Seth Golden

@SethCL

I specialize in VIX, Retail, Consumer Goods. Hedge fund consultant, chief market strategist Finom Group

When 1st announced, our rolling 12-month price target objective would take $SPX through Q2 2025. We understood it didnt look appetizing at the time. SPX finishing 2024 at 5,881, our price objective looks more realistic to onlookers, representing +5% upside. For all the data and…

Comparing $SPX trend after Apr8th low to average path off 8 recessionary bear market lows since 1957. SPX gain of +26.5% over last 3½ months is about 4-5% ahead of average path of newly-birthed cyclical bull mrkts. Something else is GOING on, and SPX is screaming😱 about it!…

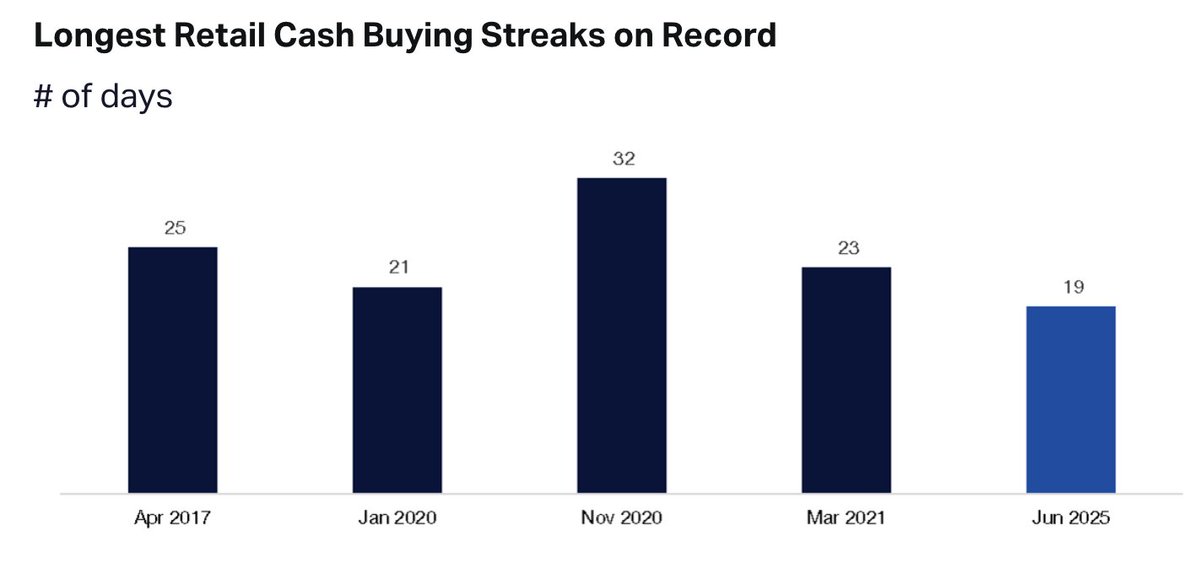

No room for institutional money, retail has elevated! Retail activity has been a buyer of equities for the past 19 straight trading sessions. This is the longest daily buying streak in the past 4 years (since March 2021) and 5th longest streak on record. Who's the smart money?…

