Paola Rojas 🐝

@paola_rojas

Metals, stocks & markets. Corporate advisor to buy/sell side @synergyrescap w/$80M+ in deals. Investor. AAusIMM. Sydneysider, originally Chile/Argentina

My current sentiment in a nutshell: Bullish short + long term - copper - gold - silver Bullish long-term (despite current weakness/volatility, needs patience to recover and active portfolio management) - lithium - uranium Bearish for the foreseeable future - cobalt: I learned…

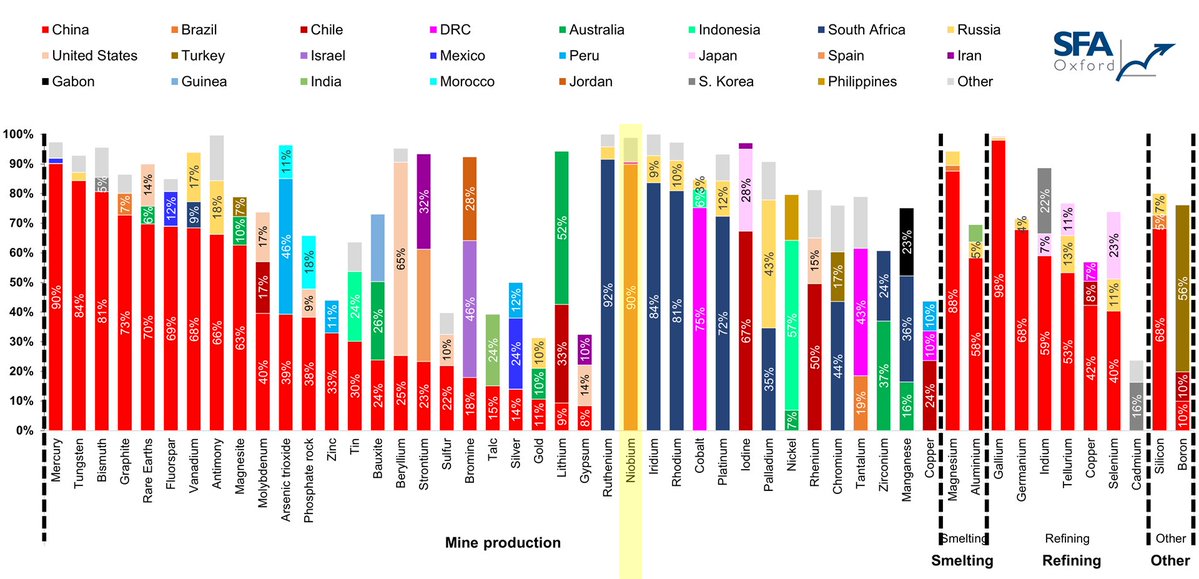

You may not know this: Niobium production is highly concentrated... but not where you'd think. As it turns out, for this metal, Brazil is the king with 90% of all production. 📊 @USGS #WA1 $NB $SGQ

Investing | 📋 $SGQ is now covered by Evolution Capital. They initiated coverage with a 12-mo target price of A$0.14/share considering their existing REEs and niobium endowment and catalysts. For details, see their latest research on the stock. 📇 @StGeorge_SGQ

📋 #S32 is reiterated as Buy on valuation grounds, price target unchanged at A$3.40 by @Jefferies ▣ #mining #stocks For details, see their latest research on the stock. ___ PS: You'll find more in our feeds and via email updates

🔺 $SGQ seeks trading halted pending announcement on capital raising ▣ #niobium #stocks

These metals will be in every investor’s portfolio (yes, including you) Plus what we're watching this week, across markets and commodities. paolarojas.blog/2025/07/21/the…

Analysis | On our desk, under review: • CH-116 asset in Atacama, Chile • Seeking: Acquisition | JV • Focus: copper, gold, silver Learn more about our deal flow via link in bio.

Commodities | Argentina won the lithium match, period. $LAR $LIT

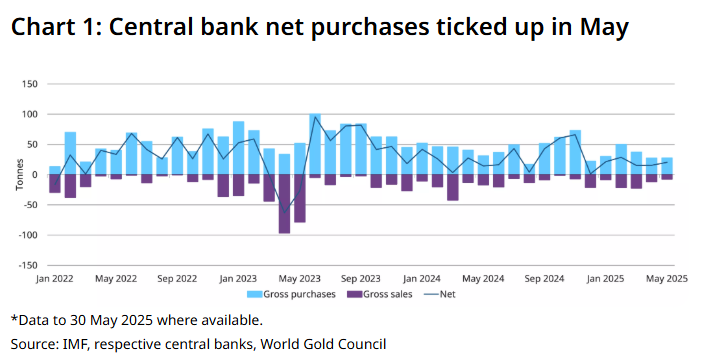

Far from over. Global central banks bought a net 20t in May, up but below the 12-month average of 27t. We should see lifts given increased geopolitical risks. Are you bullish? 📊 @GOLDCOUNCIL $NEM $AEM $OR

Stockhead’s Tylah Tully looks at the latest from @StGeorge_SGQ, who is looking to expand its Araxá rare earths project in Brazil. #ASX $SGQ buff.ly/FvBaE3b

Don't forget: China thinks in centuries and plan their mining investments accordingly, while in the West we think in quarters. They have been positioning for decades, across dozens of countries and minerals. The future is poised to be quite different.