Neil Sethi

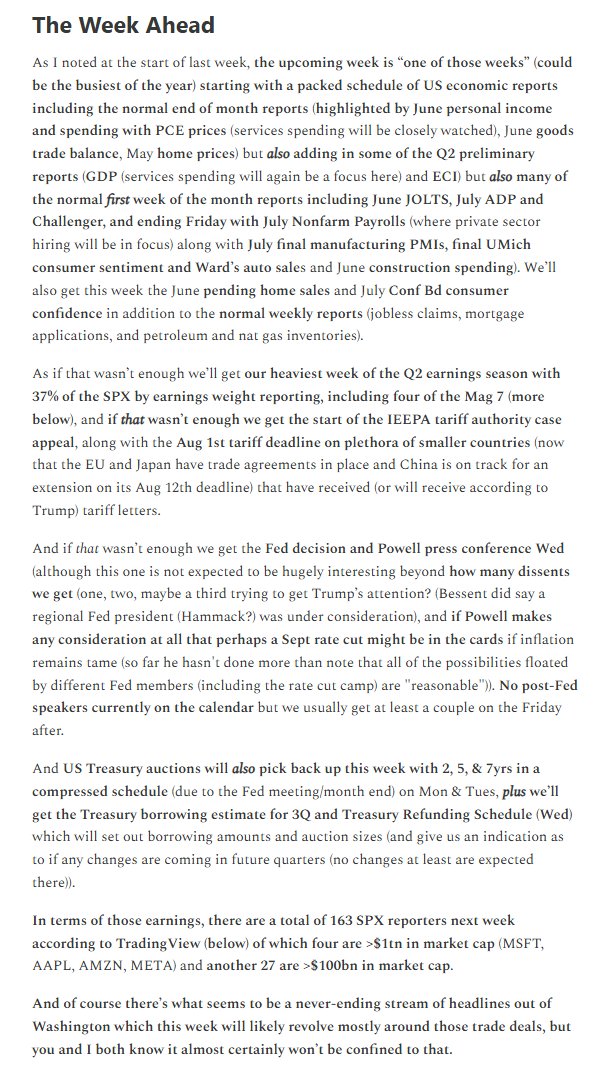

@neilksethi

Managing Partner at Sethi Associates. Hopeless optimist. Jiu-jitsu enthusiast. Reposts and suggestions encouraged. Try to be low on hyperbole, high on data.

The Week Ahead - 7/27/25 A comprehensive look at the upcoming week for US economics, equities and fixed income neilsethi.substack.com/p/the-week-ahe…

DB: Positioning is in line with the steady high-single-digit growth evident from the Q2 earnings season so far, as we wrote today in our early takes on the season.

DB: Our measure of aggregate equity positioning has continued to climb but is still only modestly overweight (0.28sd, 59th percentile). With volatility low and trend signals strong, systematic strategies are ramping up exposure (0.48sd, 69th percentile) while discretionary…

SPX stock-by-stock flag from @FINVIZ_com relatively consistent with a lot more red today particularly outside of Tech and Energy. Still just 12 SPX components down more than -3% (vs 7 Fri but 38 Thurs, 14 Wed, 16 Tues) with one down more than -10% (vs 1 Friday, 5 Thurs, 4 Wed)…

