SuperMacro

@super_macro

Veteran hedge fund PM with 25 years’ experience of trading and macro investment. Ex-Brevan Howard partner and PM for 12 years, former Citigroup MD

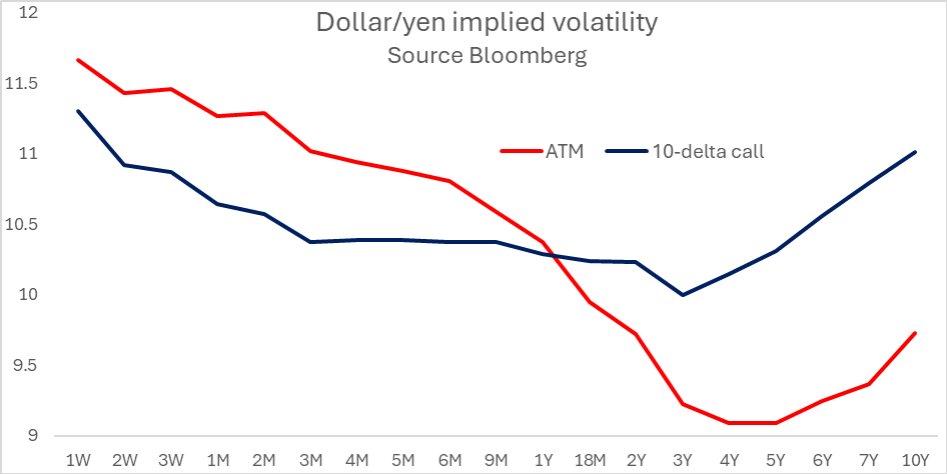

super-macro.com Our dollar yen calls have more than doubled since the post on Jun 6th. This morning we have taken some profit, but still have the majority of the trade on, as we remain bearish of the YEN. This isn't investment advice, just our opinion

super-macro.com Back to the widow-maker trade : USD/JPY Last weekend in the SuperMacro note we wrote: Expectations of the yen sliding above 200 to the dollar has been a widow-maker trade for the past two decades. However, if the MoF shifts to a heavier reliance shorter…

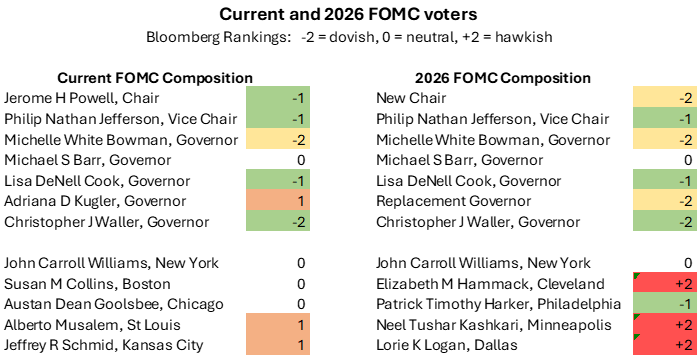

super-macro.com Doves should have more control over the Fed in 2026 The uber dovish Waller has backed a July rate cut, urging markets to look through tariff-driven price spikes. Other potential nominees for the Fed chair, Hassett and Warsh, are both on the same page as…

