Mike Castle

@mike_castle2

Commodity Market Analyst at @StoneX_Official. Tweets are my own and do not necessarily represent StoneX positions, strategies, or opinions.

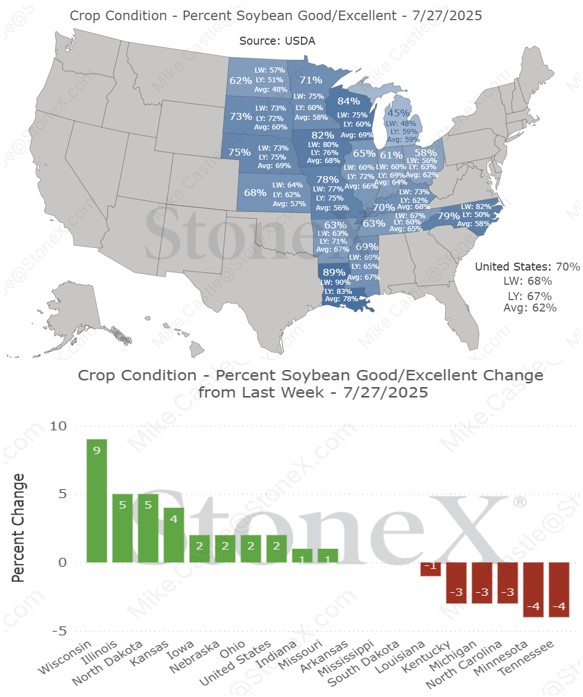

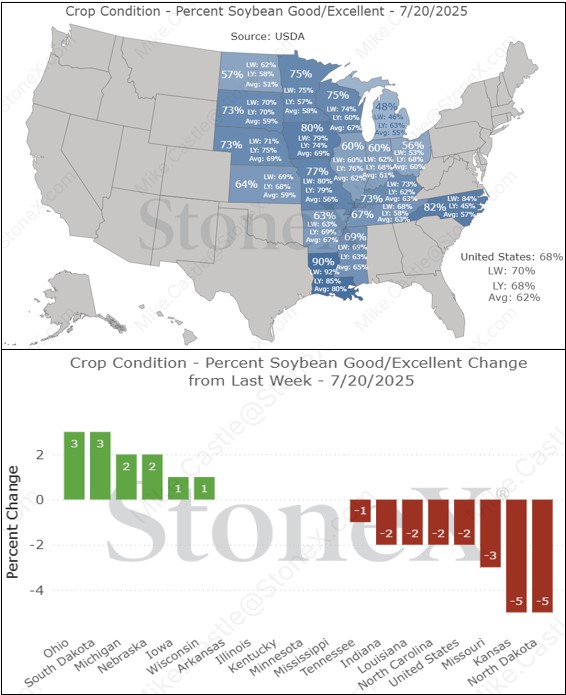

After last week's unexpected dip, US #soybean conditions rose 2% to return to 70% G/E, maintaining the best ratings since 2020. Biggest week-over-week increases were seen in WI (+9%), IL (+5%), and ND (+5%). #oatt

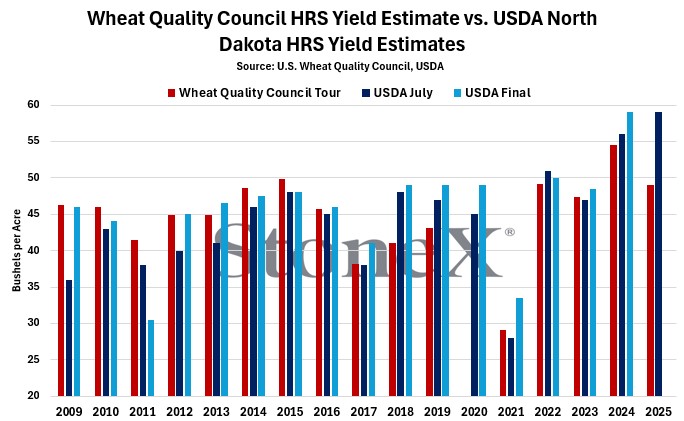

A look at how the #Wheat Quality Council Tour's HRS yields compare to #USDA's North Dakota HRS estimates for both July and final. The Tour has been below USDA's July figure only 4 out of the 15 prior years but below USDA's final figure 10/15 years (no tour in 2020). #oatt

