Rick Sharga

@ricksharga

Founder & CEO, CJ Patrick Company, Formerly EVP at ATTOM, Carrington Mortgage & RealtyTrac, CMO at http://Auction.com/Ten-X. Long-suffering Phillies & Eagles fan.

The @federalreserve Bank's decision to hold steady on current rates doesn't bode well for a #housing market desperately hoping for lower #mortgage rates to help improve affordability. Chairman Powell's comments indicating some concern about unemployment and slower economic growth…

Great article from Andrew Dehan discussing inflation and home affordability, including insights from @Bankrate's Mark Hamrick and @BankrateGreg and Lawrence Yun from @NAR_Research. The article points out that shelter costs have risen by 3.8% in the past year and contributed to…

What's going on in the #housing market? Are declining sales the fault of the Federal Reserve and Jerome Powell? Or are there bigger, broader issues at play? Great conversation today with @connellmcshane on @NewsNation. We discuss #mortgage rates, affordability, inventory and…

With affordability at about the worst levels in the last 40 years, posing massive challenges for homebuyers - especially first-time buyers - any help defraying costs is worth looking into. Saving enough money for a down payment is one of the biggest hurdles for prospective…

Honored to be one of the speakers featured in this webinar from OSC on July 24th. This conversation will feature a unique combination of experts on #housing, #mortgages, #foreclosures, #insurance, #realestate investing. If you're interested in any of those topics, please join…

This @Bankrate article by @bio561 Jeff Ostrowski is the latest indication that what might be slowing down the #housing market the most is homeowner psychology. When over 50% of homeowners say they wouldn't sell their home or buy another one no matter what happens to #mortgage…

Consumer credit delinquencies are up across the board, #mortgage delinquencies are rising, and so are #foreclosure actions. Not surprising to see a jump in #bankruptcies as well.

#Bankruptcy filings rose by 10% in the first half of 2025, and consumer #bankruptcies rose by 15%, an indication of growing household financial distress. @HelloSolutions1 can connect servicers with law firms that specialize in these matters. themortgagepoint.com/2025/07/07/sna…

If you follow the headlines - and the politicians - you may believe that huge institutional investors and hedge funds are gobbling up housing inventory across the country, and making it impossible for traditional homebuyers to find anything to buy. Some Congressmen say that these…

Affordability continues to be a challenge for homebuyers - especially first-time buyers, who lack equity to make a significant down payment. One trend that seems to be taking shape is buying smaller homes, and new home sizes have shrunk for the first time in years. Another…

Is the risk of a recession a reason to opt out of the #housing market? Should you put your plans to buy a house on hold because of worries about an economic downturn? Jeff Ostrowski (@bio561) lays out a thoughtful, well reasoned way to look at the pros and cons of buying a home…

Are recession fears causing you to pause your homebuying plans? They probably shouldn’t. Most recessions don't lead to massive job losses. The smart move: Focus on personal needs rather than economic forecasts. bankrate.com/mortgages/why-…

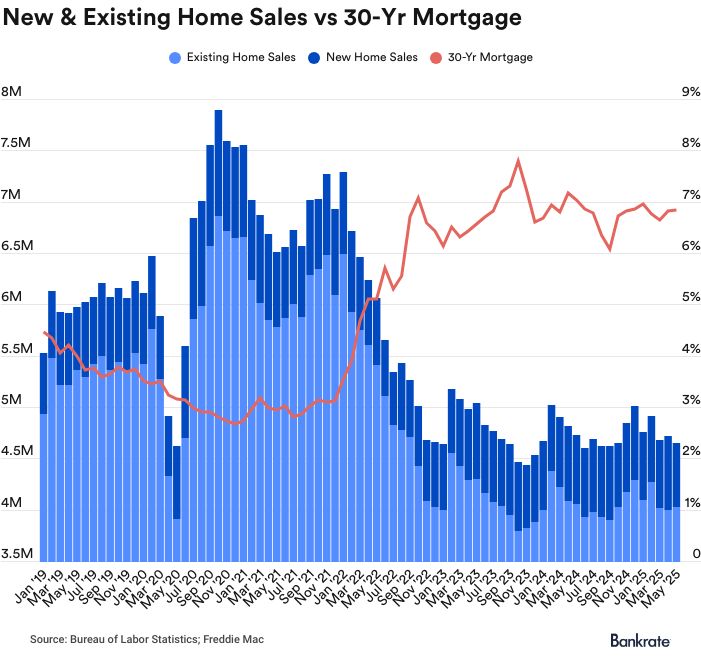

Had another great conversation with @connellmcshane on @NewsNation today, talking about dismal #home sales numbers, and what needs to happen before things start to improve. No big surprises, but there is some reason to believe that things will get at least marginally better…

