Emir | The Millennial Finance

@themillennialf_

Like to talk about finance a bit Youtube: http://themillennialfinance.com/yt Ask me a question https://ngl.link/themillennialfinance_ *Not financial advice

3 pillars of personal finance that I like to talk about. Earning, saving, investing. The trifecta. You'll do pretty well financially if you can sort these out 👇 Earning 🧑💼 Cold hard truth first. It's hard to get far with your finances if you don't earn much. This should be…

People are PISSED 😂 “We have one of the lowest wages” “We’re the most overworked” Exactly, go fight for more AL. Our minimum is 8 days We don’t need random public holidays, we have plenty It’s a cheap tool they use to improve sentiment 🤷♂️

Honestly Malaysia needs to chill with these random public holidays We already have so many

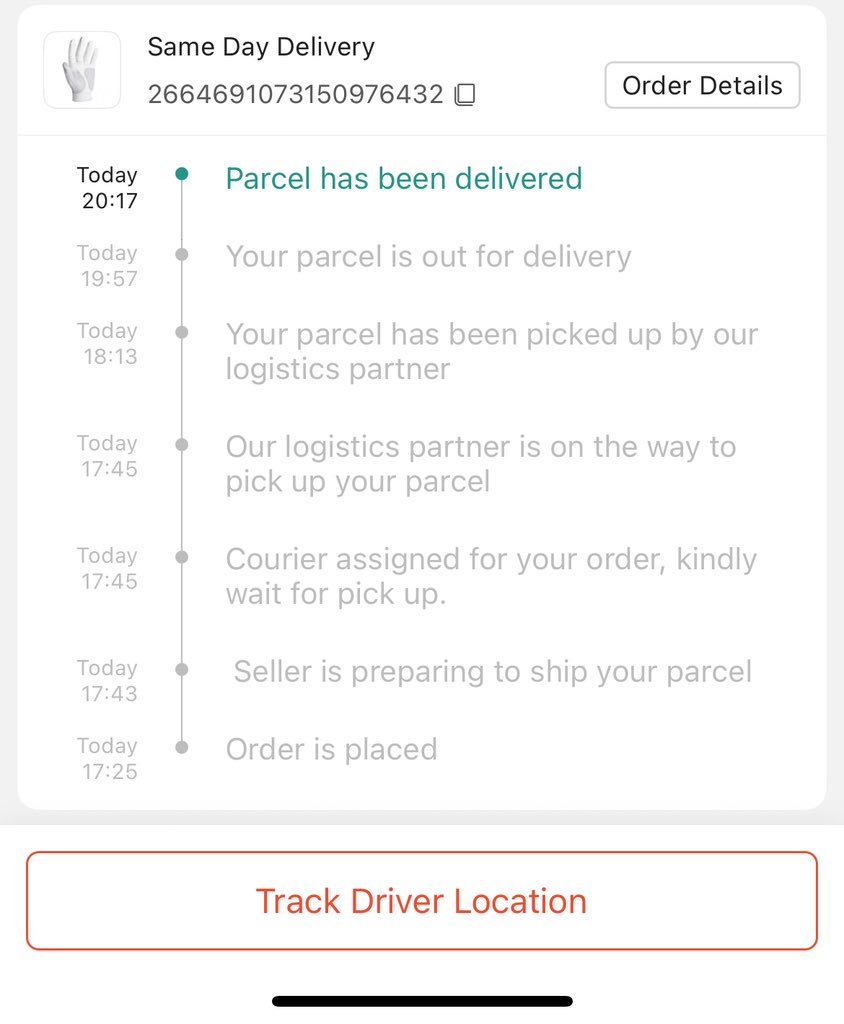

Ordered at 5pm, delivered less than 3 hours later This same day delivery thing is amazing, Shopee really won the e commerce battles

Damn landed properties are so expensive these days where do I even go?? Was interested in Parkcity Cyberjaya but its starting at RM1.3m for their first phase 🥵

