Prince | Accidental Investor 🇮🇳

@AI_Feb21

Proud & Long India 🇮🇳 | Student of Market | RT ≠ endorsement |🎙️Podcast Host | #AI | YouTube Link 👇

*Important Links* Pls Connect 👇 Accidental Investor Prince Twitter(x) - x.com/AI_Feb21 YouTube — youtu.be/1OFHKI_LCWY Telegram — t.me/Prince_AI_Feb21 WhatsApp Channel — whatsapp.com/channel/0029Va…

What lies beneath is far grimmer than it appears. It's time to brace for impact.

TCS to cut 2% of workforce, affecting around 12,000 jobs: economictimes.indiatimes.com/tech/informati…इस खबर के आने से दो दिन पहले ही ये पॉडकास्ट रिलीज़ किया है, AI के खतरे को समझो, फालतू की रील देखने से बेहतर है ये शो खुद देखें और बच्चों को दिखाएं. youtu.be/aFd7kl-7cFM

Success demands a lot more than we all think !

Massive Infrastructure and Coverage Expansion. - Investment Opportunities? Push for Domestic Manufacturing and Localization - Tailwind for “Make in India"? Digital Talent & Emerging Tech Focus - Bets on Tech & Skilling? Views invited!

India has unveiled the draft National Telecom Policy 2025 (NTP-25), on July 23, 2025, outlining a strategic vision to position the country as a global leader in telecom technology by 2030. The proposed goals include universal 4G coverage, 90 per cent population coverage with 5G,…

Worthwhile to read this and ponder about your goals and ways to achieve them. In an era of disruption, no point living in oblivion. C: @StableInvestor

You may want to work till 60. But that is not entirely in your hands. More so if you get laid off unexpectedly after your mid 40s. You are smart, so prepare accordingly. Remember, that F.I.R.E. can also mean ‘Forced Into Retiring Early’.

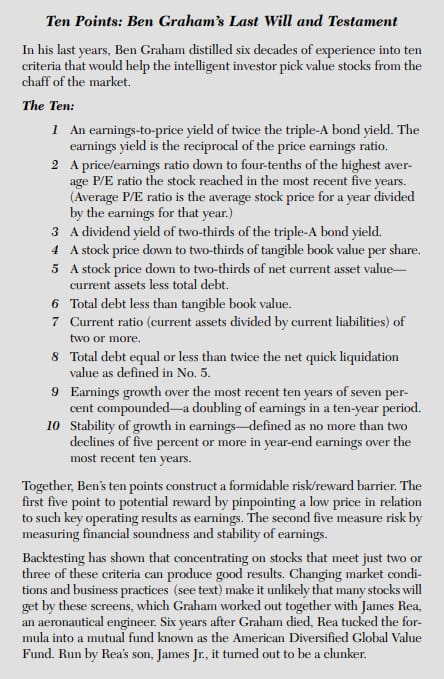

10 Investing Principles from Ben Graham’s Six Decades of Experience.

AI can certainly help cut down on the count of questions. A few good prompts are enough. C: @BrianFeroldi