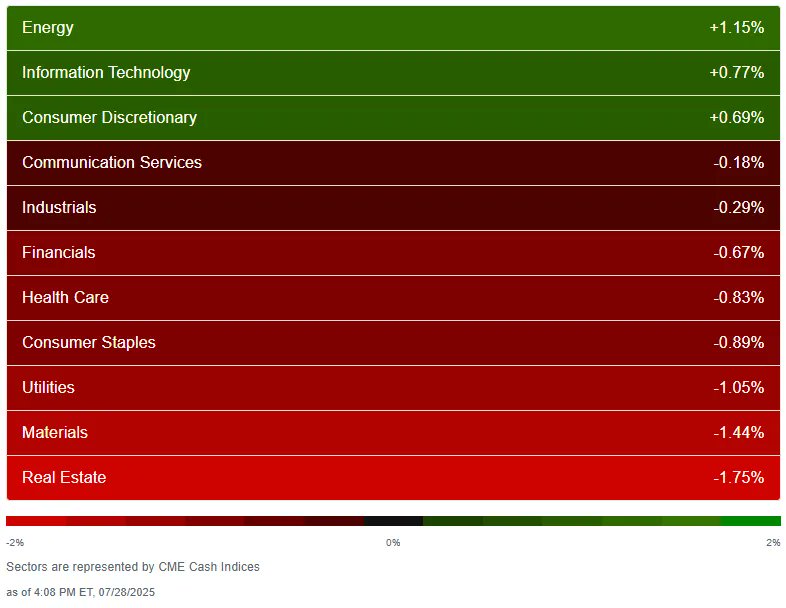

The SPX finished flat but sector breadth from CME Cash Indices was weak with just three green sectors from nine Friday although did have one up over 1% (Energy, which finished in the top 3 for the 4th session in 5), same as Friday (Materials). Three sectors though down that much…

The SPX finished flat but sector breadth from CME Cash Indices was weak with just three green sectors from nine Friday although did have one up over 1% (Energy, which finished in the top 3 for the 4th session in 5), same as Friday (Materials). Three sectors though down that much…

