Stage Analysis

@stageanalysis

Stage Analysis Screener & Market Breadth Tools Stock Trading & Investing – Stan Weinstein's Stage Analysis & Wyckoff ➜ Join: https://stageanalysis.net/members

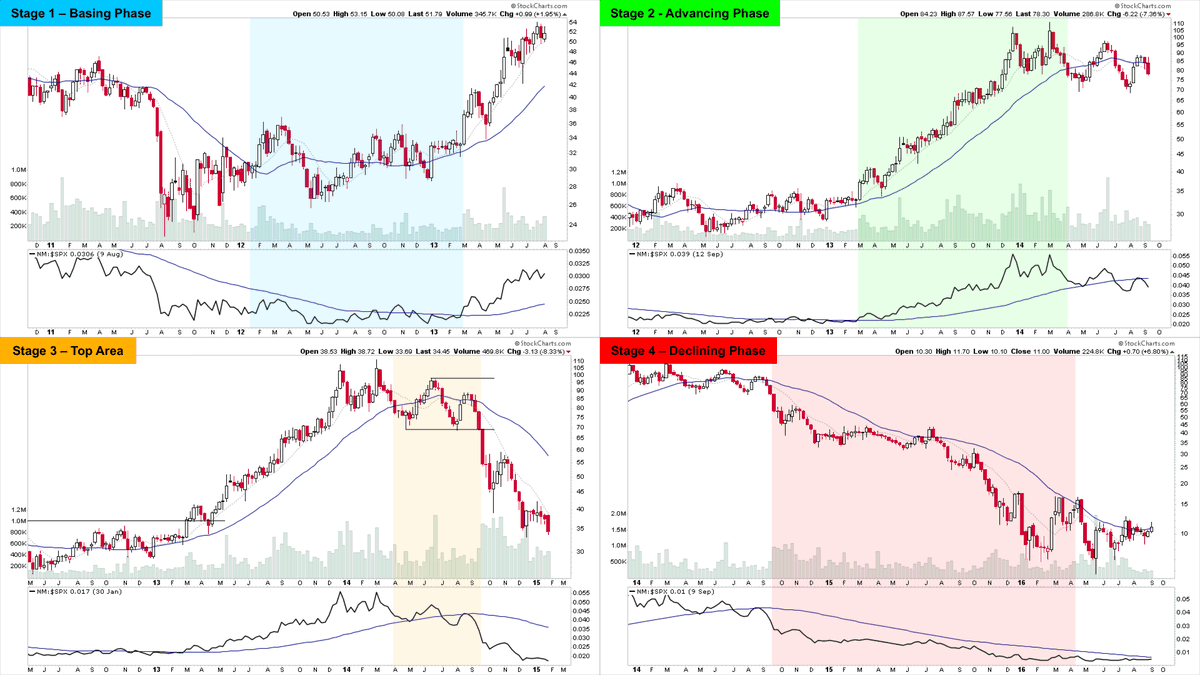

Stage Analysis – The Four Stages ****************************** Thread: Examples of each of the Four Stages to help you learn Stan Weinstein's Stage Analysis method. Also will help you understand what I'm referring to in my posts #stanweinstein #stageanalysis #stocks #study

Stage Analysis Screener – Stage 2 Breakouts & Continuation Breakouts LQDA, MUFG, GL, BKR, NOC, SMFG, FSV, BR, IP, NLY, COUR, GILD, DXCM, GPC, WEX, PHG, AGNC, YETI, GNTX, SW, CRL, IQV, PCAR, LW, TXG, ILMN Filters: Stage: 2A, 2, 2B Stage Change: Stage Changed Market Cap: +Mini…

$ARM is the institutional due diligence phase about to end. Classic Wyckoff structure. Earnings: 2025-07-30 (AMC)

