Ming | RBX🐰 (ai/acc)

@ming_rbx

Building @rabbitx_io @blastfutures | Shaping the future of finance. Game theorist.

I have never seen a worse customer support expexrience than X

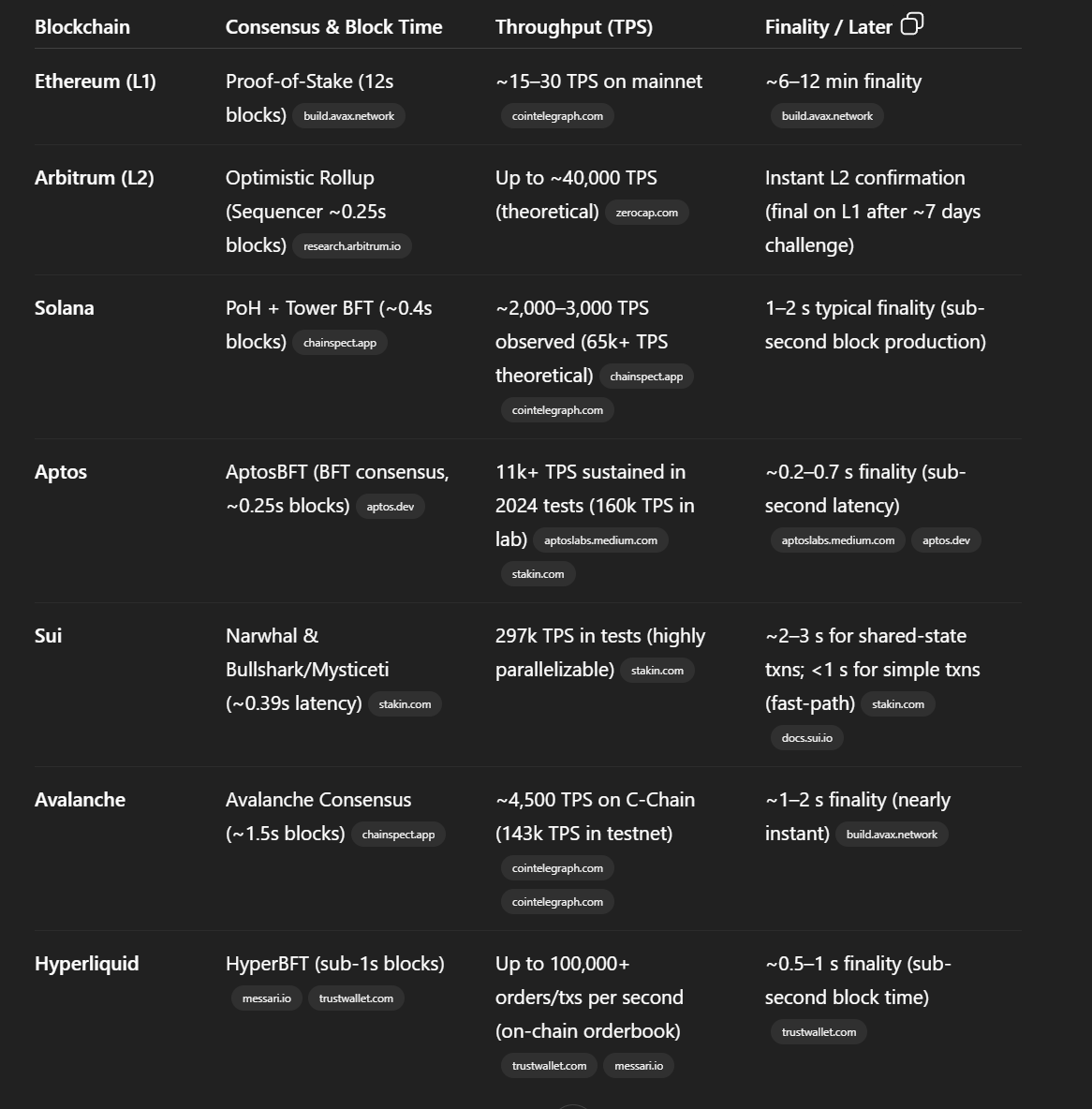

On most important metrics (block time & finality) Aptos seems to be the clear winner, even beating out centralised chains like Hyperliquid 🤔

Perpetual AMMs are Broken As someone who's spent years building infrastructure for decentralized perpetuals, let me say this clearly: Automated Market Makers (AMMs) are categorically the wrong model for leveraged perpetual markets. They’re not just inefficient, they’re…

Did the Singapore gvt just rugpull the entire crypto ecosystem there?

The RabbitX RLP vault is back near ATHs. It's the best investment rn if you don't have a strong market view.

Most decentralised perpetual exchanges I see today are UGLY as hell SLOW as hell EXPENSIVE as hell At RabbitX, the platform is GORGEOUS SCREAMINGLY FAST FREE TO TRADE

It's crazy to think that we some of the most cracked developers on our team, with PHDs in Physics and Mathematics and AI experience

Even on a red day, the RabbitX LP vault is up +0.5%. It uses high-frequency trading and AI to manage risk, provide liquidity, and deliver steady returns for stakers.

The truth is that our team has been so focused on building the best product and the screamingly fast exchange and liquidity market making algorithms that we forgot to market. But that's about to change.

A 10-year U.S. Treasury yield at 5% is not just a technical level. It’s a signal. The last time we hit this was in 2007, before the Global Financial Crisis. But back then, debt-to-GDP was around 60%. Today we’re over 120%, with $1 trillion in annual interest payments. That…