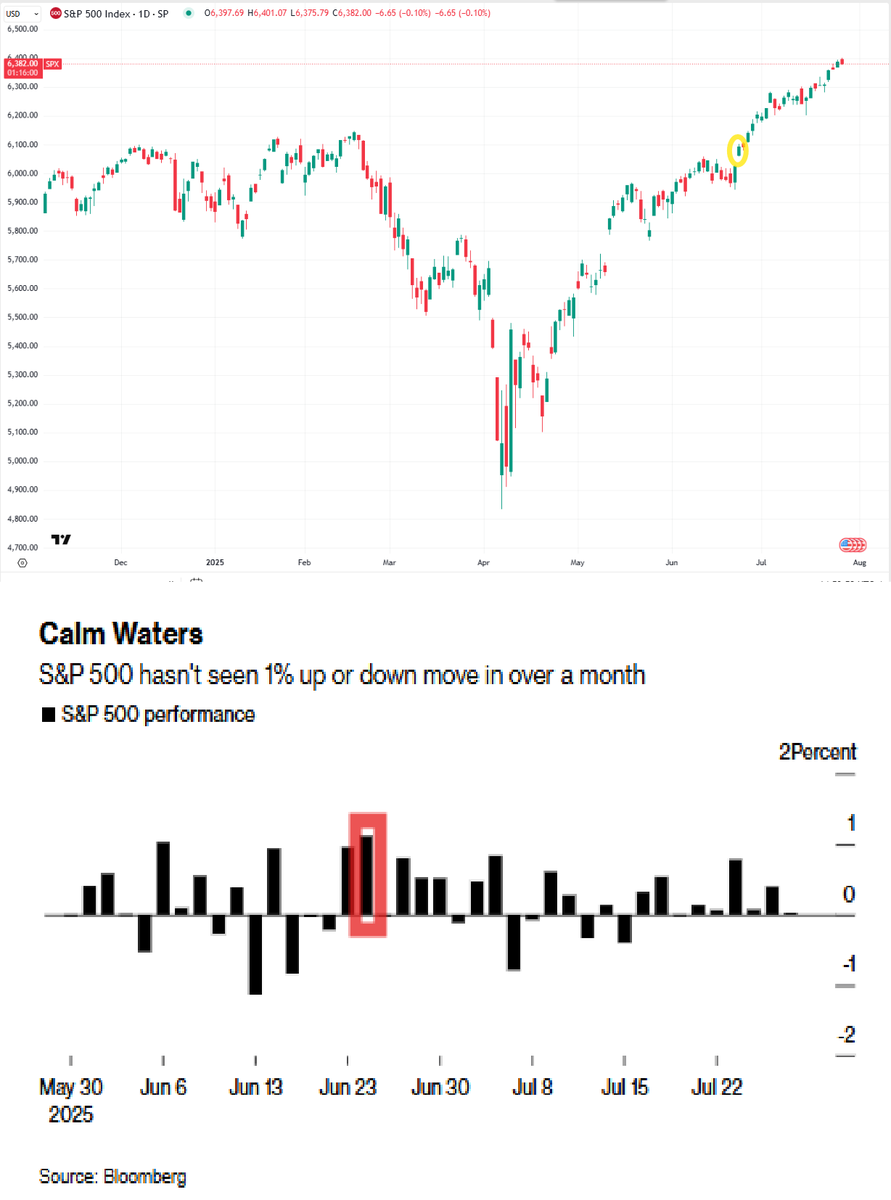

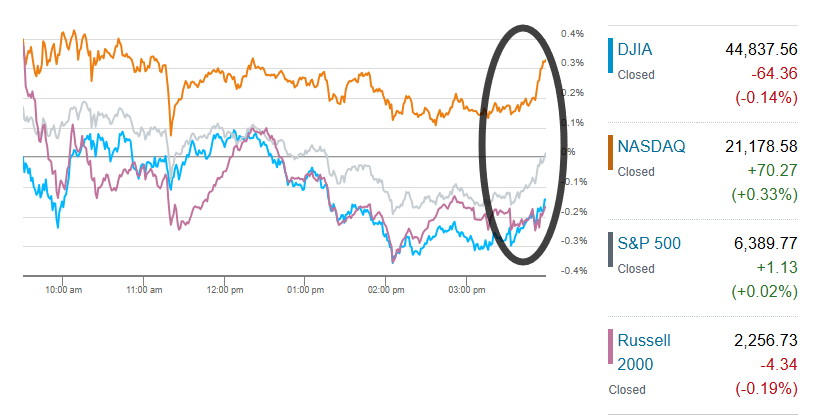

US equity indices opened modestly up, but deteriorated until the last hour when EOD buying (norm systematic, institutional, etc.) took them off the lows & pushed the SPX just into the green for a 6th consec ATH close. All finished w/in 0.33% of unch.

After this morning’s interesting 2yr #UST auction where we saw weak foreign demand that was more than made up for by record domestic demand leading to a solid trade through (yield below expectations), we also got today the second of this week’s three #UST auctions in $70bn in…

US 5-Year Note Sale: - High Yield Rate: 3.983% (prev 3.879%) - Bid-Cover Ratio: 2.31 (prev 2.36) - Direct Accepted: 29.5% (prev 24.4%) - Indirect Accepted: 58.3% (prev 64.7%) - WI: 3.975%

