Matt Cerminaro

@mattcerminaro

Creating Wealth’s Premiere, Custom-Branded Charts. Free 30 Day Trial 👉 http://exhibitaforadvice.com

Investors have had a painful year😱 S&P 500 in 2022 has had 63 -1% days. Ouch. In the past 50 years, there have only been 3 years with as many days down -1% 📉: 1974: n= 67 2002: n= 73 2008: n= 75 Returns in following Year 📈: 1975: 32% 2003: 26% 2009: 23% 👇 2023: ?

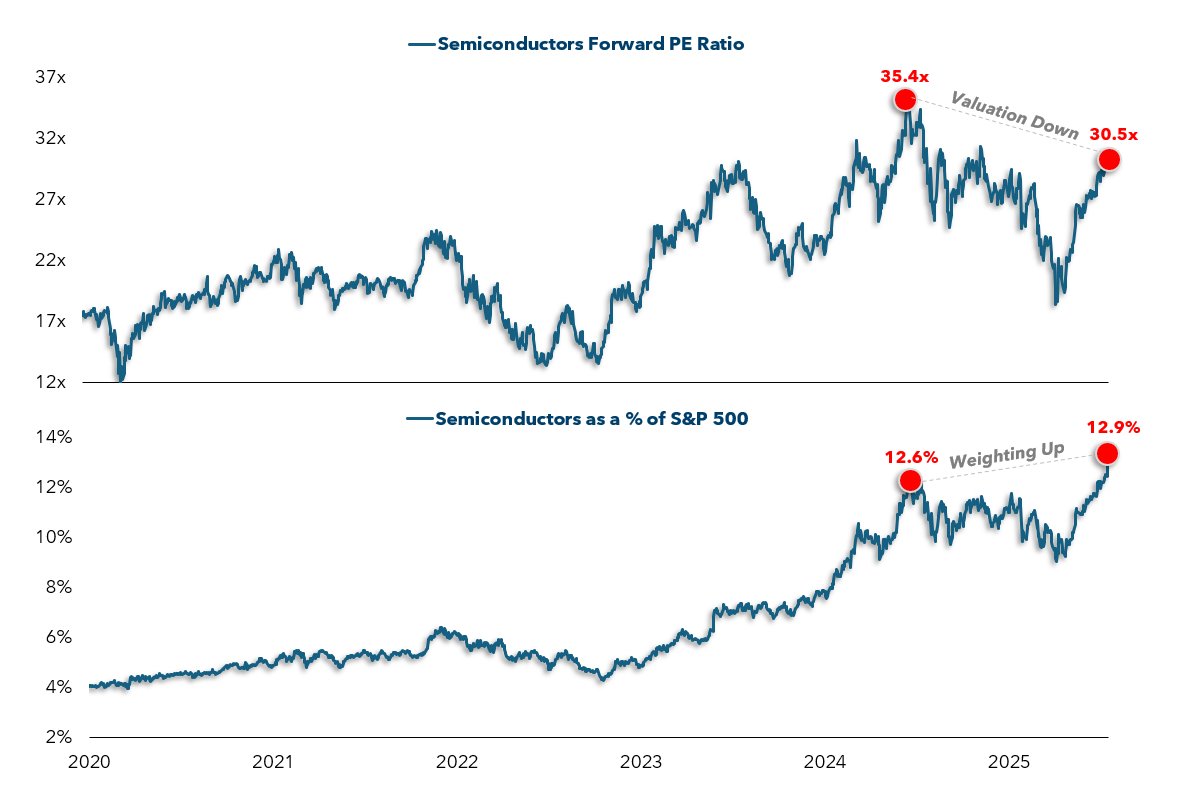

Semis are ripping. And the fundamentals support it. On 6/18/2024: - Semis Forward PE: 35.4x - Weight in S&P 500: 12.6% Today: - Semis Forward PE: 30.5x - Weight in S&P 500: 12.9% (an ATH) Valuation 📉 Weighting 📈 Healthy? Yes.

