Shreenidhi P

@nid_rockz

Research Head at PINC Wealth Management CFA Level 3 candidate, MBA Finance from Great Lakes Institute of Management, Passionate about equity research

Good #Q1FY26-23/7/25 post 8pm Borosil Renewables #BoroRenew #BorosilRenewables Good margin expansion QoQ and YoY Rev at 332cr vs 242cr, Q4 at 327cr Utilization is almost at 100% OPM scales back up to 28% PBT at 67cr vs -5cr, Q4 at 45cr Good QoQ growth 325cr one off loss due to…

Good #Q1FY26-23/7/2025 from 4pm till 8pm Force Motors #Force #ForceMotors Solid Q1FY26 on a big base Good margin expansion QoQ and YoY Rev at 2297cr vs 1884cr, Q4 at 2356cr PBT at 287cr vs 185cr, Q4 at 268cr PAT at 176cr vs 115cr Senores Pharma #Senores #SenoresPharma Rock…

Good #Q1FY26-23/7/25 till 4pm Sky Gold and Diamonds #SkyGold Solid Q1FY26 with 100bps+ margin expansion 👏 Good QoQ uptick 15% QoQ PAT growth 18% QoQ PBT growth Solid set overall Rev at 1131cr vs 723cr⏫56%, Q4 at 1058cr EBITDA ⏫92% at 71cr OPM at 6.3% vs 5.1%⏫120bps PBT…

