turbanurban

@turbanether

Head of DeFi Trading & Alpha PM @GSR_io | Crypto/derivatives-tinkerer, connoisseur of dark humor, with a love of maths | ex-GS🛢vol trader | Opinions mine.

The promise of crypto is true ownership of value, and seamless flexibility in its utilization. By developing solutions for on-chain derivative margin optimization on @CantonNetwork , Digital Asset is bridging the liquidity gap between crypto-native players wanting access to…

Leading liquidity providers @B2C2Group, @DRWTrading, @FalconXGlobal, and @GSR_io join @flowdesk_co and @QCPgroup in building a collateral management application on the Canton Network. The on-chain solution will - among other things - increase collateral mobility and enable 24x7…

A pleasure chatting options, market structure, and flows w/ @options_insight and Evgeny. Thanks for the opportunity!

Spend One Hour Here, Sound Smarter All Week. 🧠 This week, Imran & David break down the latest tariff announcements and their impact on $BTC. They discuss whether Bitcoin is becoming immune to tariff fears and how shifts in bond yields and the dollar are shaping price action.…

Stablecoins moved $27.6 trillion in 2024, more than Visa and Mastercard combined. Blockchain and digital assets are here to stay. @USDC is driving this new era as the world's largest regulated stablecoin. And it’s coming to Sei. Markets Move Faster on Sei. ($/acc)

mF-ONE is the byproduct of a robust partnership between @MidasRWA @FasanaraCapital @MorphoLabs and of course @SteakhouseFi. It serves as a prime example of institutions embracing the promise of crypto for capital markets: employing TVL for real world use-cases, and enabling…

Introducing mF-ONE, a tokenised certificate issued by Midas that tracks the performance of @FasanaraCapital’s flagship F-ONE private credit strategy. Now live on @MorphoLabs, use mF-ONE as collateral to borrow USDC with liquidity from vaults curated by @SteakhouseFi.

We are honoured to be named Market Maker of the Year by The Digital Commonwealth (@TheDCW_X). This award reflects our commitment to supporting founders and institutions with deep liquidity, strategic insight, and market leadership.

One of the largest crypto VC firms just published a report on institutional adoption. I was shocked with how much progress is happening that we aren't seeing -- and you probably will be too. I read the 47 page report -- here are the 5 takeaways you need to know 🧵

Catch you across the pond (and in the order book) bruv 🙏🏽🚀

Bro @turbanether is moving to Switzerland 🥲🇨🇭 One of the earliest @volmexfinance supporters!

Join Panopticon—a #DeFi side event at #ETHDenver2025—for a deep dive into how derivatives drive market efficiency! Panelists: 🔹 @MLGavaudan – Co-Founder, @InfPools 🔹 @Mikemillered01 – Head of BD, @xbtogroup 🔹 @turbanether – Head of DeFi Trading, @GSR_io 🔹 @Crypto_A_S –…

Kudos to @ColeGotTweets and @kgbabaoglu over at @volmexfinance on their continued focus on providing reliable quality indexes, with $MVIV joining the ranks of $BVIV and $EVIV. Just wait until we've got a full blown active vol/variance market 😉.

Introducing new Volmex Indices 🎉 MVIV Index (Market Volmex Implied Volatility): The MVIV Index uses individual implied volatilities with weights based on underlying asset market capitalization, utilizing the BVIV and EVIV Indices. It is an easily replicable portfolio of implied…

It’s an exciting time, for both @GSR_io and the #crypto industry as a whole, as we navigate the tumultuous waters of macro winds, the shifting political and regulatory landscape, much-awaited ETF news, and a myriad of crypto-specific catalysts. This marks the next chapter in…

Today, we are thrilled to announce the appointment of @RichR_GSR and @xinsong86 as Co-CEOs of GSR. This marks a critical next step in GSR’s evolution as we intensify our global client focus. We are very excited for this next chapter in GSR’s journey. bloomberg.com/news/articles/…

