Biotech Investor

@learnbiotech

Learn to invest in biotech like the professionals from a former biotech executive and investment banker. For education purposes only. Course on Thinkific

Pharma has varying levels of success developing drugs. That's a boon for biotech Here are the biopharma companies ranked by likelihood of first approval (LoA%) from 2006-2022 $AMGN, $NVO, #Eisai top the list $GSK, #Astellas, $ABBV are at the bottom #BiotechPrometheus

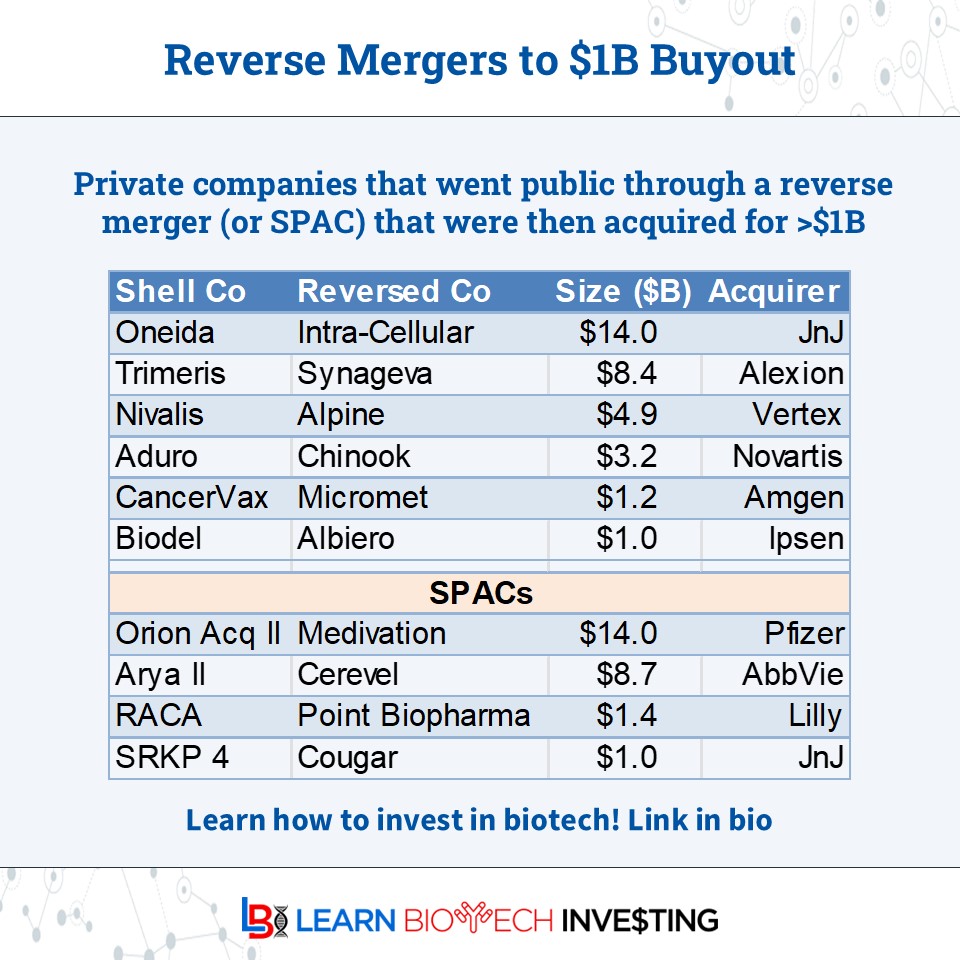

Sometimes a #reversemerger or #SPAC can result in a high value (>$1B) #biotech buyout. Both ways enable private companies to go public without an #IPO Here's a selected list: Any others I'm missing? Who will be next? #learnbiotechinvesting #investing #BiotechPrometheus

The @X #biotech community is still the most useful for learning, breaking news, and exchanging ideas. Here’s a list of thoughtful accounts worth following to continue building the community (no particular order): @yaireinhorn @Biotech2k1 @A_May_MD @BioStockAnalyst @BiopharmIQ…

