QuantSeeker

@quantseeker

Investing and Trading. For information and education only, not investment advice.

A fresh roundup of the latest investing research is out. This week's topics include: ➢ Predicting Commodity Returns ➢ Market Microstructure in Crypto ➢ Identifying Mispriced Stocks ➢ Factor Momentum ➢ Great Blogs, Repositories, and Podcasts…

Most recent episode of Value Investing with Legends podcast with Prof Kent Daniel. Kent is a superb academic and fantastic teacher. A treat for those interested in finance theory, especially behavioral issues. @CenterDodd @Columbia_Biz podcasts.apple.com/us/podcast/val…

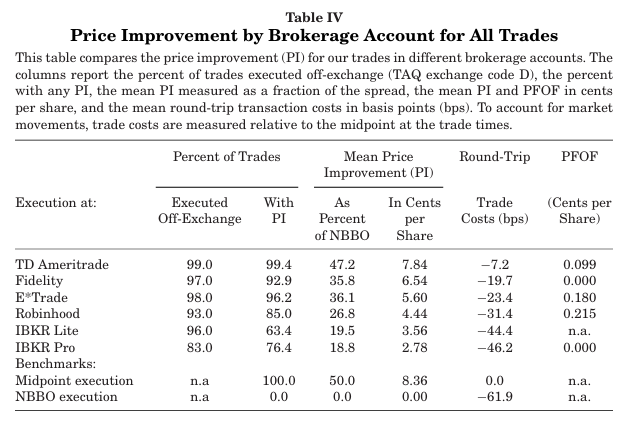

Contrary to conventional wisdom, payment for order flow (PFOF) isn’t systematically linked to worse execution. A new Journal of Finance paper finds large cost differences across brokers, even for identical retail-sized market orders, not explained by PFOF or commissions. Market…

Managed futures fund performance update: Mean-version over the past month of trading for the YTD leaders, AQR.

This is a comprehensive survey paper on crypto, covering research on trading strategies, portfolio construction, volatility prediction, data sources, and includes a rich reference list for further reading and idea generation. Paper: researchgate.net/publication/35…

An interesting new paper by Sobotka finds that a small group of stocks appears repeatedly across many anomaly portfolios, driving much of their performance. These “overlap” stocks make up about 10% of stocks each month but explain about 40% of anomaly returns. Allocating only to…

"...I would much rather have a single strategy with an expected Sharpe ratio of 2 than a strategy that has an expected Sharpe ratio of 2.5 formed by putting together five supposedly uncorrelated strategies each with an expected Sharpe ratio of 1." - Peter Muller, PDT Partners

A revised version of Jacquier et al. on quantifying overfitting is out. Key takeaways: – Overfitting is worse with many weak signals – Favor a few, strong predictors – Use the longest backtest you can – Simple models replicate better out-of-sample Paper: arxiv.org/abs/2501.03938

A revised version of Jacquier et al. on quantifying overfitting is out. Key takeaways: – Overfitting is worse with many weak signals – Favor a few, strong predictors – Use the longest backtest you can – Simple models replicate better out-of-sample Paper: arxiv.org/abs/2501.03938

For those interested in this topic, check out Stefan Nagel's recent NBER presentation of his paper with a follow-up discussion by Bryan Kelly. Talk starts at about 7:08:30. youtube.com/watch?v=oFEBlj…

A new paper by Nagel challenges the “virtue of complexity” in return prediction. Prior work claimed that overparameterized models trained on tiny samples deliver strong out-of-sample performance. Nagel shows they essentially boil down to volatility-timed momentum. The paper…

The Post-Earnings Announcement Drift (PEAD) is strongest when earnings news goes against investor expectations. Though many claim PEAD is fading, this new paper shows it remains strong when earnings surprises contradict analyst sentiment. Stocks disliked by analysts that deliver…

A new paper on the skfolio library. Paper: arxiv.org/abs/2507.04176 skfolio: github.com/skfolio/skfolio

Managed futures funds YTD. AQR still leads the way with $QMHIX followed by LoCorr $LCSAX

A new paper by Nagel challenges the “virtue of complexity” in return prediction. Prior work claimed that overparameterized models trained on tiny samples deliver strong out-of-sample performance. Nagel shows they essentially boil down to volatility-timed momentum. The paper…

A fresh roundup of the latest investing research is out. This week's topics include: ➢ Asset Allocation ➢ Currency Crashes and Momentum ➢ Time-Varying Factor Risk Premia ➢ Predictability in Prediction Markets ➢ Great Blogs, Repositories, and Podcasts…

Great episode packed with insights. Some key takeaways: 1) How much you buy often matters more than what you buy: “If you choose the right things to buy and sell but you size them incorrectly, you can go bankrupt. But if you choose even the wrong things and size them correctly,…

New podcast with Victor Haghani (@ElmWealth)! We cover: - Can you predict the market if you know the news in advance? - Merton's view on position sizing - His framework for asset allocation - When should you do a Roth conversion? Thanks to our sponsor @ycharts! Links below

Just found Turtle Talk. Great stuff on trend following!

🚨 NEW EPISODE – Turtle Talk #004 is LIVE! 🐢🎙️ Featuring special guest Dr. Kevin Maki 🎧 Listen now: aussieturtles.com/episode-004-fr… #TrendFollowing #TurtleTalk #SystematicTrading #AllocatorMindset #MomentumQuality

A fresh roundup of the latest investing research is out. This week's topics include: ➢ ETF Arbitrage ➢ The Post-Earnings Announcement Drift is Alive ➢ Asset Allocation and Regime-Switching ➢ Volatility Trading ➢ Great Blogs, Repositories, and Podcasts…