Antifragile Thinking

@unseenvalue

Playing for the unseen upside of randomness, volatility, and variability | Author: Framing Business Uncertainty https://antifragilethinking.substack.com/

antifragilethinking.substack.com/p/bliss-gvs-sh… #BlissGVS et al

If you can’t fully wrap your head around something, just steer clear, as no point getting tangled up in stuff that doesn’t make sense. There’s always a ton of other better bets out there, so just hang on to your cash and wait for the ones that click. After all, smart investing is…

Totally free—just register, no paywall substack.com/@antifragileth…

Sector agnostic framework—consumption, science, defence, technology ... anything and everything!

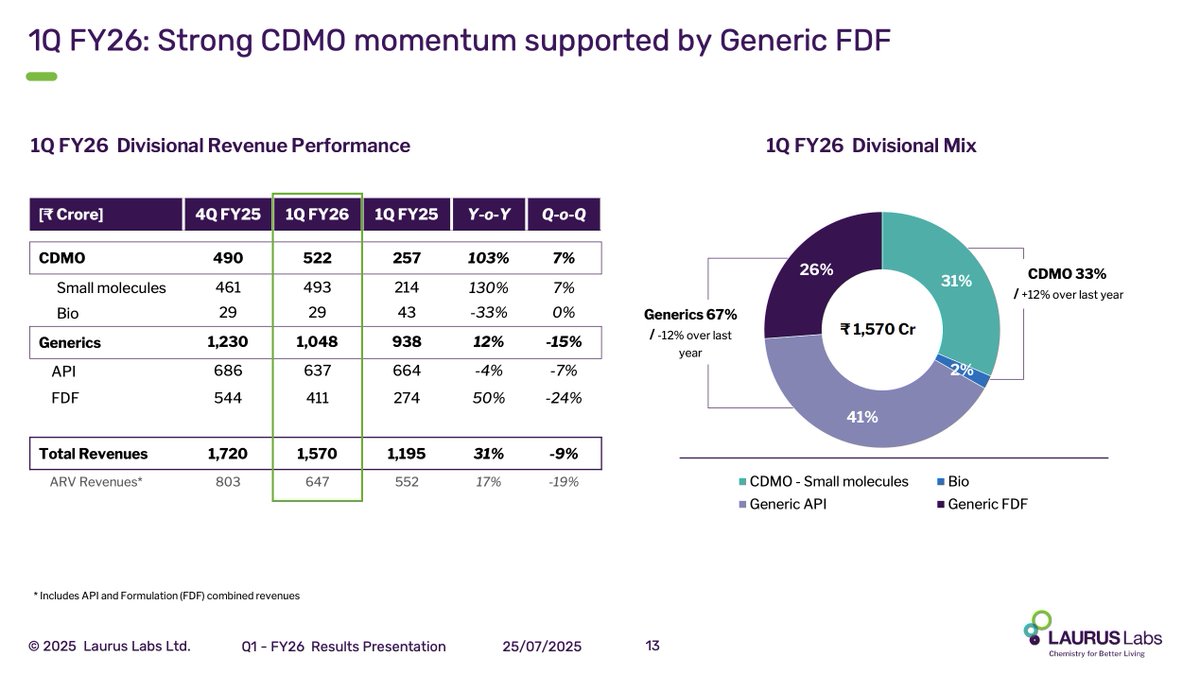

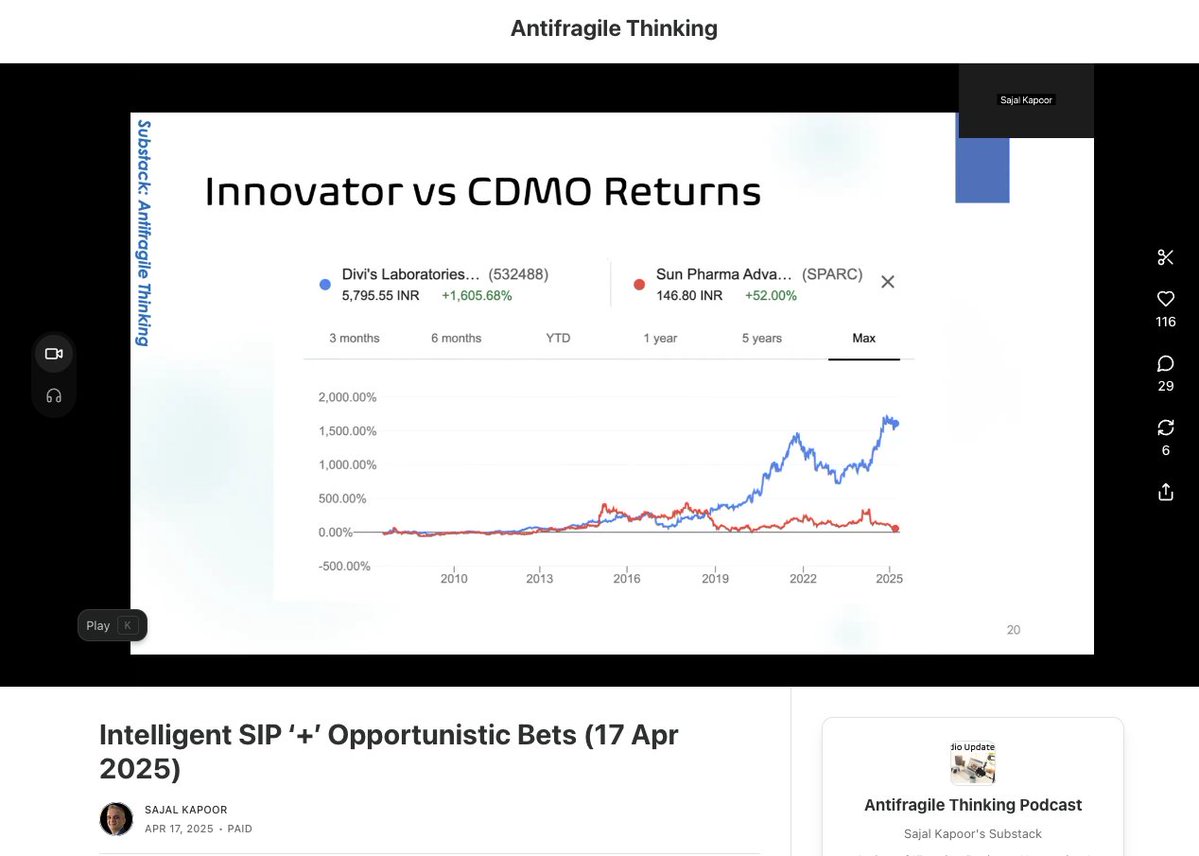

Coming out today. I’m putting together a quick video about the whole CDMO universe—covering all the major players—and I’ll share my thoughts on whether I’m planning to start, continue, or possibly stop my SIPs in this sector. Think high valuations. Think risks. Always.

What exactly is a CDMO? Who’s running the show — are the people behind it solid? What’s driving them — what motivates the team? What are the main risks in these companies? Where could things potentially go off the rails? How much are they asking for in terms of valuation?…

Agreed, However some guidelines would help, where market irrationality takes it to obscene levels.

Via Negativa! Not giving any guidance and the policy of “execution first” and then “repeat execution” is the best policy. Very few Indian companies talk less and do more. High quality people are rare. Dr Satya and team is a very high quality group. They listen to small investors…

By continuously talking about USD 1 billion sales in FY23, @LaurusLabs has killed any opportunity that was there to positively surprise the markets. If they do deliver those numbers, there’s no joy left. If they don’t for whatever reason ! .. there be unwanted wrath and loathe.