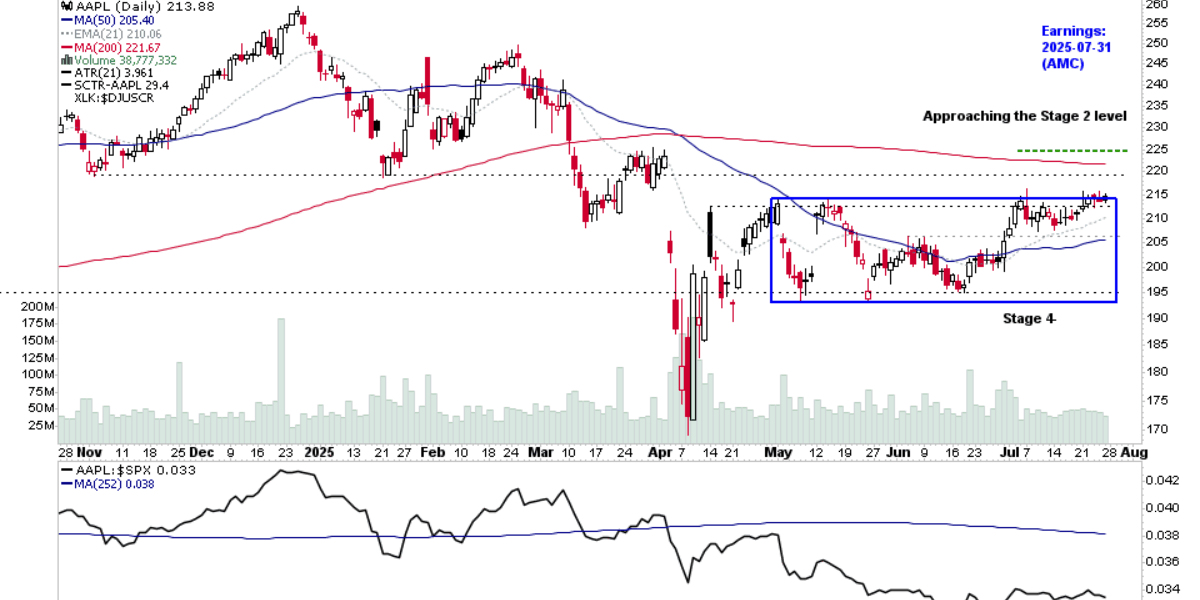

New Blog Post: US Stocks Watchlist – 26 July 2025 There were 26 stocks highlighted from the US stocks watchlist scans today – $AAPL, $ARM, $IBIT stageanalysis.net/blog/1312931/u…

New Blog Post: US Stocks Watchlist – 26 July 2025 There were 26 stocks highlighted from the US stocks watchlist scans today – $AAPL, $ARM, $IBIT stageanalysis.net/blog/1312931/u…

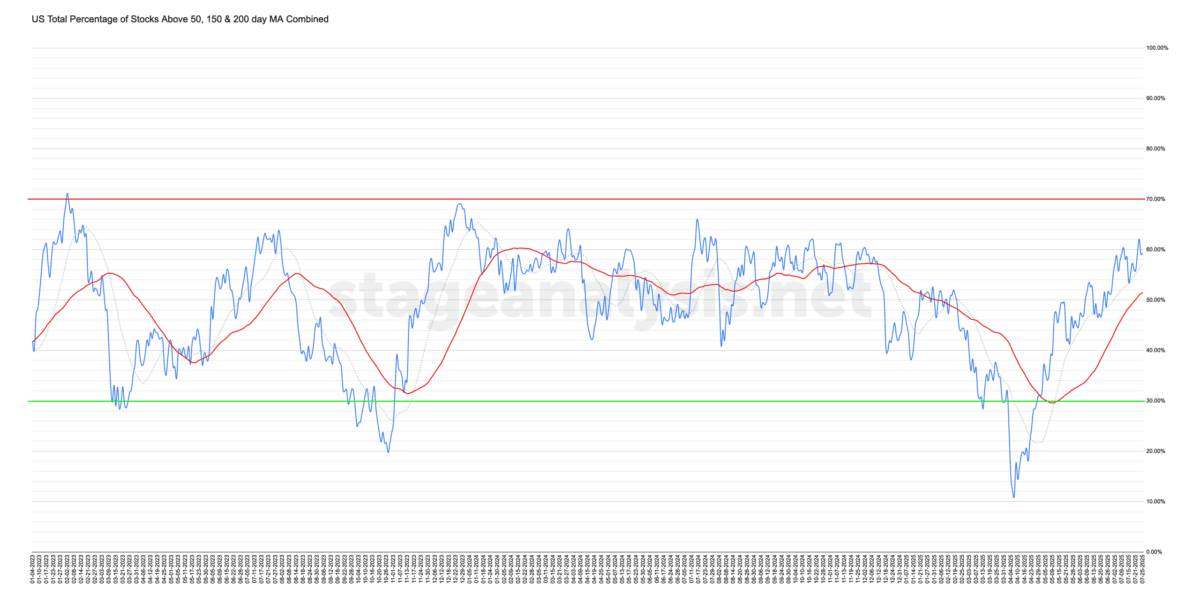

New Blog Post: Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined ▪️59.34% (+3.22% 1wk) Status: Positive Environment stageanalysis.net/blog/1312518/m…

First design update to the Stage Analysis homepage layout in many years is a big visual improvement, especially for the most popular screen size of 1920x1080. Lots more to do still, as it's just the top section that's changed so far, but was needed. stageanalysis.net

