Moses Kagan

@moseskagan

Owns many apartment buildings w investors. Manages many more for other owners. Co-founder: @reconvenela & @reseedpartners. Join my mailing list here ⬇️

Our strategy is simply to do what smart families have always done: - Acquire great assets in supply-constrained mkts - Leverage them conservatively - Steward them well - Refinance them opportunistically to return capital tax-efficiently - Hold them indefinitely

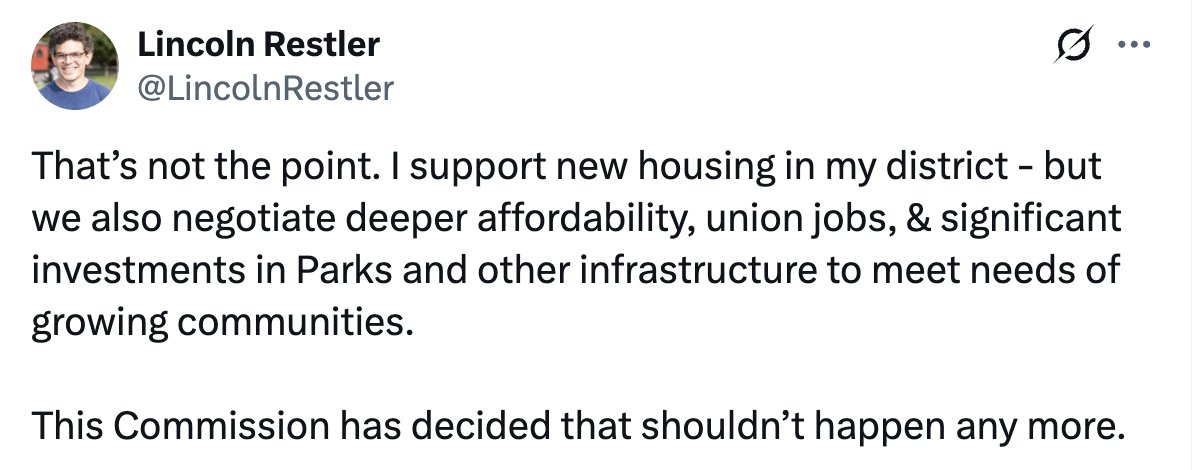

"I support building cars in my district - but we also negotiate for them to cure cancer, get you concert tickets, make excellent cappuccino..."

Especially early in your career, accommodate large capital partners, even if they have needs that take you off the beaten path in terms of structure, economics, control, etc. (But not if it involves taking excessive risk of personal bankruptcy!)

This is amazing... and I'm genuinely excited to have Chris talk about it at Reconvene this year

Forza Commercial opened Jan 2020 *recently acquired building 97 *under const on 4 buildings *dozen buildings in design *dozen properties in escrow In 4.5 years we have survived covid, supply chain crisis's, '22 interest rate run up I would bet on my team all day long...

In our business, where we're handling keys to people's apartments & a lot of other people's $$, we need to do background checks before hiring. This is the company we use, & I strongly recommend them. (Didn't receive anything for posting this, to be clear.)

If prospective investors wanted to invest with a huge organization, they would send a check to Blackstone. That they’re talking to you is good news: It means they prefer dealing with a human. So be a (genuine, decent, trustworthy, thoughtful) human.

As a real estate deal sponsor, you bring the ideas & hustle & accountability. It is *not* your job to run the risk of personal financial ruin on every deal.

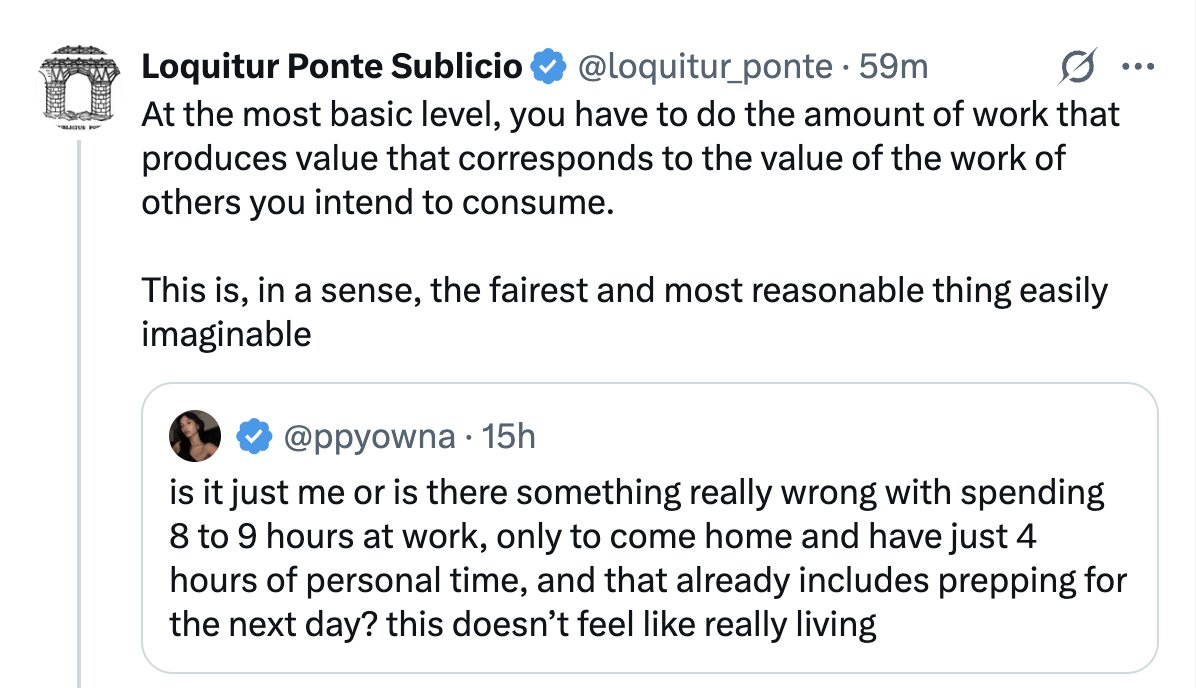

Posting this as a screenshot to try to maximize distro (LPS one of the most insightful accounts on here)

Gainzz! (Also: As hard as having kids has been at various times, including as recently as this morning, it's all outweighed by the joy I get from moments like this, especially as they get older.)

If you've spent the early part of your career chasing high EV / low probability outcomes and hit middle age with ~nothing to show for it, maybe consider using the skills you've developed in a lower-EV / higher probability service business

Have this friend who was the youngest VP ever at his public co at like 24. Caught the startup bug. One failed endeavor after another. Now in mid 40s - no savings, no home, no wife and still chasing ideas. Sometimes the moonshots don’t work out.

For the ~3 yrs I worked for other people, a significant portion of my mental energy went to: - Alternately fantasizing & dreading what my bonus would be, & - Politicking to try to make it bigger Going out on my own immediately removed that noise.

Being a fiduciary: Sitting next to the cookie jar for decades with no one around & never reaching your hand in