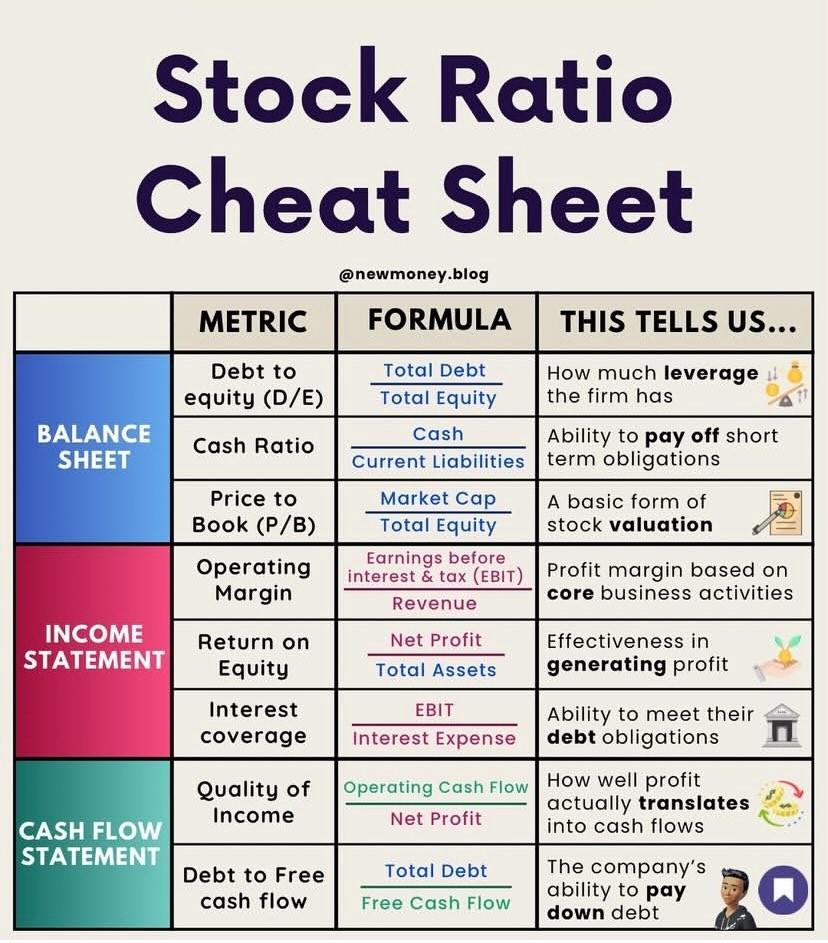

Stock Ratio Cheat Sheet! Metric -> Formula -> Inferences C: @InvestmentBook1

Sector agnostic framework—consumption, science, defence, technology ... anything and everything!

Many false twitter handles pretending to be me. Please note that I do not offer any education or group sharing of stock tips whether for free or for fee. Kindly avoid such fraudsters. @BeraShantanu

Prof. Sanjay Bakshi, renowned value investor, cautions: Recent research by his firm shows how dangerous it is to stay invested in an expensive market. Every time Nifty’s P/E > 22, average 3-year returns turn negative. ⚠️ Nifty P/E > 22 = Pain Ahead? 🧠 Valuation matters!

Prof. Sanjay Bakshi says that when Nifty’s P/E goes above 22, returns over the next 3 years are usually negative. blog.elearnmarkets.com/nifty-p-e-rati…

'How much to buy' > 'What to buy' 'Game of allocation' > 'Game of Probabilities'

95% of investors think about what stock to buy while top 5% are obsessed with how much to buy. Most of us make stock allocations either randomly or have some fixed amount in mind that goes into every new idea. This leaves a lot of money on the table. Because if you had a great…

"It ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward." - Rocky Balboa Indeed a super read. Highly recommended you all to read.

Jaypee Associates: A Deal Too Heavy To Carry? The story of India’s most ambitious infra bet, and how it unravelled. Dams. Expressways. Power Plants. Cement. Even an F1 track. JP wanted to build everything. And it did, on massive debt. Between FY14–FY23, JP sold over ₹50,000…

Help me identify someone who can help us understand the nuances of FTA agreement with the UK over a spaces session. Pls share handle names for ease in reaching out to them.

India stands out for its prudent approach - non-financial debt-to-GDP has stayed flat for 15+ years. While others leaned on heavy stimulus post-2008, India stayed disciplined. A rare case of stability among large economies. 🇮🇳📉

India is one of the few large countries in the world where non-financial debt to GDP ratio has remained flat for over 15 years. Government and corporates have been disciplined and avoided excess debt. After the global financial crisis, most countries have used fiscal and monitor…

For retailers who started recently. Let patience be by your side clubbed with consistency in hard work. Market will surely reward you'll bigtime. Stay the course! C: @PositivitySaid

Tax is the culprit?? 😲😲 Or we missing some nuances to it? C: Invest in Assets

Hey, @grok, who were the most famous people to visit my profile? They don't need to be mutual, don't tag them, just mention their names.