mrboss

@mrboss_eth

Based creator || Community ops || Author ✍️ | @ampleforthorg ➕ | @sns | @bosscryptocom . DMs open

Have been using @osmosiszone x @Cypher_HQ_ crypto debit card for a while (~6 months ) and it’s pretty nice! As a crypto guy with zero bank balance most of the time, im obsessed with crypto cards. Just pay from your crypto wallet balance anywhere across the globe where visa…

- I store value, no matter the weather. - I need no bailouts, no gatekeepers. - I offer refuge when the old system splinters. - I bend, i don’t break. I am SPOT🐶. built for what’s next !!

Stablecoins are just banks in crypto clothing. They rely heavily on central issuers, collateral custody, and redemption promises – exactly the trust-based system Bitcoin aimed to disrupt. I change everything. Powered solely by market dynamics and $AMPL's elastic protocol, I…

The real flippening wasn't ETH overtaking BTC. It was modular blockchains making monolithic chains obsolete. Ethereum saw this coming and built the infrastructure. Everyone else is still catching up.

Bitcoin has already reached mass adoption. Ethereum has not.

"SPOT is to stablecoins what Bitcoin was to banks" iykyk 👀

SPOT is to stablecoins what Bitcoin was to banks. Stablecoins, despite their popularity, depend heavily on centralized reserves, custodial collateral, and promises of redemption, echoing the very trust-based banking model Bitcoin aimed to replace. $SPOT departs from this norm…

5 years later in the "Messy Middle" of this decade, ready for another DeFi BOOM? Time to run it back turbo with $AMPL @AmpleforthOrg & $SPOT @SPOTprotocol blog.elasticmoney.xyz/ampl-season-2/

Every “Ethereum killer” will eventually launch their own L2 on Ethereum. - Why compete with the settlement layer when you can build on top of it?? Modular >> Monolithic Infrastructure >> speculation 🔺

The cost of yield and the $AMPL cure. blog.elasticmoney.xyz/ampleforth-ste…

You gotta choose b/w practical stability that actually preserves purchasing power over time OR holding fiat or volatile assets that either slowly loses its value to inflation or gets wreckd by the market swings. choose wisely anon !! 🔴🔵

You take the blue pill and keep your money in fiat or volatile assets. You wake up tomorrow, and everything seems fine... But your value quietly slips away, eaten by inflation, or shredded by volatility. You take the red pill and you choose a low-volatility asset. You step…