Defining patient populations matter for investors. Ovarian cancer patient recurrence to 2nd line platinum therapy is influenced by how long their tumor was controlled by 1st line therapy Probability of response to 2L Pt is low for refractory (~0%) or resistant (~10%)

The BioTech scene on 𝕏 is amazing and full of great people and content creators! Here are some great names to follow for those on 𝕏 who are interested in BioTech: @Biotech2k1 @BiopharmIQ @Maximus_Holla @Pharmdca @BiomedicalRX @learnbiotech @CrisprGlenn @JessieChimni…

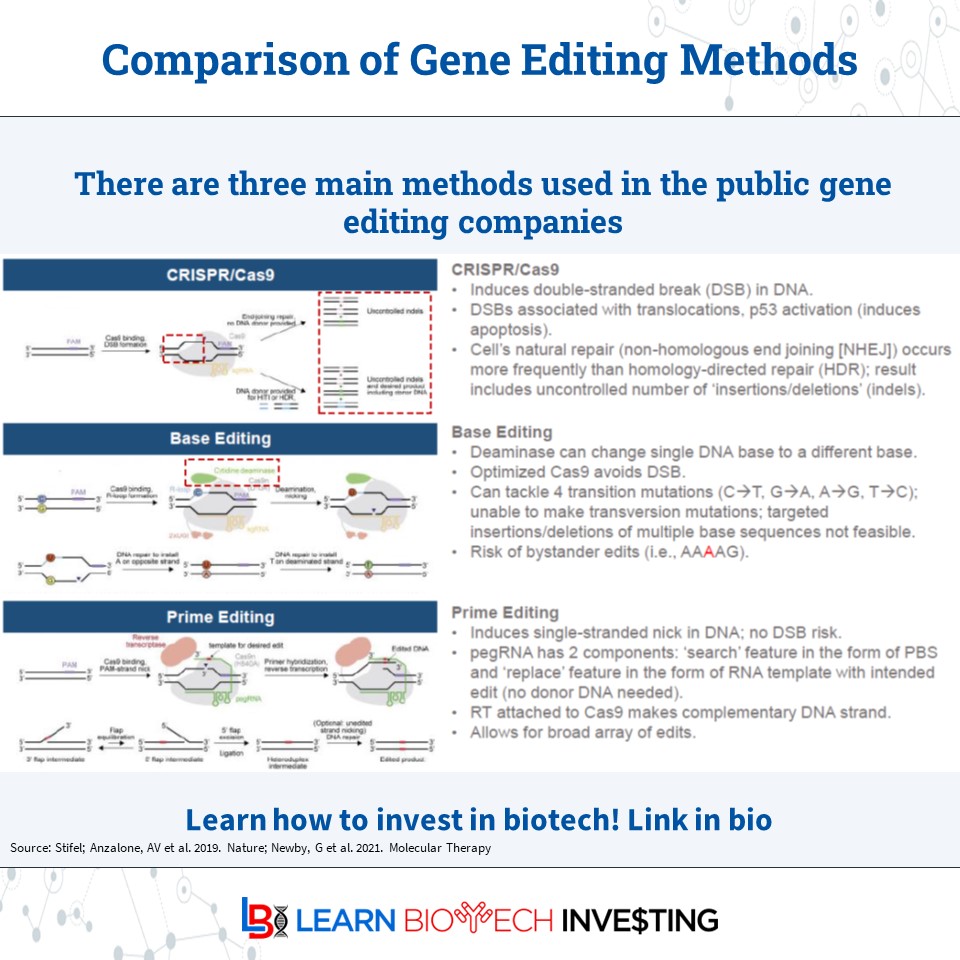

Investors should note that not all #GeneEditing technologies are the same. Different approaches are being tried, some with more data, some with more potential Understand what the tech can AND cannot do is important #learnbiotechinvesting #biotech #investing #BiotechPrometheus

