Nishant Kumar

@nishantkumar07

Chief Correspondent, Bloomberg. Writes on hedge funds & talks to his plants. Ex-Reuters. Retweets & likes are not endorsements. Tips to [email protected]

EXCLUSIVE: Ex-Marshall Wace Ravi Naresh lands $3B from Millennium. Thomas Wong’s Optimas gets $1.2B. Millennium is pulling top traders into its orbit - external or internal - as AUM hits $77B bloomberg.com/news/articles/…

Ex-Citadel PM Sean Murphy lands $200m SMA from Qube to launch Jerpoint Capital — a long/short & risk arb hedge fund. bloomberg.com/news/articles/…

Walleye Capital is pausing taking new cash, joining a string of multistrategy hedge funds turning down investors to avoid being bogged down by size. AUM above $8 billion now bloomberg.com/news/articles/…

Neville Shah, who previously ran money for Millennium (and others) at his own hedge fund Kodai (which decided to return cash earlier this year), is coming in-house to join equities management team at Izzy Englander’s $77 billion investment firm bloomberg.com/news/articles/…

Man Group is cutting jobs in a revamp that includes a leadership reshuffle as part of an ongoing overhaul by CEO Robyn Grew bloomberg.com/news/articles/…

After 7 years, $30B AUM & avoiding US, hedge fund Qube is finally setting foot there. The secretive quant giant is opening its first U.S. office, in Houston. From London to Hong Kong, Aarhus to Sydney and now Wall Street’s backyard. bloomberg.com/news/articles/…

Walleye is feuding with a former top trader, Geoff Tennican, over his ability to form a new venture after he left the hedge fund earlier this year bloomberg.com/news/articles/…

A portfolio manager who used to run money at Ken Griffin’s hedge fund behemoth Citadel is preparing to launch a new macro fund, joining a rare breed of independent managers starting out with $1 billion or more bloomberg.com/news/articles/…

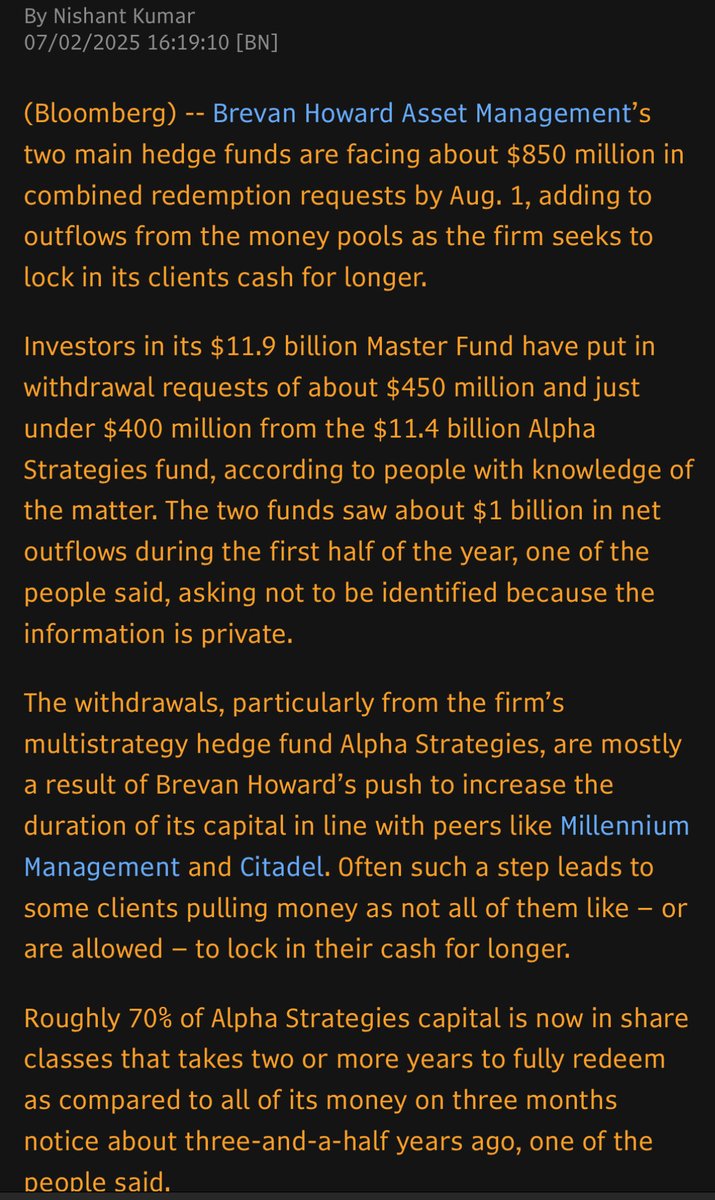

Brevan Howard is shutting a hedge fund run by star trader Ville Helske as it focuses on increasing the duration of cash it manages to gain a more stable asset base. Helske will continue running billions for other BH funds. His H1 was +15.5% in the fund bloomberg.com/news/articles/…

