Lisa Abramowicz

@lisaabramowicz1

Co-host of @bsurveillance

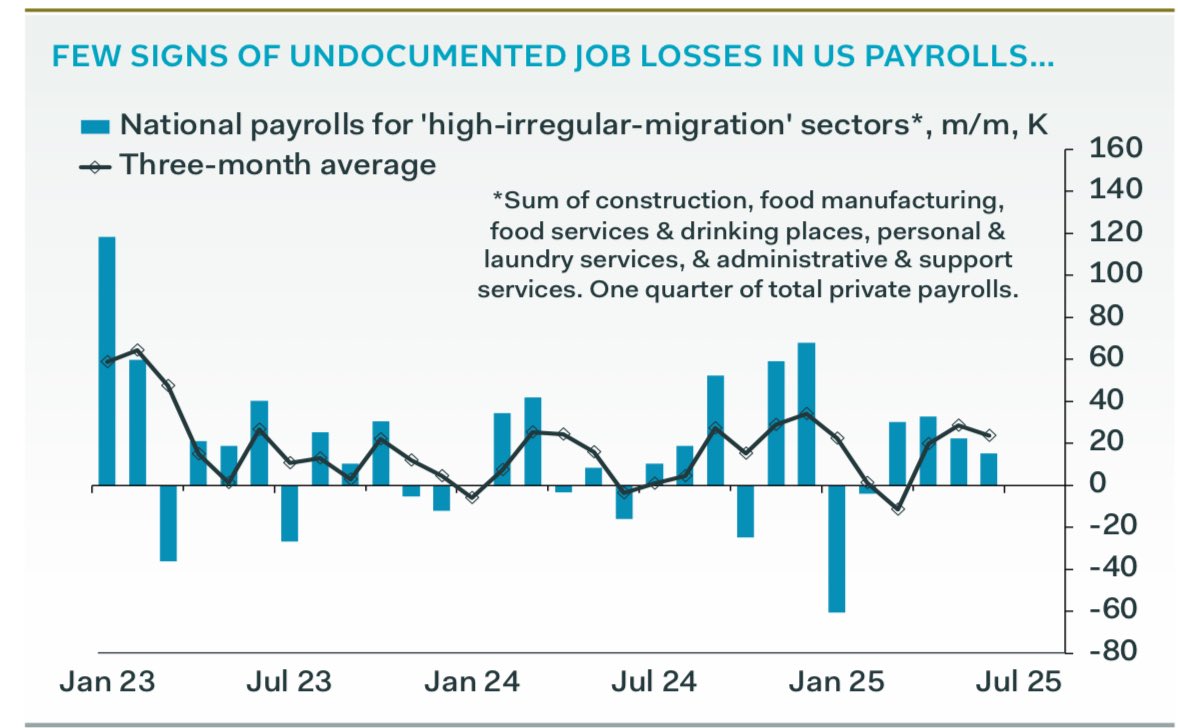

“One notion we reject strongly is that the migrant workforce already is rapidly shrinking:” @PantheonMacro report. Payrolls data “pour cold water on the notion that the workforce of irregular migrants is falling sharply.”

BTIG's Jonathan Krinsky: "Party Like it's 1999. As we discussed last week, the Nasdaq 100 has now gone 60 trading days without closing below its 20 DMA, the second-longest streak in its history (back to 1985). The longest was ended in early 1999."