Some sobering numbers from @StephenGKates at @Bankrate. Until May, new home sales had been the bright spot in an otherwise lackluster #housing market. But sales plummeted in May, and prior months' numbers were all downgraded. Meanwhile, new home inventory is at its highest point…

There's been a lot of talk about whether or not the #Trump Administration will attempt to release @FannieMae & @FreddieMac from the government conservatorship they've been held in since 2009. Accounting for about 70% of the #mortgage market, any action taken regarding these two…

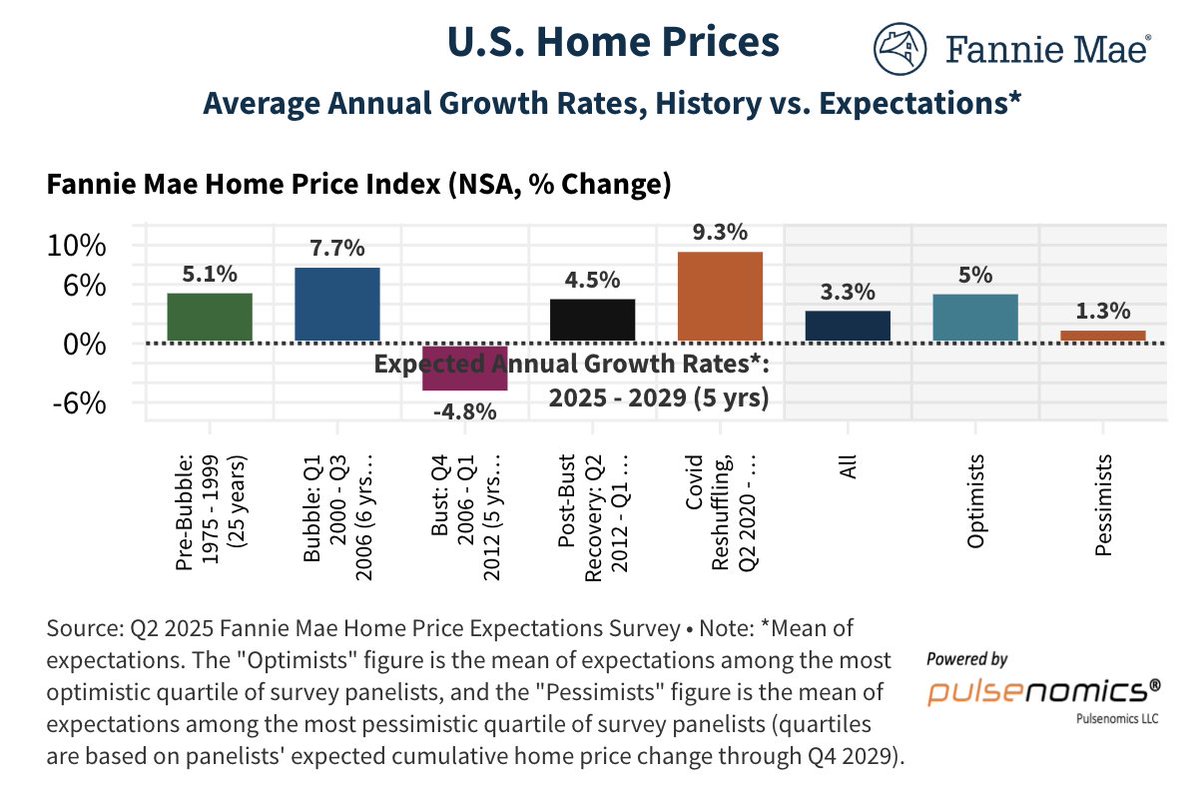

Despite what you've probably been reading about the coming swoon in home prices as buyers suddenly regain the upper hand over greedy sellers, the general consensus among 100 economists and market analysts (myself included) calls for price appreciation to continue to rise - but…

