Token Treasury Tracker

@tkn_tracker

Token treasury data, updated regularly. Follow for insights. Explore more at https://www.tokentreasurytracker.com/.

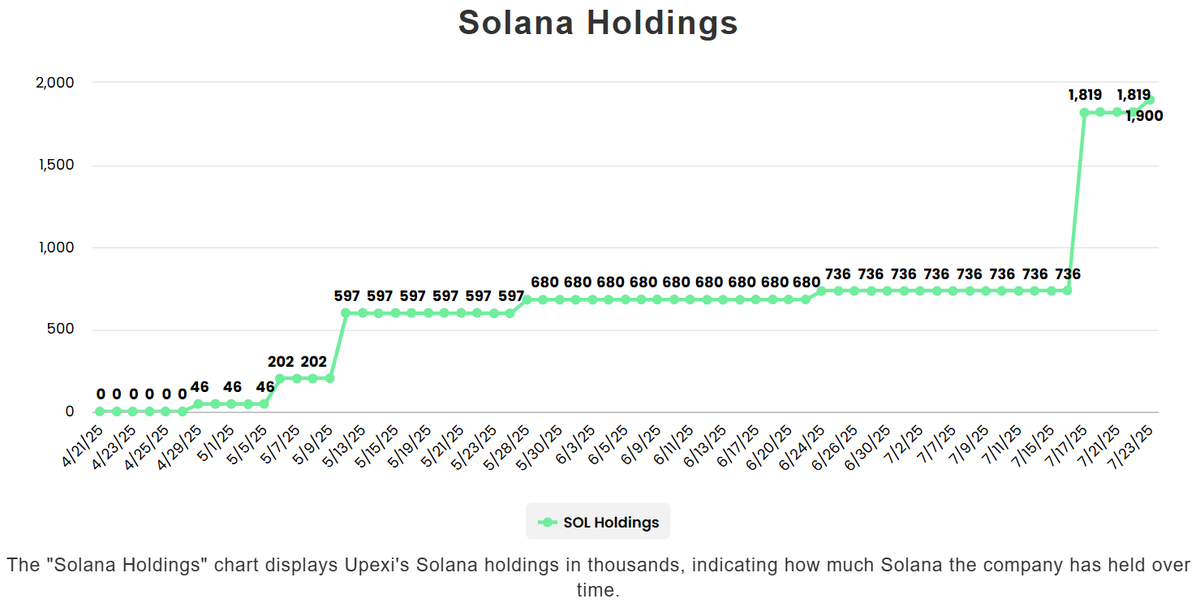

Solana Treasury Weekly Recap $SOL Price +5% $DFDV: - Stock (21)% - Holds 1M $SOL (0.0514 SOL/share) - mNAV fell from 3.01x → 2.00x - +141K $SOL added $UPXI: - Stock (18)% - Holds 1.9M $SOL (0.035 SOL/share) - mNAV fell from 1.25x → 0.93x - +83K $SOL added - Announced up to…

$UPXI just announced a $500M ELOC with AGP — unlocking firepower for $SOL buys via stock sales once its S-1 goes effective. Additional access to capital is coming. But with NAV <1x market conditions will matter.

Why are $SOL treasury companies like $DFDV different from ETFs? They can buy discounted $SOL. $DFDV’s latest purchase: $133 — ~25% below market. Every dollar stretches further, giving treasury firms a powerful edge over traditional $SOL exposure.