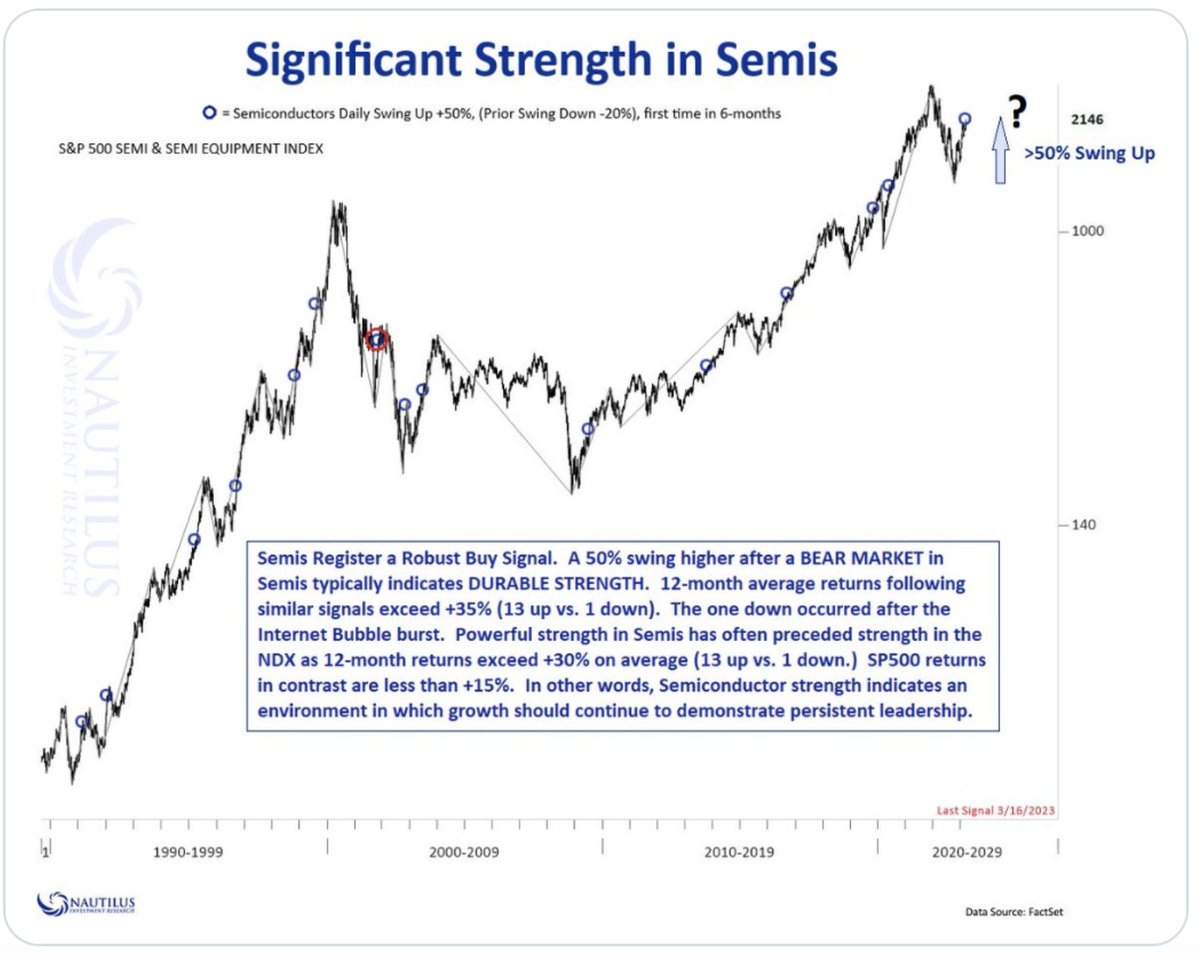

BOOM 💥BUY signal. 50% upswings in the Semiconductors, after a bear market. The last time this 50% signal triggered was March of 2023. Semiconductors would go on to gain another +75% over the forward 12-mon period. $SPX $SMH $SOXX $NVDA $MU $AMD $QQQ $SPY h/t @NautilusCap