🆓 Wednesday links: the semiconductor surge, the power of the Taco Bell Crunchwrap, and the importance of an independent central bank. abnormalreturns.com/2025/07/16/wed… image: x.com/mattcerminaro/…

Semis are ripping. And the fundamentals support it. On 6/18/2024: - Semis Forward PE: 35.4x - Weight in S&P 500: 12.6% Today: - Semis Forward PE: 30.5x - Weight in S&P 500: 12.9% (an ATH) Valuation 📉 Weighting 📈 Healthy? Yes.

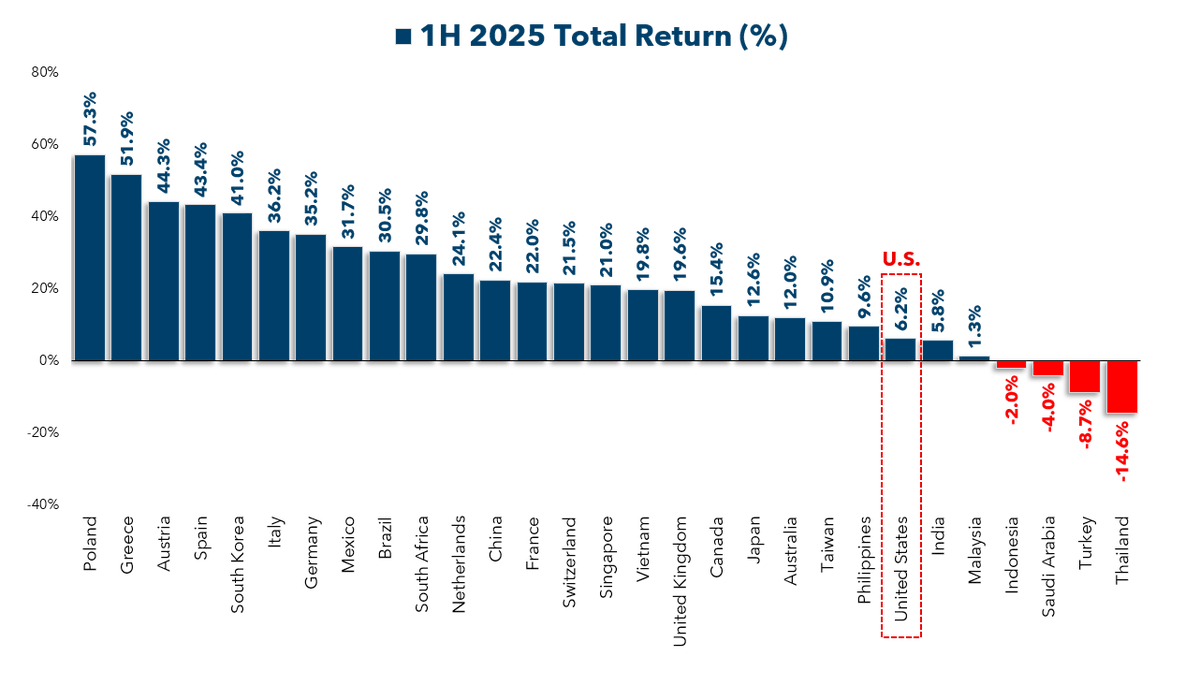

Despite the face ripping rally since April's low, from a global perspective, the U.S. is still severely lagging its peers. 👇

AAII bulls down 4 weeks in a row NAAIM 2 month lows Initial jobless claims down 6 wks in a row Hedge funds most net short this year S&P 500 with 5 new all-time highs in a row Interesting times

Nikkei futures up 4%+ today. This was Josh's favorite of all the country charts I brought to the podcast last week x.com/TheCompoundNew…

Nick's new book is now available! Can't wait to read it. Get your copy! 📚👇

My book, The Wealth Ladder, is now available: geni.us/wealthladderha…

Attn Young Guns - The Future Is For The Taking! Do NOT get caught up in this doom & gloom from your peers & elders about rates or AI or anything. Life was always hard & it always will be. Still, The Future Is For The Taking & your attitude towards the future is everything.

