pennyether

@penny_ether

Public BTC Miner analysis, like no one else. Won't take refuge in the false security of consensus (except BTC). Critical thinker, happily accept corrections.

Port ballooning despite significant powder (cash/gold). Things feel hot, my spec bets are hitting, and so I continue to trim. My biggest bets are probably TLT calls and ZQ contracts. I think Fed cuts sooner and bigger than the market does. In the BTC / mining / HPC world... I…

At current mNAV of 1.80x, $MSTR will have to sell 13,471 BTC-worth of ATM ($1.6b) to generate a 1% BTC Yield. In May this number was around $1b. People just don't understand exponential curves.

The irresponsibly long MSTR group is remarkably, extremely, desperately salty and bearish. Kind of intriguing, since their absolute, bulletproof euphoria in November was the literal pico top.

$BITF - I had hundreds of $1C for Jan, waiting for the $RIOT overhang to be done with.. but this buyback announcement is just as good. Trimmed. Most miners are back to where they were 6 months ago, which would put $BITF at around $1.60.

$OPEN - Haven't seen 500% IV since peak $GME. Christmas coming early for Citadel and friends.

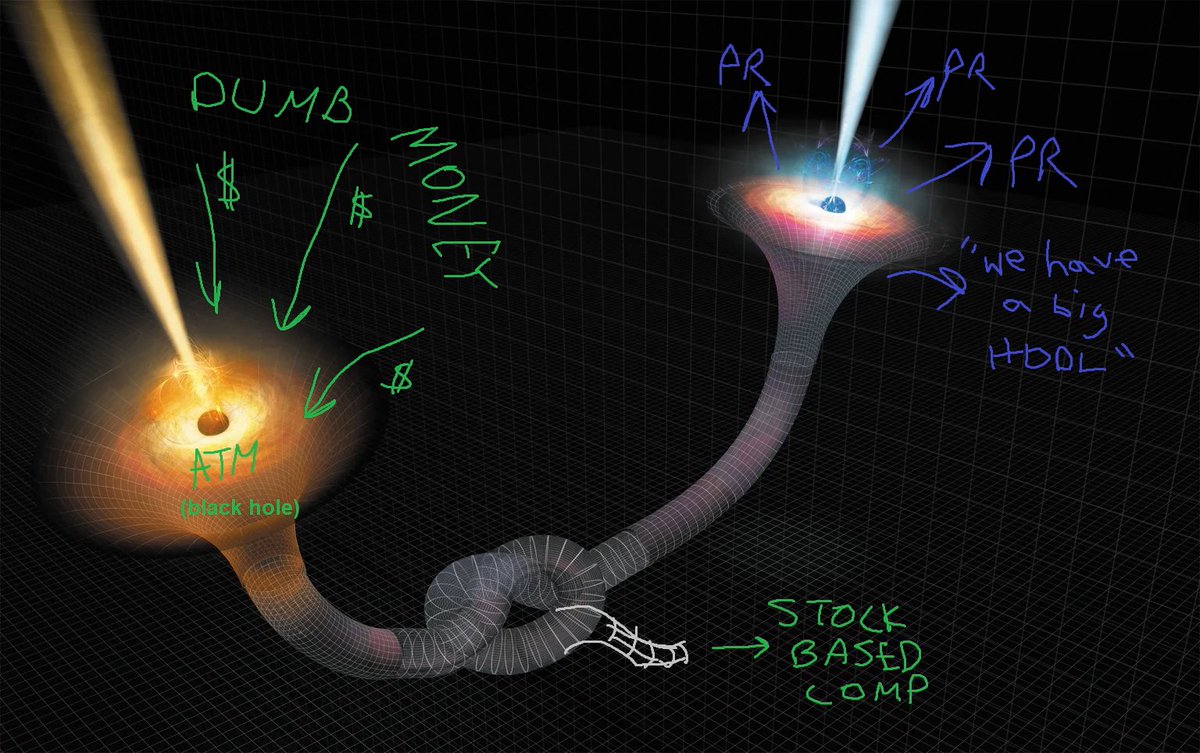

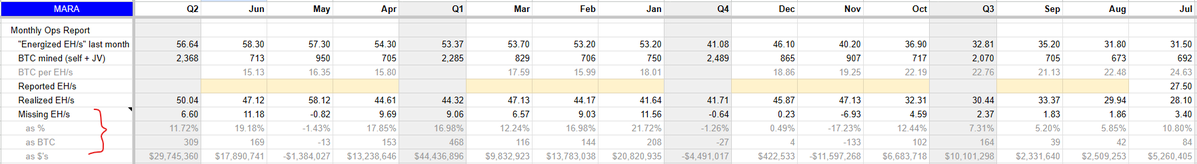

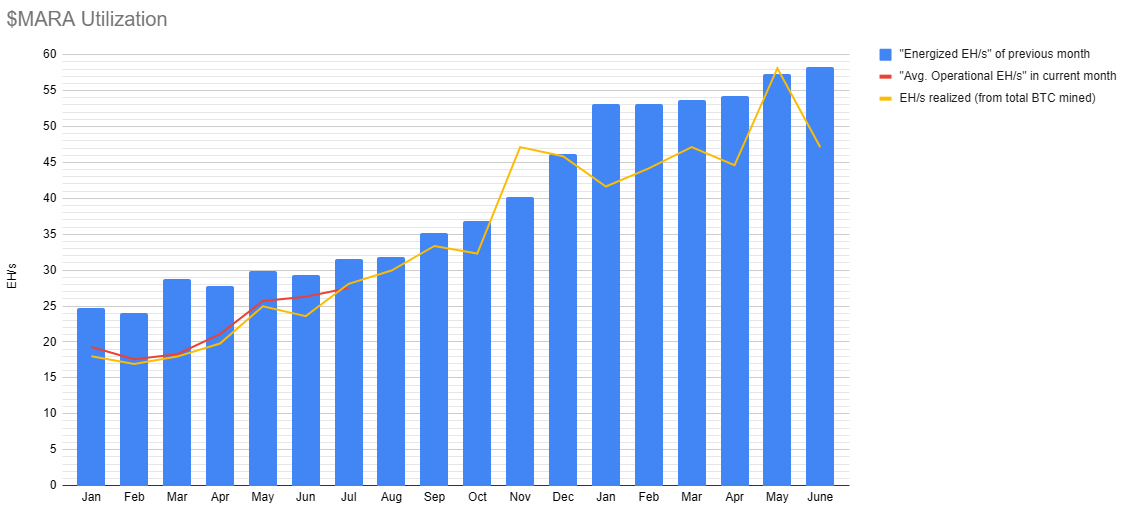

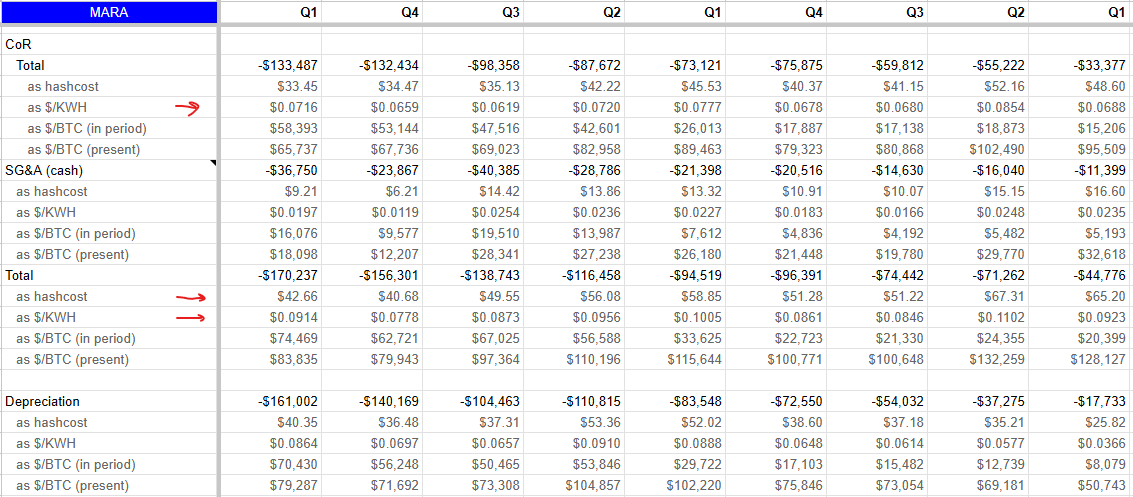

$MARA - Going back to my roots for a moment and calling out red flags. This was off-the-dome, so I probably forgot some stuff (feel free to comment). Happy to hear counter-arguments to any of these -- other than "they have a big HODL". Financials: - Heavy reliance on ATM. That…

Cycle will top when a token makes their own treasury, goes public, and prints tokens to increase their tokens / sh.

The recreate-$MARA-in-aggregate (purple) has done well. Basically, it's short $MARA, but long a basket (of equal cost) which yields more profit/$ and HODL/$ than $MARA. Less PR/$, though. The weights need periodic rebalancing (I'm showing the weights at around November), so the…

