Xclaim

@xclaiminc

The smartest way to buy and sell bankruptcy claims. Over $1 Billion traded on Xclaim.

#FTX Stub Claims Now Eligible for Immediate Offers If you've already received a distribution on your FTX claim, you can sell the remainder (your "stub claim") today. - 69% or more for claims over $1M - 62–69% for claims under $1M - Zero seller fees - Claim your offer immediately…

Starting in a couple hours! Spaces discussion with with @LouisOrigny, @RLohCFE, @ThomasBraziel, @MrPurple_DJ, @andreweglantz, @BenjaminButte13 diving into the the @linqtoinc bankruptcy and what it all means for the customers. JOIN US at 1pm ET and set a reminder here ->…

We have a stacked line-up for the next Spaces discussion - a deep-dive into the @linqtoinc bankruptcy and what it all means for the customers. JOIN US and set a reminder here -> x.com/i/spaces/1zqKV… Looking forward to the chat with @LouisOrigny @RLohCFE @ThomasBraziel…

Trade Closed: $48.2M Yellow Corp. Multi-Employer Pension Plan Withdrawal Liability Claim #Xclaim is proud to have arranged the sale of a general unsecured multi-employer pension plan withdrawal liability claim against #YellowCorp. and its debtor affiliates. More pension funds…

#Petrofac Update ⛽️ (5/5): For Petrofac specifically, the debtors will need to cut a new deal that addresses these strategic creditor concerns or pivot to a liquidation scenario. We’ll be watching. #Xclaim #Restructuring #InsolvencyLaw #UKLaw #Petrofac #CourtOfAppeal…

#Petrofac Update ⛽️ (4/5): (3 of 3) Increased conflict between unsecured creditors: Unless the decision is reined in by future courts, it is likely to drive a larger wedge between vendors, customers and other trade creditors who might suffer in a liquidation scenario against…

#Petrofac Update⛽️(3/5): The Court of Appeal disagreed, with significant implications for future restructurings: (1 of 3) Broader "no worse off" test for approving a restructuring plan over liquidation: Courts may now consider indirect economic benefits (like competitor…

Petrofac (1/5): It’s back to the drawing board📋 The UK Court of Appeal on Tuesday decided to overturn Petrofac's £355m restructuring plan. This marks a watershed moment for UK restructuring practice. After the High Court initially approved the plan in May 2025, creditors…

#Petrofac ⛽️Update (2/5): Samsung and Saipem argued they were actually worse off under the restructuring because Petrofac's liquidation would have eliminated a major competitor, allowing them to win more contracts and charge higher prices. The High Court ruled these "indirect…

📢Join us this morning (11:00am ET) for a great discussion with @ThomasBraziel of 117 Partners and @andreweglantz of #Xclaim as they dive into the most interesting issues and opportunities left within #crypto distress. Set your reminder ->x.com/i/spaces/1ZkKz…

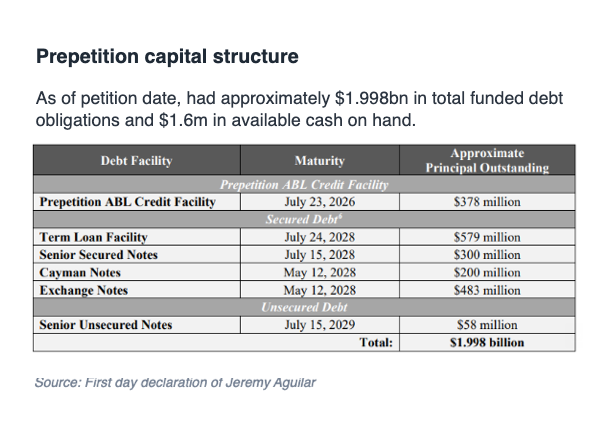

🚨New Case Alert: At Home just filed for chapter 11 with $1.998B in funded debt and $1.6M in cash, blaming tariffs, operational challenges and an overleveraged capital structure. A 2023 LME transaction wasn't enough to keep them out of bankruptcy. They filed with an RSA in place…

Looking forward to our next XSpace discussion with @andreweglantz (#Xclaim) and @ThomasBraziel (117 Partners) as they discuss "What's left in crypto distress?" See you 6/17 at 11am EST. #crypto #FTX #claimstrading x.com/i/spaces/1ZkKz…

Turn what’s left of your #FTX claim into cash now. Now that the first distribution has passed, don’t let the remainder of your claim sit idle. #Xclaim connects you with a marketplace of vetted buyers competing for your claim—so you get the best possible price and access its…

#YellQ Case Update: Trade creditors are getting active in Yellow Corp., filing objections to MFN/Mobile Street's motion to convert the case to a chapter 7 liquidation. Following preliminary observations by Judge Goldblatt about how MEPP withdrawal liability claims should be…

#HarvestSherwood Case Update (3/3): A recent example is Johnson & Johnson’s LTL Management case, transferred from the Western District of North Carolina to the District of New Jersey based on insufficient contacts and the debtors’ alleged bad faith attempt to shield good assets…

#InClaimTerms: KYC Part II - Ever wonder what documents are actually needed for KYC? In this episode we cover what creditors should expect to submit and what screening checks are performed. #KYC #BankruptcyClaims #FTX #Xclaim #claimstrading