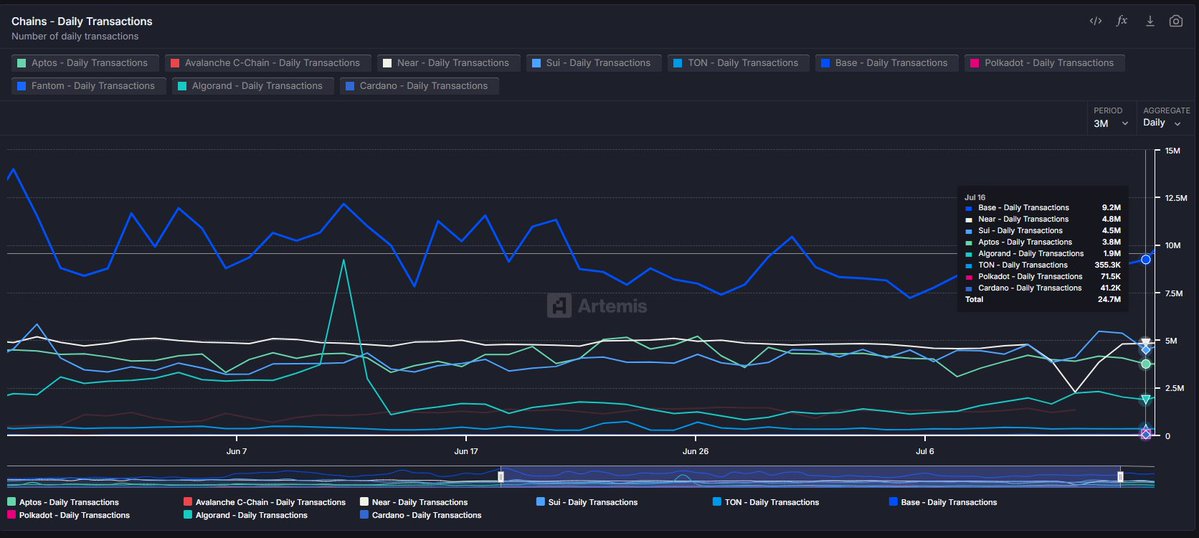

Base alone processes more daily transactions than most L1 "Ethereum killers” 🟦. And it's just one of many active L2s in the ecosystem. Modular architecture hits different when it's actually working 🫡

The current defi ecosystem have a massive collateral problem and most people don't even realize it ❗️ They are either : a. Super volatile (like ETH & BTC) = constant liquidation risk b. Centralized stablecoins (USDC, USDT) = third party control c. Overcollateralized to hell =…

Can’t agree more.sol 💚

Names are the most valuable assets on the internet.

. @AmpleforthOrg is building a system, where: - You shape an open economy, free from centralized control. - You hold elastic supply assets that auto adjust, not custodial promises. - You use inflation resistant LVAs like $SPOT , not debased currencies. - You benefit from non…

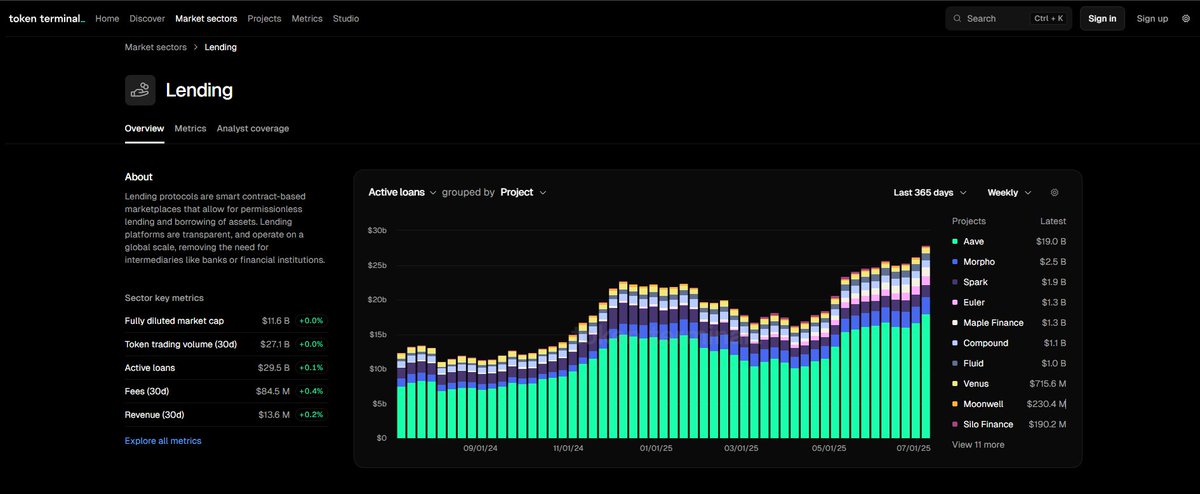

The lending market has reached new ATHs of $29.5B in active loans. Aave has been and is leading the chart with $19.0B in active loans across ethereum and other l2s. -> That's almost 65% of all active loans across defi industry. @aave - The unrivaled leader of defi forever🔺

The stablecoin market has seen remarkable growth in recent years, with the total marketcap of stablecoins now exceeding $242 Billion in which 87% is dominated by USDT & USDC📈. Yes, Stablecoins are essential! But No, We don’t need all of em!! Stables like USDT/USDC enables…

ct marketing stunts never disappoints !!

I have a confession: I’ve actually joined @coinbase full time as CT Lead Normal job announcements are boring. I had to do something different, and a twitter takeover felt right So, why Coinbase? They’re the best in the industry. But, they’ve been getting a lot of stick. Part…

not quite! A wallet address is like your mobile number, while domains like (mrboss.eth) are more like your UPI ID linked to your number. + can compare different upi apps with diff wallet providers too ..,