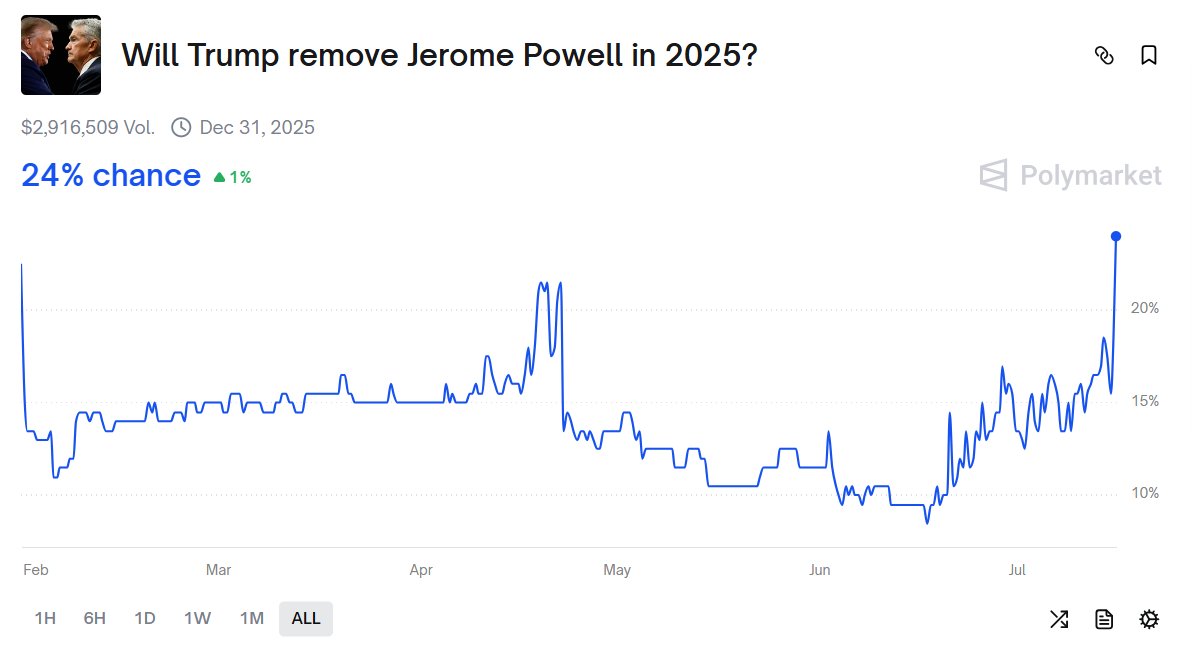

Betting markets are showing a growing chance that Trump will fire Powell this year, as per Polymarket:

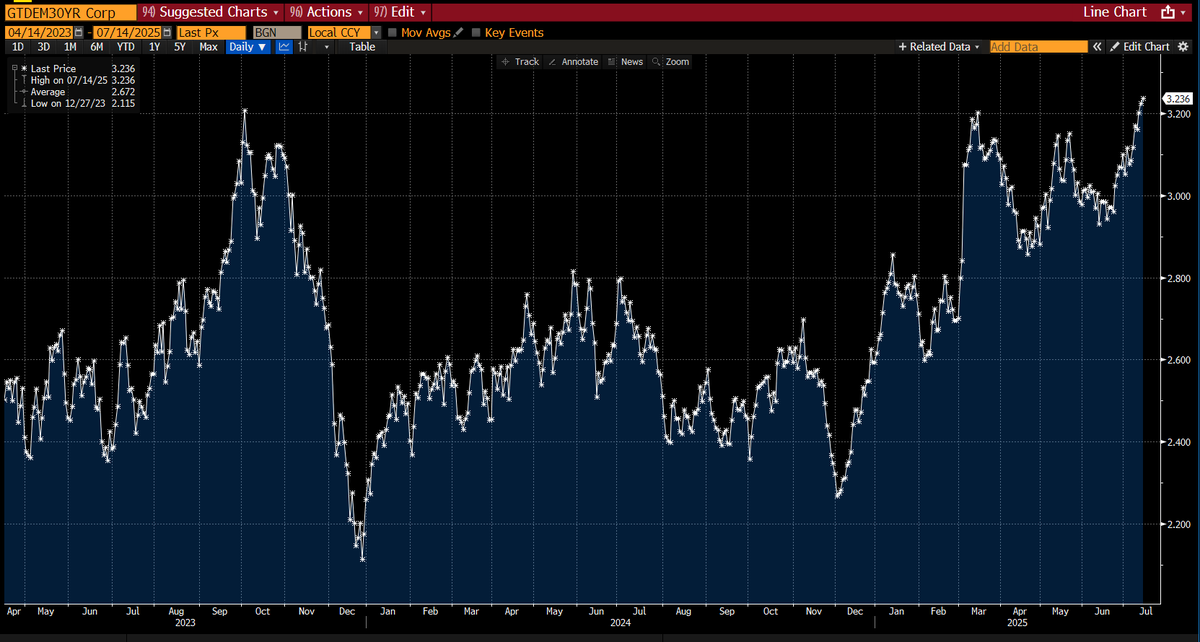

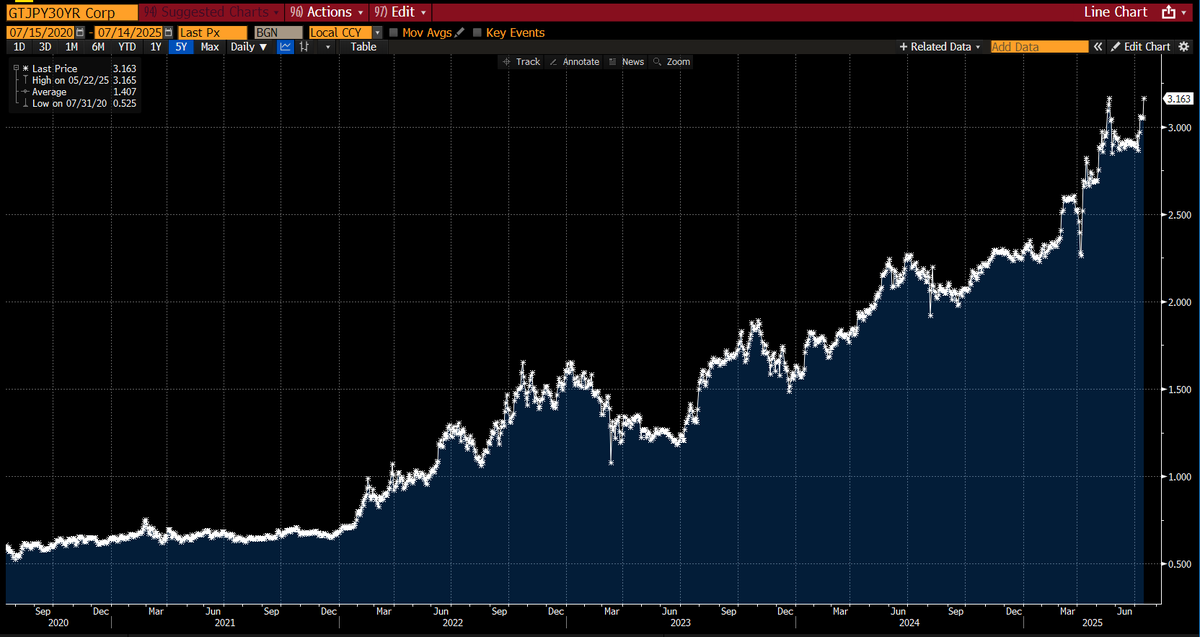

Long-term yields are surging around the world, with German 30-yr rates at the highest since 2023 and 30-yr yields in Japan surging toward new records. The uncomfortable truth: no politician wants to pay for spending with cuts & taxes, & bond markets are getting nervous.

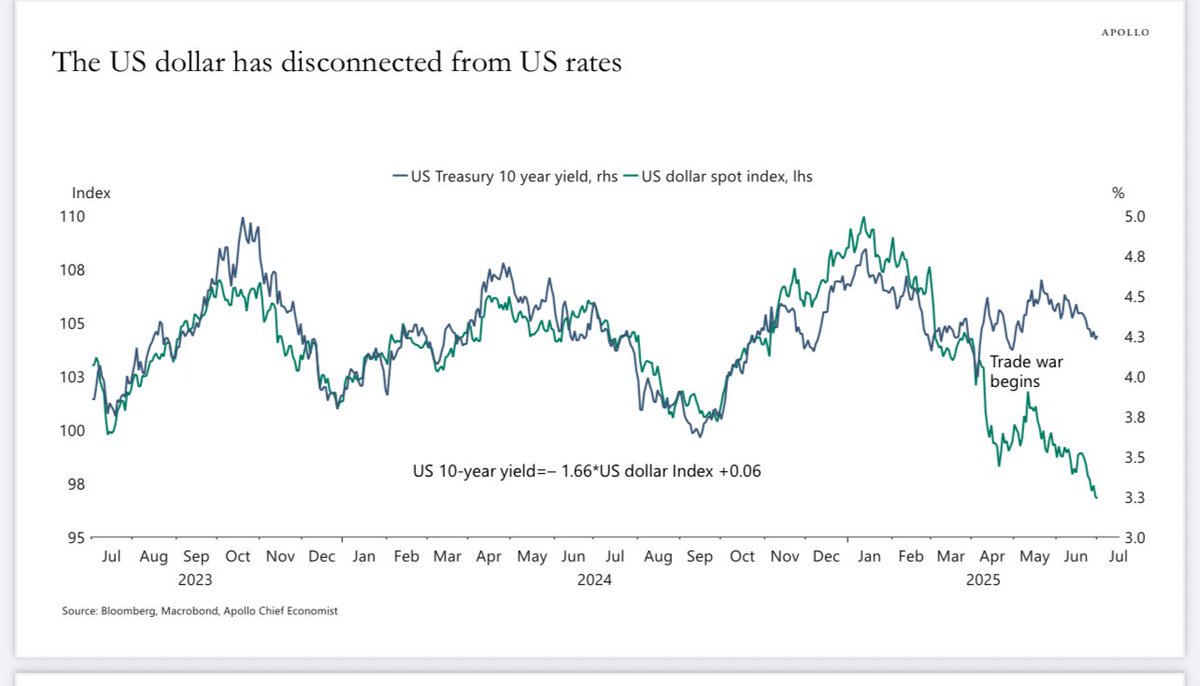

In recent years, the value of the dollar was driven by rate differentials, with foreign investors drawn to the US’s stronger growth and higher risk-free income. That relationship has broken down since April. Chart from Apollo’s Torsten Slok: apolloacademy.com/wp-content/upl…