I've talked quite a bit about home affordability here, and the combination of rising #home prices, stubbornly high #mortgage rates, #inflation, higher insurance premiums, and escalating property taxes has resulted in the worst affordability in at least 20 years - and possibly…

Looking forward to tomorrow night's LIVE event, where I'll attempt to match wits with Dennis Walsh and Christian Walsh as we debate what the status of today's #housing market is, and where we see it going in the coming months. #Mortgage rates, #homesales and prices, growing…

Mark Hamrick (@hamrickisms) shares some sobering information from @Bankrate's study on "hidden" costs of homeownership. Determining whether you can afford to buy - or keep - a home increasingly depends on whether or not you can handle these growing financial commitments.

The cost of homeownership goes beyond purchasing a house. According to @Bankrate’s study, the average annual hidden costs associated with homeownership for a single-family home in the United States are $21,400 in 2025. bankrate.com/home-equity/hi…

For everyone believing the hype that there are 500,000 more buyers than sellers in today's #housing market, and the subsequent home price declines that imbalance might cause, you might want to double check that math. As @Bankrate's Jeff Ostrowski (@bio561) breaks down, home…

The latest Case-Shiller Index shows home prices are still climbing, but the pace is cooling. March saw 3.4% growth, down from 3.9% in Feb.. High mortgage rates still limit inventory. bankrate.com/real-estate/ca…

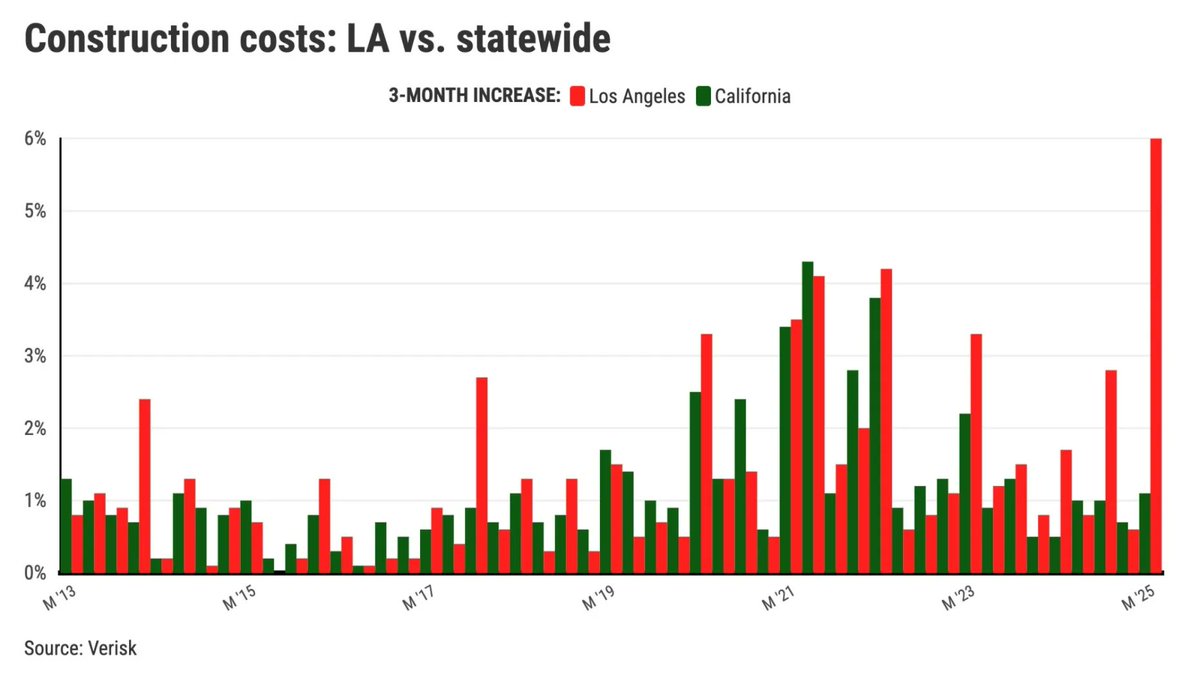

Interesting piece of data unearthed by Jon Lansner @jonlan from the Q1 2025 Repair and Remodel Index from @Verisk Property Estimating Solutions. Repair costs skyrocketed around the fire-damaged parts of Los Angeles in the first quarter, driven largely by higher labor costs. This…