Vance Harwood

@6_Figure_Invest

Volatility focused investor & consultant. Interests include VIX,VIX futures, ETPs like UVIX SVIX VXX UVXY SVXY ZVOL BITX ETHU. No investment advice

Interesting thread with the next level of detail underlying the latest GPD number. For example, businesses spent heavily last quarter, likely hoping to beat tariff driven price increases.

Real GDP fell at a 0.3% annual rate in Q1. The underlying numbers are very extreme--with an enormous increase in imports and inventories. My preferred measure of "core GDP" a better signal, up at a 3.0% annual rate (see next)

Could be a seasonality effect. August, and especially September tend to be weak months for the market, and there haven't been any significant downturns in months. The Christmas dip looks subdued compared to normal, which supports the seasonality idea.

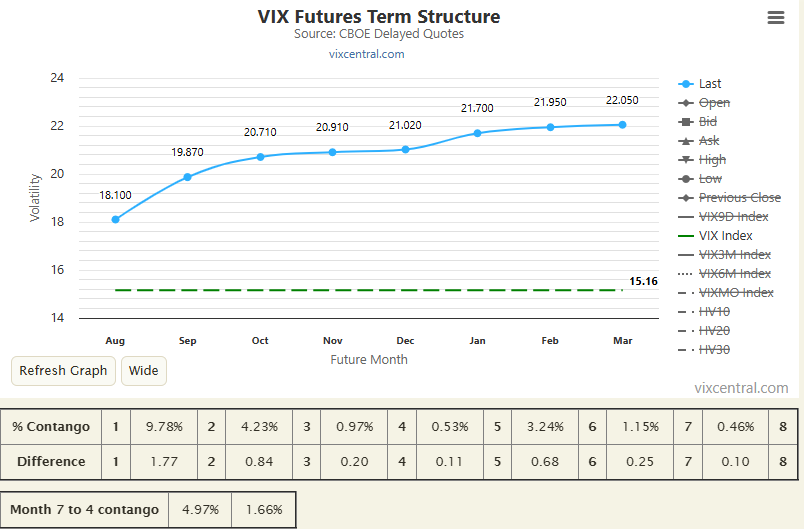

Wow! Some serious premium in the front-month VIX future, almost 3 points over the $VIX. At face value bullish for the short-term inverse Vol ETPs (e.g., $SVIX, $SVXY).

Wow! Some serious premium in the front-month VIX future, almost 3 points over the $VIX. At face value bullish for the short-term inverse Vol ETPs (e.g., $SVIX, $SVXY).

If the historical data is human scaled (e.g., daily prices moves since 1933) there isn't near enough data to characterize the tails of the distribution. Of course, there are also the exogenous events, not driven by the process itself, to worry about too.

Many things are approximately normal in the middle but not in the tails.

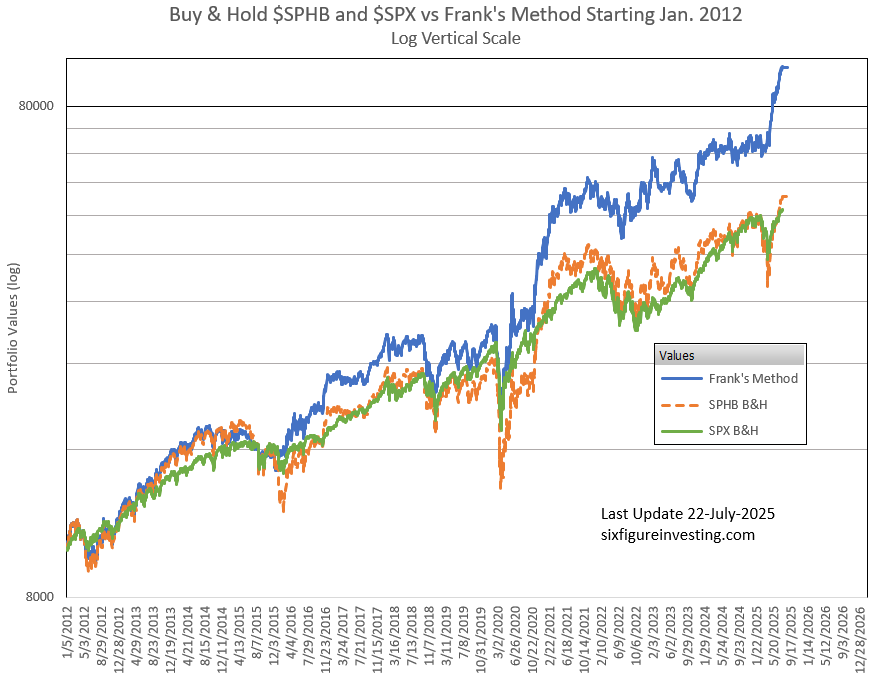

Frank Roellinger is back, after a year's hiatus. Frank is again notifying me of the changes in his portfolio, now $SPHB based, using his modified Ned Davis approach, which I will post on my blog and on X. Frank has written an update blog post sixfigureinvesting.com/2025/07/a-meth… describing…

please report as an imposter @6_Flgure_Invest (using an L instead of an i in figure)

Hint: If the scattergram looks like a ball of dots, there is no useful correlation between the two axes...

No

Collective obsessions and controlled schizophrenias: in which I review "The Battle of the Big Bang" for @CERNCourier cerncourier.com/a/the-battle-o…

I totally agree. LLMs are clearly a replication one of the modules of the brain, but a lot more is required for sentience. A wing is an essential part of a bird, but a wing is not a bird.

Sentience is an exquisite consequence of the laws of physics, and the embodied mind of organisms shaped by millions of years of evolution is the remarkable product of a billions upon billions of failed experiments and dead ends and strange loops. It is a mark of profound hubris…

I just accidentally invented the word "decrepency". Seem like it might be useful...