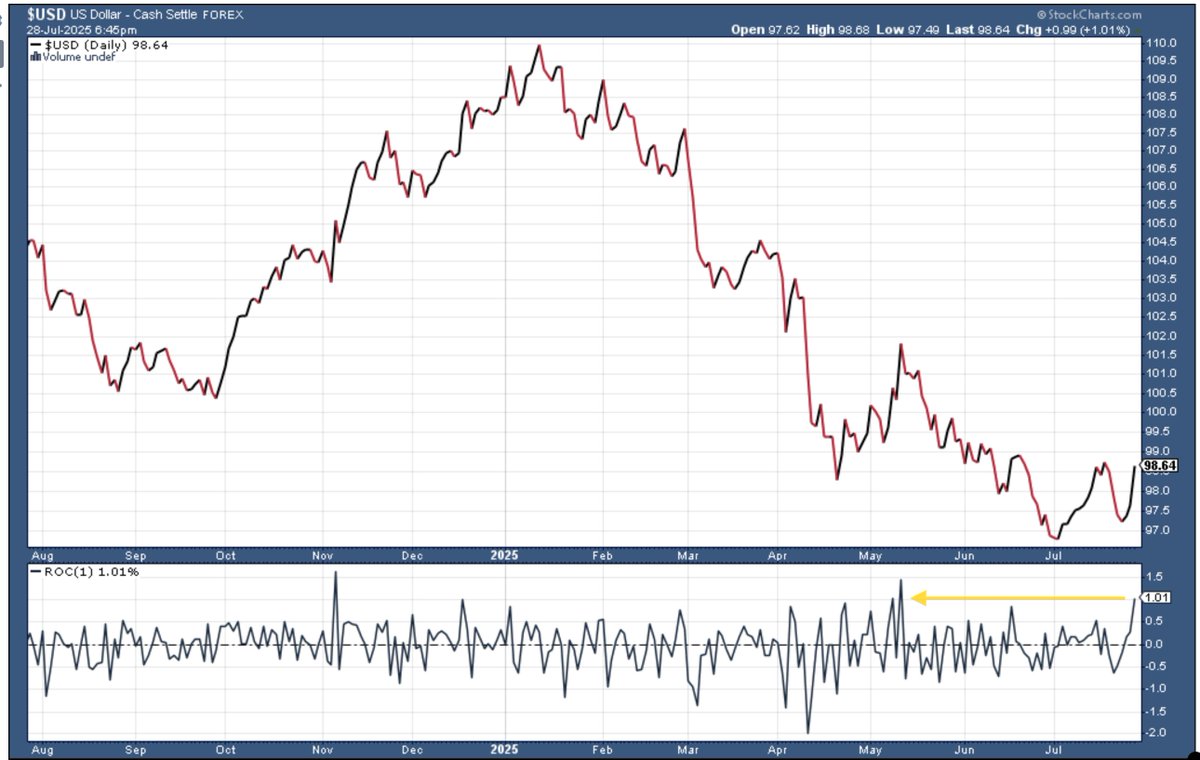

$USD dollar index is on pace for its best day since May up a big 1% while the euro is down the most in over two months.

Consistent with the declining volatility expectations as expressed in the VIX and to some extent the VVIX, Goldman notes that the daily implied moves for the FOMC meeting and upcoming ISM/Payrolls have dropped to low levels relative to history. There is [also] limited volatility…

The VVIX (VIX of the VIX) like the VIX has remained in the same the past 22 sessions at 90.6, but unlike the VIX hasn’t broken to the lows of that period. Still though it's under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent with “moderate” daily moves in the…

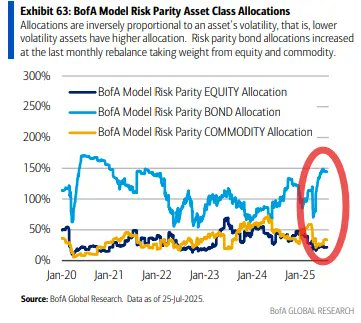

BoA continues to model risk parity funds (whose AUM is est’d to be as big as CTAs & vol control combined ($500bn-$1tn)) with their (leveraged) overweight to bonds continuing to roll over although still remaining near the highest since 2021, while their commodity and equity…

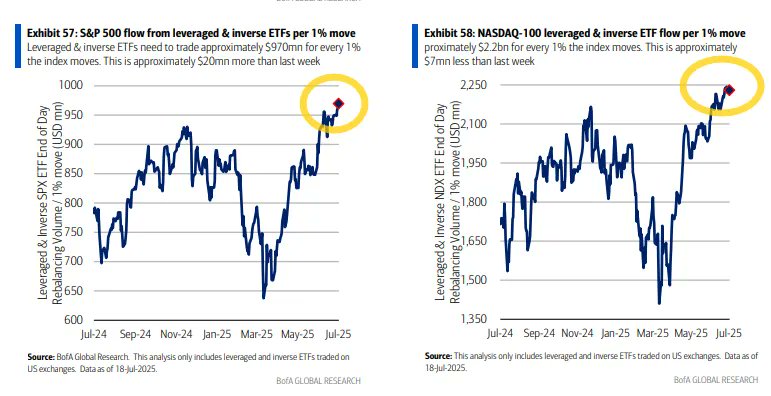

I like to look at the notional value in leveraged ETFs as a barometer of risk appetite, and both the SPX and NDX leveraged ETFs remain at the highest levels since pre-2024.

10-yr breakeven rate also pushed up to the top of its post-2022 range last week at 2.44%, +3bps w/w and the highest since February.

Long term inflation expectations as measured by the 5-yr, 5-yr forward rate (exp'd inflation starting in 5 yrs over the following 5 yrs), which continues to be referenced by Fed members (including Jerome Powell (although I don't think he mentioned it at the June meeting)) as…

