M. V. Cunha

@mvcinvesting

Long-term investor. BSc in Economics, MSc in Finance. Equity Analyst with a focus on Fundamental Analysis and Valuation. Not a financial advisor.

My honest opinion: Jerome Powell has done an excellent job over the past few years. He doesn’t deserve to be fired. This sets a troubling precedent, and that’s why the market is reacting negatively. The Fed’s independence should be non-negotiable.

$PGY is down 10% following its announcement of a $450M private debt raise, but the market might be getting it completely wrong. The company is issuing senior unsecured notes due 2030 to repay credit facilities and $75M in other secured borrowings, most of which carry interest…

🚨 JUST IN: The U.S. government is actively seeking alternatives to SpaceX for Trump’s “Golden Dome” missile shield program, per Reuters. While SpaceX remains the dominant player in launch capabilities, officials say its share of the program could shrink. The U.S. is already…

$PGY is up ~35% since I initiated my position last week. But that doesn’t mean it’s 35% more expensive. Few understand that.

I’m all for a healthy correction. Volatility works in our favor.

JUST IN: Moonvalley, one of $NBIS' customers, has launched Marey — the world’s first generative video model trained exclusively on licensed HD footage. 👀 This marks a significant milestone for the creative industry. Marey enables filmmakers and content creators to control each…

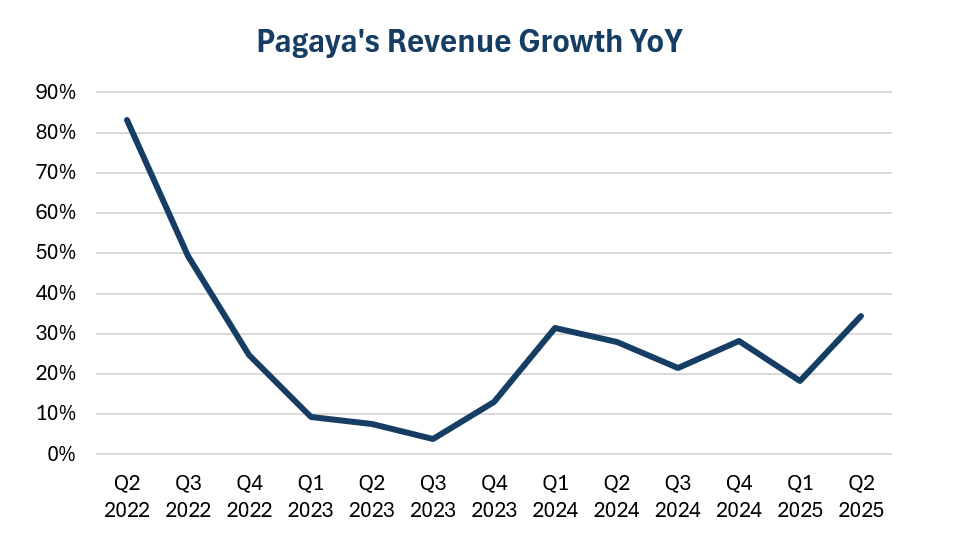

$PGY is sharply accelerating revenue growth, up over 34% in the preliminary Q2 results. That’s the fastest growth rate in 3 years, and we still have rate cuts ahead as a major tailwind. Accelerating top-line + operating leverage + multiple expansion = a VERY powerful setup.

Friendly reminder to check out my Deep Dive on $PGY. It’s already up ~30% since I published it, but I still firmly believe it’s a bargain at current levels. Link in bio.

Just before the 4th of July weekend, I asked for stock ideas to explore over the break. Out of 200+ suggestions, many of which I already knew, $PGY caught my attention. Yesterday, I published an 8,000+ words Deep Dive on the company. You can find it in the usual place.

One year. Today marks one year since I finished my MSc in Finance and decided to start creating content here. I can’t fully express how much this has changed my life. All I can say is thank you for being part of it.

Benchmark raised its Price Target on $PGY from $25 to $42 and keeps a Buy rating 🟢 Improved sentiment had been driven primarily by the strength of the company's Q1 report, but many investors were still looking for confirmation that $PGY was on track for sustained profitable…

Brand new all-time high for my portfolio today. A pullback might be around the corner, but I’m definitely taking a moment to celebrate. Up 41.9% YTD.

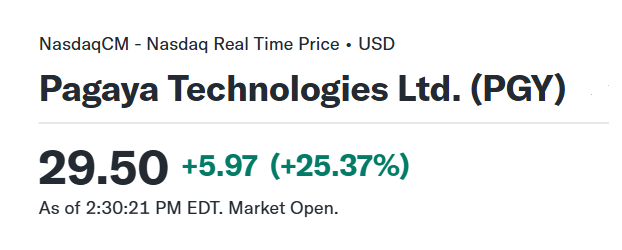

I could be happy seeing $PGY up 25.4% the day after I started a position — but honestly, I’m a bit annoyed. I was planning to at least double my position before Q2 results, but they went ahead and dropped a preliminary report today. Still a bargain, though.

I missed this news from yesterday: ClickHouse Cloud joins the new AWS Marketplace “AI Agents and Tools” category with a remote MCP server for a turn-key AI-to-data connectivity 👀

It’s kinda funny how some people trash those who are profiting from their high-conviction plays (shitcos aside, of course). Way too many folks care more about sounding smart than being right and making money. You can surely have both — just don’t put your ego over results.

JUST IN: $PGY Announces Preliminary Q2 Results 🔥 The stock is up 10.5%. I literally started a position during yesterday’s flash dip, right when rumors about Trump firing Powell started circulating. My subscribers were alerted. Preliminary Q2 2025 Results: Network Volume:…

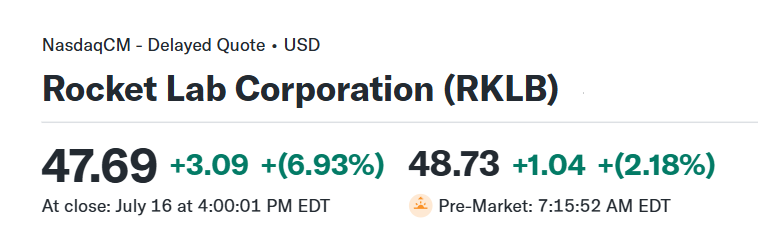

For everyone asking what I plan to do: $RKLB's valuation has always seemed “too stretched” — and I think it always will. I don’t blame anyone for taking profits here, it's definitely a legitimate decision. But my original thesis was based on $RKLB's potential to become a $100B+…

50 weeks after my initial purchase, $RKLB is officially a 10-bagger in my portfolio. Not a bad way to start the day. 🤜🏻🤛🏻

50 weeks after my initial purchase, $RKLB is officially a 10-bagger in my portfolio. Not a bad way to start the day. 🤜🏻🤛🏻

$HITI Closes on $30M Convertible Debt from Cronos Group Inc. If this means Germany is coming — I’m all for it. Traditional non-dilutive funding probably wasn’t an option anymore, so they tapped Cronos — a LP sitting on $800M+ in cash and doing very little with it. Yes, this…

Yesterday, someone asked Jim Cramer what he thinks about $NBIS. He said: "Just buy CoreWeave and don't deviate." Bullish... 😂