Neeraj Gupta

@neerajg

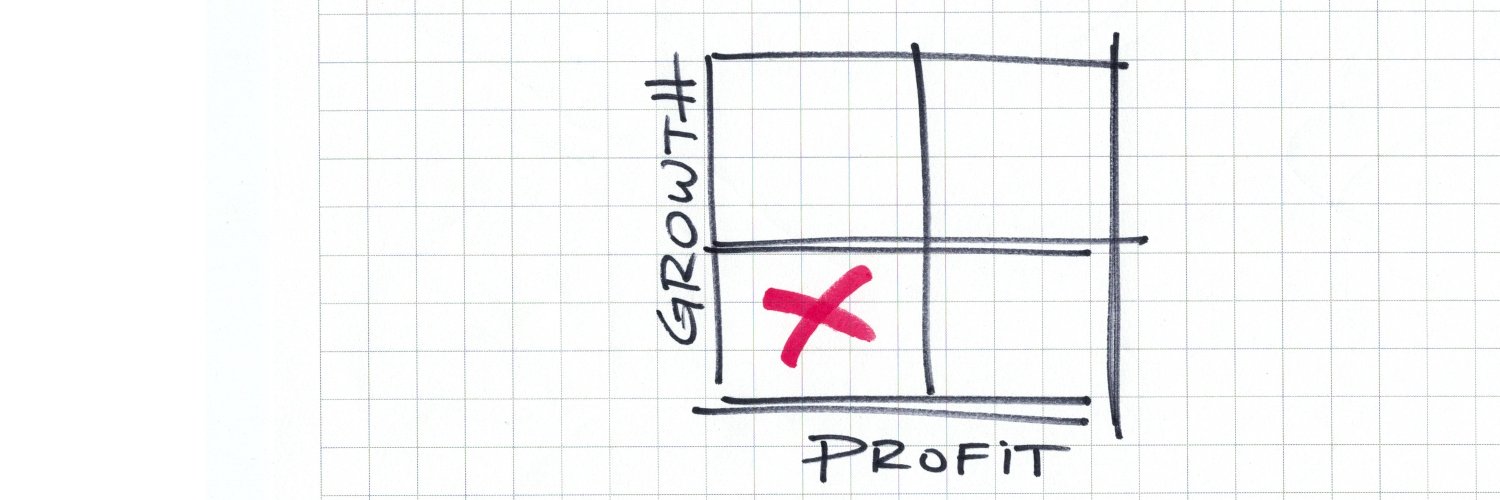

Buying another $1B in B2B software companies by 2025. 150+ completed tech acquisitions since 2002. No profit, no growth... no problem.

After years of reading, I'm finally going to start posting – straightforward views on PE dealmaking for "less than exciting" companies. DM me if a lower-left quadrant B2B software company needs help, a lifeline, or an escape pod. And yes - we pay generous finders fees ($$$).

Killer post @carried_no_interest. "Greater fool: theory at it's finest. Our model/platform lets us run businesses sustainably and profitably (but low growth). We are literally the best workout group on the planet and are helping senior lenders that take they keys to the car.

THE BUBBLE IN SOFTWARE PRIVATE EQUITY (PRIVATE CREDIT EDITION): I deep dove a ton of lending data and discovered some hilarious stuff. For a while, there have been rumors that a bubble is forming in private credit related to private equity. I'm not sure about that, but I am…

This should never happen. These companies have real value, even if they are no-growth/no-earnings (lower left quadrant). We lean into this situation for b2b software companies (buyout, debt purchase, refinance). Ping if I can help.

Talked to yet another founder whose company was killed by venture debt. I asked why they took it. He said they just tacked some onto the end of one of their funding rounds. It seemed like free money.

Sell - and spin up a new company that has a shot at a fun (and lucrative) triple triple double trajectory. Running a successful low/no growth company is hard and not for everybody.

When growth slows, You cut the marketing budget. And then growth slows more, Then you cut the marketing budget even more. And then growth slows even more. Then you’re left, Just doing a podcast. With 7 downloads.

Yeah, what he said. This the sandbox we play in. The number of convos we are having with over-leveraged lenders is mind boggling. DM me if we can help. Nothing is more frustrating than companies just shutting down.

The Venture Capital Apocalypse is coming...it might even be here already. The venture capital asset class is facing a watershed moment. Orphaned/Zombie VC software companies are everywhere. I'm a 'DATA DRIVEN' guy so I'm going to show you 6 graphs that illustrate how dire the…

Here’s how I read a CIM (prefer using AI for most steps): 1: AI-generated summary from the website 2: Financials - what is broken or omitted? 3: Develop my hypothesis 4: Test rest of CIM against my POV 5: Ignore TAM and team stuff, or do it last I don’t need 90% of the pages.