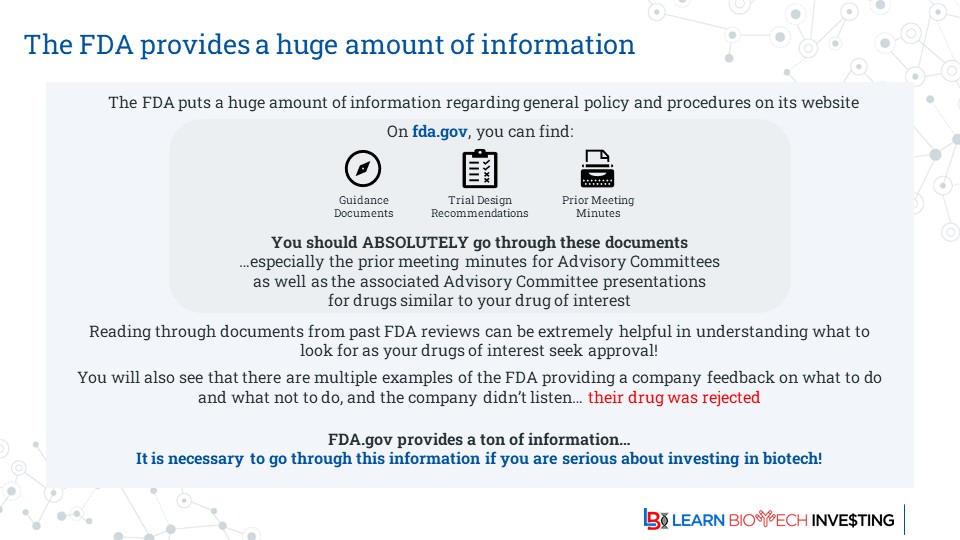

Investors, remember that the FDA puts out a wealth of information about drug candidates ahead of a potential approval A serious investor MUST read these! They are the ultimate arbiter for approval in the US #learnbiotechinvesting #biotech #investing #BiotechPrometheus

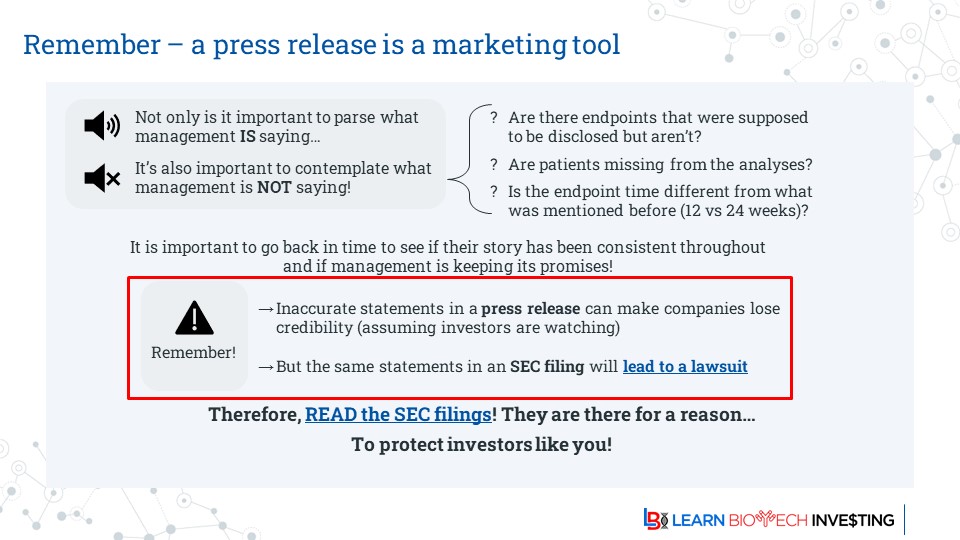

As we say here often: "A press release is a marketing document, an SEC filing is a legal document" Read the SEC filings! They exist to help #investors! And they are freely available, often on the company website #learnbiotechinvesting #biotech #investing #BiotechPrometheus