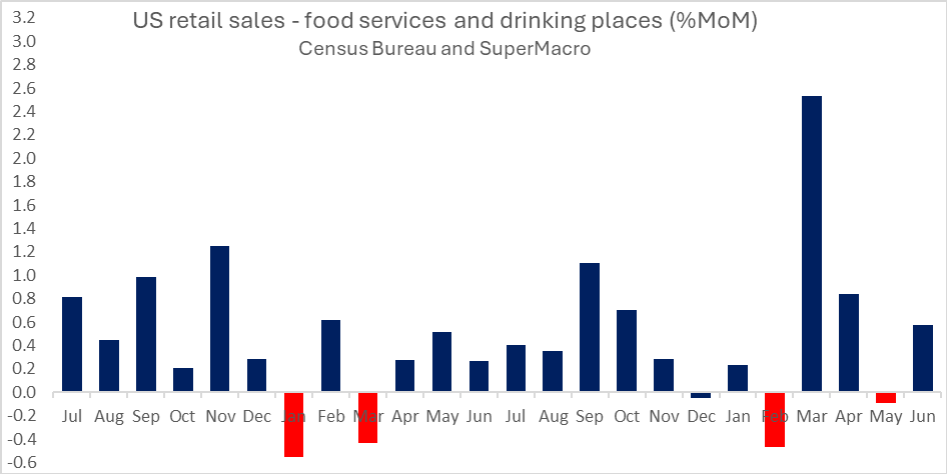

super-macro.com U.S. Retail Sales Reflect Sustained Service Demand Retail sales beat expectations in June, with control group and ex-auto sales up 0.5% m/m. But with goods prices rising, part of that strength reflects tariff passthrough. More telling: food services &…

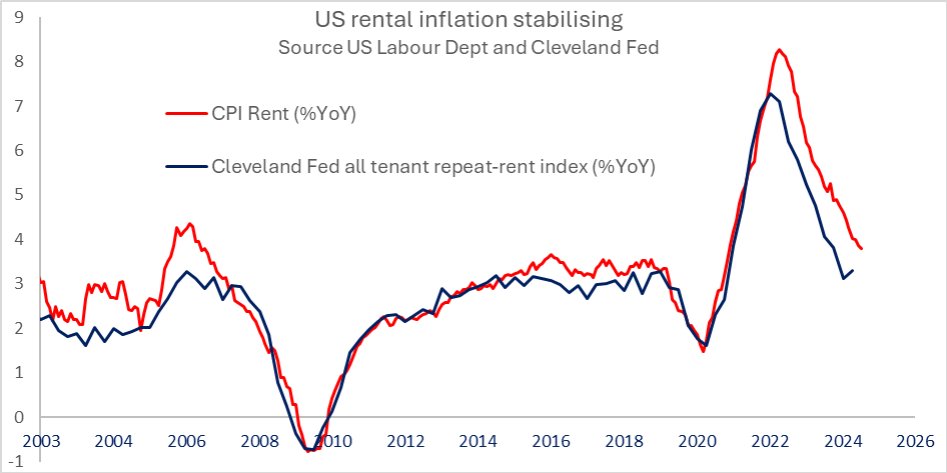

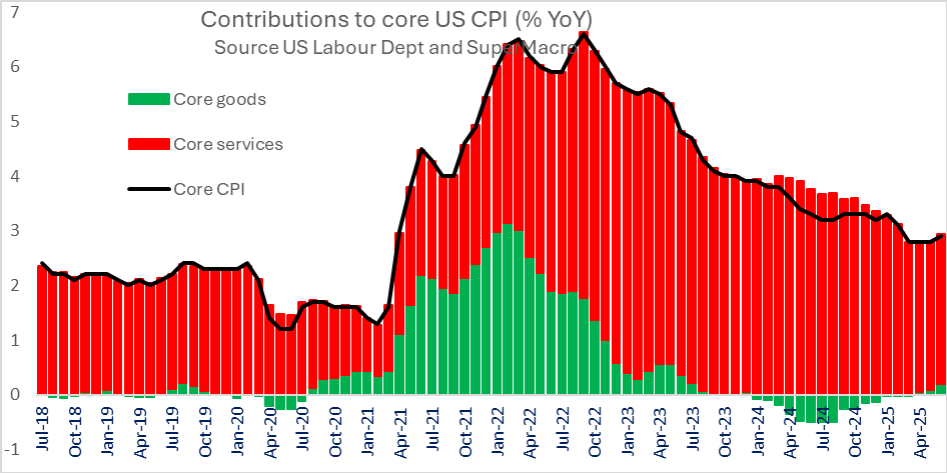

super-macro.com US Rental disinflation is over The rent slowdown has run its course. Cleveland Fed data shows new-tenant rent growth stabilizing, meaning the biggest disinflation driver in core CPI is fading fast. Don't count on shelter to keep cooling inflation from…

super-macro.com US inflation hiding a strong undercurrent Despite the mixed inflation data, underlying pressures remain firm. Tariffs are beginning to feed into consumer prices, and without the unexpected decline in the CPI measures of new and used auto prices , the…