I read hundreds of confidential information memorandums ("CIMs") on companies for sale every year. Most are poorly done including many of the ones by the best middle market investment banks. Lets talk about it.... 1/7

Eerily similar back-to-back banker calls: The buyer we picked couldn't get the financing they needed. Will you honor your all-cash offer from 6 mos ago and close in 30 days (client is out of cash)? Sellers: Speed/certainty is a thing, don't pick a buyer that can't perform.

VC's have the power law. Employees have no such luxury. @PeterJ_Walker and @cartainc – pls. publish stats directly relevant to employees! Off the top of my head, by startup vintage: • % options retired worthless • % common stock retired worthless • value of common vs.…

How far have startups incorporated in 2019 made it in the fundraising journey? Original set of 4,379: - 54% live - 42% closed - 4% acquired - 0.2% IPO (and none if you remove biotech) Most of the companies that are going concerns in the seed / Series A range

Founders getting $0 on exits is more common than you think. @jeremyblalock sorry this happened to you.

Recently learned that Adalo, the company I founded & ran for the first 3 years, is being sold for $2M, and I’m getting $0. Yeah, $2M, which is less than their current ARR. They raised ~$10M, and there’s a $1M employee carvout from the $2M, so investors are getting $.1/$

Most won't pass the test comparing any "good" figure in forecast vs. history. Used to play a game w/ my kids. They'd show me the revenue graph from a CIM while hiding date. I'd pick "today". They thought it was magic, but all I was doing was picking the bottom of the J-curve.

The quickest way to discredit a forecast is to compare ROIC in the forecast period to ROIC in the historical period The most fanciful forecasts typically see ROIC explode in the forecast period - pure nonsense Forecasts don’t survive this test 9.9/10

I run M&A for a serial acquirer (b2b software). I just wrote and deployed my first app w/cursor, in < 30 mins. Total f'in game changer. "Full stack" AI devs (cursor/LLM/v0.dev/replit) will juice investor returns more debt. We are hiring dozens; code writers need not apply.

We choose to run companies for cash every single time. As a buy and hold investor, the risk-weighted trade off is easy. Note: most entrepreneurs don’t have the right muscles to run a low growth / cash flow business, nor should they. It’s a completely different world.

Software execs act as though Rule of 40 is a simple trade-off between growth & profit. Reaccelerating growth is extremely hard to do & taking out cost can happen overnight. Sometimes companies have no choice but to run the company for cash.

Amen. I'd give my left arm for a good solution for LLMs to deal with arbitrary spreadsheets.

I look at ~10-20 CIMs per week. Claude / GPT4 are now at the point that with the right prompt, they ask as good of questions as I do if not better. Sometimes it misses a few, at least 1/5 of the time it catches something I missed. We are probably 2-3 years from AI being…

Mostly agree - managed services and recurring services are also ARR ... and some of the stickiest at that.

Seems like the wrong question. Tell an LLM to "implement python in native python" and BOOM. Writing tight algorithms from scratch is so last year. I used Groq for this because I didn't want to wait more than a second (including description of the code, algorithm, and examples).

asked a candidate to implement quicksort in an interview today suffice to say, they're probably not getting a call back...

10 startups shutting down PER DAY, trending to be 8x the volume of 2021! I'm taking the under on vintage '19-22 VC fund returns vs. target. "If you’ve curtailed your growth with cuts [to stay afloat] then it’s maybe not a VC business." (@PeterJ_Walker). "Not a VC-business" is…

![neerajg's tweet image. 10 startups shutting down PER DAY, trending to be 8x the volume of 2021! I'm taking the under on vintage '19-22 VC fund returns vs. target.

"If you’ve curtailed your growth with cuts [to stay afloat] then it’s maybe not a VC business." (@PeterJ_Walker).

"Not a VC-business" is…](https://pbs.twimg.com/media/GVcQappXMAEFlMB.jpg)

If I'm an LP in these funds, I'd want to see rationale for the marks. Won't save the investment, but will tell me a lot about the VC. There should be a bunch of $0 equity values.

This chart from Carta is pretty brutal. Over 40% of 2018-vintage VC funds have not made a single distribution.

Brutal data - negative IRR for recent VC funds. The world around these startups has completely changed. VC, founders, execs, employees all know if the company won't ever get there. Pull the cord early, sell the business, and move on to one that has a chance. Funding a failed…

30% of recent VC deals are flat or down rounds (per Pitchbook). Lots of broken cap tables out there!! Companies should be required to disclose the exit valuation at which the employee stock is worth $1. Sadly, employees (including to execs) got zero proceeds from each of our…

1/10 Just signed an LOI for a SaaS company where sadly the founder is going to get $0. Shocking how many VC-backed CEOs have ABSOLUTELY NO IDEA what purchase price causes their stock to be worth even $1. Founders: you better understand your waterfall!