Buying stocks at all-time highs leads to better returns compared to buying at any other time over the last 75 years. (h/t @mattcerminaro @ReadOpeningBell)

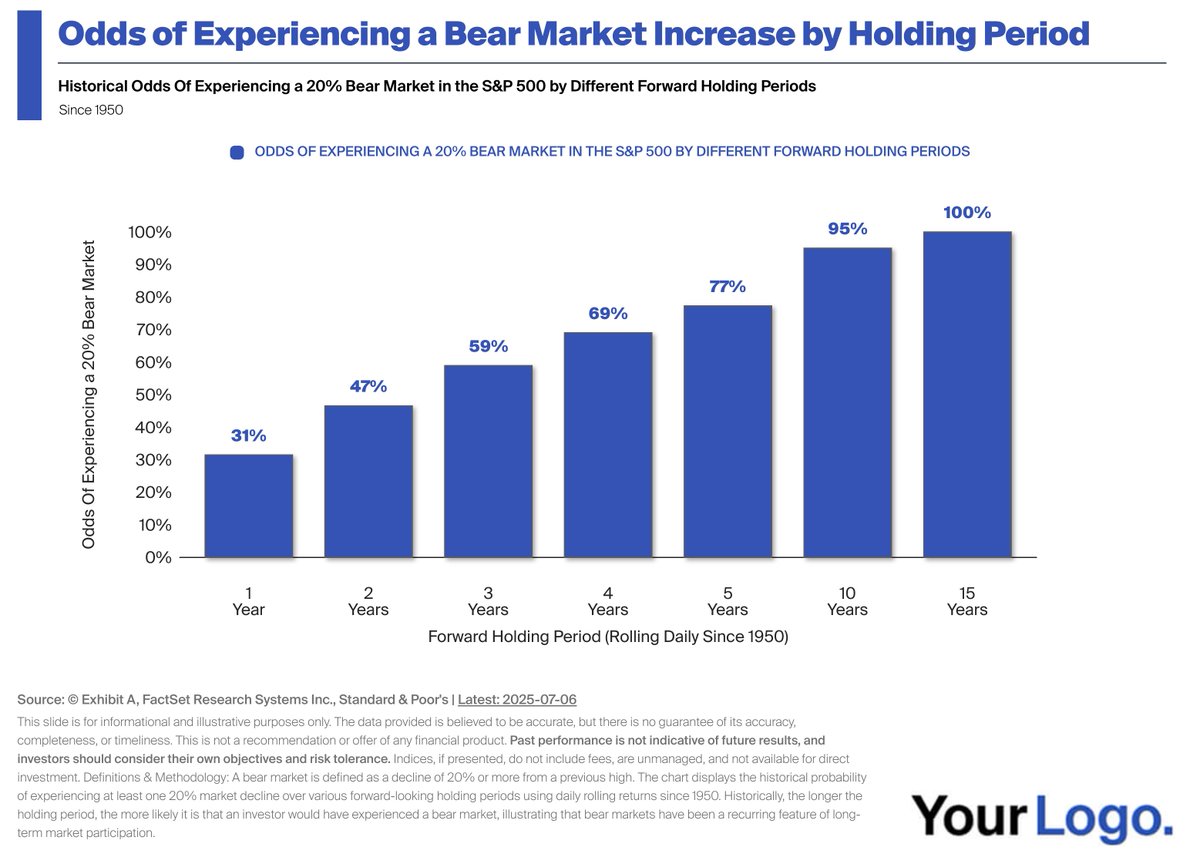

All-time highs are back, but history tells us that another bear market could be coming. The chart below, from @mattcerminaro, highlights the fact that bear markets are normal. Rather than feared, maybe bear markets should be expected... This week on Yield to Maturity in bio!