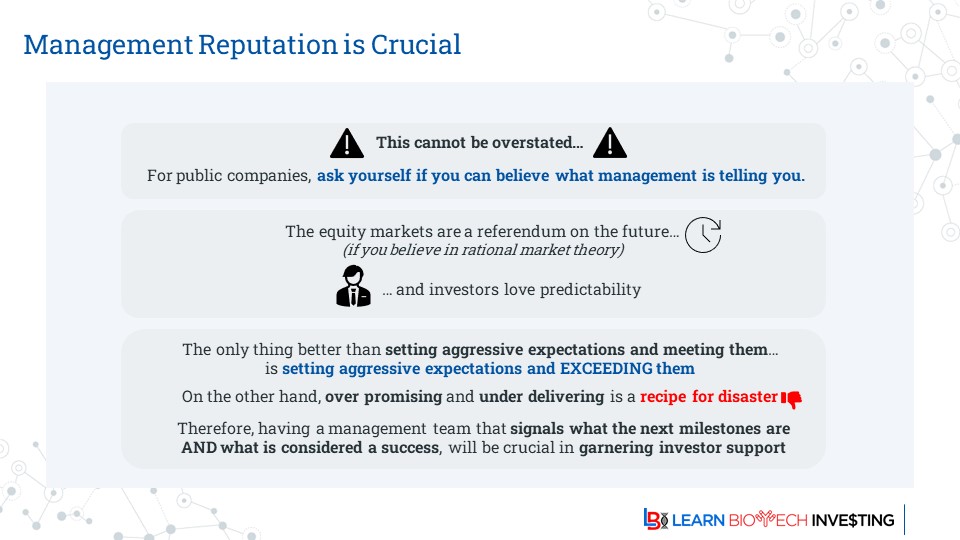

A key variable for investors is management reputation A lot that happens inside a company that is critical for success is outside of public view Investors must ask themselves if they believe management is giving an accurate assessment, both good & bad #learnbiotechinvesting