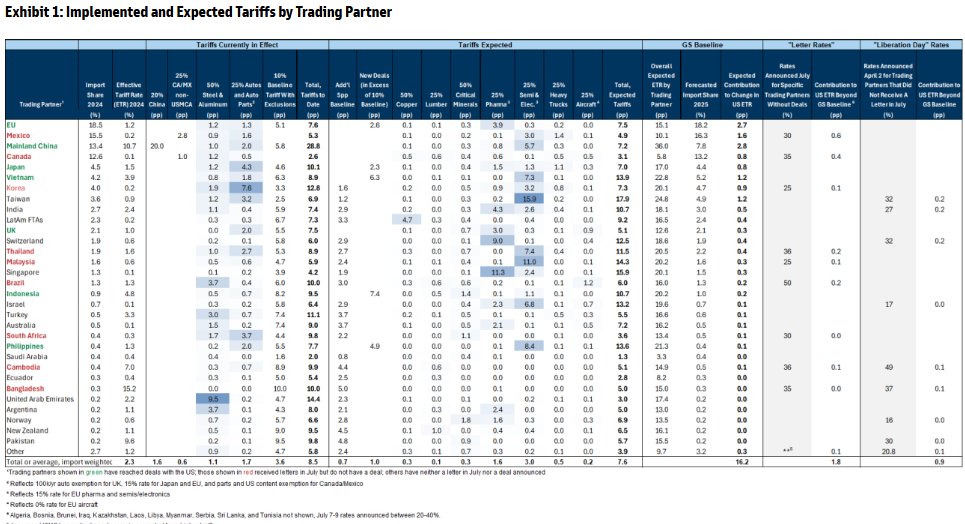

Goldman: The US-EU deal and the recent US-Japan deal raise the odds that other trading partners negotiate lower sectoral tariffs. But if no further deals are announced and all of the tariff rates President Trump proposed in the July letters are implemented, this would add 1.8pp…

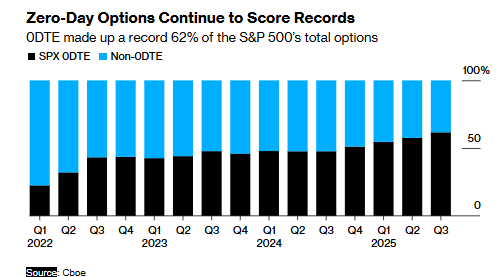

MarketWatch: Mandy Xu, head of derivatives market intelligence at Cboe Global Markets has a similar takeaway looking at call skew: "while demand for options contracts tied to Opendoor Technologies Inc. and other meme names has soared, this hasn't resulted in a broader spillover…

Goldman: We do not see significant crowding on the long or short side in S&P 500 single stock options. We believe put-call skew in S&P 500 stocks is a far more relevant indicator of forward index returns than call buying in meme stocks. This metric shows that despite the S&P 500…

MarketWatch: Dennis DeBusschere, chief market strategist at 22V Research notes that the asymmetric response to earnings (beats better than normal reaction, misses worse than normal) is further reducing correlations: "Correlations were low heading into reporting, and the…

In terms of how markets are handling earnings beats & misses for 1Q, it seems investors are taking an asymmetric approach, as Factset says looking at the two days before to two days after a report beats have seen a +2.1% reaction vs +1.9% in Q1 and versus the 5-yr average of…

We got our first of this week’s three #UST auctions this morning (which are on a compressed schedule all today and tomorrow) w/$69bn in 2yr’s. This auction has been on balance one of the stronger ones over the past 12 months, outside of a very weak result in April, although last…

US 2-Year Note Sale: - High Yield Rate: 3.920% (prev 3.786%) - Bid-Cover Ratio: 2.62 (prev 2.58) - Direct Accepted: 34.4% (prev 26.3%) - Indirect Accepted: 55.3% (prev 60.5%) - WI: 3.925%