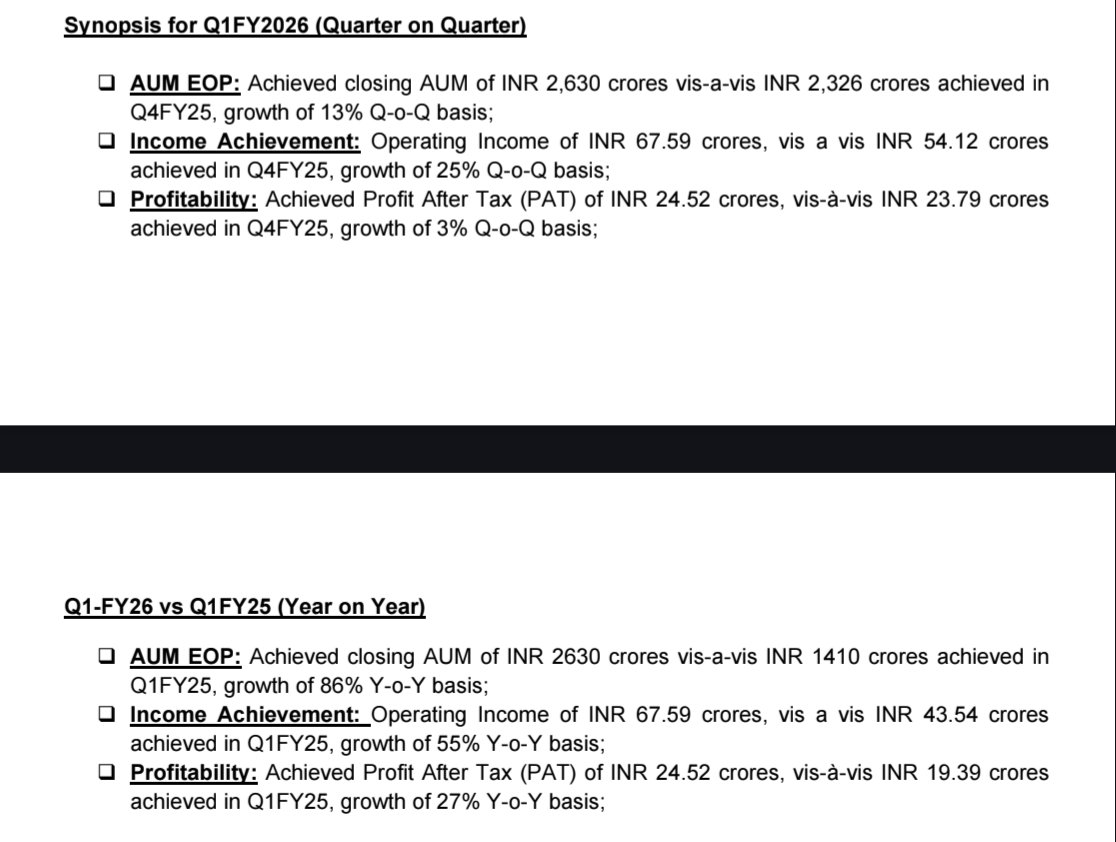

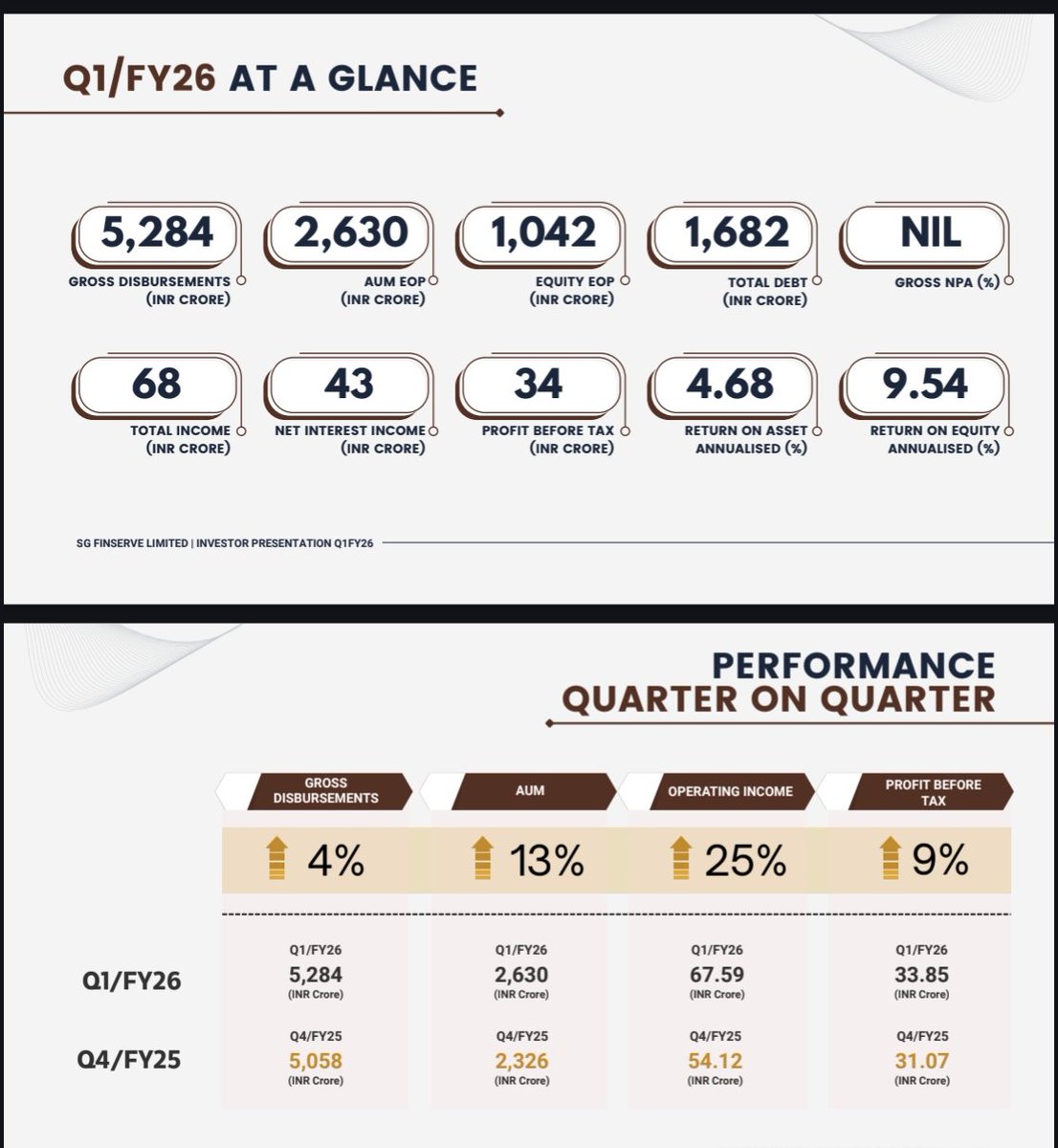

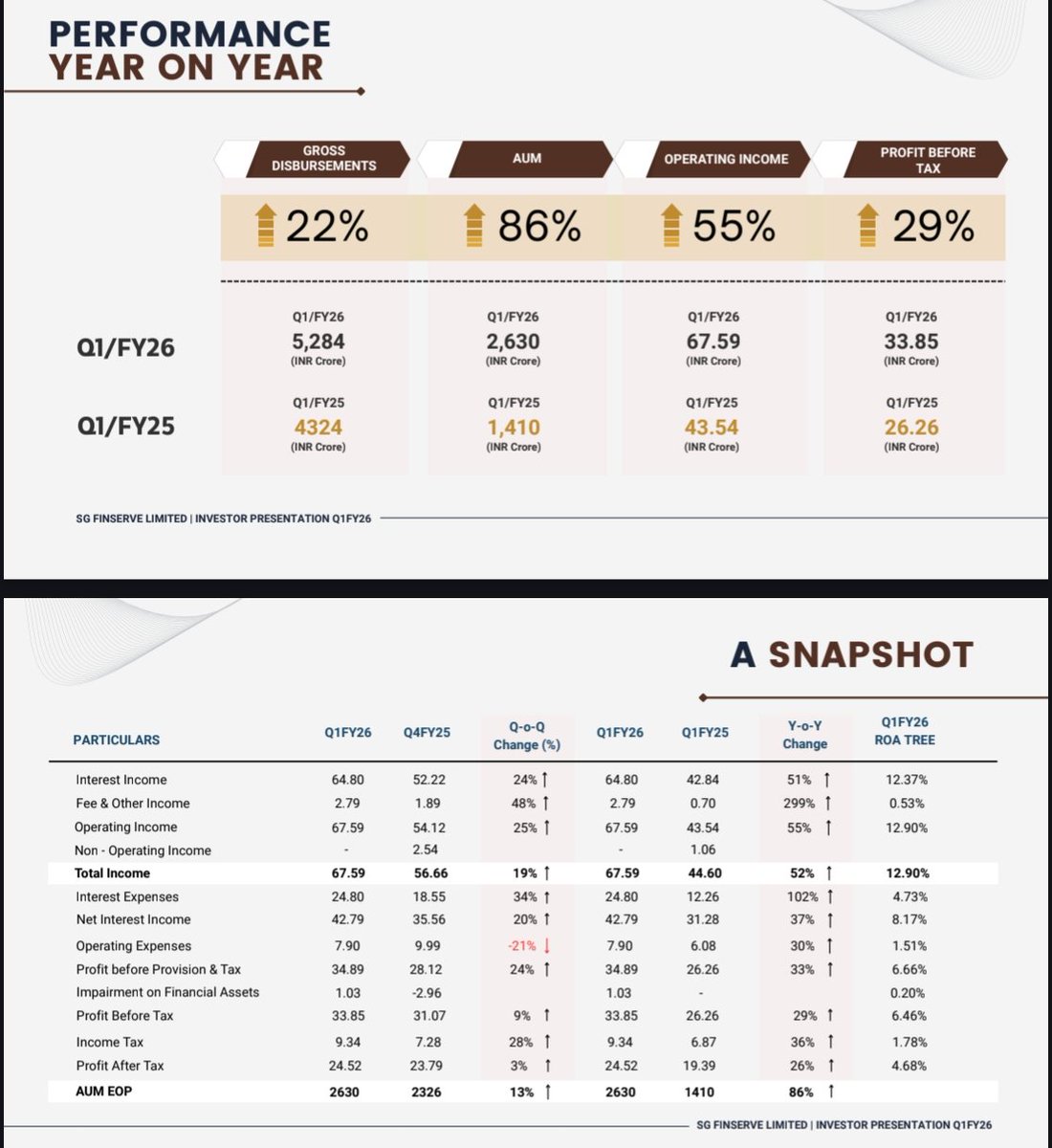

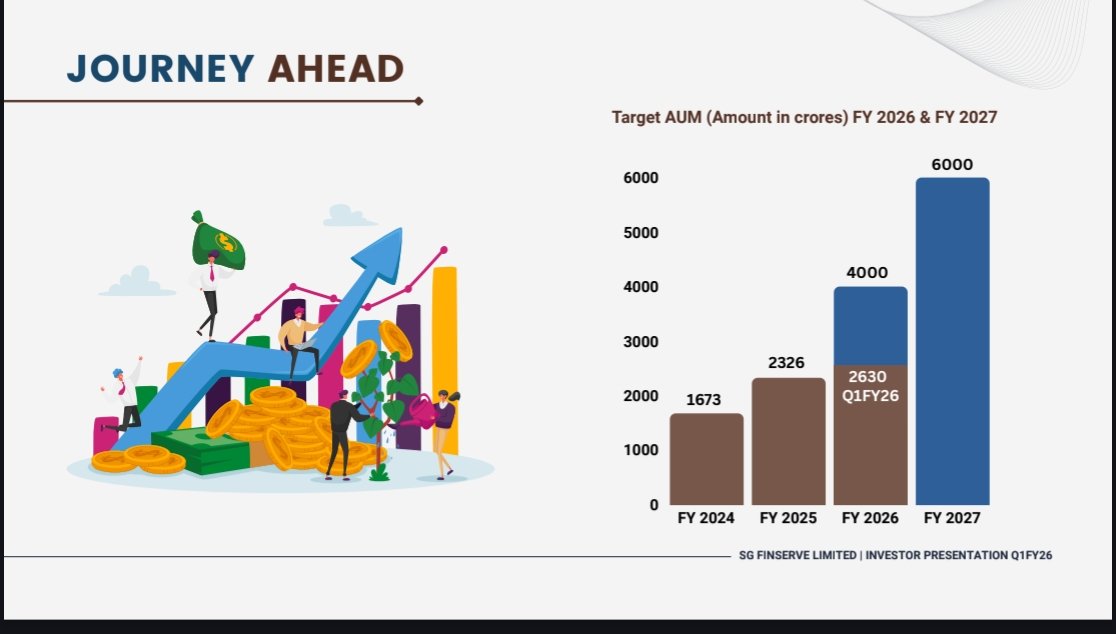

SG Finserve #SGFinserve #SGFin #SGFinserv Good Q1FY26 with decent QoQ uptick for AUM, Rev, PPOP and PBT Solid uptick in AUM AUM ⏫86% YoY at 2630cr ⏫13% QoQ FY26 AUM Target of 4000cr FY27 AUM target of 6000cr 4.68% RoA 9.54% RoE Rev at 65cr⏫51% YoY ⏫24% QoQ PPOP…

Good #Q1FY26-22/7/25 post 9pm Infobeans Technologies #Infobeans Solid margin expansion Great QoQ and YoY uptick in EBITDA, PBT and PAT even after excluding other income Rev at 111cr vs 97cr, Q4 at 103cr Other income at 12cr vs 3cr, Q4 at 4cr PBT at 29cr vs 11cr, Q4 at 15cr…

