Twigmaester

@twigmaester

Dev @BlockAnalitica | Built Sphere 🔮 so I could stop waiting for it to exist → http://sphere.blockanalitica.com

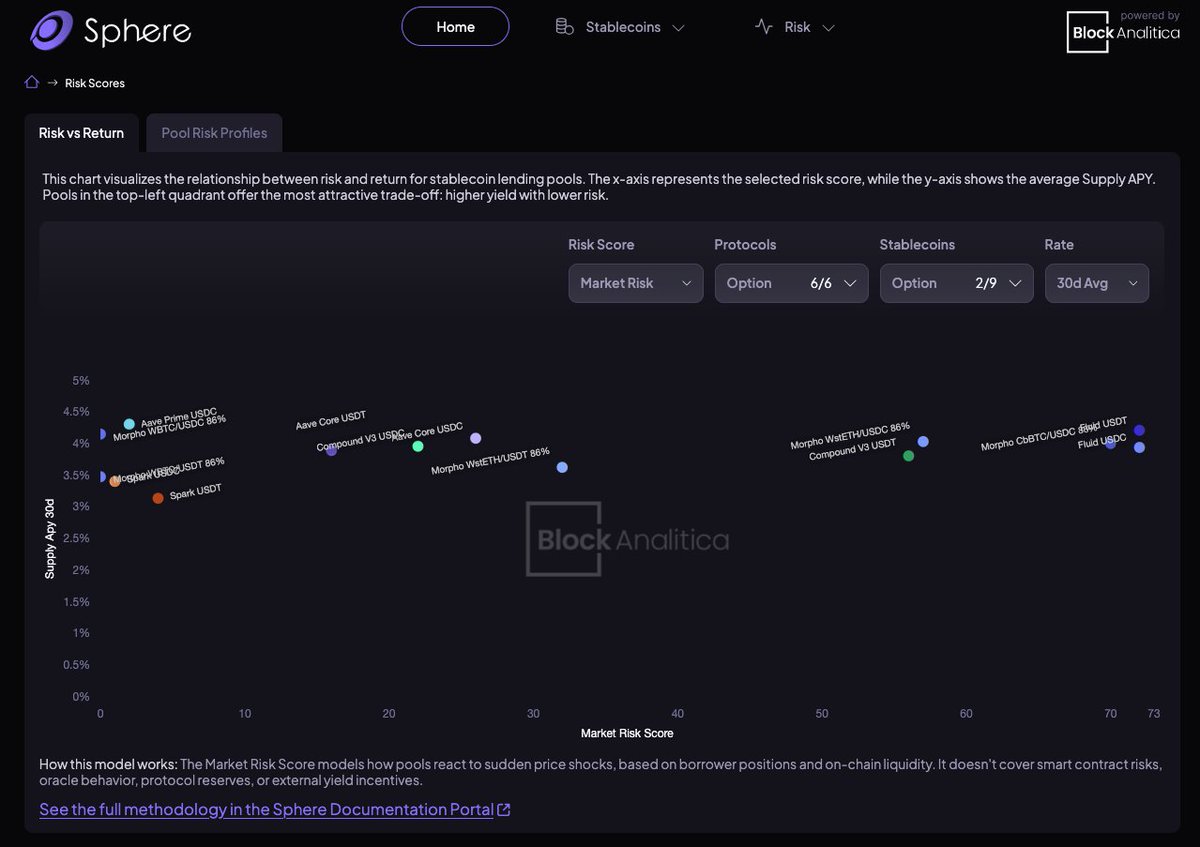

Market risk in DeFi can escalate fast. @blockanalitica’s Market Risk Scores quantify undercollateralization risk from price shocks. These scores power the Sphere Dashboard, helping users navigate market-level risks clearly. 1/🧵

Market risk in DeFi can escalate fast. @blockanalitica’s Market Risk Scores quantify undercollateralization risk from price shocks. These scores power the Sphere Dashboard, helping users navigate market-level risks clearly. 1/🧵

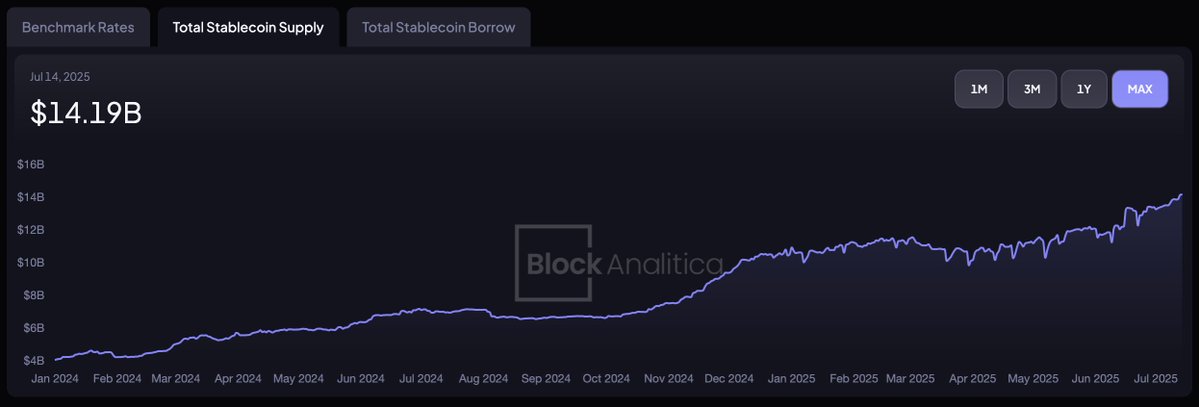

Total stablecoin supply in DeFi just hit a record high of $16.8B. Where is this capital allocated, and which pools currently offer the best risk-adjusted rates? TLDR: • For USDT and USDC, @aave is the most popular alternative, accounting for 64.5% of total stablecoin deposits…