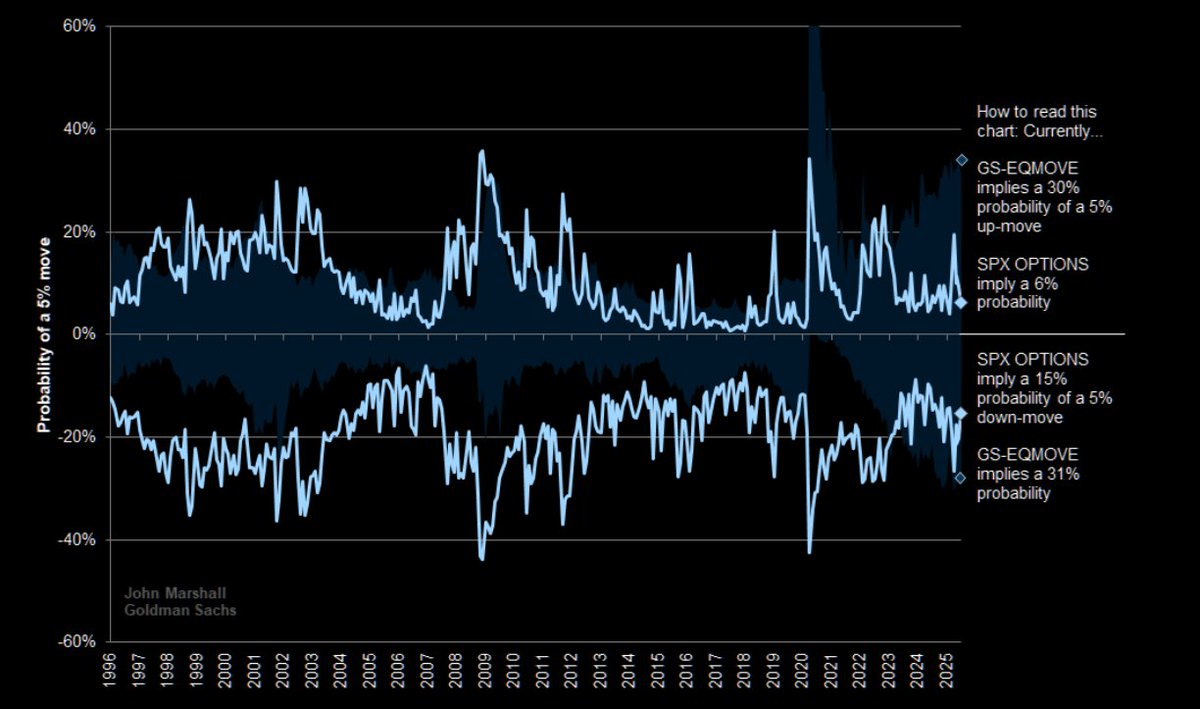

Goldman: "Based on the latest macro data, GS-EQMOVE 2.0 estimates a 30% probability that the S&P 500 rises more than 5% over the next month, while S&P 500 1-month options currently price only a 6% probability that the S&P 500 rises more than 5% over the next month" (via…

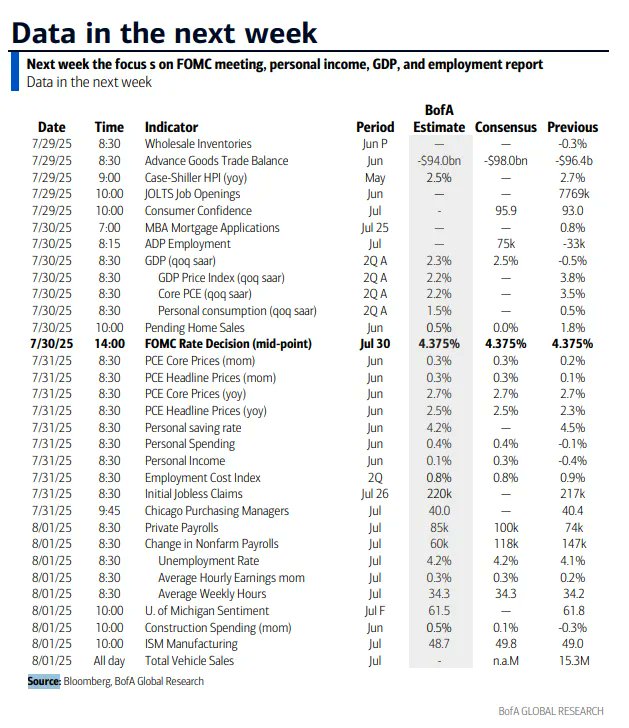

BoA notes on gamma positioning that “[t]o start the week SPX gamma was modestly elevated at +$3-5bn, however, the dealer gamma footprint has since flattened and was ~$0.4bn as of Thursday’s close (23rd 1y %ile). With numerous companies reporting next week (e.g., MSFT, META, AMZN,…

![neilksethi's tweet image. BoA notes on gamma positioning that “[t]o start the week SPX gamma was modestly elevated at +$3-5bn, however, the dealer gamma footprint has since flattened and was ~$0.4bn as of Thursday’s close (23rd 1y %ile). With numerous companies reporting next week (e.g., MSFT, META, AMZN,…](https://pbs.twimg.com/media/Gw870LZXoAA8Ivy.jpg)

