BTC dynamics are shifting again. 📊 This explainer still offers a clear insight into how traders are acting on it. ICYMI ➡️ spr.ly/6014fG8CG

From crude to corn, fuel your trading strategy with a single, powerful contract that captures broad-based commodity exposure – FTSE CoreCommodity CRB Index futures are now live. Explore the contract ➡️ spr.ly/6010fBIop

Traders continue to turn to Equity options to mitigate market volatility, nearly 24 hours a day. With non-U.S. hour volume reaching a record of 259K contracts in 2025, Equity options allow you access to the world's benchmark indices to effectively capitalize on earnings season…

Reaching new heights requires power and precision. Huge congrats to Robert Sánchez on being named the best goalkeeper at the 2025 #FIFACWC! ⚽️🏆

Golden glove winner. 🏅

We heard you, and it's finally here. Dive into our new, fully customizable Trading Simulator, where you can: 📈 Experience cutting-edge charting tools. 😎 Tailor your trading environment to fit your style. 🖥️ Learn to trade the futures market, not just watch it. Practice now…

Is ether's recent strength against bitcoin signaling a new shift in the market? 📈 Find out how traders are using this dynamic to spot new opportunities and what the data reveals about this trend. Read our analysis ➡️ spr.ly/60104ATxY

Record trading in Tuesday options, again. Following yesterday's record (74K traded, 86K OI), Tuesday-expiring #Treasury options are again seeing record activity with over 124K contracts traded as of 9:30 a.m. CT.

Newly launched Tuesday Treasury options seeing big demand ahead of #CPI, with a record 62K contracts traded so far today.

As 2025's midpoint approaches, dive into Inspirante Trading Solutions' Fresh from the Trading Room to uncover compelling opportunities from the weakening dollar's paradigm shift. spr.ly/60154NFlX

This year gold hits new record highs, surpassing $3,500 for the first time. Silver follows, peaking above $37/oz, yet still trails 1980 and 2011 highs. Discover the reasons behind the lag in our latest article ⬇️

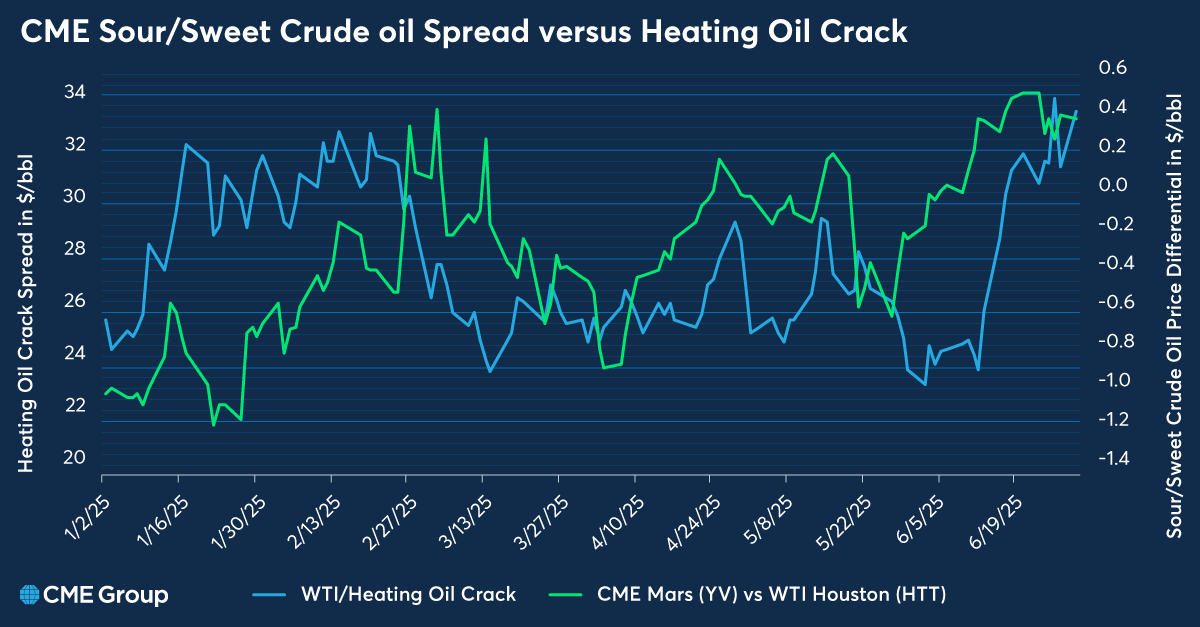

#OOTT Sour crude now tops sweet. PVM breaks down the shift and its likely reversal. spr.ly/60134avaW

Spot-Quoted futures are built for traders looking for cost-efficient, precise access to our suite of U.S. indices and cryptocurrency markets. Watch our on-demand webinar to learn the basics, see trading use cases and get all the contract details you need from industry experts to…