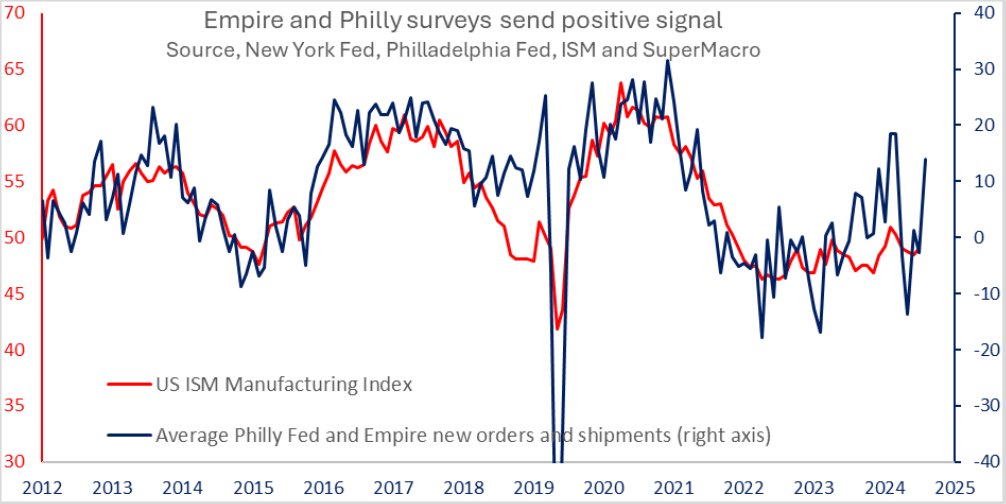

super-macro.com Signs of a US manufacturing recovery A strong rebound in the Philly Fed index (+20pts to 15.9) mirrors the Empire State's gains—signs of renewed manufacturing momentum. Surge in orders, shipments, and employment suggest rising optimism ahead of July’s…

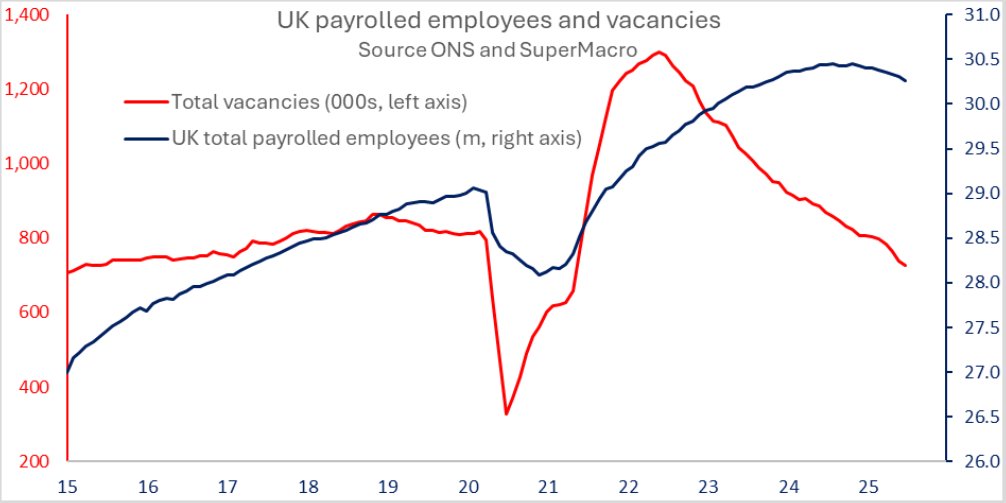

super-macro.com UK labour market flashing warning signs: Unemployment hit 4.7%—highest since mid-2021—while payrolled employees fell 41K in June. Wage growth slowed (but still way above BOE target inflation) and vacancies declined for the 36th straight period. A…