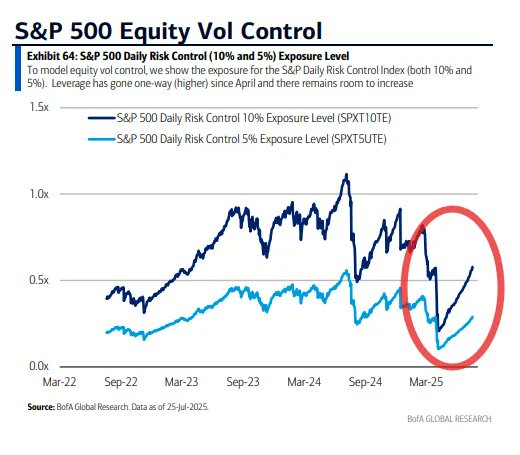

With realized volatility already sharply lower at the 1-mth horizon and the 3-mth horizon now getting there, BOA sees vol control (volatility targeting funds) exposure continuing to slowly rebound now a little above their lowest positioning of 2024. This is in marked contrast to…

BBG: While once piling into low priced names or those with high short interest was a symbol of rebellion against the well-heeled Wall Street establishment, today "it’s just another day in markets... retail-driven speculative behavior no longer signals generational angst or…

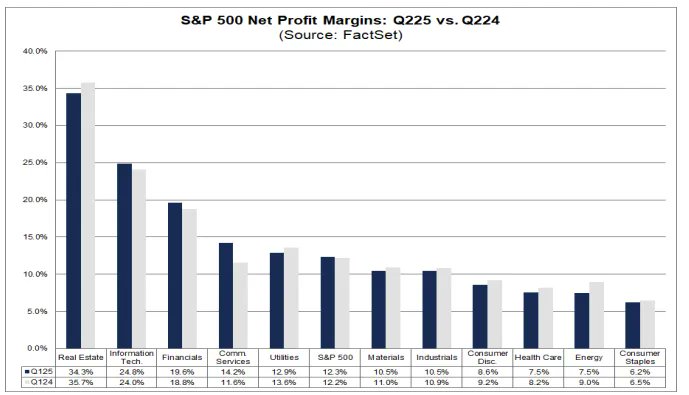

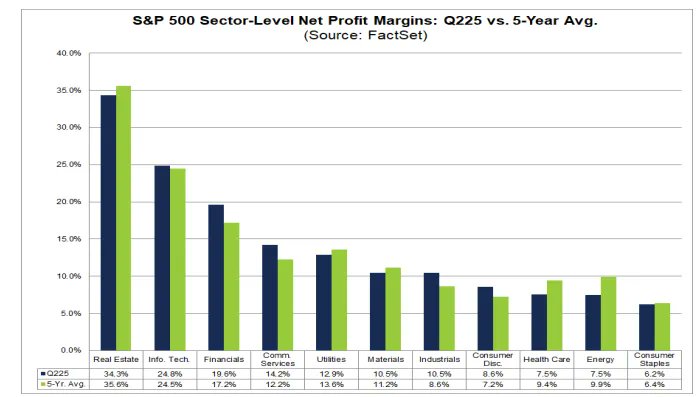

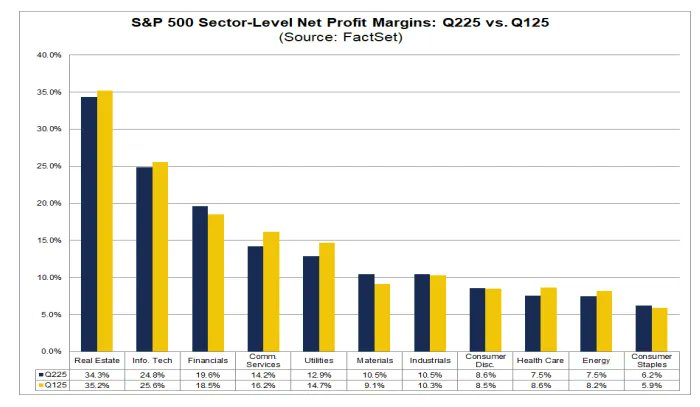

With the tariff backdrop, profit margins will be a big focus this earnings season. Currently, Factset says expectations are for 12.3% profit margins for Q2 (unch w/w), down from 12.7% in Q1 but up from the 12.2% a year ago and above the 5-year average of 11.7%. That would be the…