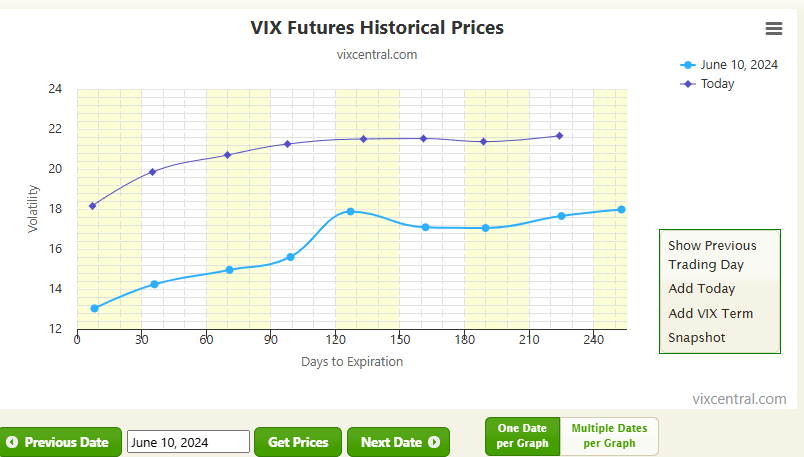

Today's $SPY 601.46 , 1 year ago $SPY 535,66, yet today's front month $VIX future at 18 vs 13 a year ago. With volatility, the path matters...

When you see the word "paper" in sentences like this, set the credibility of the author to zero.

Meme of the week?

Trading this week: reversion to the meme

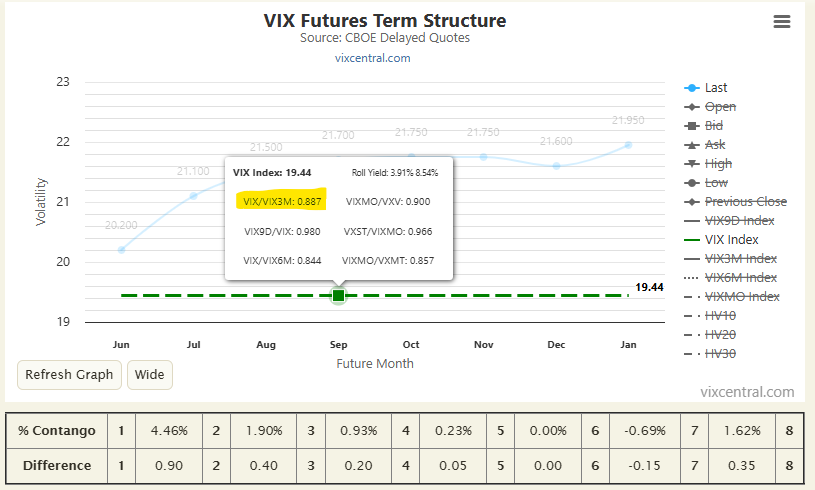

Very nice chart going back to 2020 showing the 0.95 threshold for the $VIX/$VIX3M ratio. If the threshold is exceeded at the beginning of a longish stretch of >0.95 then the user is generally quite happy. The handful of very short-lived spikes above 0.95 typically seen per year…

A simple risk on/off indicator is the ratio of the Cboe's $VIX & $VIX3M indicators for 30 and 93 day horizons. When it goes above 0.95 it's definitely time to think about taking some risk off--if you are a mature enough investor. Historically, it has signaled at least a day…

A ETF strategy that schemes to convert dividend income into capital gains.

Actual ETF Innovation: F/m's Compoundr Dividend Hack nadig.com/p/actual-etf-i…

Detailed notes regarding problems with the 7th and 8th flight. Probable root cause on engine relight problems on the booster was identified. Report claims that failures on Starship flight 7 and 8 had different root causes, and that they have put in fixes for both for the next…

Starship is designed to fundamentally change and enhance humanity’s ability to reach space. Its eighth flight test was a reminder of the value of putting hardware into a real-world environment as frequently as possible, while still maximizing controls for public safety, to…

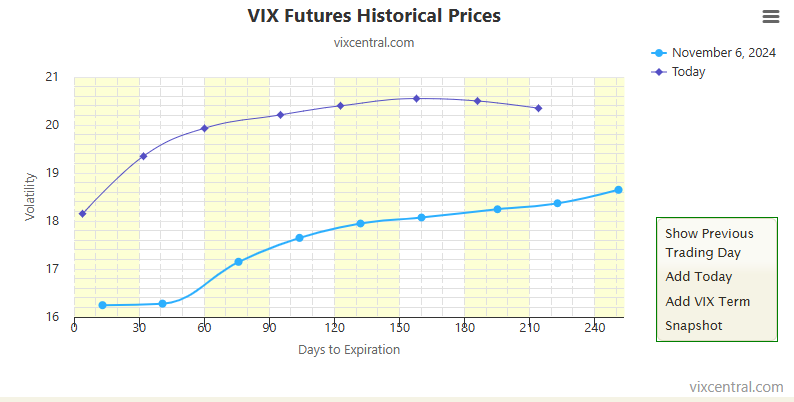

$VIX future term structure today 16-May-2025, with S&P at ~5900 and the first time it hit 5900, 6-Nov-2024. Some path dependence...

Fair to say that the current VIX Future term structure is flat, less than 0.5 points difference across the entire span.

Fun stats! Interesting that Caymans is on the leaderboard for Bloomberg terminals per capital...

The Vatican has more Bloomberg terminals than the UK Treasury I believe ?? (Post from LinkedIn)