Grains are mostly lower and we see more news for the fertilizer markets on Friday. Mike Castle (@mike_castle2) from @StoneX_Official joins us to discuss in our @markettalkag Midday Commentary for Friday, July 25th, 2025. americanagnetwork.com/?p=91295?rand=…

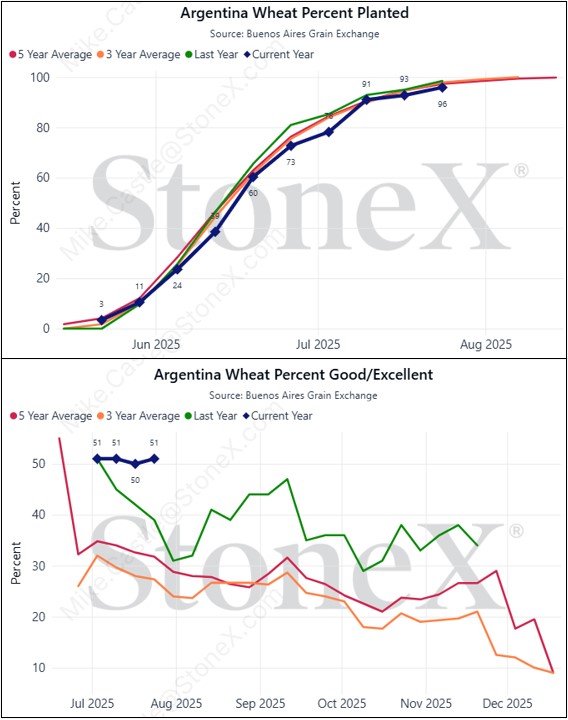

Planting of Argentina's #wheat crop is nearly wrapped up, advancing 3.1% week-on-week to reach 95.9% complete. Conditions are off to a great start, in their best shape at this time since 2021 at 51% good/excellent, up another 1% from the week prior. #oatt

A corn sale correction and an India urea tender are some of the main headlines in Thursday's market trade. Mike Castle (@mike_castle2) with @StoneX_Official joins us to discuss in our @markettalkag Midday Commentary. americanagnetwork.com/2025/07/24/cor…