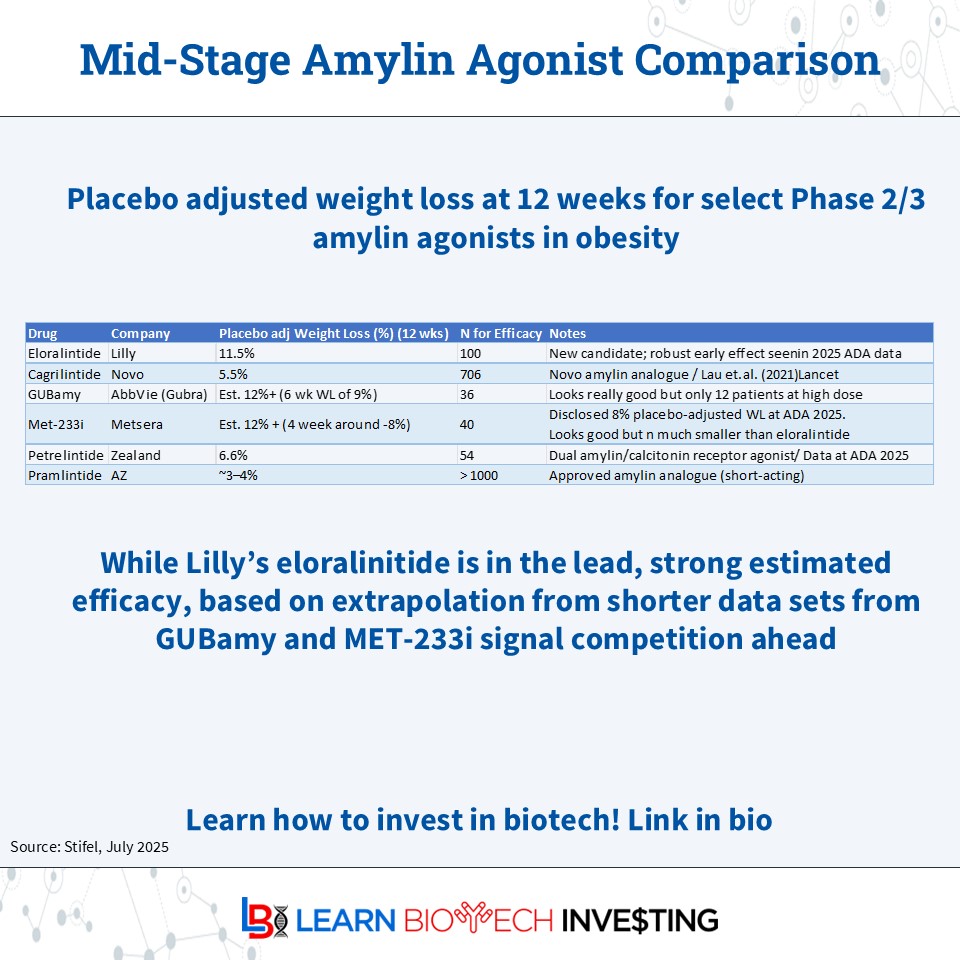

Amylin agonists are the next wave of #obesity drugs following the GLP-1s b/c they are likely to spare muscle Competition is intense with several mid-stage compounds: $LLY $NVO $ABBV $MTSR #ZEAL $ANZ Who will win? #learnbiotechinvesting #biotech #investing #BiotechPrometheus

Table notes the share price today v. @ FDA approval date for all 164 new comm'l-stage non-oncology focused bios since 1/1/13. These are tracked manually so o/c we may have missed 1 or 2 (or a split). $XBI Biggest winners: $VCEL $CPRX $ADMA $INSM $ZEAL $TGTX $LQDA $ALNY $RYTM

🧬 Biopharma 𝕏 Weekly Recap 📝 Interesting posts/ppl to check out! 👇 @ohadhammer New Jefferies Report Explores China’s Biotech Ecosystem » x.com/ohadhammer/sta… @BowTiedBiotech Great figure from Oppenheimer team on The China Trade 🇨🇳 » x.com/BowTiedBiotech… @BioStocks…

Great figure from Oppenheimer team on The China Trade 🇨🇳

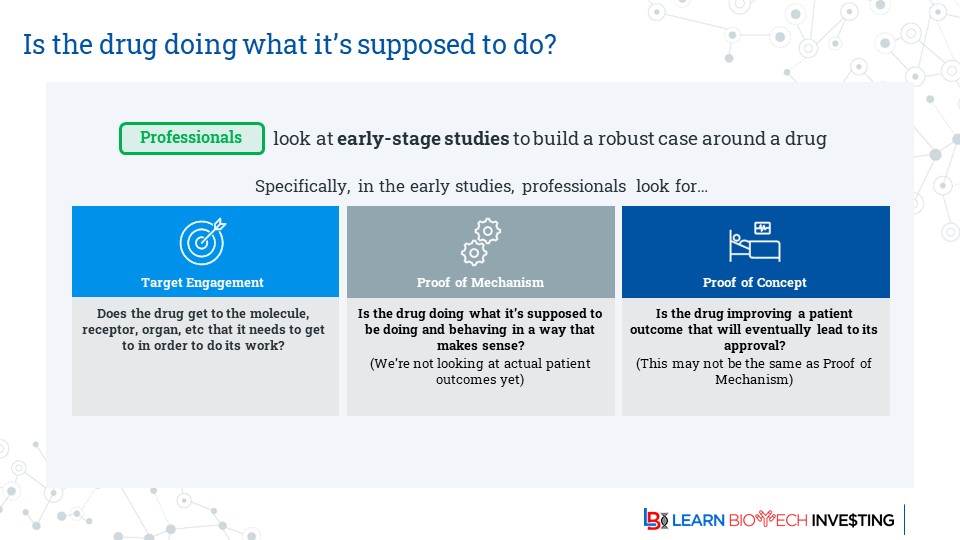

Investors should take an unbiased view of data and not only listen to management. Ask yourself: Is the drug doing what it's supposed to do? Look for: target engagement, proof of mechanism, and proof of concept #learnbiotechinvesting #biotech #investing #BiotechPrometheus

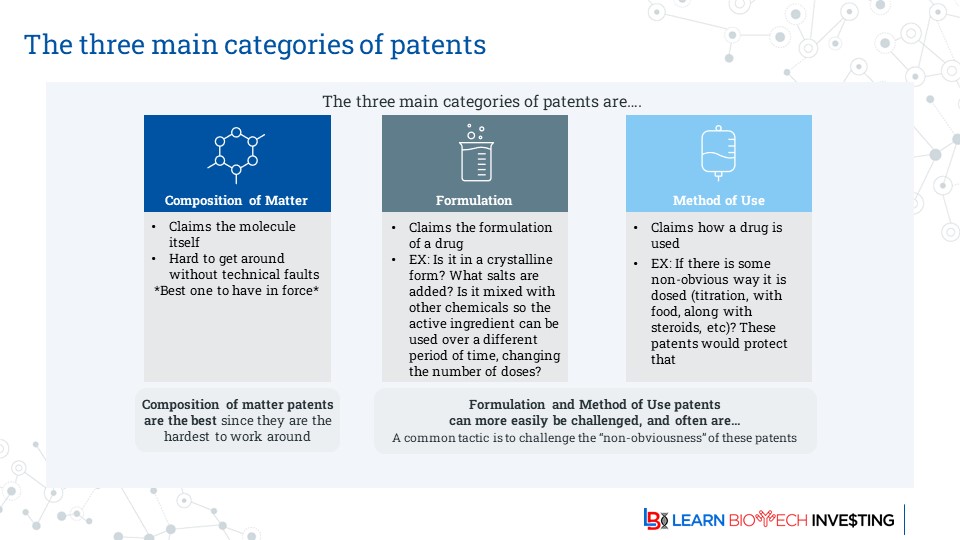

Investors must understand the patents which protect a drug. It's essential to determine the drug's revenue opportunity and therefore value There are 3 main types, with composition of matter being the most important #learnbiotechinvesting #biotech #investing #BiotechPrometheus

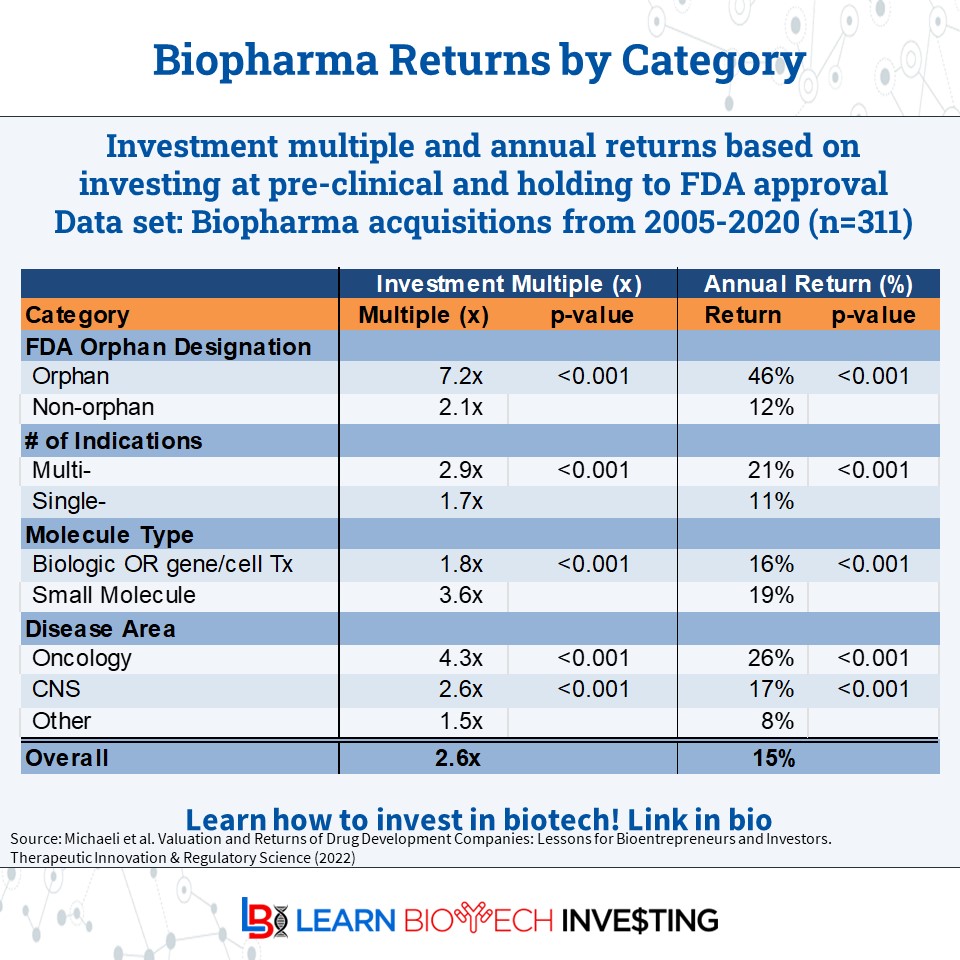

Historical investor return is 2.6x with a 15% annual rate of return for acquired companies (2005-2020 data set) The ideal profile is an orphan, multi-indication, small-molecule, oncology asset Does this still hold? #learnbiotechinvesting #biotech #investing #BiotechPrometheus

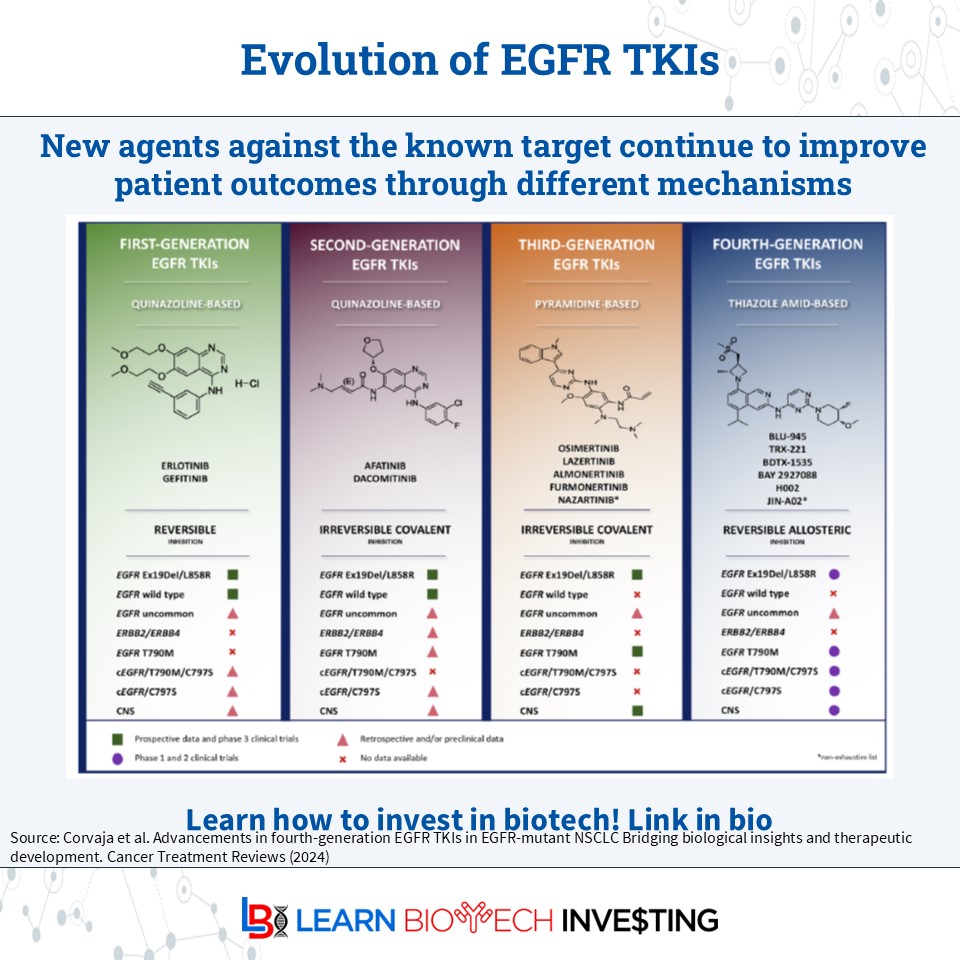

Targets with existing therapies can still be pursued IF the next generation of compounds has meaningful differentiation Here's the evolution of the EGFR TKI landscape. