jake2b

@sboho

I am not a licensed financial advisor and as such, I do not post financial advice. All X are my thoughts and opinions, solely information and entertainment.

I would like to present a roadmap of my thoughts for $BBBY Class 9 shareholder recovery, specifically as it relates to Interests. I hope you enjoy it. $BBBYQ

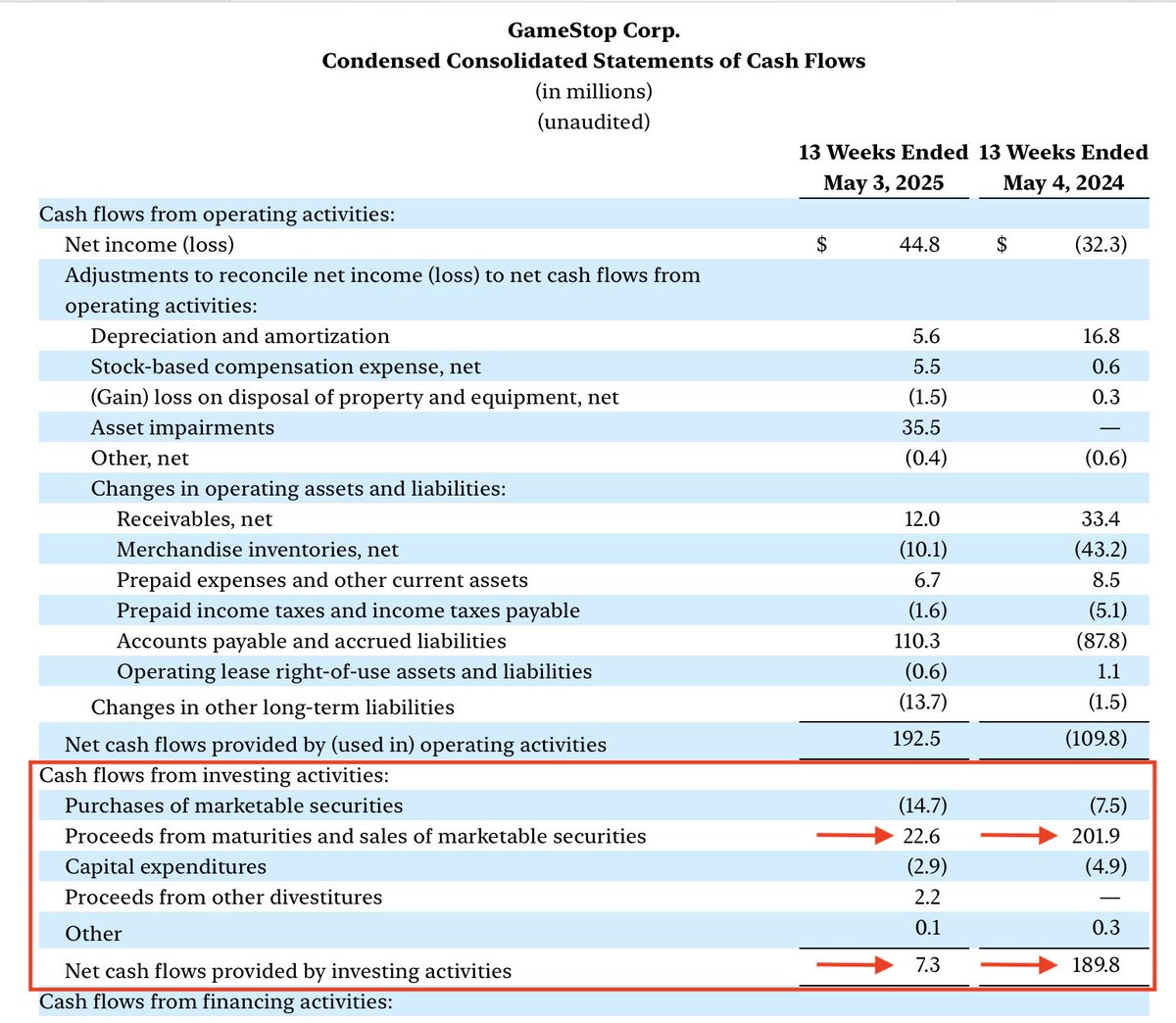

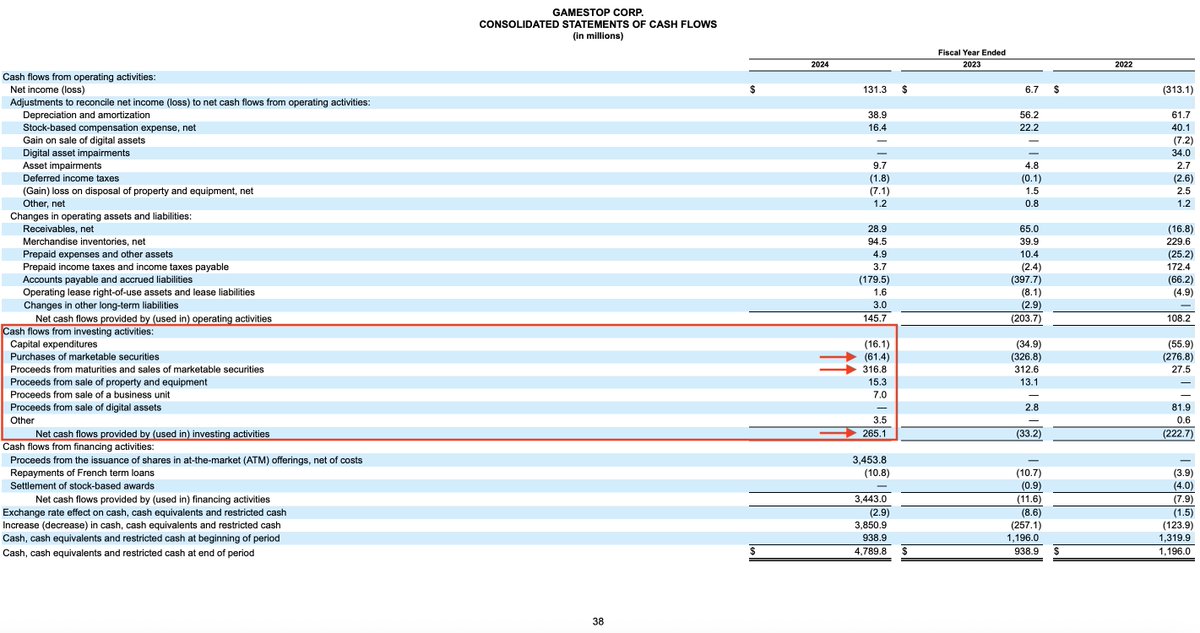

$GME made 0.001% on their cash in Q1 compared to 19% during the same period last year, despite having 539% more cash and no one is talking about. GameStop is clearly not hoarding cash to accrue quick interest on short-term treasuries.

in my opinion, this is the most curious part of the $GME balance sheet that deserves some discussion but I don't think I have seen it talked about at all. remember, the numbers for 2024 are based off of 1 billion in cash since both capital raises in 2024 occurred after the Q1…

in my opinion, this is the most curious part of the $GME balance sheet that deserves some discussion but I don't think I have seen it talked about at all. remember, the numbers for 2024 are based off of 1 billion in cash since both capital raises in 2024 occurred after the Q1…

Alright, let's have a $BBBY post. I want to chime in with some thoughts and opinions about the discussion relating to Mr. Kurzon's shareholder motion and scheduled hearing. warning: this post will be positive. tl/dr: don't worry. I do not believe it is causing any delay.…

links to easily navigate my profile: Hudson Bay Capital— • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • •…

by far one of the most rewarding things about being a part of the $BBBY community has been the pleasure of making real, face-to-face friendships with so many good people. I was fortunate enough to meet a lot of them in 2023 thanks to Ramez Jamali. I am always reminded and…