The trade here, and I've called this out many times, is to short $MARA and go long an aggregate reconstruction of it. I refer to this as my watering hole. The factors you want to reconstruct are up to you, but I've been going off of: - HODL / sh - Future BTC produced / sh -…

How is this waste of bitrate allowed on TV? $CRWV stands to gain ~$680m/yr in EBITDA. No synergy? Then he confuses net income with cashflow. Certified 🤡. He seems to think MWs are in huge demand, though, so presumably a bull on other miners if he could add 1+1? @gilluria

"Core Scientific's purchase doesn't add any profits to $CRWV," says D.A. Davidson's @gilluria. "All they're doing is ensuring $CORZ doesn't give its capacity to somebody else." cnb.cx/4nR7CUO

Banger post, and article, explaining the $CORZ discount via a lower synthetic forward price on $CRWV. High borrow cost, lower "future" price. Great article on put/call parity as well.

Deal came out at $20.40, all stock. A bit worse than expected but not too far off. I expected an all stock deal higher and/or with some price protection. This suggests a couple things, 1) CORZ desire to get a deal done was very high, 2) CRWV is being tighter with their purse…

$CORZ / $CRWV - All stock deal at conversion of ~1:8. Pending shareholder approval. Effectively $CORZ is "worth" ~$20/sh, but really it'll be worth 1/8th of CRWV at close (exp: Q4). So why the dip? Note: In this post, anytime I use "$20/sh" I'm referring to ~1/8th the price of…

Welcome to the party, Patrick Boyle youtube.com/watch?v=inI0SC…

This doesn't seem like a big deal. The miners will be able net out the expense of the ASICs in a lump sum rather than across 3+ years... but it's the same amount of expense either way. I don't understand how this provides tax savings. If they take a big lump sum writeoff now,…

$MARA $IREN $CIFR $RIOT The “Big Beautiful Bill” reinstates 100% bonus depreciation for equipment purchased through 2029, allowing Bitcoin mining investors to immediately expense ASIC hardware costs in the year of purchase, rather than depreciating over five years. This enables…