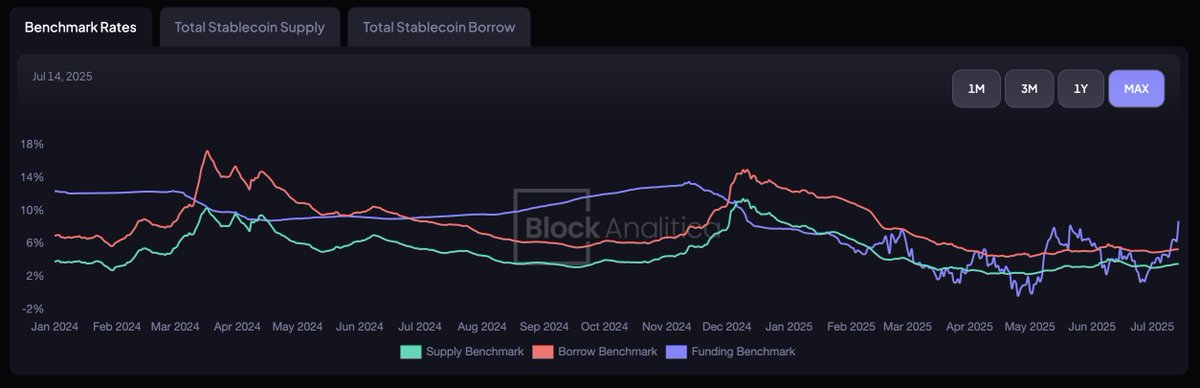

Funding rates on fire. @BlockAnalitica's sphere.blockanalitica.com

Markets seem to be quicker in pricing the cost of capital on the higher-leverage venues like perpetual futures exchanges, than lending venues in DeFi. Historically, benchmark stablecoin borrow rate on DeFi lending protocols has shown to lag a bit behind benchmark funding rate,…

Quick alpha: You can check the backing of each stablecoin pool on @BlockAnalitica's Sphere dashboard.

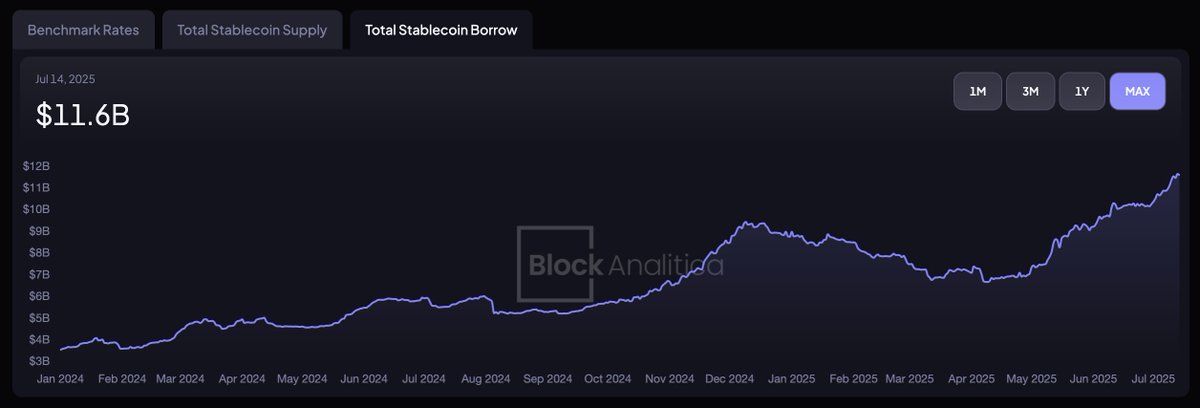

Funding rates spiking. Total stablecoin supply in DeFi at ATH. Total stablecoin borrow in DeFi at ATH. BTC at ATH. Liquidity, leverage, euphoria all peaking. What’s your worst take on what this means for DeFi?

New on the Sky Risk & Analytics Dashboard: Star Monitoring To support the evolving @SkyEcosystem Allocation System, we’ve deployed a first version of Star Monitoring, measuring: • Risk Capital • Actively Stabilizing Collateral • Star allocations info.sky.money/star-monitoring

If you're a stablecoin lender, just use Sphere 🔮

Where should you put your USDC to work? Do you prioritize liquidity? Consider @0xfluid Lower concentration risk? Try @compoundfinance Borrowing with size? Explore @aave Pool risk profiles make it easy to compare pools and pick the one that fits your strategy and risk appetite.

Sphere pulls data from major lending protocols into a single dashboard to help find the best borrow rates and risk-adjusted yields in DeFi. Below, we explain how to: - Compare borrow rates - Estimate rate impact from utilization changes - Review individual pool metrics →…

Let's say I want to deposit ETH or sUSDe to borrow USDC or USDT. Is there an overview site for borrowing rates?

It was less than 6B just a year ago. I wouldn't be surprised if we see 15B till end of year.

Did we just reach a new ATH on stablecoin borrows?