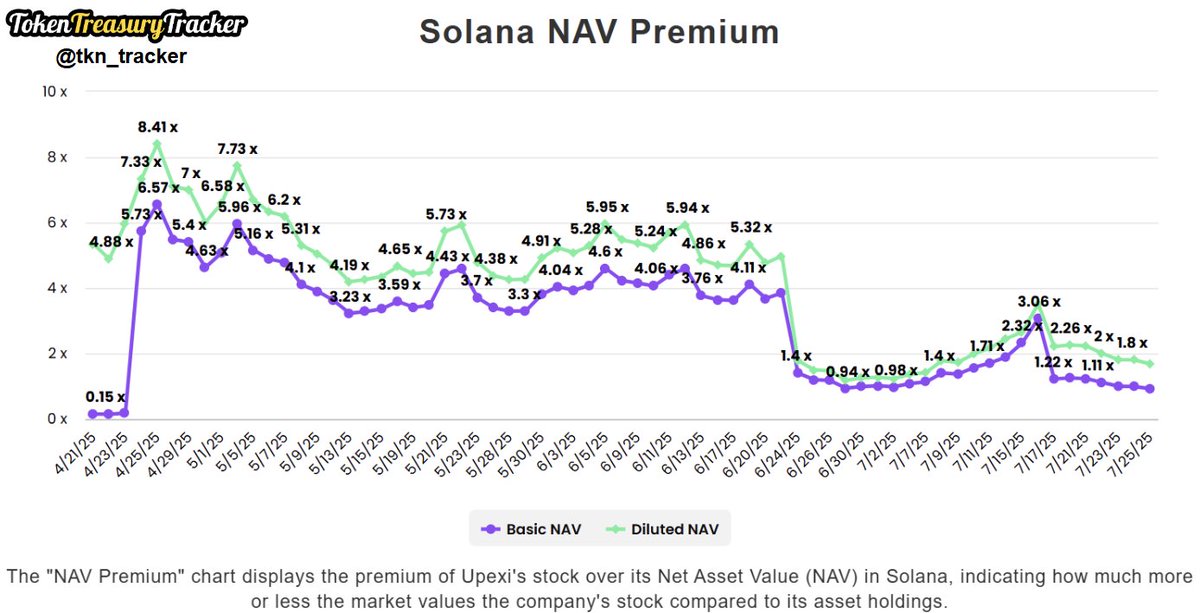

$UPXI's stock has slumped — now trading below 1x NAV, meaning its $SOL holdings are worth more than its market cap. Management has creatively scaled $SOL buys, but investors should monitor how steep the “discount” to $SOL becomes.

$UPXI is nearing 2M $SOL — without an active ATM. To fund the buys: - Issued $150M convertible note for locked $SOL - Closed $50M private placement (w/ mgmt participating) A creative, scalable playbook. Now it’s all about continued execution.

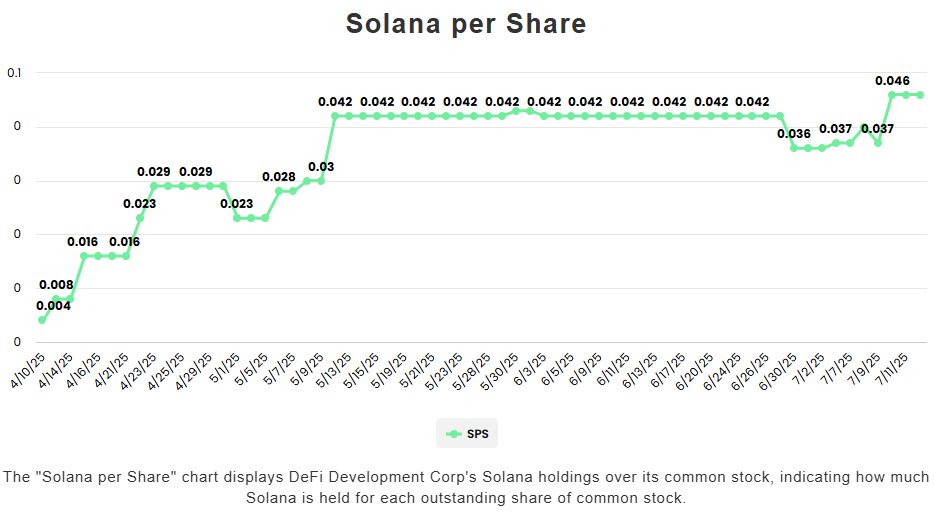

$DFDV stacked 1M $SOL in 104 days. At $135/SOL, the next 1M = $135M. With $19.2M raised in July via ELOC and ~$2M/day pace, $DFDV could hit 2M $SOL in just 70 days. The $SOL accumulation flywheel is accelerating.