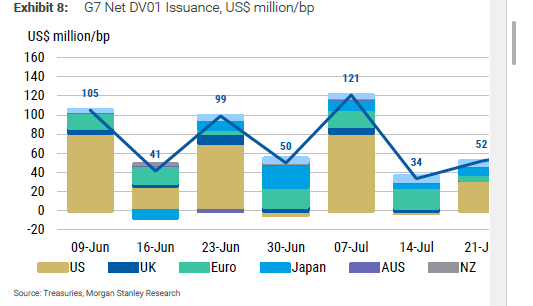

Morgan Stanley's Matt Hornbach tallied up the net issuance from G7 nations in the next month or so. The US is the biggest debt seller with more than $220 billion of net sales in the next five weeks, but the EU is catching up with a net sales of 93.8 billion euros in the period.

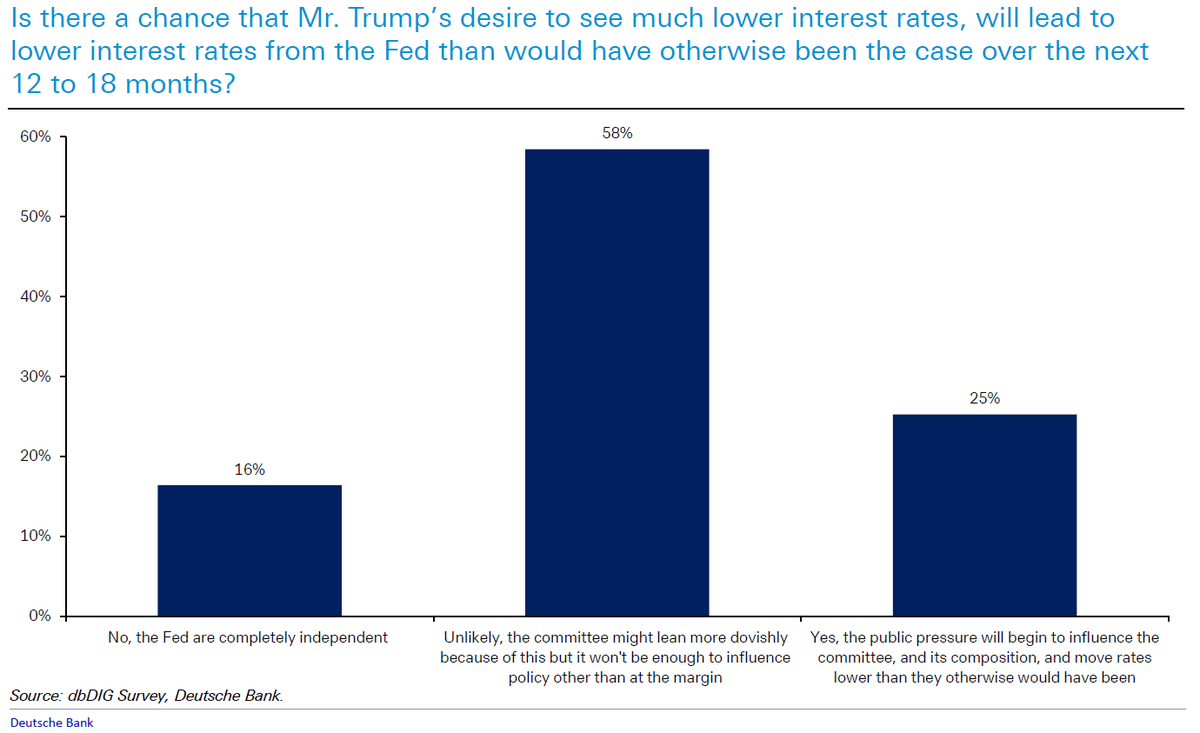

Only 16% of respondents in a recent Deutsche Bank survey believe the Fed is completely independent, with 25% seeing political pressure leading to lower rates.