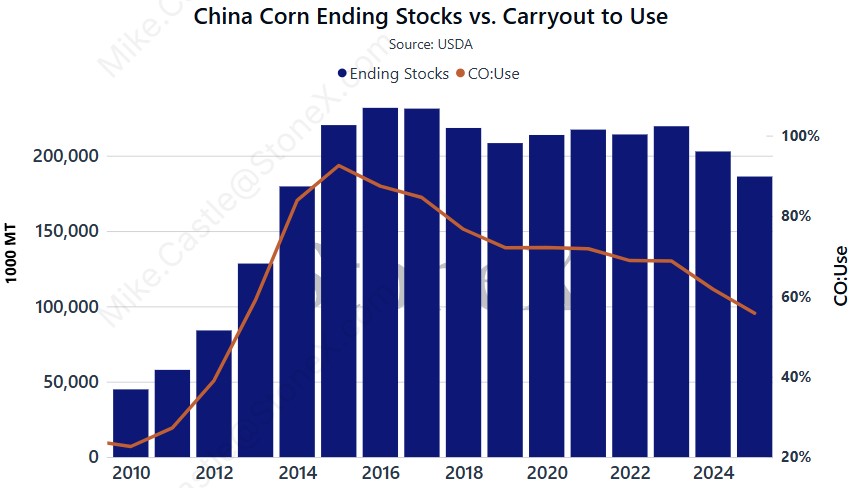

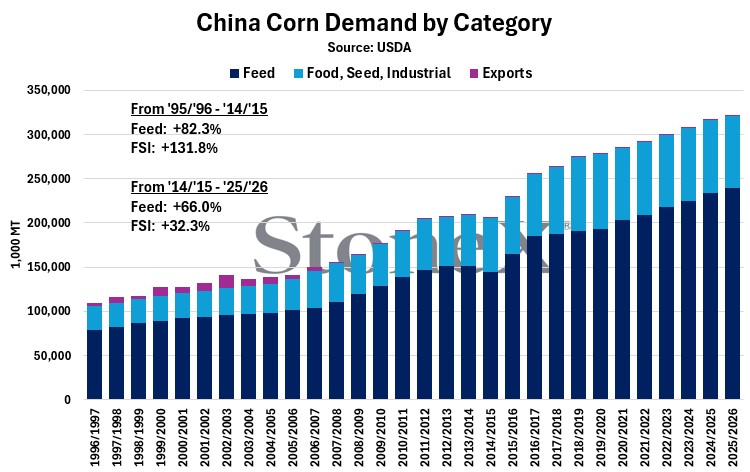

A visualization of the growth in #China's #corn demand over the last 30 years. As can be seen, much of the growth over the last decade-plus has come from the feed side, with FSI growing much more moderately. #oatt

A big part of #China's falling #corn stocks is the slower growth in their production relative to domestic consumption; that shortfall in '25/'26 is estimated at 26 MMT, highest in at least 30 years. Since '14/'15 Production: +18.1% Dom. Consumption: +55.8% #oatt

Markets don't seem to be showing much enthusiasm related to trade deal announcements on Wednesday. We discuss the grain trade, the outside markets and more with Mike Castle (@mike_castle2) from StoneX in our @markettalkag Midday Commentary. americanagnetwork.com/2025/07/23/mar…

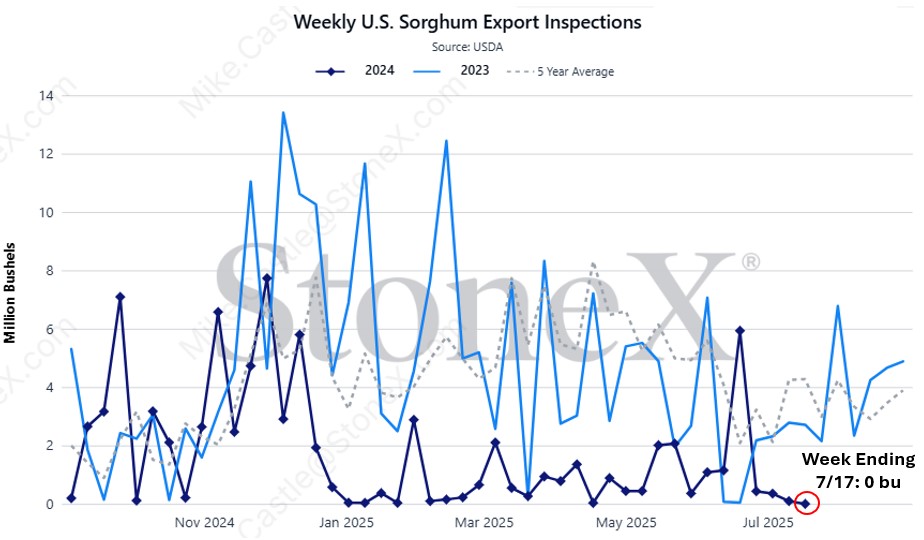

Interesting note from yesterday's #USDA data--there were zero bushels of #milo (#sorghum) inspected for export in the week ending 7/17, the first time this has happened since at least 2000. We've shipped zero bushels to China, our traditional top customer, since March. #oatt

Grain markets are mixed at midday on Tuesday. We take a look at grains, fertilizer markets and talk trade with Mike Castle (@mike_castle2) from @StoneX_Official in our @markettalkag Midday Commentary for Tuesday. americanagnetwork.com/2025/07/22/gra…

Unexpected 2% week-over-week decline in US #soybean ratings on this afternoon's #USDA Crop Progress report; now sitting at 68% G/E vs. market expectations of a 1% improvement to 71% G/E. Biggest drag came from 5% declines in ND & KS, as well as a 3% drop in MO. #oatt