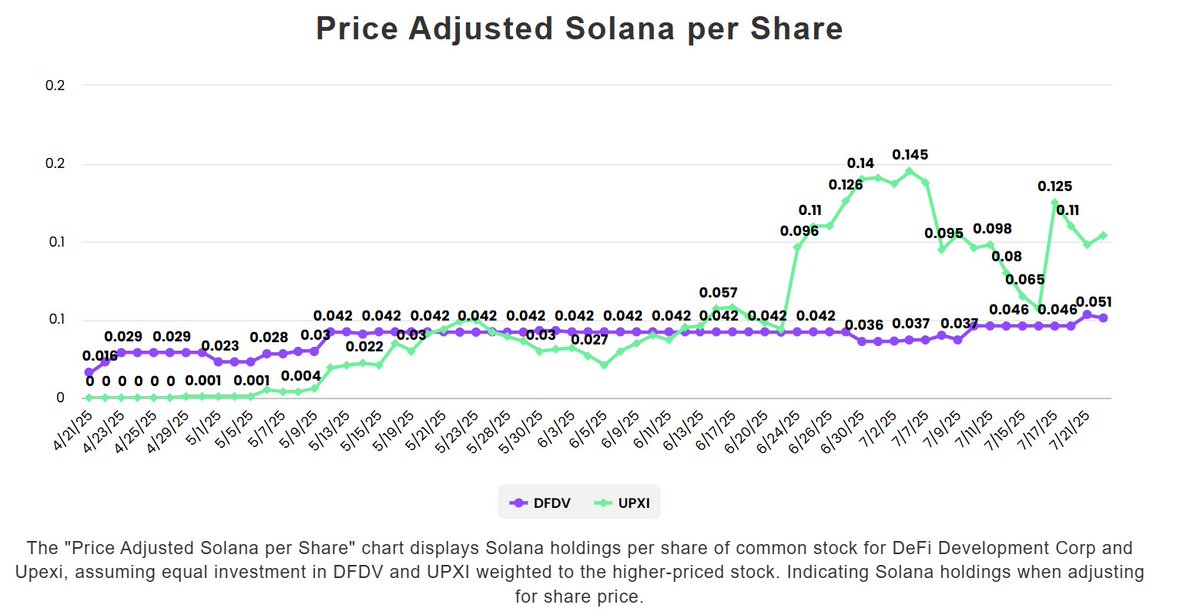

$SOL per share (SPS) is key when comparing $DFDV vs $UPXI: 1 $DFDV share (0.051 SPS) = ~3.1 $UPXI shares (0.104 SPS) — giving $UPXI a 2x+ SPS edge. But as SPS levels shift, the spotlight may turn to capital efficiency and long-term $SOL accumulation strategies.

$DFDV is setting the gold standard for transparency — publishing NAV and SPS across scenarios: - Current - Adjusted for debt - Debt converting to equity - Fully diluted (warrants + convertible debt) Retail can stress test NAV/SPS, and management is accountable to raise >1x NAV.…

Why is $DFDV down despite strong guidance (0.165 SPS by June 2026 vs 0.045 today)? 3.9M shares (~20% of float) likely hit the market after prior raise unlocks: - 2.4M convertible shares @ $9.74 - 1.5M prefunded warrants @ <$0.01 Strong outlook, but near-term pressure = supply…

$DFDV tokenized its stock on Solana via @krakenfx and @xStocksFi, $DFDVx. It trades at a spread vs the public equity — creating a potential arb opportunity (buy low, sell high). Not financial advice: low volume and fees = execution risk.