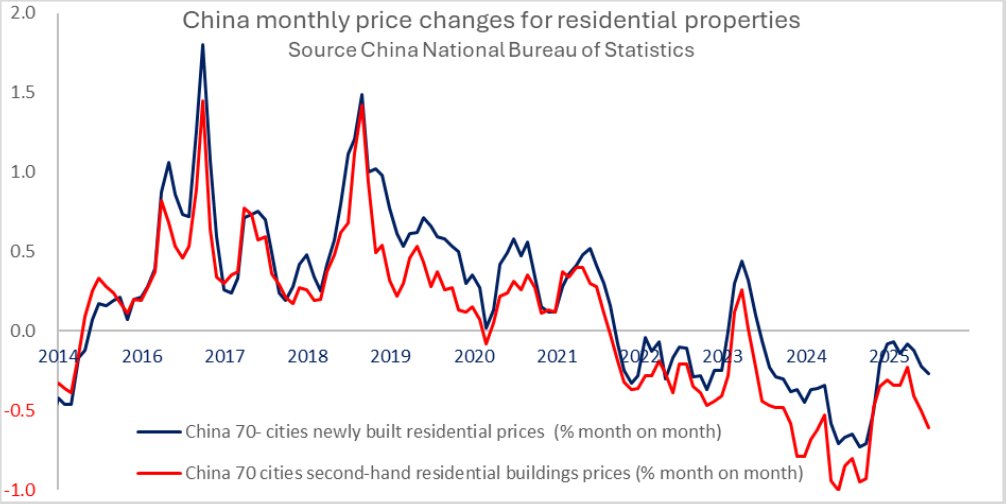

super-macro.com China's Housing Market Slump Deepens Home prices in China extended their decline in June, with the 70-city index for new homes down 0.27% and second-hand prices falling even faster at 0.61%. The downturn, ongoing since late 2021, continues to erode…

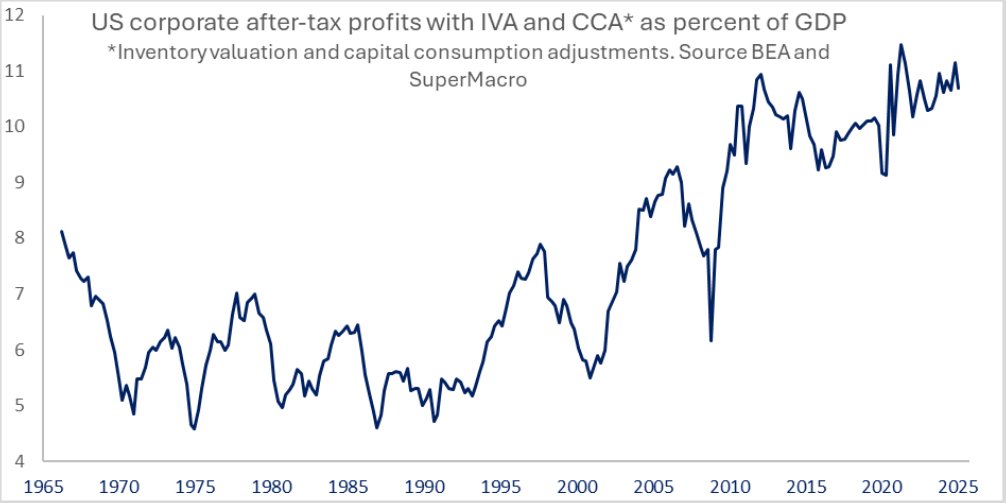

super-macro.com US Corporate Margins vs. Tariff Pressure U.S. corporate after-tax profits hit 10.7% of GDP in Q1—near record highs. For context, margins rarely topped 8% in the second half of the 20th century, and only neared today's levels before the 1929 crash. But…