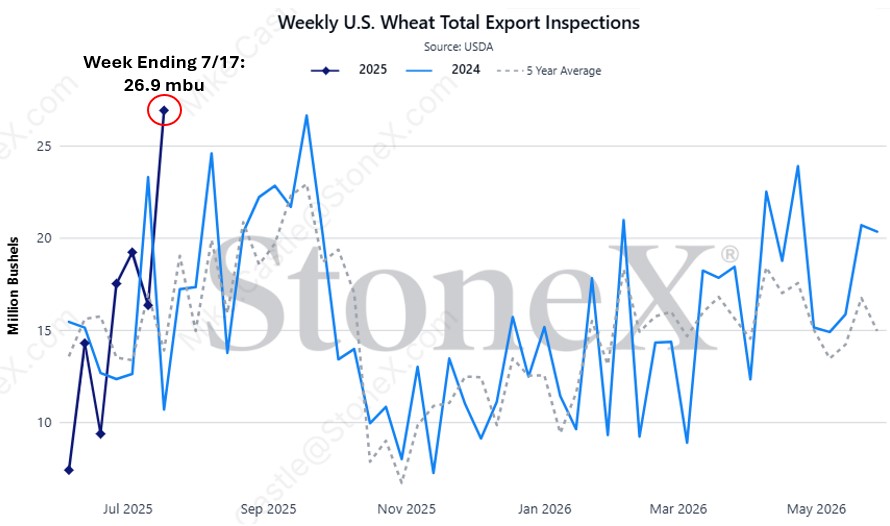

More positive news on the US #wheat demand front: biggest weekly #wheat inspections since September 2022 @ 26.9 mbu, with Nigeria the featured destination. However, spillover selling pressure from #corn/#soy have futures in the red after trading higher in the overnights. #oatt

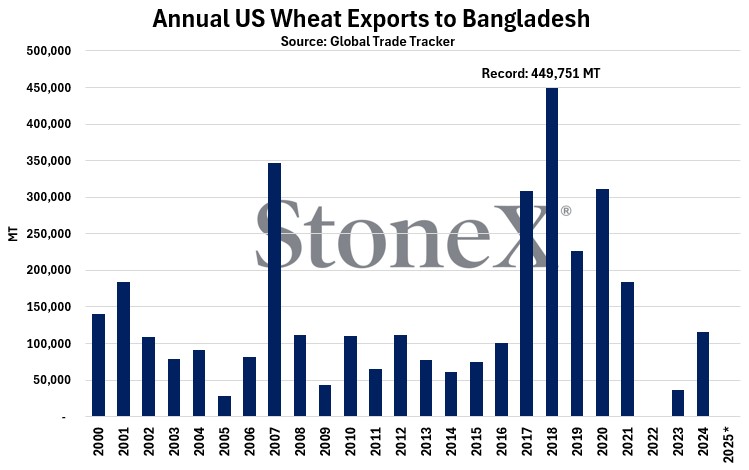

Bangladesh has signed a deal to import 700,000 MT of US #wheat annually over the next 5 years. As shown, this is a sharp uptick from traditional US export volumes to Bangladesh and would be roughly ~250,000 MT larger than the previous record set in 2018. #oatt