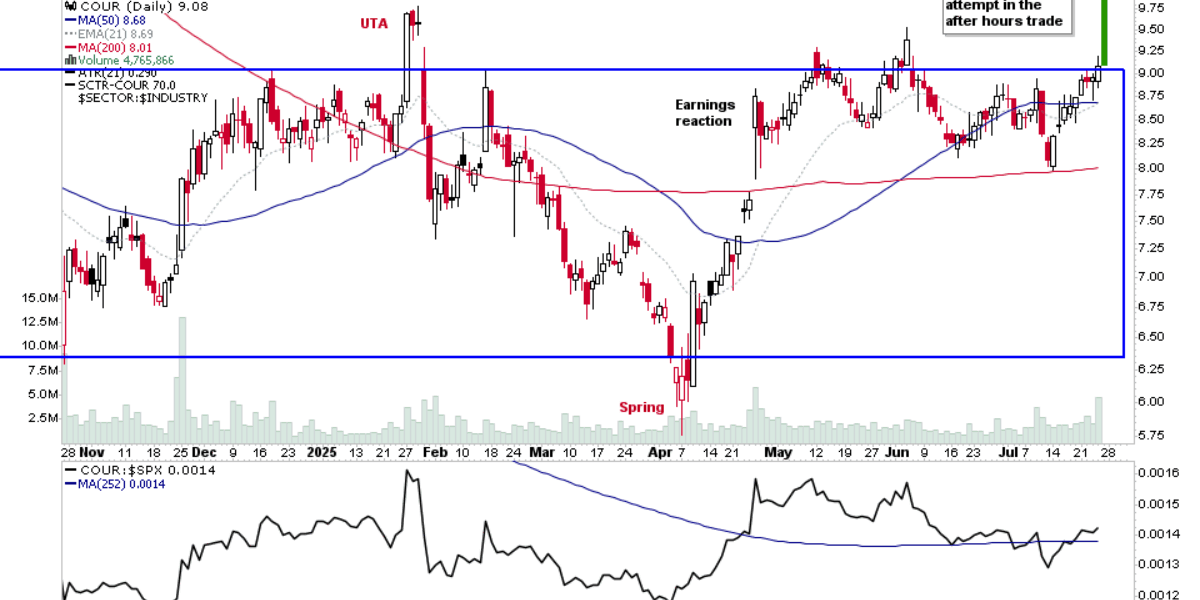

$COUR with a powerful Stage 2 breakout attempt in the after-hours trade on earnings results fro the one year+ base structure.

$COUR approaching the Stage 2 level in massive one year+ base structure with a strong Stage Analysis Technical Attributes (SATA) score. Mansfield RS just above its zero line (52 week RS MA) and Earnings due on 2025-07-24 (AMC).

New Blog Post: US Stocks Watchlist – 24 July 2025 There were 12 stocks highlighted from the US stocks watchlist scans today – $COUR, $DECK stageanalysis.net/blog/1312338/u…

$BTDR from the watchlist with a Stage 2 breakout attempt

Sector Breadth with one of the strongest overall averages year to date at 48.57%. But still an extremely neutral field position. i.e. there's plenty of scope for improvement with no sectors extended.

$QQQ Lockout rally continues. Approaching the highs in the futures

$QQQ Nasdaq 100 has closed above its 5 day MA for the an entire month. If it closes below it today then it would be a small change of behaviour 👀

$TEM still holding since 21 May. It's gone sideways for two months, but managed to close above its 50 day MA today for the first time in a while. I had a good trade in it in Jan/Feb x.com/stageanalysis/… Tried it again in March for a small loss: x.com/stageanalysis/……

$TEM have started a position at 62.50

$VST Continuation attempt to new all time highs. Earnings: 2025-08-07 (BMO)

$SG Breaking out of the 2 month base in Stage 4- which is a change of character. Earnings 2025-08-07 (AMC)

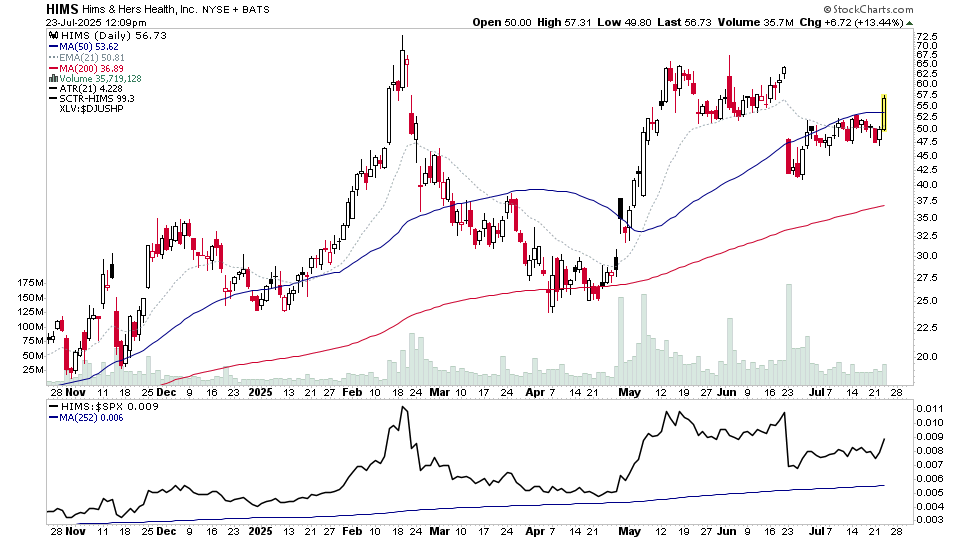

$HIMS regaining its 50 day MA is a change of behaviour

$QQQ Nasdaq 100 has closed above its 5 day MA for the an entire month. If it closes below it today then it would be a small change of behaviour 👀

$ETOR Spring and Test continues to develop and crossing above its 21 day EMA today

$ETOR moved into the Test position

$CHYM First ever Stage 2 breakout attempt from the IPO base

$CHYM from the watchlist, breaking out within the broader IPO base structure