vanillager

@vanillager

analyst

Several hundred people followed me today after I made this post about how I bought very short term and very out of the money call options in the morning, and those options ended up paying off in the afternoon. Some people asked for tips. As it turns out, I have a lot of tips!…

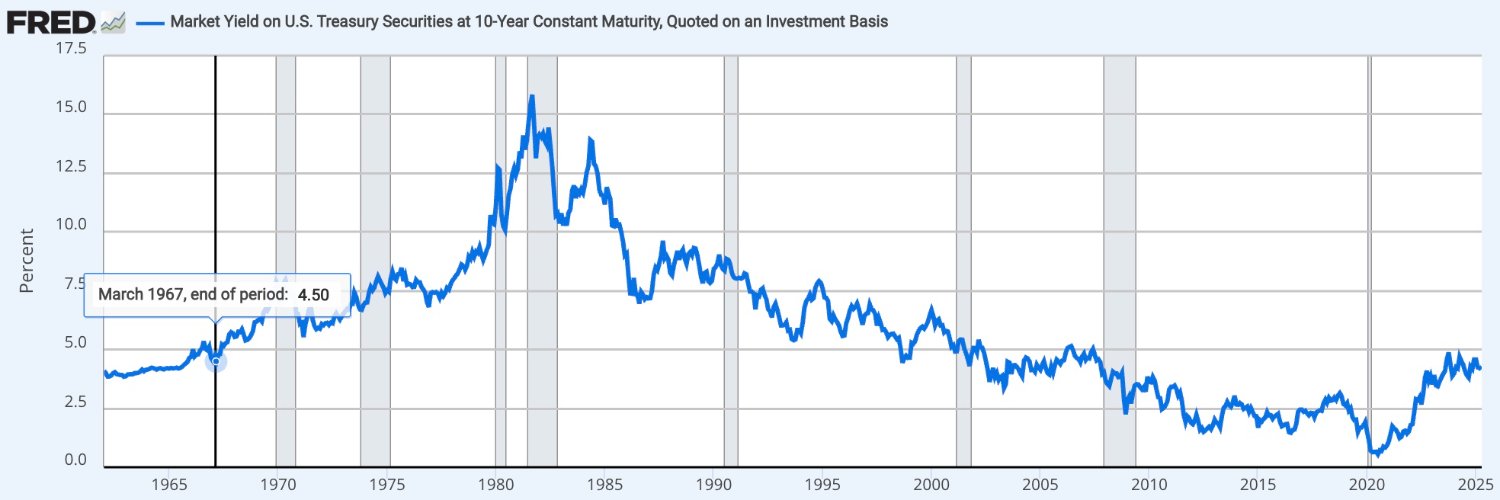

I bought 0dte SPX 5300ish calls this morning. Not because I think the market will go up today (just the opposite), but because volatility is cheap. And because my bets against equities and bonds are now so large that I risk getting blown out by a surprise reversal from Trump.

Costco still sells gold and silver below spot with a cashback credit card and executive membership. The population that buys bullion is a subset of the population that buys staple foods in bulk, and so it's not clear to me how other bullion dealers manage to stay in business.

For Americans with an interest in gold, Costco is selling coins and bars for 0% to 3% over today's increased spot price. There's free shipping and no tax in some states. With a cashback credit card and executive membership, you can buy at a discount to spot. Tough to beat!

This sounds right to me. Two years in, my default sizing is: 0.03% - options, hedges, shorts, gambles 0.1% - entry-level buy and hold (~200 positions at this % or above) 0.3% - conviction hold (~100) 1% - very high conviction (~20) 3% - core, permanent (~10) 10% - ceiling (~1)

I can't recommend enough that you do NOT take >5% positions in your first few years of investing. For starters, you need many reps at taking losses. Almost everyone starts out overconfident. Taking losses is a superpower because you get first hand experience about what it's…

Fresnillo $FRES $FRES.L is up 140% year to date and 55% since I made this post, purchased shares, and stopped paying attention to it. It's grown into my third-largest position, and I just now spent 15 minutes taking another look at it. Despite the price appreciation, it's…

Fresnillo $FRES $FRES.L is still comically cheap. It's net cash. Pays a dividend. 2024 FCF/EV was 11%, and 2025 may be >15% *even if silver is flat*. Big, diversified, well-run, cost-conscious. Tailwinds from a weak peso and improving ops. Market cap is <5% of $200b reserves.

Long note on taxes (only relevant for Americans) - I like what I own. My long portfolio is roughly 99% unchanged over the past four weeks, and my performance over the same period is roughly flat. But I have a diversified portfolio, and the market has been moving a lot, which…

Today feels like early 2020 in that it looks like we may have kicked off a cascading process that may not be easy to stop or reverse (and no one is trying in any case). But people are behaving like the boulder is going to hit an invisible wall and roll itself back up the hill.

The United States of America is abandoning free-market capitalism in favor of a mixed economy. And you're bullish?