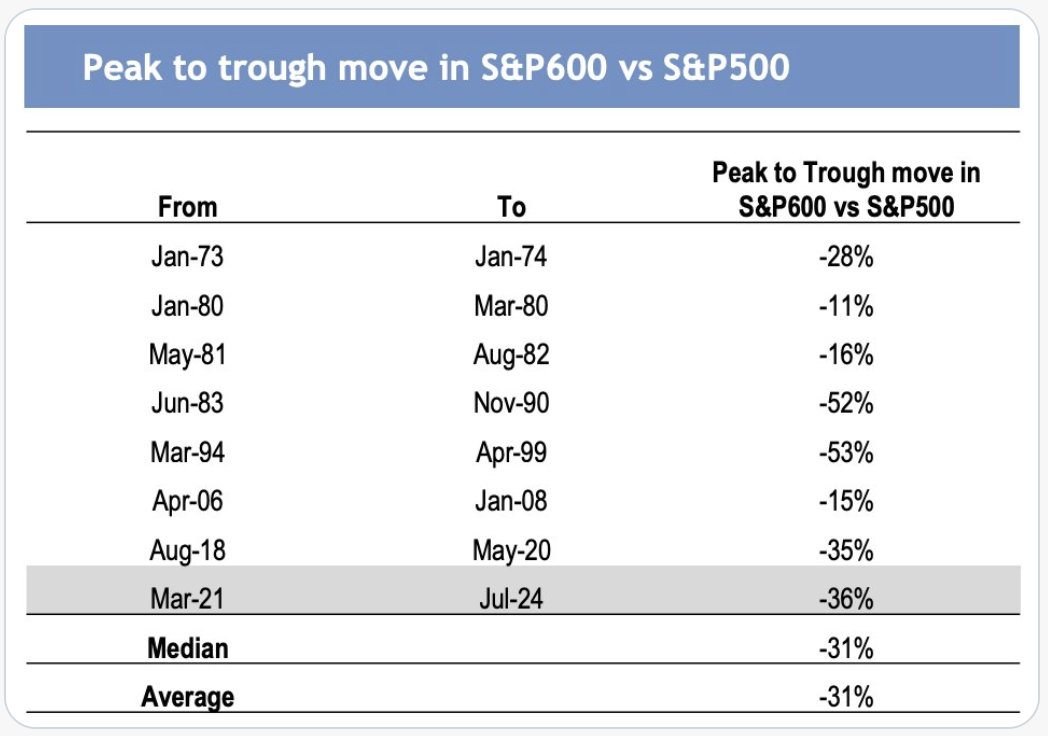

Small-cap underperformance relative to Large-caps has been greatest in its history, outside of a recession. Small-caps represent greatest US market opportunity, but may not become realized unless "higher for longer" relents. $SPX $ES_F $SPY $QQQ $IWM $RUT $NYA $TNA $RTY