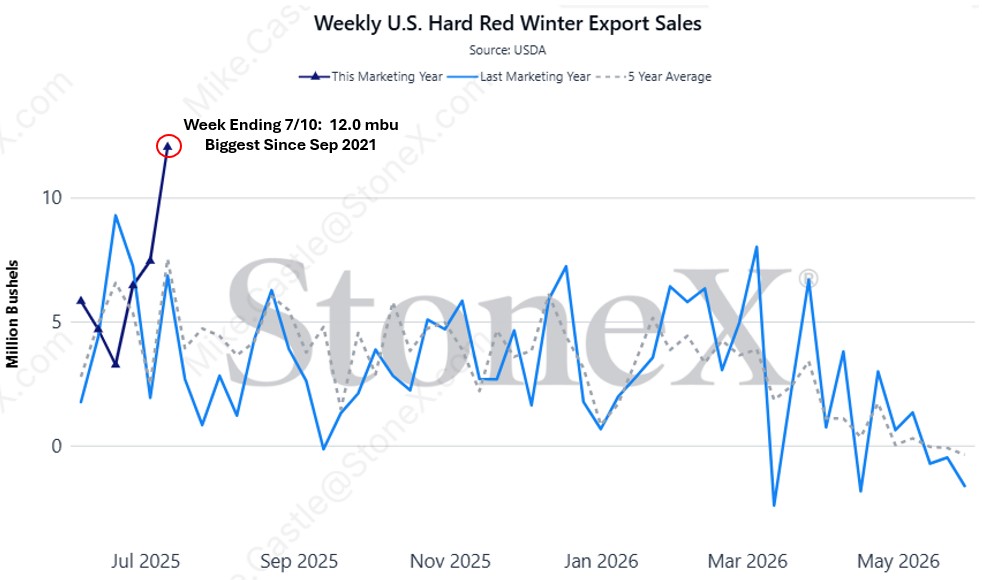

Weekly US hard red #wheat sales hit a nearly 4-year high @ 12.0 mbu, with South Korea and Mexico being the featured buyers. #oatt

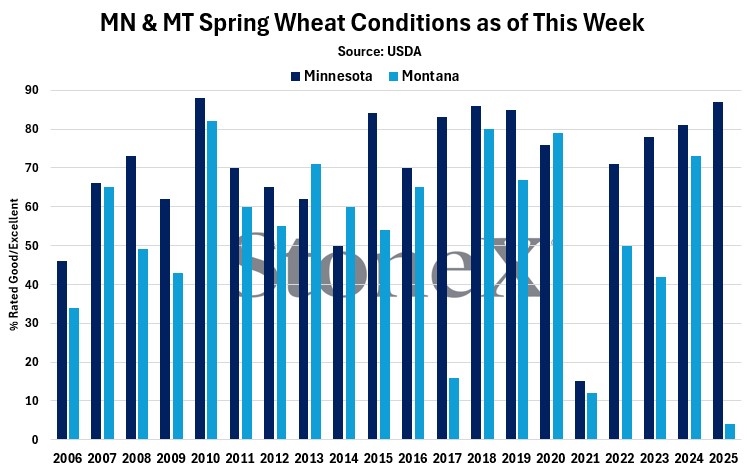

A tale of two sides in the US spring #wheat crop-- Minnesota: 87% G/E (+7% week-on-week) 2nd highest rating at this time on record (just behind the previous record of 88% set in 2010) Montana: 4% G/E (+2% week-on-week) Worst rating at this time on record #oatt

With #corn holding steady and #soybeans rising 4% week-on-week, US corn and soybean ratings are both now the highest they've been at this point in the year since 2016. #oatt

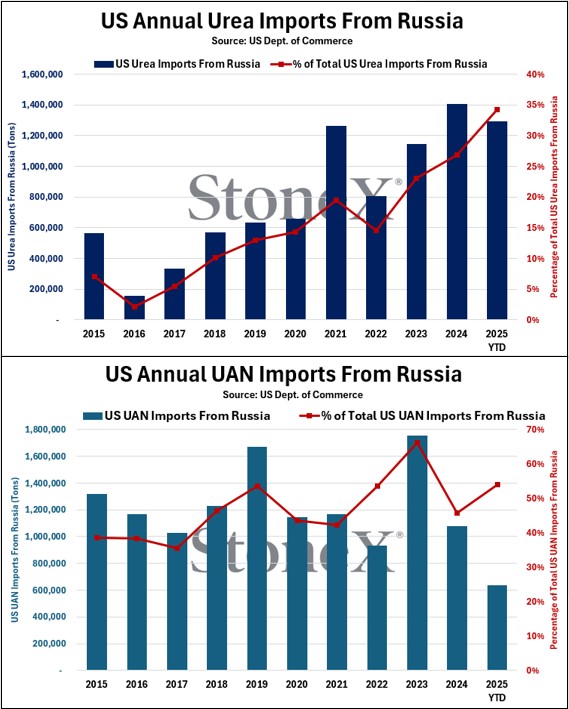

For those saying today's threats of tariffs on Russia don't matter because the US "doesn't trade with Russia," look to the #fertilizer sector. Russia is our top origin for both #urea & #UAN imports, with their market share growing substantially in recent years. #oatt

#USDA cuts China ‘24/’25 #corn imports by 2 MMT to a 6-year low of 5 MMT. With rest of their balance sheet left alone, this lowers ‘25/’26 ending stocks by same amount to reach an 11-year low at 179.163 MMT. Big part of why world ending stocks came in below expectations. #oatt