Piyush Chaudhry

@piyushchaudhry

Trader | Elliott Wave Principle | Automated Trading Algorithms | Volatility | Macros | Gymmer | @wave__analytics @tradingchakra | Insta: piyushchaudhry08 | 🕉️

Testimonials @TradingChakra DM for inquiries.

Testimonials @TradingChakra DM for inquiries.

IT Index x.com/piyushchaudhry…

The IT Index has been one of the biggest underperformers in recent years, and if ratio charts are any indication, it may continue to underperform for a considerable period going forward.

आप सबको VIX के बढ़ने पर ढेरों शुभकामनाएं और बहुत-बहुत बधाई

समय का चक्रव्यूह कुछ कहने का प्रयास कर रहा है

4 Trading Days to go.. SPX could be forming Three White Soldiers on Monthly, whereas NIFTY could be forming Tweezers. Divergent paths. * To be reviewed

FinNifty & Private Banks - both at Make or Break - and, will decide the fate of the Markets.

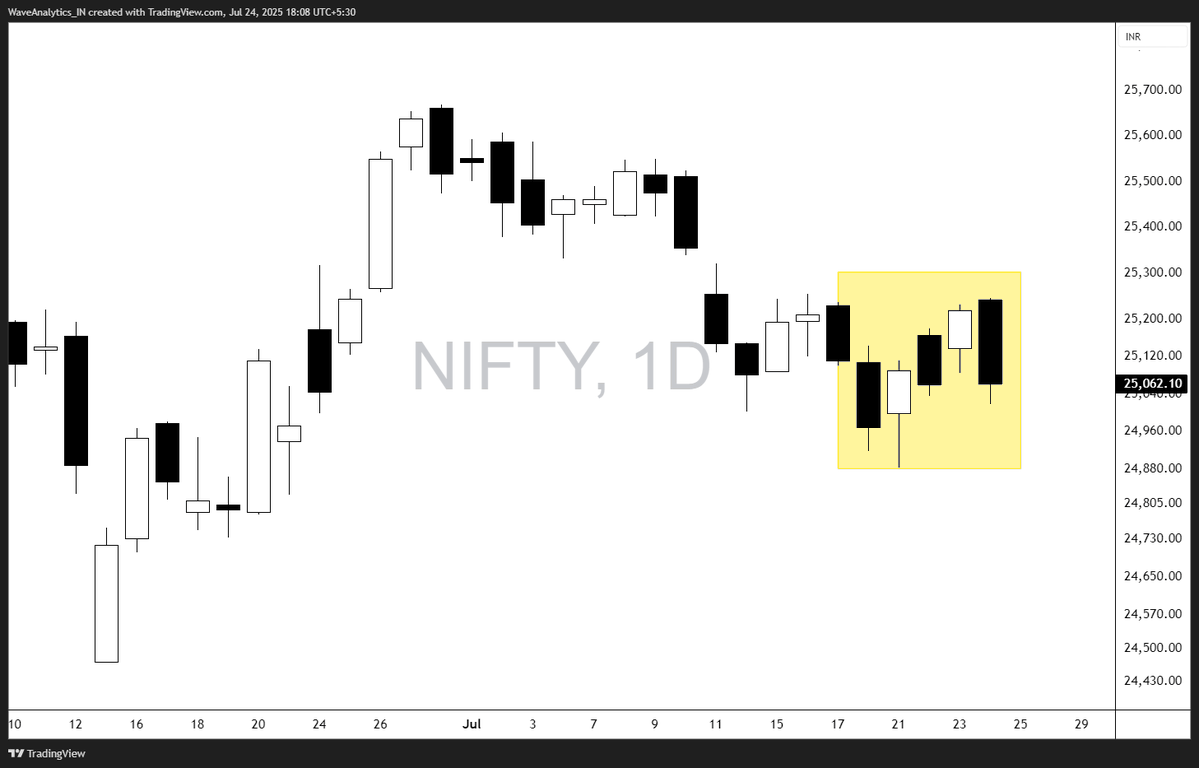

#QuizTime which single candlestick pattern has formed on NIFTY weekly❓ what are the implications — bullish or bearish❓

winds = short term price movement ocean current = the broader perspective

Let the winds rage and deceive. They shift by the hour. The seasoned warrior follows the ocean current beneath: steady, unseen, and strong. Those who chase the wind fall to chaos. Those who ride the deep flow endure. They stride forward with scars and eventually conquer.

The external shocks ..

Two Giants appear to be stirring Macro Markets up at once. ● US Dollar Index (DXY) seems to be reversing its decline. Historically, there's a strong inverse correlation between DXY & Emerging Markets along with Commodities. ● Japanese Yields, after a dormant period, are now…

The tectonic shifts ..

Whenever FMCG Index starts outperforming NIFTY, it has historically coincided with NIFTY entering a Corrective phase — either in price or in time. The recent uptick in the FMCG/NIFTY ratio is a bit concerning, especially as it aligns with the Trough Zone of its Time Cycle.

The Bajaj Twins ..