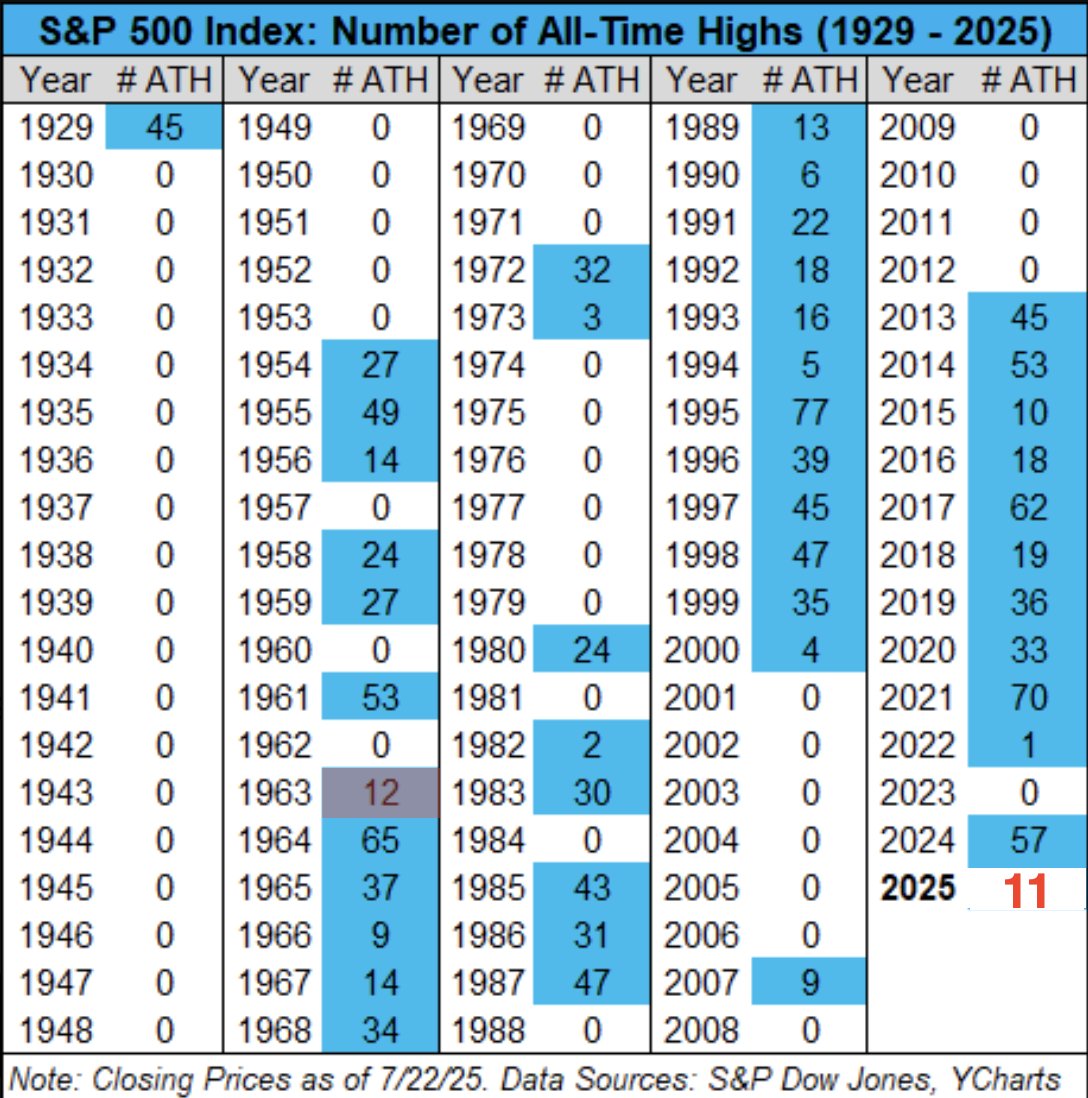

2 TINGS TO KNOW MA'AN $SPX has NEVER made 11 all-time highs in a calendar year and stopped making more (at least 12). Only ONE time has SPX made THE last all-time high in the month of JULY, my yute! $ES_F $SPY $QQQ $IWM $NYA $VOO $NDX $VIX

