Tier1 Alpha

@t1alpha

Leveraging Market Structure through Options, Volatility, Passive flows, and Systematic Rebalancing. Research Distributed through @Hedgeye

What makes these products risky isn’t just the leverage. It’s the accessibility. Is this what they meant by ‘democratizing finance’?

Lowest cash $VIX close since Feb 19, but fixed strike volatility barely moved. Today wasn't a repricing of vol, it was mostly just a reflection of $SPX sliding into lower IV along the embedded skew. Any thoughts @NoelConvex?

Another view of today's bifurcated market. The spread between $SPY and $RSP hit the 99th percentile.

Despite the flat close, 80% of $SPX components were positive today for an average gain of over 2%. There's an entirely different market beneath the surface.

I don't think most people realize the rise of 0DTE was born out of the collapse in demand for longer-term hedges. After the 2020 crash, premiums stayed high while realized vol underperformed. This drove demand for cheaper, more tactical solutions with shorter-dated contracts.

S&P 500 Hasn't Posted a 1% Up or Down Day in A Month In their Market Situation note this morning, @t1alpha highlights long GAMMA positioning as a key reason $SPX has been mean-reverting in tight ranges. It's structural flow suppressing vol — not fundamentals. Know what's under…

The 3-month rolling correlation between $SPX and equal-weight $SPX is breaking down again.

These are the kind of small regulatory changes to pay attention to. 👇👇👇

SPX AM settled options finally getting a makeover Cboe will allow overnight trading, through 9:25 AM ET, beginning in September of this year pending regulatory approval Now positions can be opened or closed in the overnight session prior to OPEX cboe.com/notices/conten…

Five-day tick chart of the 30-year yield reacting to Powell getting fired, sorry.... not getting fired... sorry... getting criminally prosecuted for not getting fired

You don't get "take backs"... Powell still out (whether now or May)... and no one cares Two-day tick chart of the 30-year yield reacting to Powell non-news.

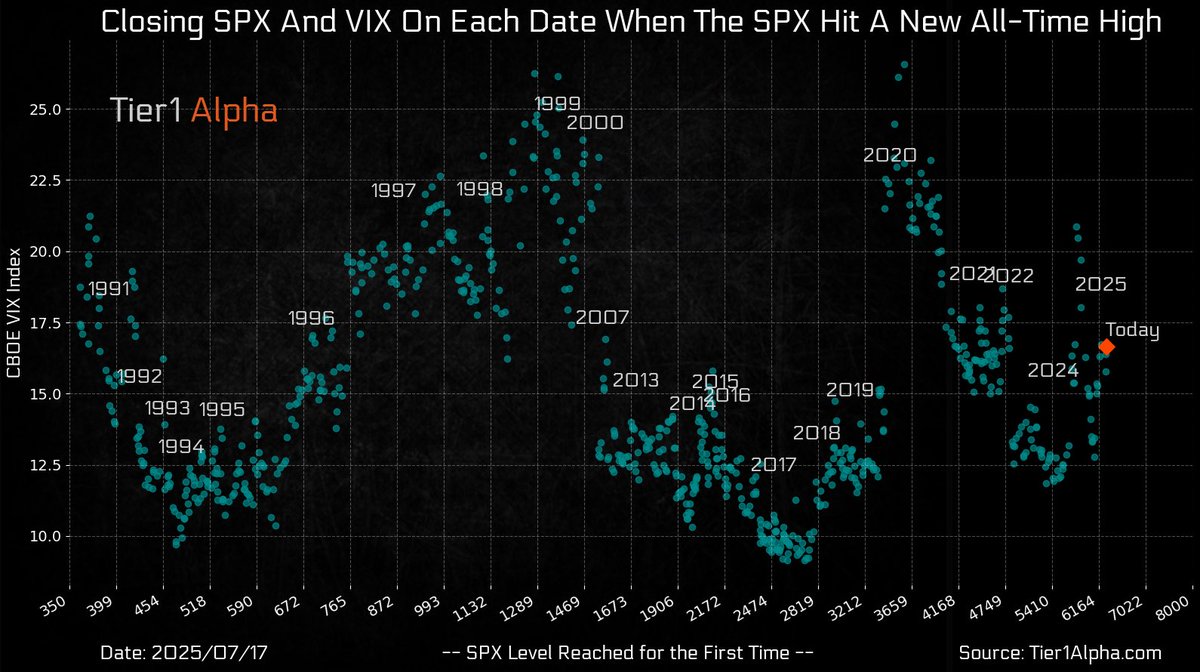

Quick reality check with $SPX at all-time highs. Buying the dip has been a far more consistent strategy than chasing the rip.

I'll be on the Spaces in 5 min. FYI, I'm not a Bitcoin expert and make zero claims to be one. I can speak to derivatives markets and some tradecraft but the idiosyncratic aspects of $BTC are not my wheelhouse.

TODAY: Please join @tomyoungjr and me for a discussion with @NoelConvex about derivatives and market dynamics. Noel has over 25 years of experience trading volatility, Market-Making, and managing risk. In the 1990s, Noel led a firm to become one of the largest U.S. equity…

$VIX call skew via MS QDS, as in, not an unreasonable time to buy VIX upside spreads

Another $SPX ATH with a structurally higher $VIX. Complacency kills.

$SPX is up 5.4% since the June OpEx with 73% positive days and 10 new all-time highs. Will the year of the OpEx continue?

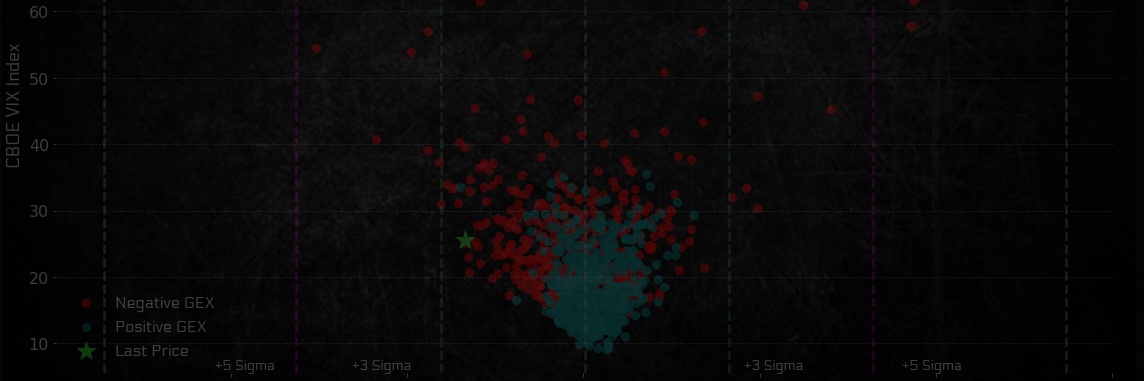

Even with the Powell drama today, $SPX vol was well within range.

85% downside day for $SPX, though you'd barely notice just looking at the index level. Note the impressive balancing act under the surface, with $NVDA, $AVGO, $MSFT, and $AAPL masking the majority of the weakness. Dispersion at its finest.