Brandon Beylo

@marketplunger1

Writer | Investor | Listener || ~ There are no great businesses, only great bets. Nothing you read here is investment advice. Read 👉 https://macro-ops.com

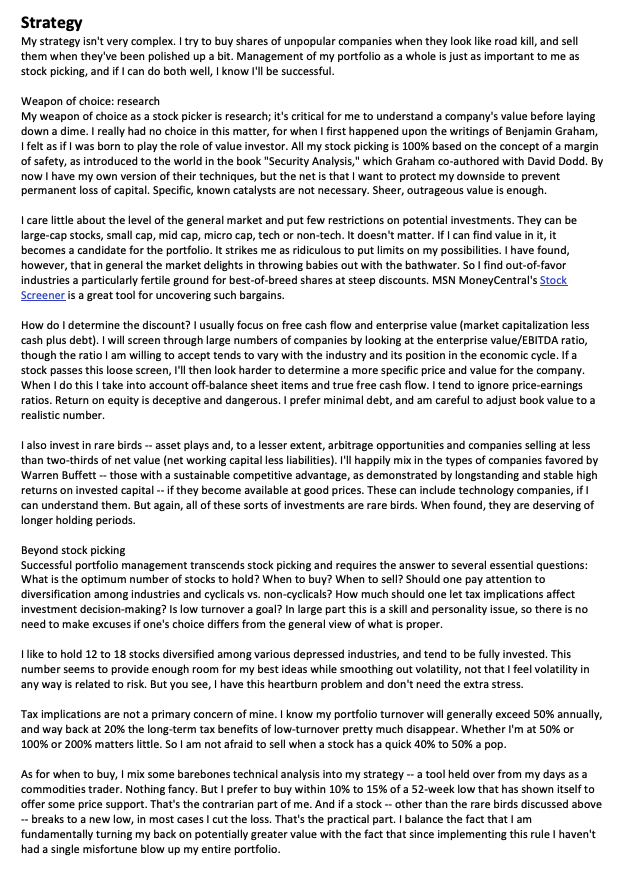

Michael Burry's (@michaeljburry) Investment Strategy One-Pager - Buy roadkill - Sell when roadkill's been polished - Care little about general market - Focus on FCF & Enterprise Value - Invest in Rare Birds - Hold 12-18 Stocks - Buy within 10-15% of 52-week low Love it.

You haven't lived until you've bought Chinese mining company stocks, which you cannot pronounce the name of, operating in the DRC, off the pink sheets.

Buy that junior mining stock. Buy the shittiest deposits you can find, the lowest grade, highest capex, run by guys who never saw gold outside a pawn shop. Buy a basket of them. Buy the ones with the most debt, the most leverage to the commodity price. Buy risk. Buy DRC, South…

the fartcoin thesis applied to mining stocks. Wouldn't bet against it in this market.

Buy that junior mining stock. Buy the shittiest deposits you can find, the lowest grade, highest capex, run by guys who never saw gold outside a pawn shop. Buy a basket of them. Buy the ones with the most debt, the most leverage to the commodity price. Buy risk. Buy DRC, South…

Buy that junior mining stock. Buy the shittiest deposits you can find, the lowest grade, highest capex, run by guys who never saw gold outside a pawn shop. Buy a basket of them. Buy the ones with the most debt, the most leverage to the commodity price. Buy risk. Buy DRC, South…

My Q2 2025 Equity Portfolio Review I explore the good, bad, and fugly of our equity trading this year, along with the lessons learned. The stats: • April: -4.82% • May: +1.46% • June: +13.27% • Q2 2025: +9.91% • YTD (thru Q2): +23.78% Enjoy 👇 macro-ops.com/q2-2025-equity…

I don't care who you are, you never like seeing someone lose 8-figures on a trade. Especially when that someone will likely owe you a new car for a bet on $CVNA stock price.

Heard you lost 8-figures on your $RILY short (from an 8-figure net worth). Bottom line-you’re a repeat spectacular failure: Fund management, marriage, fatherhood, friendship, PA investing, and even at being my enemy. That’s why you spend all your time pulverizing your noodle to…

The fact that you can freely write, and publish, a piece asking this question means it was a good idea.

Was the American Revolution such a good idea? nyer.cm/RafU1FD

Just received copper intel: I should be more bullish copper.

Just received copper intel: Chart does not show Tuesday’s action…copper futures price is up 1.75% (+$0.10, last trade $5.73)…bullish action as the b/o from the wedge has a measured target of up 14%, or to $6.32. This is occurring above the major b/o area of a huge, almost…

“When it comes to investing, I don’t skate to where the puck is, I stake to where it’s go—”

Volatility Breakout happening in gold right now. Probably nothing. $gold

I can't believe there are investors out there wasting their time on good businesses with durable moats, competitive advantages, etc. When you can buy bankrupt retailers like Kohl's and make 100% in a morning.

"The worse the business model, the better the returns. The better the business model, the worse the returns." - Intelligent Investor, 2025 Edition

My friend @SFarringtonBKC turns over more rocks than anyone I know on this platform. Highly recommend following him as he’s probably written about your favorite stock by now.

Writeup on my substack. They took two years for a CEO search, and the interim guy made a lot of mistakes. I think they turn it around, and it's a big business for the price. Plus, they should survive at least until the next consumer discretionary cycle.

Look, you can either complain about the market and what it "should" be. Or you can trade the one that's in front of you. Here's an example: Kohl's $KSS. I have no idea if $KSS is a good/bad business, whatever. I just know that it's looking like 2021 again. Don't own yet.

Grok is Peaty. Who would’ve thought.

No sugar in your blood is called hypoglycemia, which can cause shakiness or seizures. No sugar in your brain is called neuroglycopenia, leading to confusion or coma. No sugar in your liver is called glycogen depletion, risking low energy and ketosis. No sugar in your cells is…

There's currently a number of major compression regimes in key macro assets. This matters because big compression regimes precede BIG trends. $TLT, BUNDs, Commodities (BCI), and Gold are all setting up. Read more here 👇 macro-ops.com/big-moves-are-…

Congrats to the Titan Mining $TI.TO team. "[Titan Mining] will become the first fully integrated U.S. graphite producer in over 70 years once the project starts production." Make Mining Great Again!

I’ve owned Titan Mining $TI.TO since CAD 0.50. Never talked about it publicly because it was too small / illiquid, and I wasn’t super comfortable with the zinc space yet. This has done well, think there’s room to go. It’s a 3% position for me. US leverage. DYODD, please.