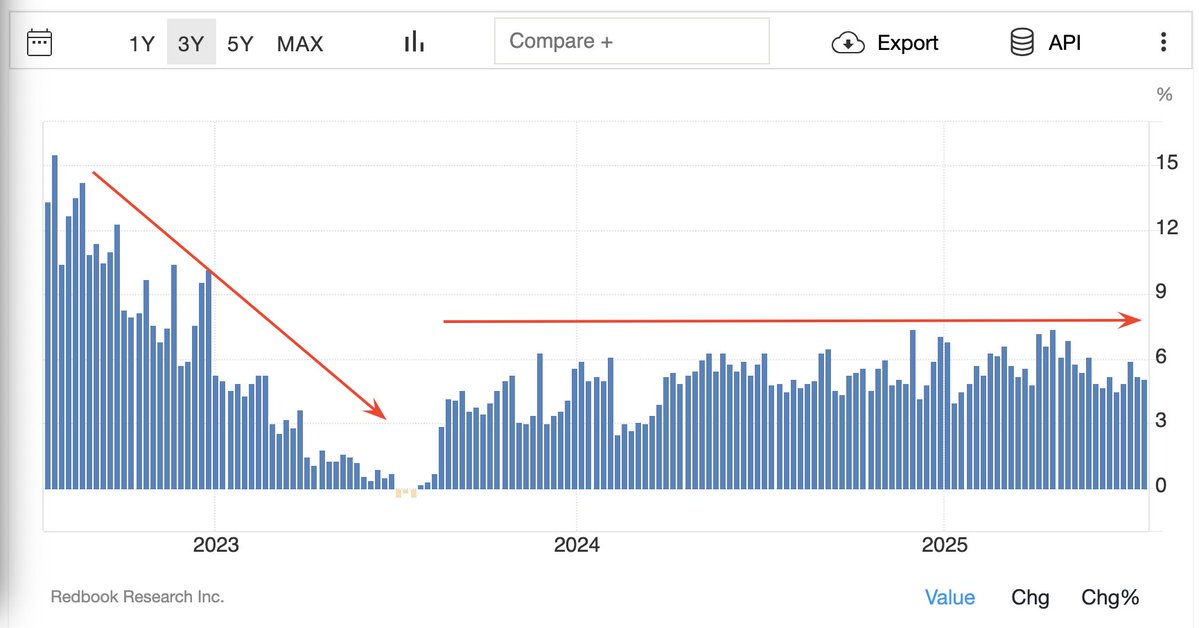

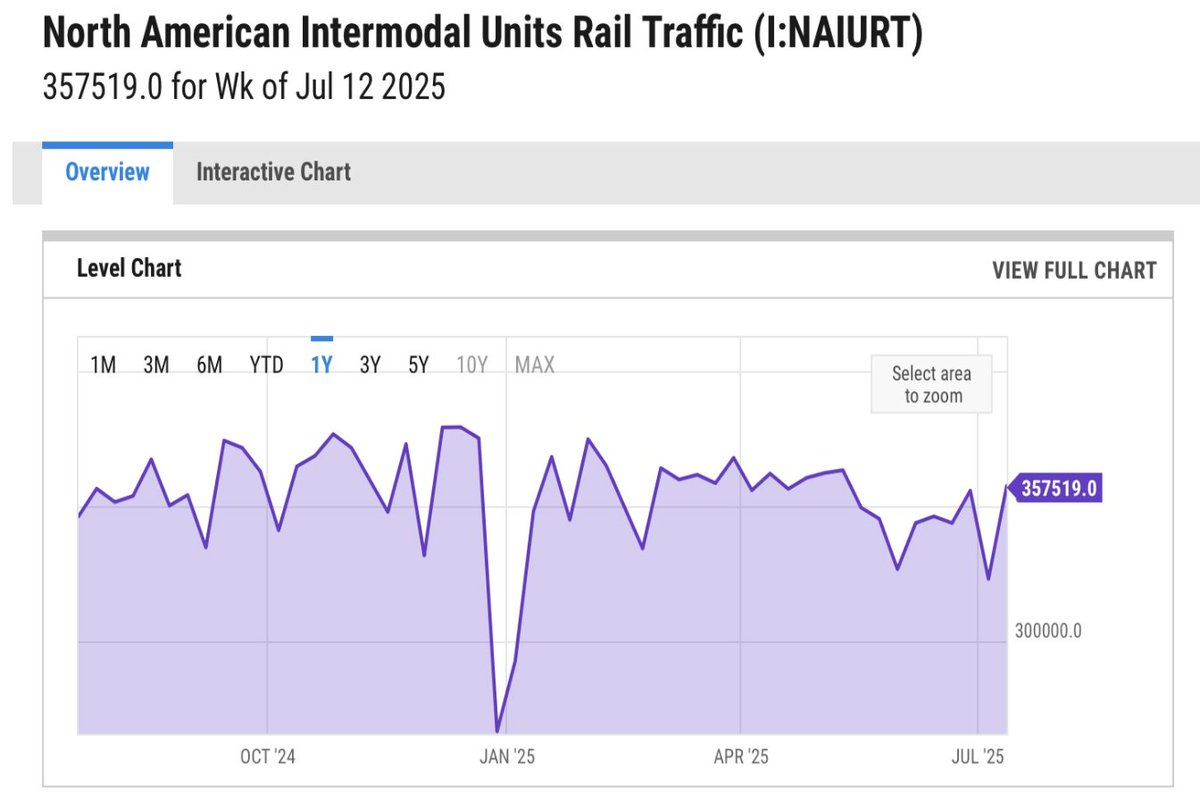

2 charts informing there is no real #consumer slowdown. From 2023 into 2024, you could have suggested as such, but NOT at all and not since. Intermodal traffic has been choppy in 2025, but highly resilient, informing those "turns on the shelf" need constant replenishment.…