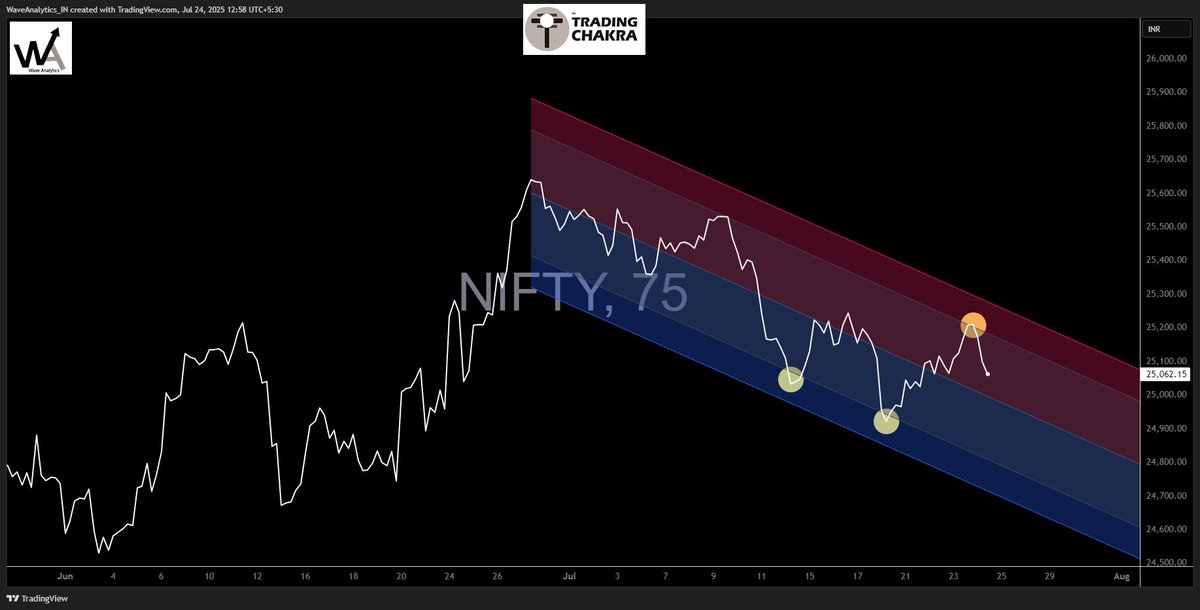

The back and forth Swings of FinNifty

NIFTY has broken to a fresh July Low. No worries though, June Low is safe and intact at the moment. Also, the Jun’24 Low.

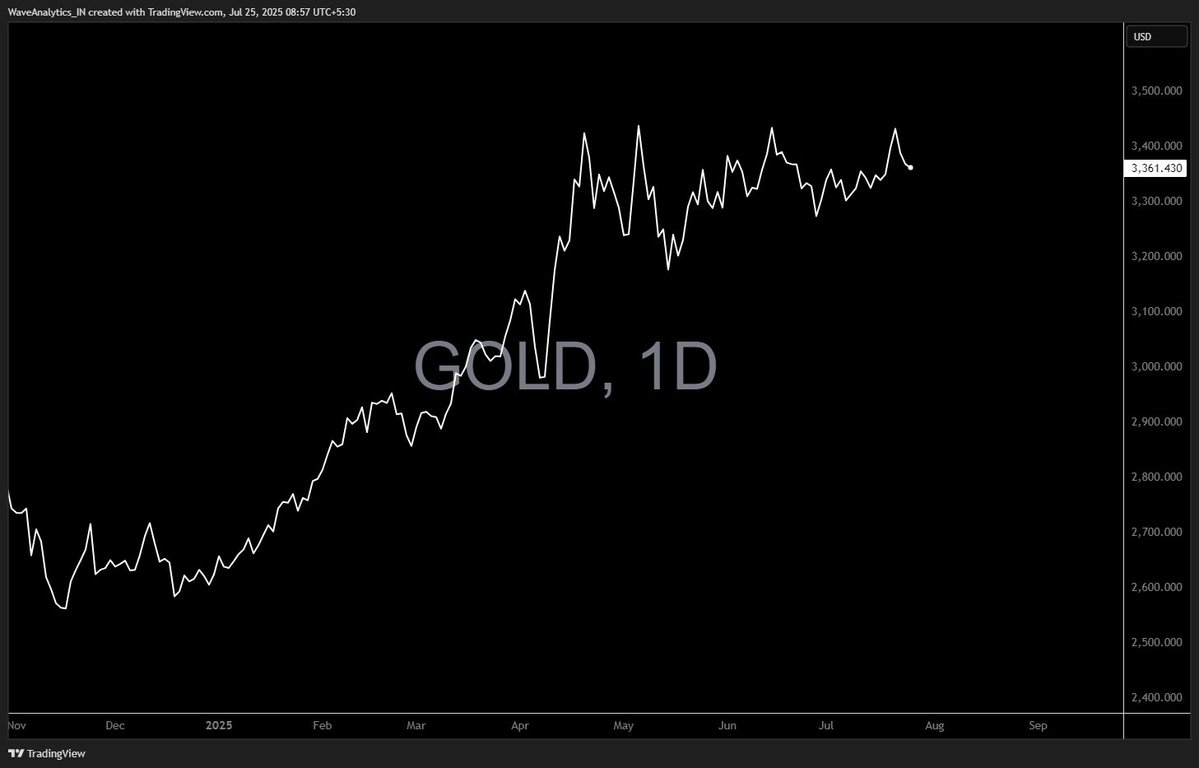

The sideways consolidation in Gold is not weakness. It is the calm before the charge. Like warriors gathering at dawn, Gold is lining up its soldiers, sharpening its blades, and studying the enemy gates. Each candle on the chart is a war drum, steady and relentless. The fortress…

It's THAT phase of the Market — BTST: Buy Today Suffer Tomorrow STBT: Sell Today Burn Tomorrow