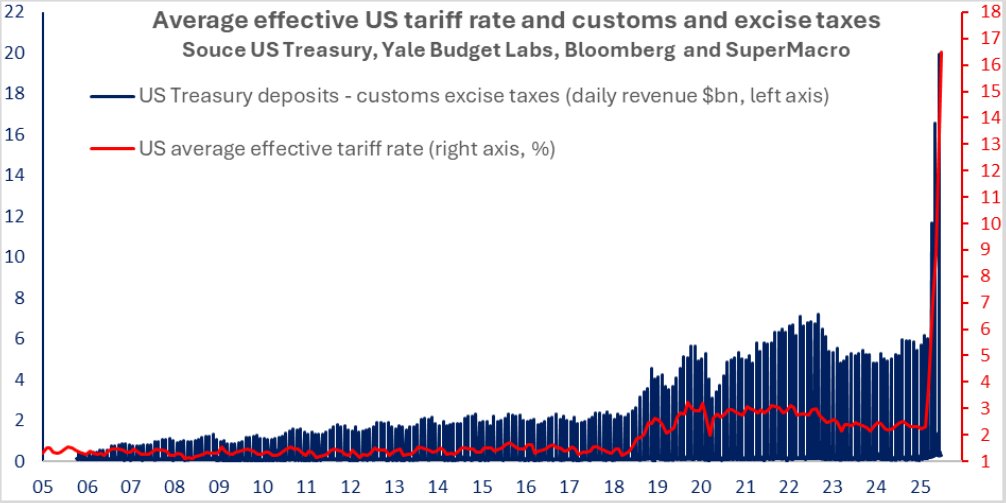

super-macro.com Tariff Tsunami: Trump Turns Up the Heat With markets calm and stocks at all-time highs, Trump unleashed another tariff blitz: Letters sent to 14 countries raising tariffs well above the 10% baseline 50% on copper sent NY futures to record highs Coffee &…

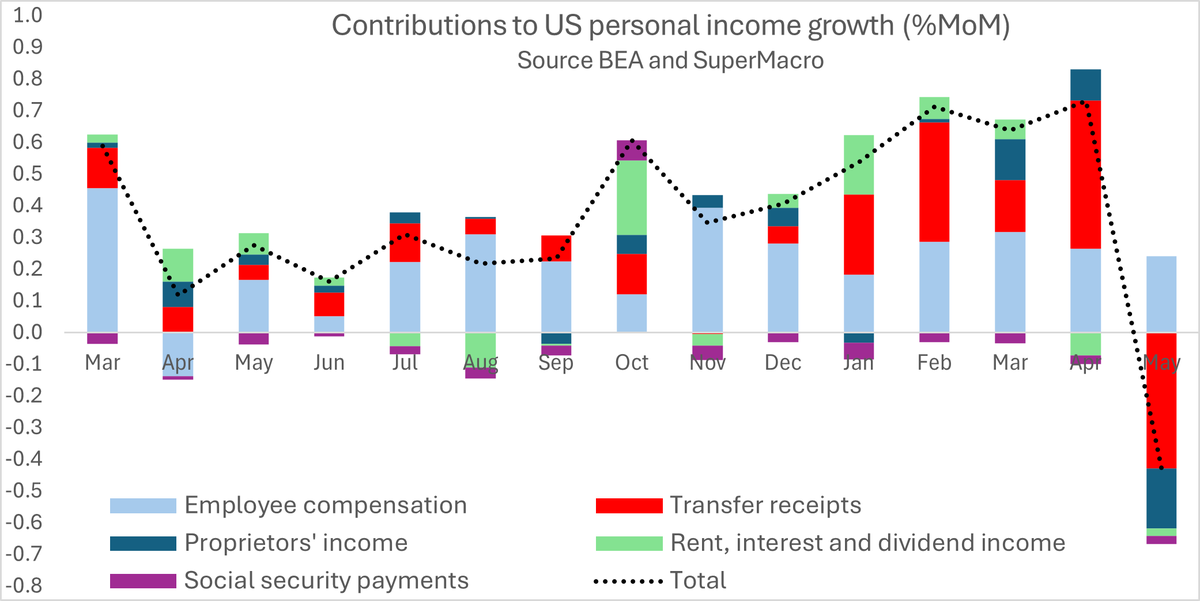

US Consumption on Borrowed Time We warned in SuperMacro that earlier income strength was driven by one-off gov’t transfer boosts—COLA hikes in Jan & retroactive Social Security payments in Mar/Apr. Those boosts from social security payments reversed in May, and spending followed…

