Hendrik Ghys

@minus1_12

Founder @ThalexGlobal

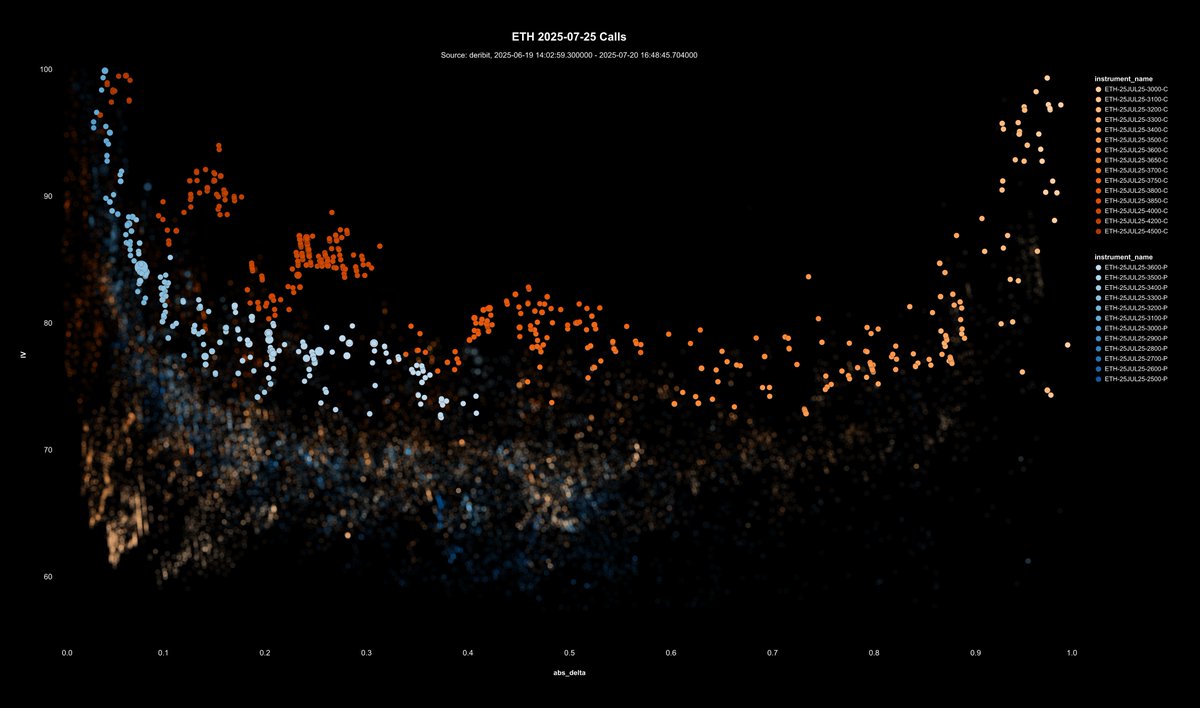

Lively Sunday session in ETH-25JUL25 options. Flow seems to bet on continuation. Vols got lifted and call skew emerged. I used an opacity filter to highlight today's trades. The vol gap in 10-30 δ hints at the use of risk reversals, i.e. funding upside calls by selling…

ETH vol coming alive a little on this move. That said, this is low spot-vol correlation. We did 2.4 to 3.7K and vol basically ranged.

Looking at a chart like this, it's tempting to jump to a narrative: "Put vols spike as traders believe..." Think simply first. Price went up above 120K: • OTM calls went closer to ATM • OTM puts went further OTM Recall that IV exhibits a volatility smile. IV is lowest at…

Junior options trader question. Focus on $BTC going over 120K: • Call marks were flat • Put marks popped Can you explain why?

Chart crime season

Don't need to be a quant to figure out the relationship between basis and price here. Also, it's a full-on bull market. Dual-axis charts are totally allowed and considered part of the scientific method now.

Always love a good explanation of the non-ergodic coin toss. It's a great metaphor for why most traders lose even in bull markets. Even if you have edge, it's easy to lose it to volatility. The coin toss teaches that the average investor does not get the average return. They…

x.com/i/article/1943…

We have partnered with @ThalexGlobal for the summer camp we are doing with @FoftyPawlow. As a result, every sign-up will receive an account on Thalex with $500 to trade with. On top of that, they are giving away a free spots to summer camp, more details in the post below.…

We're proud to announce that we're partnering with Summer Camp by @abetrade and @FoftyPawlow to promote options trading. We'll give $500 in free collateral to each course participant who signs up on thalex. We'll also hand out 5 free courses. To get the chance to win, DM us…

$BTC realized volatility is at an interesting spot.

Realized shows similar seasonality as implied. No surprise. Focus on 90-day RV (orange). Looks like a sine wave doesn't it? Volatility is mean-reverting. And we're near inflection ~ 35. (2/n)

Confusion de Confusiones was written in 1688. "two classes of speculators in this gambling hell" Its depiction of bulls vs bears is still so accurate.

Puts on $BTC are -EV in isolation. Puts on $BTC are +EV in a portfolio. If you're long-term bullish — buy puts. The key is rebalancing payoffs back into spot.