Pentwater’s hedge funds soar 21% in H1, among their best ever. The driver? A bold, $1B bet on US Steel–Nippon Steel deal that it stuck to through the 18-month saga that divided the US steel industry and became a flash point in American politics bloomberg.com/news/articles/…

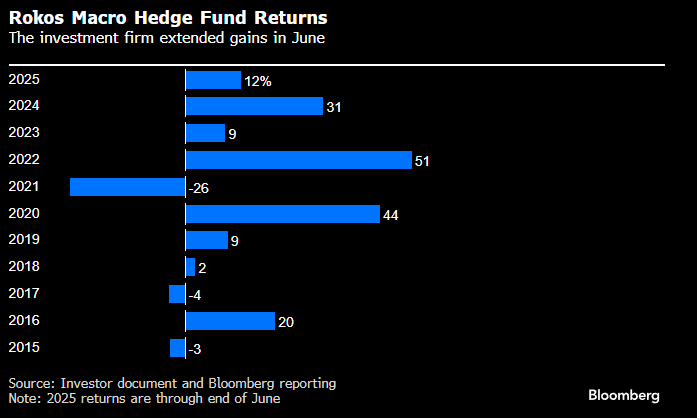

Billionaire Chris Rokos’ macro hedge fund extended gains in June to cap the first half of the year with double-digit returns bloomberg.com/news/articles/…

My Bloomberg TV interview with @sonalibasak on hedge funds' boring but valuable first half returns and what's causing outflows at Brevan Howard. Full story here: bloomberg.com/news/articles/… bloomberg.com/news/videos/20…

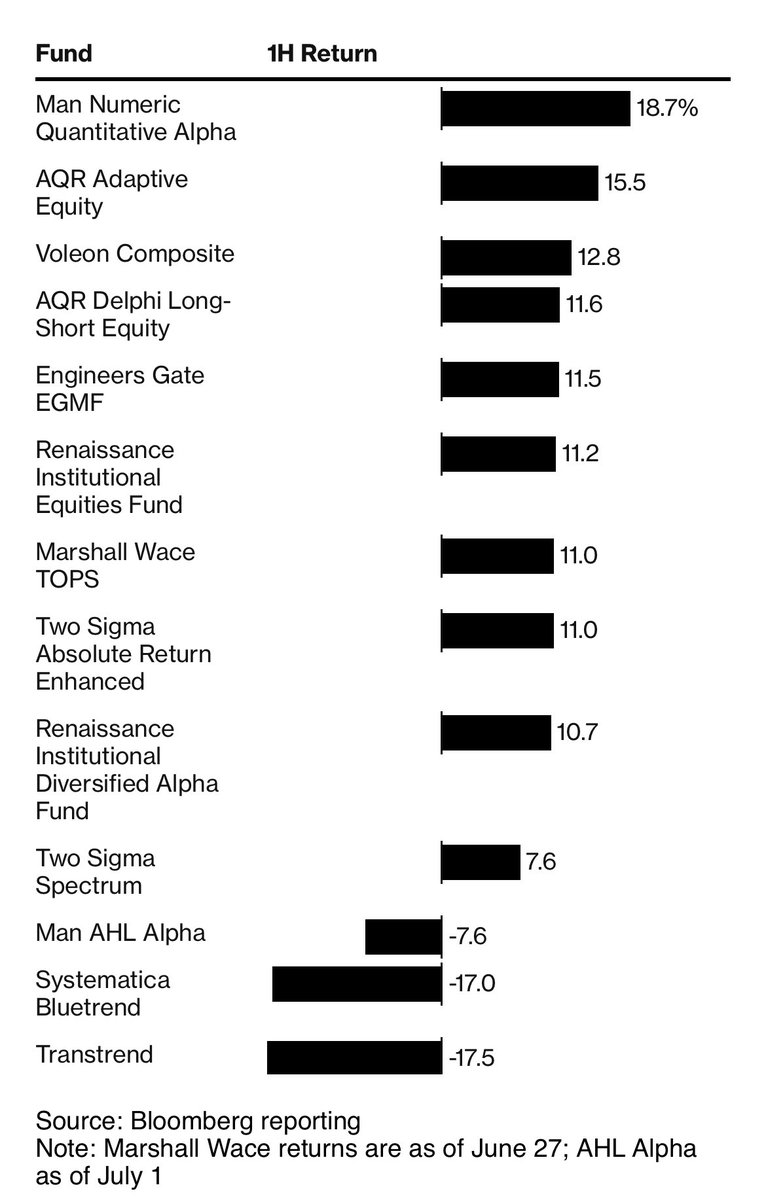

The first half of 2025 was dominated by policy upheaval and Wall Street angst. But inside the markets where the world’s biggest quants operate, a funny thing happened: Time-honored trading patterns prevailed bloomberg.com/news/articles/…

Brevan’s Main Hedge Funds Face $850 Million in Redemptions by August. The withdrawals are largely due to the firm's push to increase the duration of its capital

Scorching sun on full blast. Perfect day for two cones and no regrets!