Navigate possible yield curve volatility with Treasury options in a call calendar strategy. Rich Excell Investigates -> spr.ly/60144aZL8

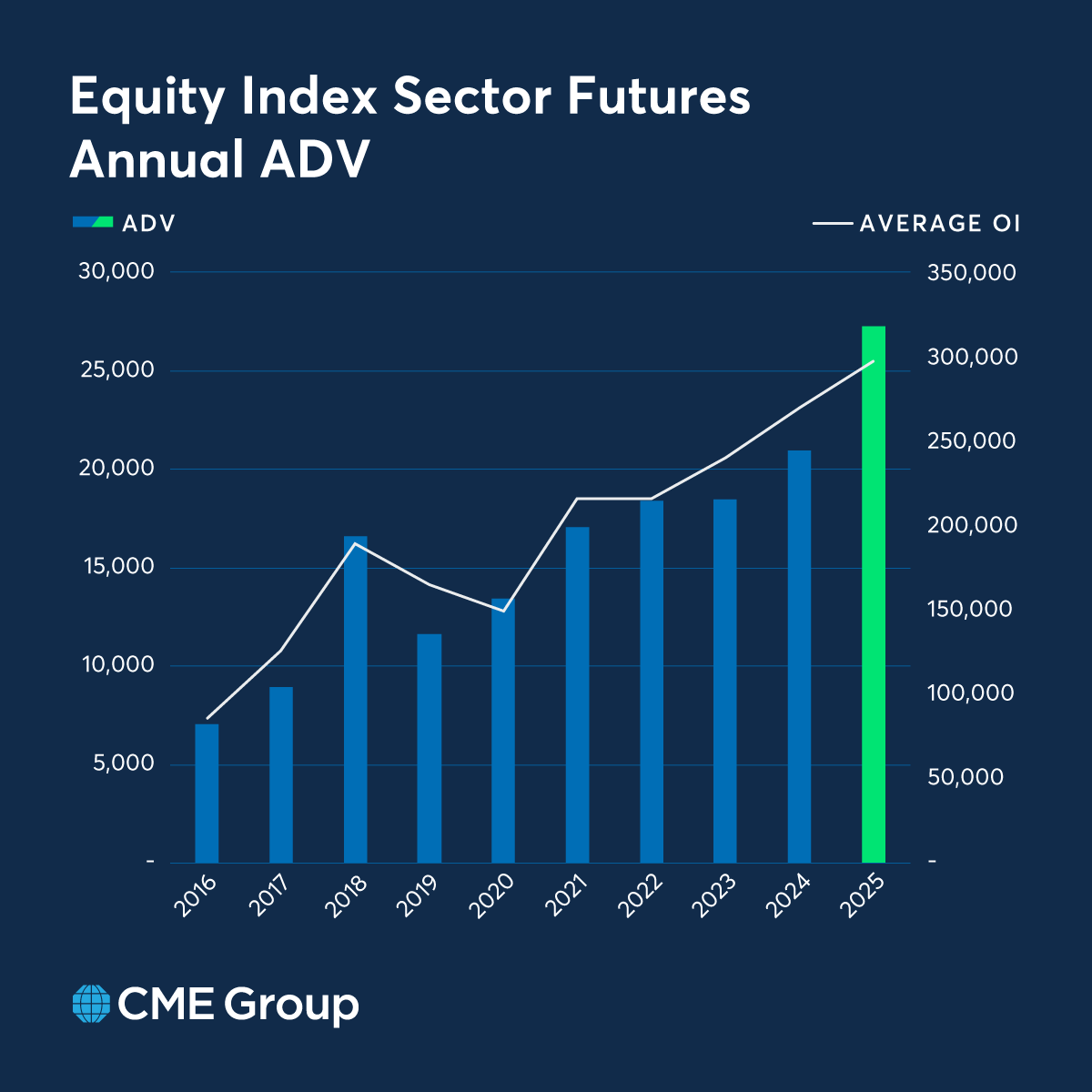

Equity Index Sector futures ADV is at a record high of 27K contracts this year, up 30% vs. 2024. Open interest is averaging a record 436K contracts, up 10% vs. 2024. See how Sector futures can help you hedge potential surprises this earnings season. spr.ly/60114t0FV

Platinum is recognized as a strategic metal in China, essential for the proton exchange membrane (PEM) technology used in hydrogen fuel cell electric vehicles. Discover how China's imports of platinum have surged to support its green energy ambitions. spr.ly/60154mHlD

#FedWatch: Calls for three cuts in 2025 fade. After today's jobs report, markets are now pricing in two rate cuts in 2025 (year-end target range of 375-400 bps) as the most likely scenario.