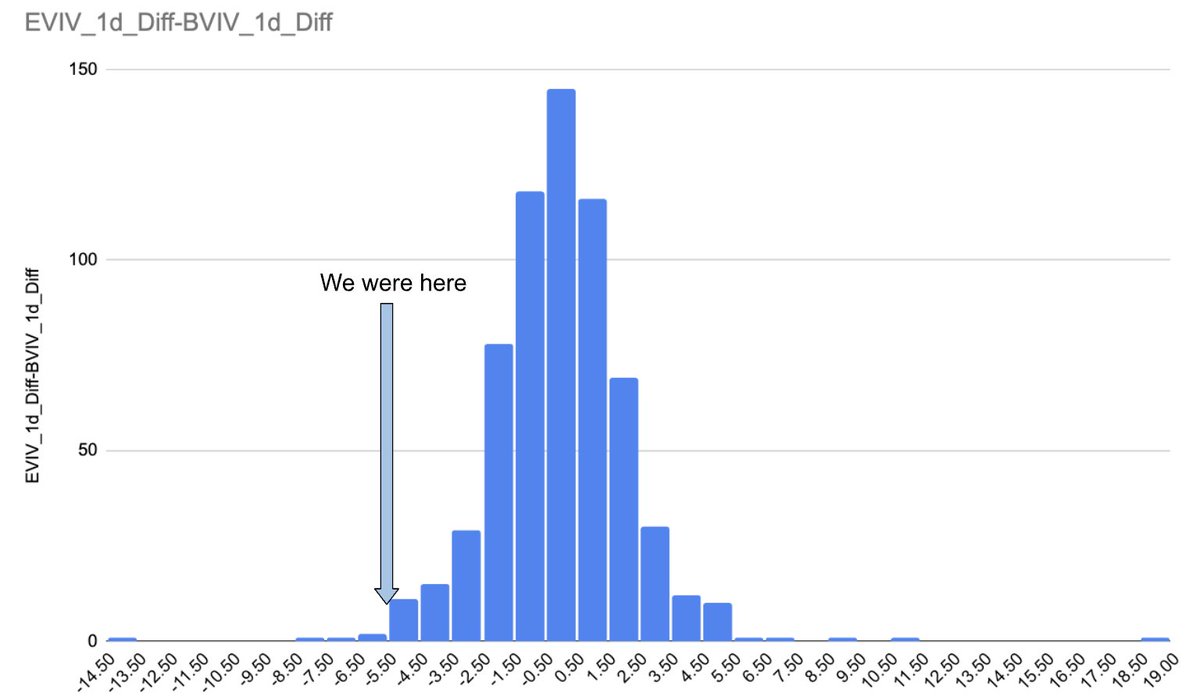

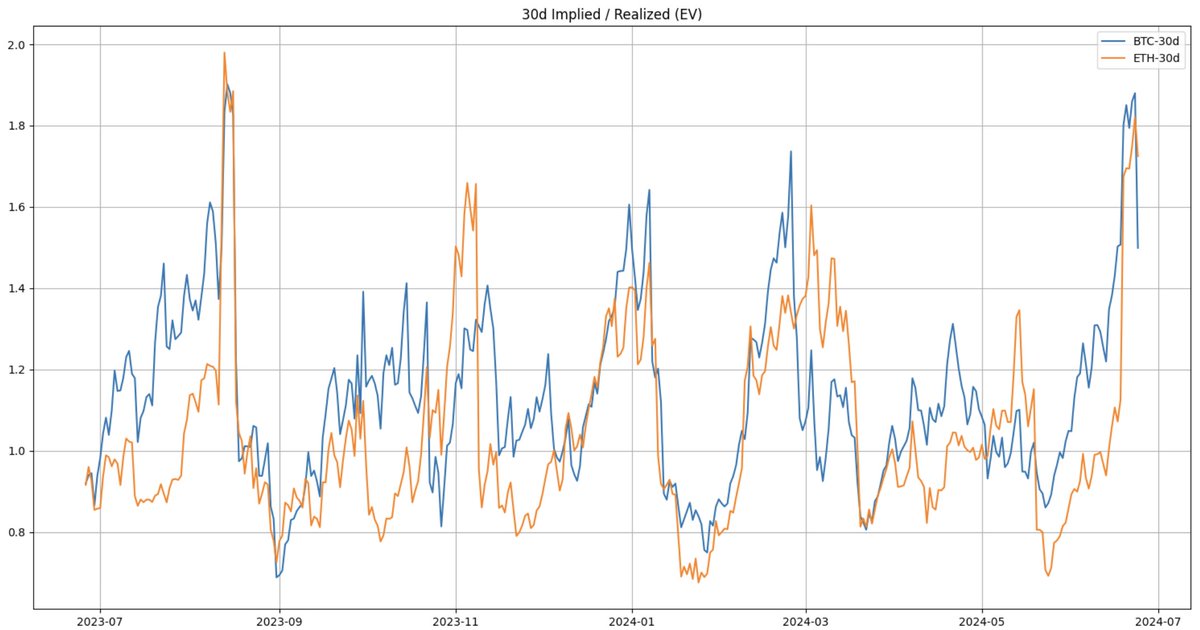

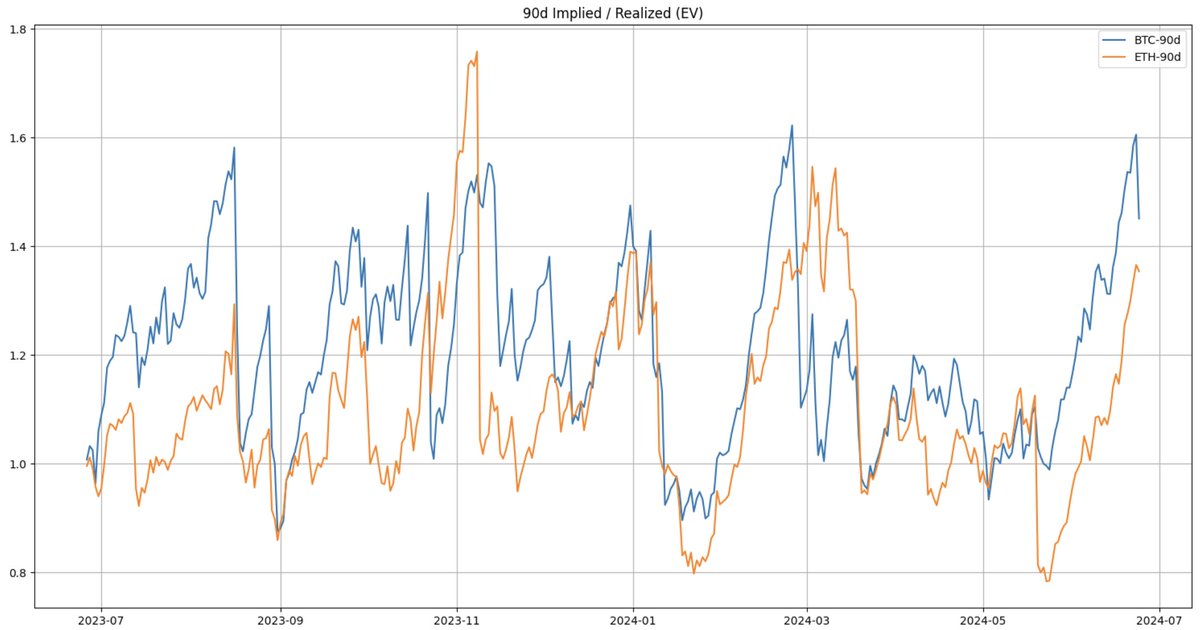

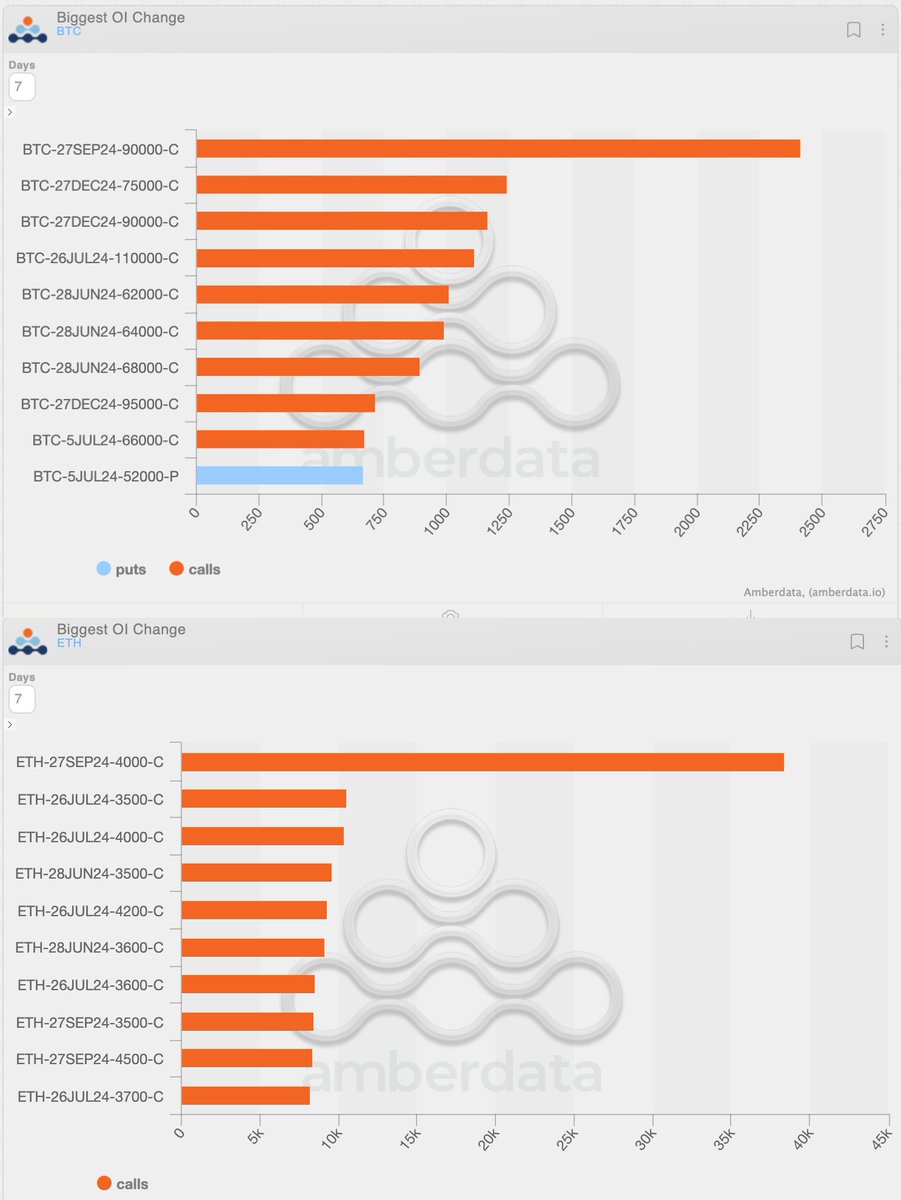

What happened w/ majors vol yest? Some thoughts... (1) @volmexfinance 's $EVIV - $BVIV vol spread compressed in a -2std move as majors sold off, with $BTC the strong under-performer in flat price (-7% on the day at one point), before retracing losses in the following session...…