I normally wouldn't make much of this, but going into earnings? Phil D. Gap showed up for work in a big way! Now the stock has made a complete B-line to a recent peak. Not an obscure move, but an overt move ahead of earnings. I got on board! $SPX $TGT $WMT $XLP $SPY $COST

Webster's Dictionary: Oxymoron: ox·y·mo·ron 💠a combination of contradictory or incongruous words such as "The Fed is being political because it won't acquiesce to the President's demands." Welcome to "Idiocracy" ~President Cruz

Good News: this quant will remain perfect if $SPX above 6,173 as of today. Bad News: June 27 price has been the low throughout quant period, no chance to buy a dip below the quant trigger price in the stated period. Nonetheless, remains perfect; this is "why we quant!" $ES_F…

Value vs. Growth: 3+ year low I would not continue to deny MAG-7, Large-Cap Growth or Nasdaq because you think a random stock is cheap or has finally based. Growth leads, Value lags and loses! $SPX $COMPQ $NDX $SPY $QQQ $IWV $IVE $MAGS

All of our short-VOL $VXX trades have proven profitable since. $UVXY and VXX both making lower cycle lows recently. Contango has risen to 9%. If it achieves 10%, "5% Rule" applies. To better understand 5% Rule feel free to read my 2017 article outlining talkmarkets.com/content/etfs/v…

Yesterday's 11th all time high for $SPX on the calendar year was also confirmed by the A/D Line making an all-time high. This is what they call "BULLISH" $ES_F $SPY $NYA $QQQ

Today's Chart of the Week was shared by @SethCL Click below to read more! 👇👇👇 finomgroup.com/market-mania-f… $SPX

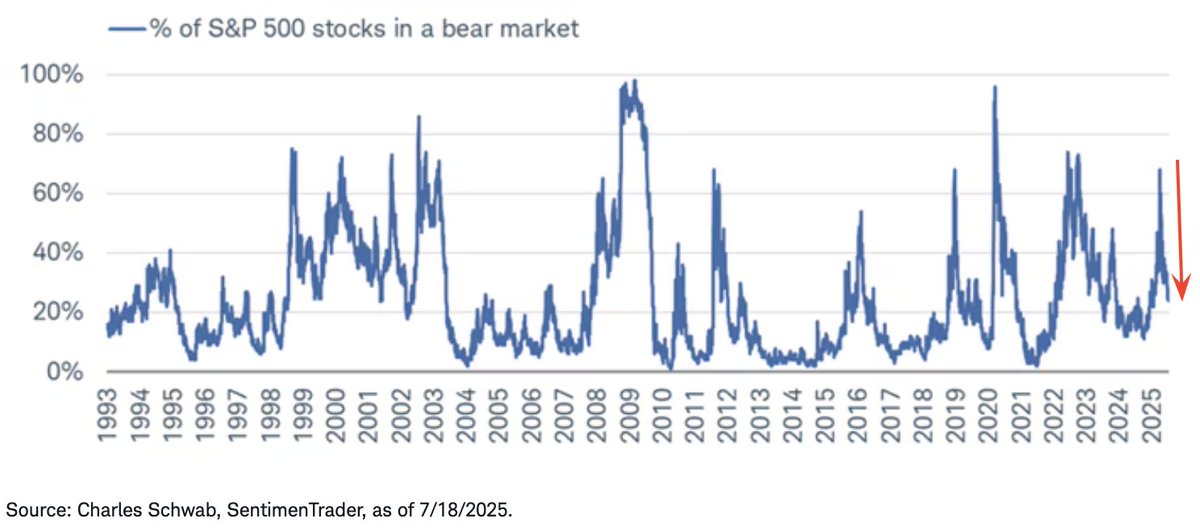

As of now, breadth is holding up well and, if anything, improving. As shown in the chart below, percentage of $SPX stocks in a bear market has been DECLINING sharply. $ES_F $SPY $QQQ $NYA $IWM $DIA $RUT $RSP $VOO