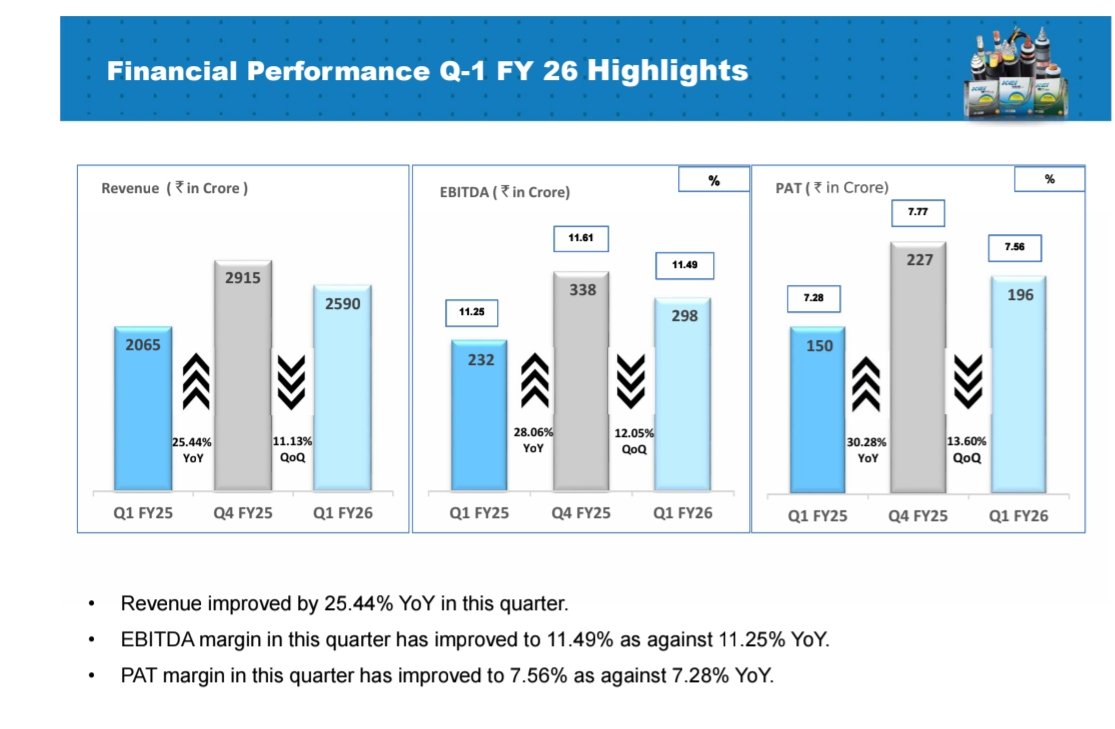

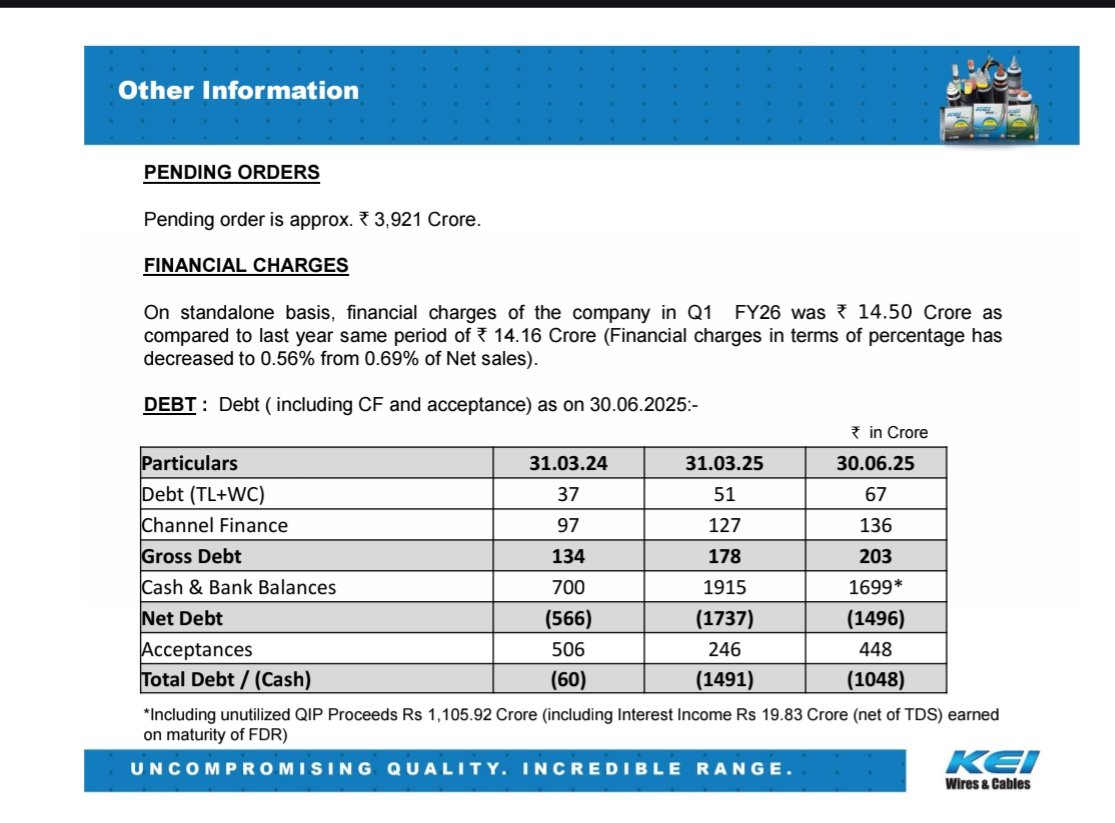

KEI Industries #KEI #KEIInd #KEIIndustries After good numbers from Polycab, KEI comes up with good Q1FY26 Rev at 2590cr⏫25.4% EBITDA at 298cr⏫28% OPM at 11.49% vs 11.25% PAT at 196cr⏫30.2% Exports⏫122% though base is low Orderbook stands at 3921cr Debt free company…