Look, management can tell you any story they want about "CDMO", but at the end of the day, it’s the numbers that really matter for investors. There are no less than 50 CDMOs in India, but most will fail to cross 10,000 Cr on-patent annual ingredients sales. Stuff like gross…

Starting something fresh—Random Question Time! Most of these will be totally free—no paywalls or premium stuff. I want everyone in the community to have a chance to join in and grow together. If you aren’t already, make sure you’re following Antifragile Thinking on Substack.…

Laurus CDMO surge will send shockwaves going forward. Save this tweet as well. I will RT.

Talking about SIPs — when’s a good time to jump in, and when might it be better to hold off?

Science as a service (blue) vs Science as a novel product (red) About 20 years ago, red and blue were pretty much neck and neck in market cap. Framework: page 192 in my book (Figure 8.6)

What is CDMO? What’s the quality of people behind the business? What’s their motivation? What are the risks? What all can go wrong? What is the asking valuation? What is the expectation baked into that valuation? Answer all above in a notebook you can refer later.

Sir ji what to do those who missed the cdmo stock wait for correction to enter or do sip now onwards.. kindly guide for newbie

Management should probably stick to running the business instead of spending hours tossing out forecasts that’ll be old news by next quarter. Let the analysts do the guessing—they’ve got more gadgets and wild theories than a NASA mission control room!

Hey Jeff, End of July 2025 is here — after all, some predictions do appreciate with time 🎯 Warm regards, @unseenvalue

Hey Jeff, I attended the earnings call yesterday. I will RT this end of July 2025 🎯 Warm regards, @unseenvalue