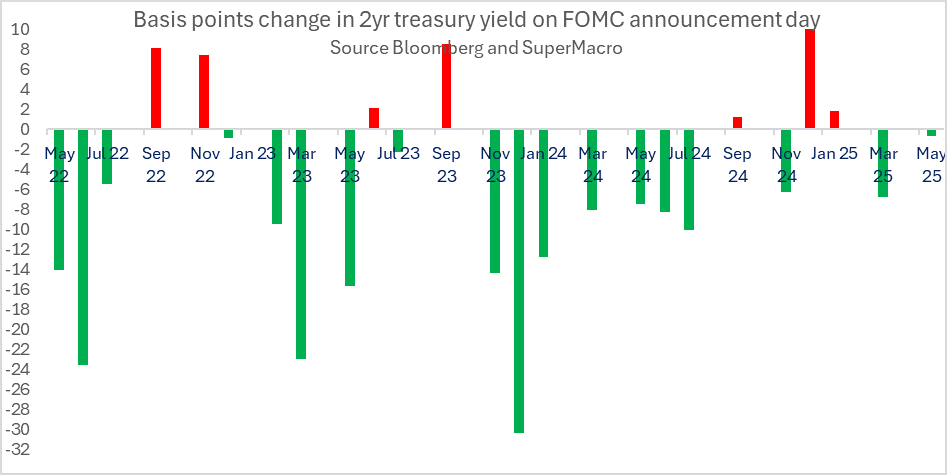

super-macro.com Fed could well signal only 1 cut in 2025 For the past three years, the market has viewed the outcome of most Fed meeting as dovish, leading to steep declines in the policy-sensitive two-year yield on the day of the meeting, despite rates being hiked over…

youtube.com/watch?v=s8nmHN… Jack Farley quizes myself and Julian Brigden on the fragility of the bond market link above

Great to be talking macro with Jack and Julian, who I both have a lot of time for. @JulianMI2

"We are in a structural bond bear market. There's an global insufficiency of savings" Special talk w/ @JulianMI2 & @super_macro for Julian's MacroCapture clients Save 10% off MacroCapture with coupon codes MM10 (for annual) and MM10Q (for quarterly) mi2partners.com/products/

super-macro.com Back to the widow-maker trade : USD/JPY Last weekend in the SuperMacro note we wrote: Expectations of the yen sliding above 200 to the dollar has been a widow-maker trade for the past two decades. However, if the MoF shifts to a heavier reliance shorter…

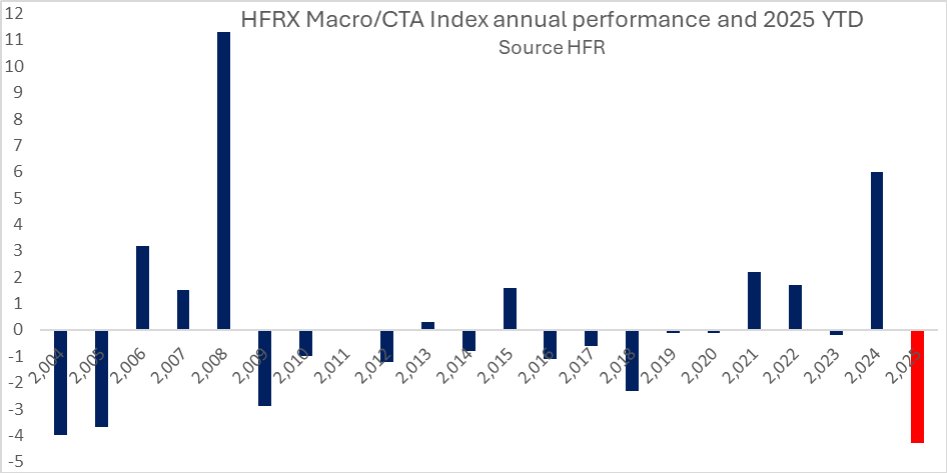

super-macro.com Macro Funds Struggle Despite the turmoil of the past five months, the TACO trade has kept markets in a range, with the S&P 500, the ten-year treasury yield, and the market price of the year-end fed funds rate all roughly where they started the year. Any…

super-macro.com The Big Beautiful Bill , dubbed 'BBB' by Trump, could well be where the US ratings are heading Trump’s ‘big, beautiful’ budget is spooking investors ft.com/content/d0b40c… via @ft