well, this answers any of the wonder surrounding RC and his status as co-debtor, creditor and party in interest within the Bed Bath Chapter 11. I should have read docket 4146 sooner. thanks plan man. $BBBY $BBBYQ

links to easily navigate my profile: Hudson Bay Capital— • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • x.com/sboho/status/1… • •…

$GME

I don’t think they would do anything to disadvantage their current Note Holders because they have an environment right now where there is extreme demand for them. I think that doesn’t lend to an ATM for now because it brings price down, potentially impairs current notes’…

thank you Ryan Cohen for making sure everyone in $GME got enough calcium.

it’s official, the $BTC acquisition for $GME was not considered a material event, which means it could have been purchased before the initial disclosure last week.

regarding $GME and the materiality of their $BTC purchase.. from the information I could find, there will be a definitive answer on June 3—prior to earnings! I want to point out that materiality considers both quantitative (i.e. 10% of assets as has been found and shared) and…

regarding $GME and the materiality of their $BTC purchase.. from the information I could find, there will be a definitive answer on June 3—prior to earnings! I want to point out that materiality considers both quantitative (i.e. 10% of assets as has been found and shared) and…

this is the best point I could find to counter my theory that the $BTC purchase made by $GME was a material event. my thoughts here: x.com/sboho/status/1… the counter-theory is that the purchase is not considered a material event in and of itself because the disclosure of a…