On Chain Times

@onchaintimes

Crypto reports read by more than 12,000 investors

Recently, @xStocksFi went live on @KaminoFinance with the following markets: SPYx TSLAx NVDAx MSTRx AAPLx QQQx GOOGLx HOODx With around close to $500k worth of xStocks supplied in this market and $117k borrowed against these it's still early days for this integration. As…

Another day, another dollar saved trading on Kamino Swap. Whether for precise limit orders or instant market swaps, the venue continues to grow in popularity and is steadily becoming a household name on Solana. The product’s newest aggregation feature has already processed more…

Kamino Swap has surpassed $1 Billion in volume Delivering the best on-chain rates on Solana. Zero fees. Zero bias.

Another new market is live on @KaminoFinance: "Maple Market" featuring $SyrupUSDC from @maplefinance. SyrupUSDC yields a 6.5% APY paid by borrowers on Maple as well as drips on top ($SYRUP rewards). Currently, $USDG from Paxos can be borrowed at just 1.38% due to $USDG rewards…

Hyperliquid hit a new all time high of $248b in perps volume in May. A new weekly all time high was also hit with nearly $80b in 1-week volume (more than $11b in average daily volume every day for a week).

Kamino recently launched an @ExponentFinance PT-SOL market featuring • PT-kySOL-14JUN25 from @KyrosFi • PT-fragSOL-10JUL25 from @fragmetric Users supplying these assets can borrow $SOL against their collateral and will get rebates in $JTO making borrowing less expensive.…

Analysis of HLP & JLP performance📊 HLP and JLP act as market makers on Hyperliquid and Jupiter respectively. Both have shown solid volatility-adjusted returns over the past year and have close to $2b in total deposits combined. HLP recently saw its largest 1-week drawdown…

Despite the market drawdown, @HyperliquidX has been able to consistently grow in perps volume this year with $189b in Jan and $187b in Feb. It is also on track to hit a new high in monthly volume as $93b has been traded in March already. Looking at the past 30 days, Hyperliquid…

If you're looking for the highest yield on $SOL, look no further than the Jito market on @KaminoFinance. The LRT $ezSOL from @RenzoProtocol built on top of @jito_sol restaking is currently earning 10.19% APY (versus 8% on regular staked $SOL). In addition, 750k $REZ are given…

The Lazy Summer Protocol by @summerfinance_ is live and is offering 50-100% APY on $USDC, $USDT and $ETH deposits across Ethereum mainnet, Base and Arbitrum. The vaults tap into protocols like Morpho, Aave, Fluid and others and are all currently earning incentives in the $SUMR…

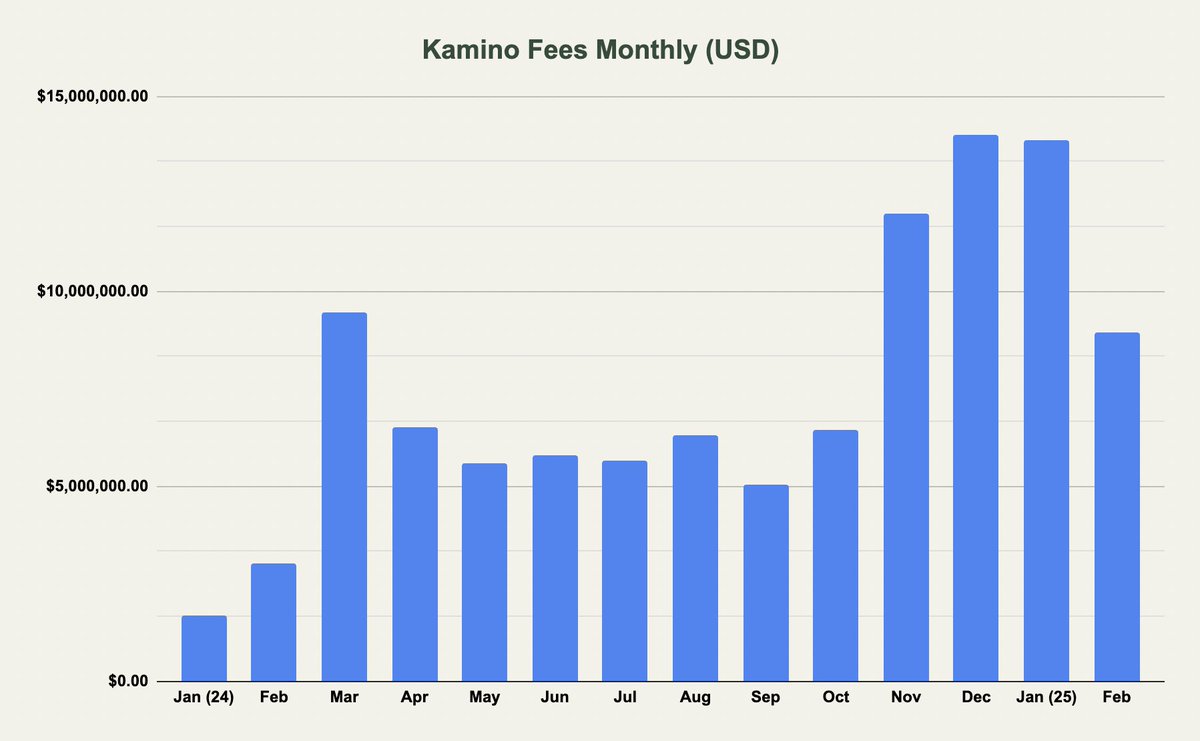

Fees generated by @KaminoFinance continues to trend upwards with $8.95m in February so far. Annualizing year-to-date fees, Kamino is on track to generate nearly $170m in fees in 2025 which corresponds to roughly $45m in estimated revenue. Data from @DefiLlama