Quantlytica

@quantlytica

Quantitative Hedge Fund for Everyone | Backed by @0xPolygon

Welcome to the new era of memory An AI model that never forgets x.com/i/communities/…

They say degens never learn. Good thing LSTM does. Every cycle looks different at first, but the patterns always return: > Sudden volume spike > Frenzied memes > Influencer pump > Exit liquidity fade LSTM (Long Short-Term Memory) is built to recognize these loops. It tracks…

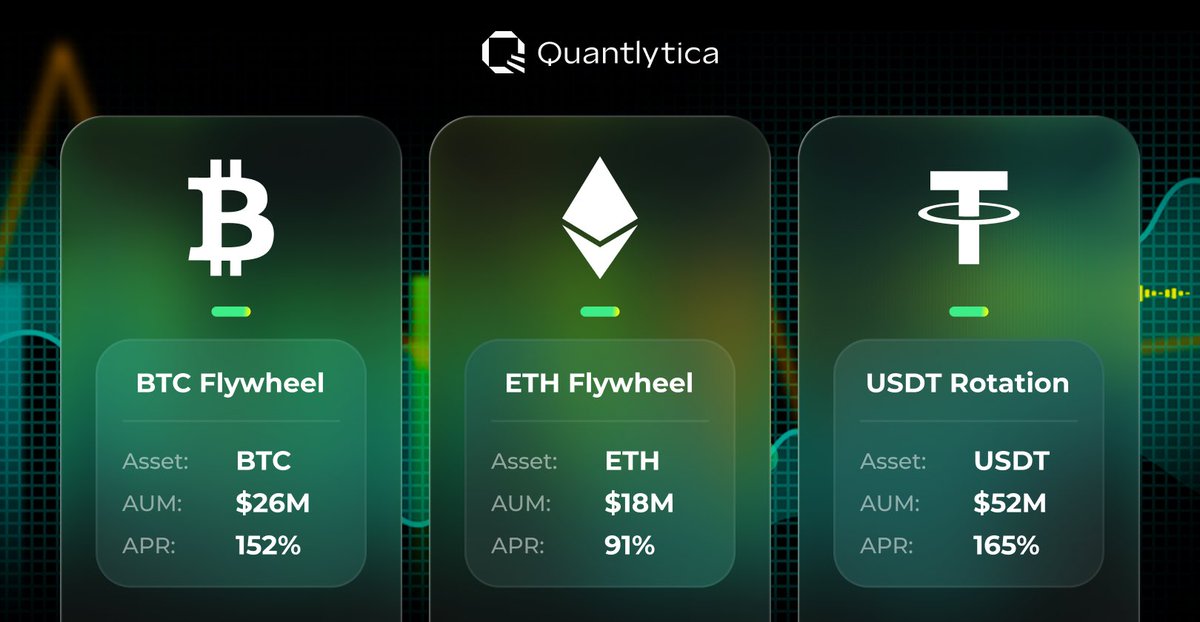

Silent in socials but loud in business. From Finland, to Dubai, to HK, for the past few months we have onboarded 100M AUM from several capitals, generating decent yield for them. Moving forward, there will be more strategies released and we will soon open these strategies to…

Why does LSTM matter in crypto? Because financial markets move in patterns. And LSTM is built to learn them. Here’s a thread of recent research showing how LSTM models outperform others in predicting market cycles, including crypto. 👇

Traders forget. Models overfit. $LSTM just loops. Why does LSTM work? Because it holds every mistake you’ve ever made.

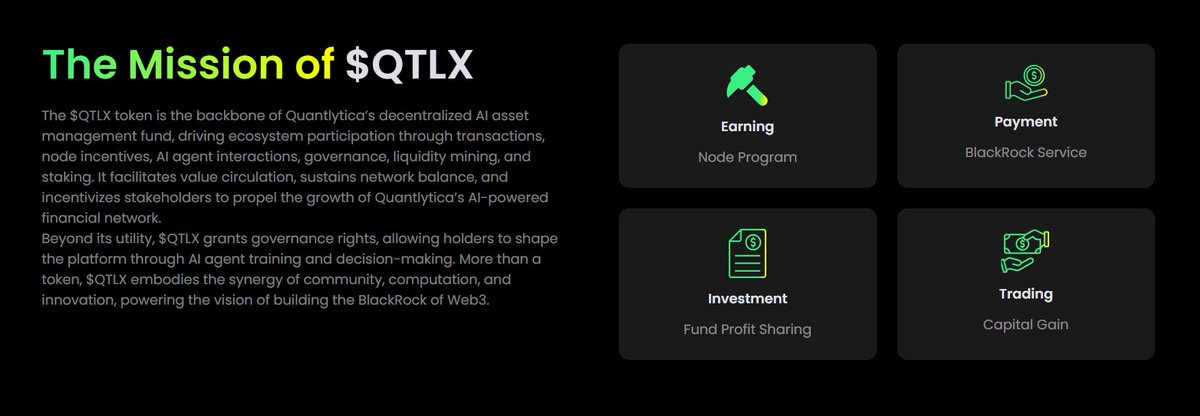

Most tokens are for trading. $LSTM is for remembering. It will be the utility token that powers the LSMemory engine: a system built to learn from market cycles, on-chain activity, and sentiment shifts. Holding $LSTM isn’t just a flex. It gives you access to memory logs,…

Crypto markets move in loops. Hype → Volume → Pump → Exit → Repeat. LSTM (Long Short-Term Memory) is an AI model built to understand those loops. It doesn’t just process data — it remembers. Short-term moves, long-term patterns, and everything in between. That’s why LSTM…

What is LSTM? And why does it matter in AI? LSTM stands for Long Short-Term Memory — a type of neural network designed to process information over time. Unlike most models that only react to the present, LSTM can learn patterns from sequences — like sentences, stock prices, or…

An AI model that never forgets. Loading your history... Scanning forgotten cycles...