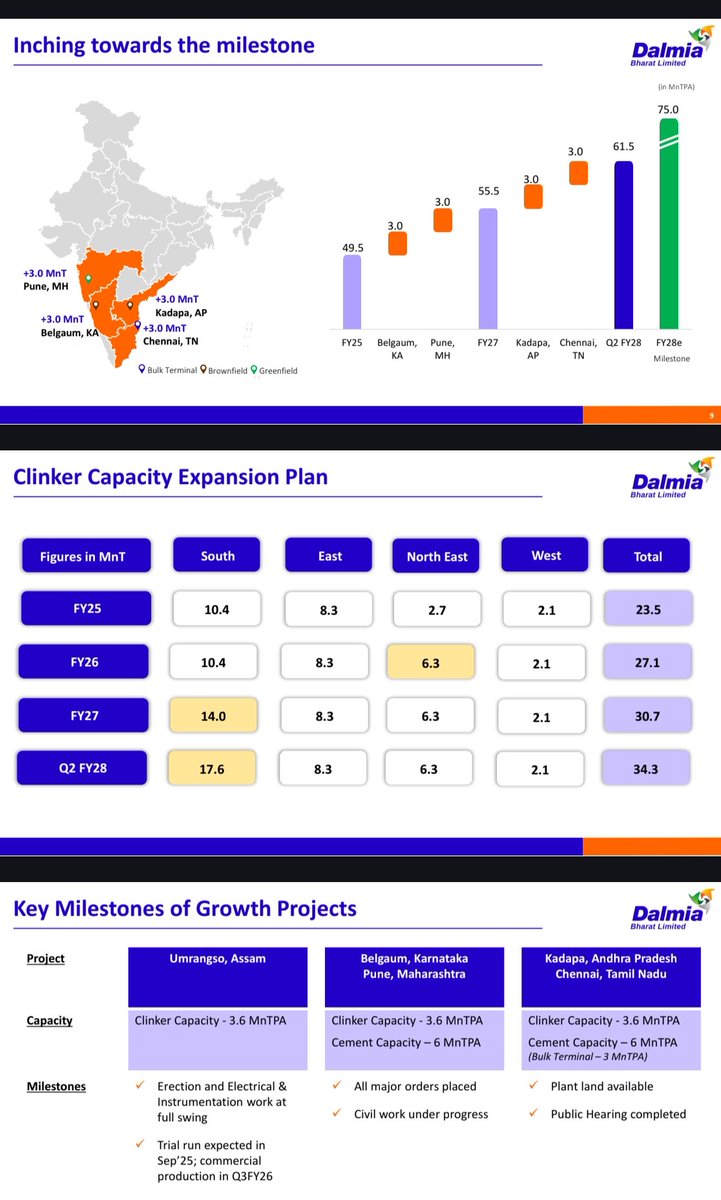

Good #Q1FY26-22/7/25 post 6pm Dalmia Bharat Cement #DalmiaBharat #DalBharat Solid margin expansion QoQ and YoY Q4 is seasonally strong qtr for Cement sector Rev at 3636cr vs 3621cr PBT at 502cr vs 308cr, Q4 at 467cr PAT at 395cr vs 145cr, Q4 at 439cr Higher tax paid in Q1…

Good #Q1FY26-22/7/2025 till 6pm SG Finserv #SGFin #SGFinserv Decent QoQ uptick Good YoY uptick Numbers should progressively get better going forward QoQ Rev at 68cr vs 44cr, Q4 at 57cr PBT at 34cr vs 26cr, Q4 at 31cr PAT at 25cr vs 19cr, Q4 at 24cr Slightly higher tax QoQ…