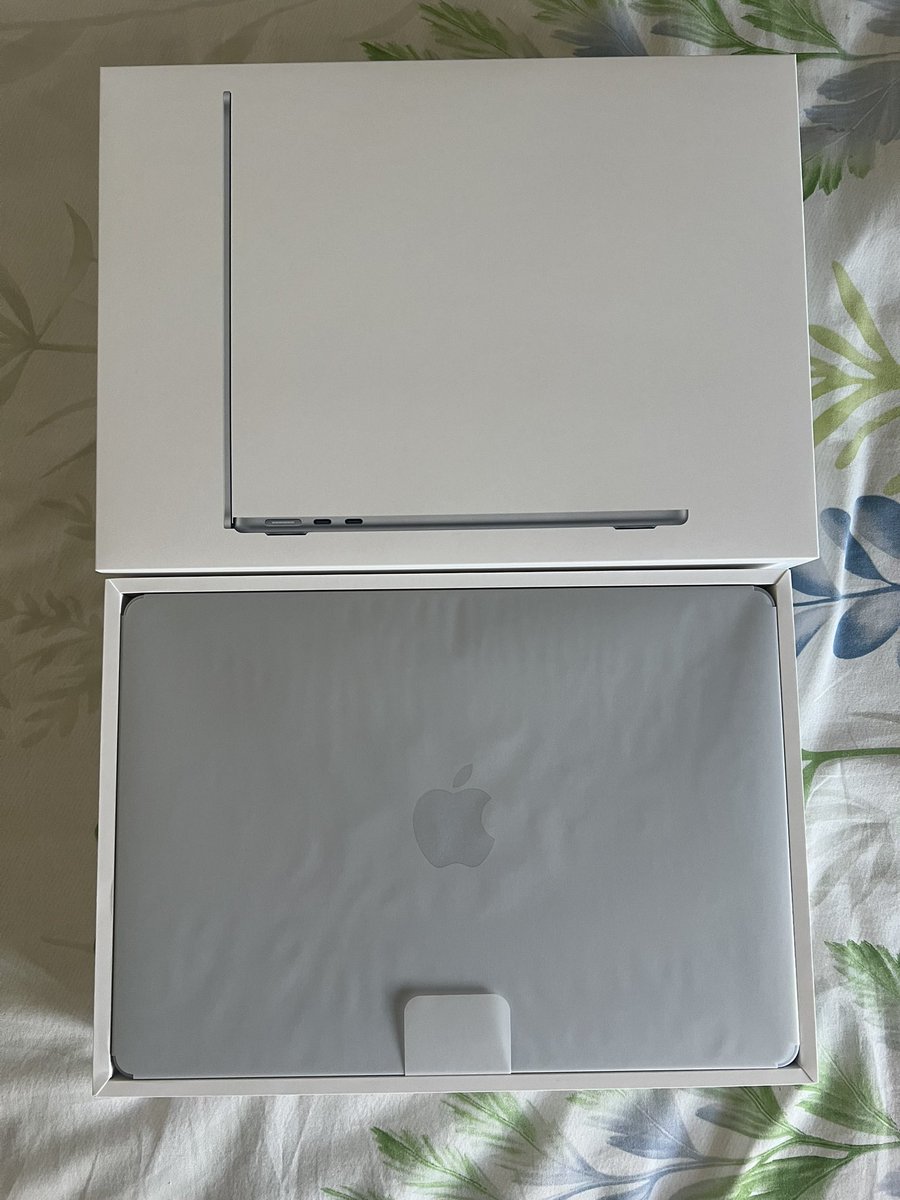

Time for an upgrade Old Mac couldn’t handle my trading app, hope this does the trick

Due to popular demand, DVTC is back for 2025! Siapa tengah belajar trading on your own tu, cepat register and test your skills. Who knows, through this you find out you CAN actually trade for a living 😁 Registration ends in ONE WEEK. More info 👉my.bursamalaysia.com/happenings/pro…

Ruginyaaa tak register Bursa Malaysia punya Derivatives Virtual Trading Challenge!! 1-30 Aug nanti dia kasi u RM100k duit virtual, trading la ikut suka, cuba besarkan modal tu Tak tau trading tak apa, u daftar je before 25 July, banyak trading webinars u boleh join, belajar

Super interesting The difference between an investor who buys the bottom every single year vs just buying immediately is a lot smaller than I thought Still can't bring myself to dump everything into stocks now so DCA it is

Wow didn’t expect this big of a gap between KL and everywhere else Don’t have experience elsewhere but I doubt cost of living is that much more in KL right?

We (World Bank) just released our latest high income data 1. Malaysia’s quest to attain high income remains 2. M’sia GNI pc of RM 53.4k < high income threshold of RM 63.8k 3. Only 5 states/FTs > high income threshold: KL, Labuan, Penang, S’wak, Selangor

BNM cuts OPR to 2.75% Mortgage gonna be a bit cheaper at least

Think a lot of ppl are underestimating how difficult it is to negotiate tariffs with the US We don’t have much leverage. Even Japan went from 24 > 25%

TLDR: If you wanna invest in US stocks, stick to passive ETFs For less efficient markets (e.g. Malaysia), active funds can outperform

Why does this X50 have to be nicer than mine 😅 Oh well, decided I'm not buying a new car for a few years at least, can't let that kinda lifestyle inflation get to me

Dah masuk showroom the all new Proton X50

You still need some liquidity for emergencies, can't invest everything Last thing you want is being forced to sell at a bad price And for that cash, may as well earn some interest while it sits idle

Bull run loading. Stocks flying. Cash melting. And you are still here comparing which 3–4% savings account is the best and boost about locking money in EPF.

US gov going to just spend more with bigger deficits Better own assets instead of USD - stocks, gold, bitcoin Only problem is they’re all pretty much at all time highs…

All time highs baby Quickest recovery from bear market to new highs, even I missed the boat 😅

How do people on an RM4.3k salary get a personal loan >RM100k? Not even sure how I would recover from this tbh, buried in debt

Gaji kasar: RM4.3K, (tolak EPF: RM3.8K) Part time: RM900 PL Bank Rakyat: RM168K, RM1878/m, baki 9 tahun CC Aeon: RM5K, RM300/m CC Maybank: RM4.5K, RM300m PL Aeon Credit: RM10K, RM247/m, baki 3 tahun Boost: RM1.1K (tertunggak, kena bayar lumpsum) Hutang member: RM2.5K, RM250/m

This is true, wages can be super low here But reality is that it’s easier/quicker to up your income than push for reforms (if it happens) We can advocate for it but while we wait, best to focus on yourself

Pattern selalu kutuk kutuk B40 ni aku perasan dekat sini antara rich finance guys atau pun tech bros tak habis suruh up skill. Tak salah nasihat tapi isu gaji kat Malaysia ni isu sistemik. Lebih 70% gaji bawah RM5k.