🚨 BBAChain x Quantlytica 🤝 AI meets Layer 1. We’re joining forces with @quantlytica to bring autonomous, real-time AI trading to the world of decentralized finance — backed by top-tier hedge fund talent & institutional-grade strategies. This is the future of wealth creation.…

Our Mega Space with 17 attendees is starting at 15:00 UTC in about 3 hours 🎙️ Will we see you there? 👀 Don’t forget to set your reminder👇

Victus Global Mega Space this Saturday at 15:00 UTC 🎙️ Topic: Web3 Builders 👷♂️ 17 attendees 👀 Co-host: @cryptovieb Projects: @ShidoGlobal @aigentdotrun @icbx_network @quantlytica @Mey_Network @TajirTechHub @KintoXYZ @yachtscoin Continued👇

🔮 #Quantlytica is coming to #Solana — bringing a smart trading revolution to the Solana ecosystem! Imagine this: while you’re making lightning-fast trades on the Solana network, a tireless AI assistant is working 24/7 behind the scenes to: 💡 Analyze all on-chain data to…

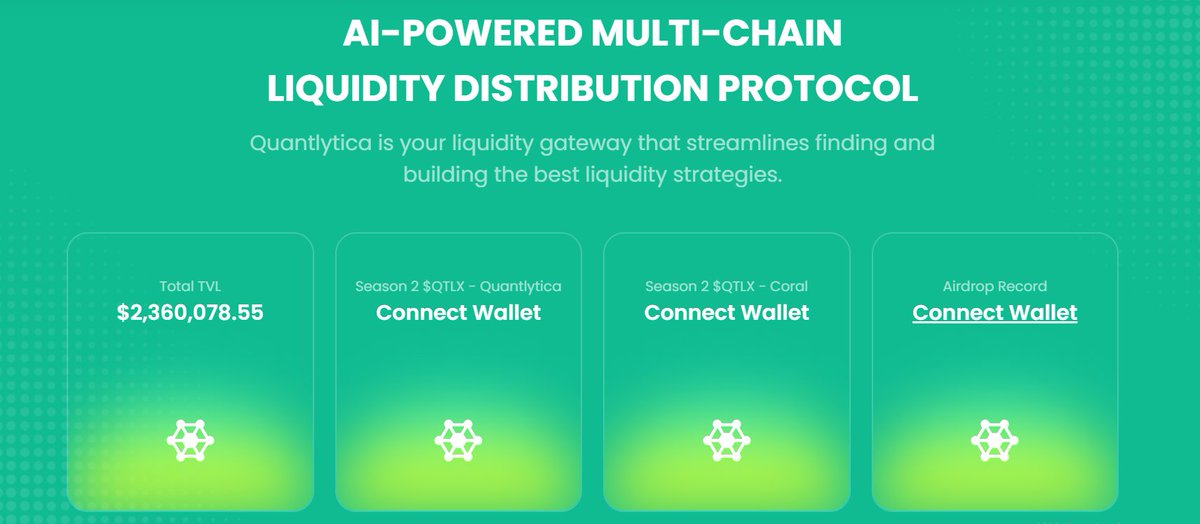

Quantlytica was designed with the user in mind, featuring a streamlined interface that consolidates various opportunities into a single, easily accessible hub. This simplifies the user experience, enabling participation in multiple investment avenues with just one click. Our…

From Bitcoin to Ethereum and now Solana, Quantlytica’s AI-powered strategies help you instantly capture liquidity opportunities across the entire chain. Faster, safer, and smarter.

🔥 Quantlytica is about to officially launch on Solana! Imagine no longer having to sift through countless pumps every day—just set up QTLX and you’re already ahead of 99% of people. Our users used to manually pick tokens, feeling the pressure of each trade. Now, Quantlytica’s…

Major news: After 18 months of late nights and endless code, we're finally launching with @VictusGlobal_ Built an AI that makes crypto asset management dead simple. One click = custom portfolio. Wild to see this baby finally take flight. Ready to show you what happens when AI…

🎯 How can QuantGPT help you earn more on Solana? Tired of overthinking crypto trades? Simply set up QTLX, the first AI-powered DCA bot. Choose your token, set your budget, and select how often you want to buy. That’s it. No more emotional rollercoasters or missed…

Humans panic sell when BTC rebounds. AI doesn't care about your feelings. Just watched my trading bot stay cool during a market dip while my group chat had a meltdown and take profit when market rebounds. Numbers don't lie - AI traders outperform emotional humans 9 times out…