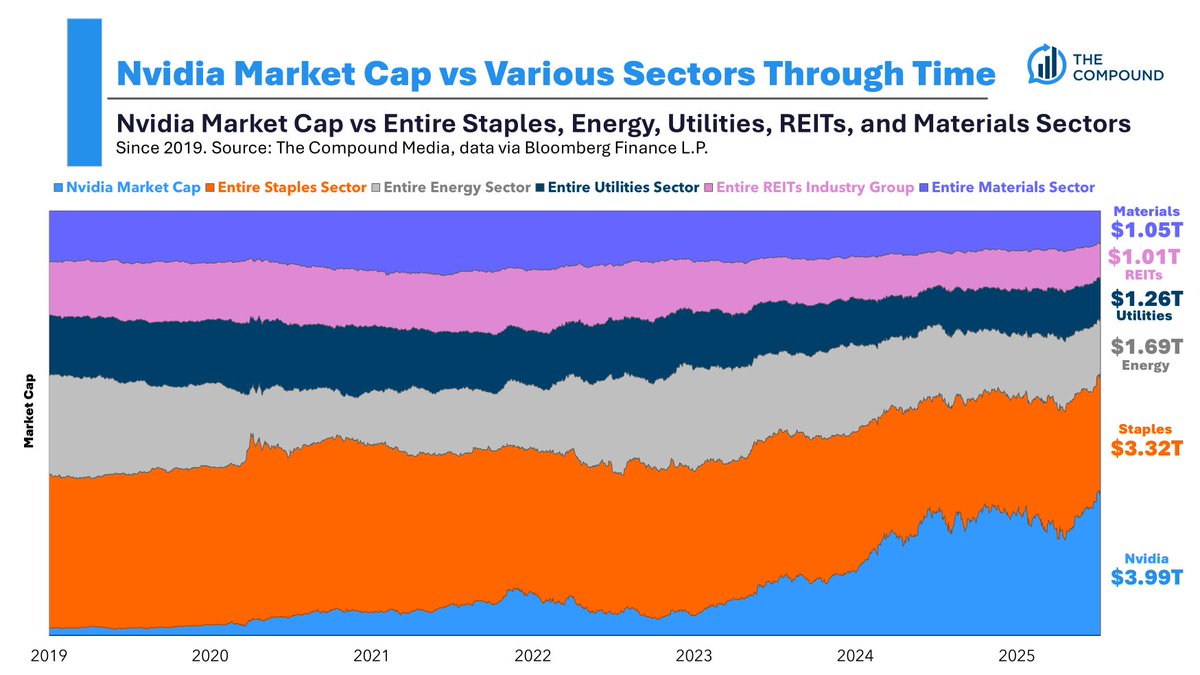

Nvidia is larger than the entire: - Staples sector - Energy sector - Utilities sector - Materials sector - and REITs sub-industry group. (not combined). Wild 👇 @TheCompoundNews

Always an honor to be @TheChartReport Chart of the Day! Even better was I got a chance to hang out with @Pdunuwila last night at the @Stocktwits @CMTAssociation Summer Social. This is simply one of the best daily lists of amazing charts out there.

Check out today's Daily Chart Report! thechartreport.com/07-10-25

Copper just logged its best single-day gain in history.

I've been using Exhibit A (custom chart-building service by @mattcerminaro and @michaelbatnick ) since its launch in March. Since adopting it, I've identified two very specific use cases for it in my practice. If you're interested in learning more about the service + how I'm…

Market hanging in today on seemingly "bad news" = bullish IMHO. It's telling of where sentiment stands. If everyone was all bulled up, would make sense to be down 2% today. But we're flat. I like that setup.

"Invert, always invert" - Charlie Munger It's true that over the long run, investment gains become more certain. Holding period matters. But there's a flipside to this: the longer your holding period, the higher the odds that you experience a bear market. Give it a look 👇

What should we ask @michaelbatnick on The Morning Show today? x.com/i/broadcasts/1…

"Long-term investors need to become accustomed to buying and holding at new heights." 😎 - @awealthofcs awealthofcommonsense.com/2025/07/invest…

Investing a Lump Sum at All-Time Highs "The math tells you the stock market is up three out of every four years, on average, and investing at all-time highs offers slightly above average results. Those are pretty good odds." buff.ly/9p9xulR by @awealthofcs

Investing Update: 1st Half Recap & 2nd Half Outlook spilledcoffee.substack.com/p/investing-up… Charts from @dailychartbook @RyanDetrick @MikeZaccardi @bespokeinvest @mattcerminaro @michaelbatnick @granthawkridge @charliebilello @_JoshSchafer @philrosenn @StockMKTNewz @fundstrat @KevRGordon…