Josh Viljoen

@thejoshviljoen

Tracking the pulse of global equity markets. Tweets are not financial advice nor the views of my employer.

Karooooo Q1 2026 results - subs +17% to 2.39 m - sub rev +18.4% to ZAR 1.141 bn (USD 63 m) - SaaS ARR +18.3% to ZAR 4.574 bn - op profit +17% to ZAR 352 m - EPS +19% to ZAR 8.55 - net cash ZAR 1.103 bn - dividend USD 1.25/sh

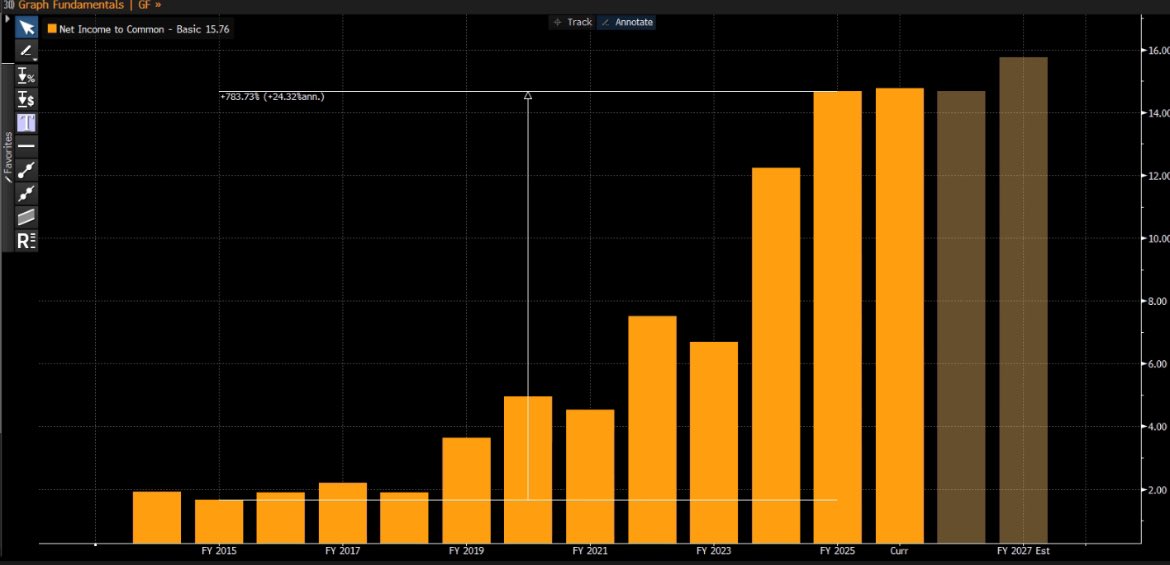

Lululemon have grown EPS at a CAGR of 24% over the last decade whilst generating returns on invested capital (around 30%) well in excess of its cost of capital

Getting kind of tired of hearing about the Astronomer CEO.

The EasyEquities screenshot era is back. Probably time to start taking some profits and positioning more defensively.

Charlie always did have a way with words

Munger on US Oil production (2022)

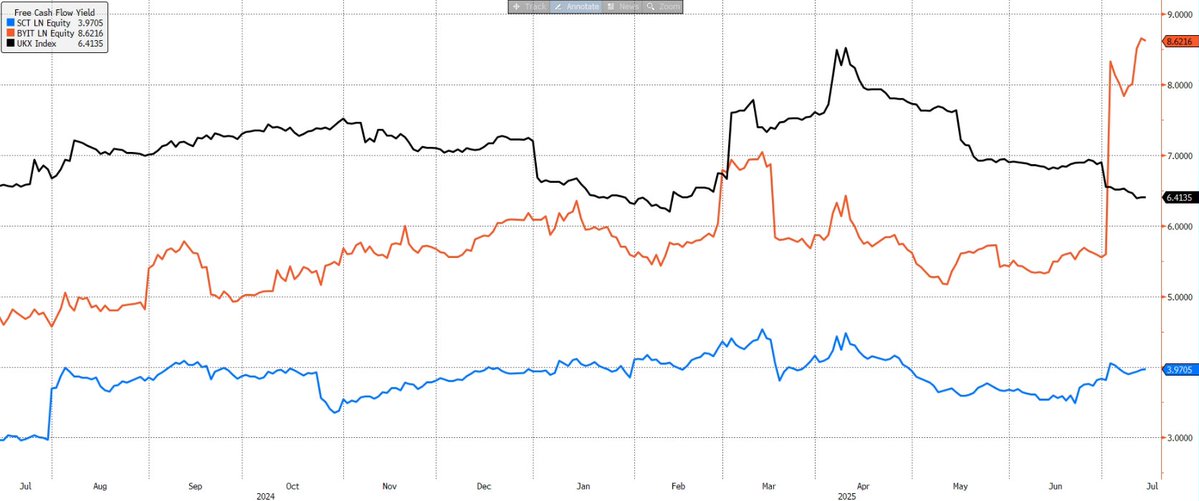

Bytes Technology PLC now trading at FCF yield of 8.6% compared to competitor Softcat PLC at less than half at 4% and the above the broad UK market index of 6.4%

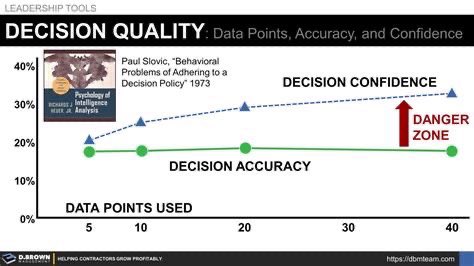

When it comes to investing more data often leads to higher confidence, but not better accuracy. The danger? Overweighting positions with false conviction. Focus on material data, not mental comfort.

The Q2 2025 edition of On Point Newsletter is now available. From shifting mindsets to admitting mistakes, the problem with mega funds, and the investment case for healthcare or energy. This edition is jam-packed with insight. Click here to read: merchantwest.co.za/wp-content/upl…

Jannik Sinner getting that walk over after being two sets down… #Wimbledon2025

Accounting areas of estimation / subjectivity like asset useful lives for depreciation between companies can have a material impact on the amount/timing of IFRS profits. Precisely why in such cases it is important to follow the cash flow.

CoreWeave and the Never-Ending GPU Depreciation — A Masterclass in Accounting Elasticity CoreWeave and Nebius, two public companies riding the AI infrastructure wave, both operate nearly identical business models: providing high-performance GPUs — such as NVIDIA’s H100 and H200…

Alcaraz looking shaky in his opening match of Wimbledon 🫣

$LULU EPS (blue) vs share price (red) $NKE EPS (blue) vs share price (red) Which would you rather own at current prices (or neither)?

Quite interesting to see the returns of JSE all share alongside the returns of spot plats. At the start of the year plats prices were heavily & severely lagged the JSE. After the recent run (+42%) the gap has narrowed. Could platinum be in store for a similar run seen in '07?

One of the better takes I’ve read in a while

deep thoughts on "research" ... sell-side research was never built to be early. It was built to be safe. It is not designed to move ahead of the market. Its designed to follow it. To justify decisions already made. To reinforce narratives already priced in. Every note you see has…

Here you go, JSE all-share in USD terms vs plats in USD

Hi Otavio. Can you do a similar chart but for South African equities, please?

🚨 JUST IN: Iran just launched missiles at US air bases in Qatar and Iraq.

🚨 JUST IN: Iran just launched missiles at US air bases in Qatar and Iraq.

Pop Mart, the creator of viral plush toys called Labubu’s, has seen its share price rise 527% in the past year.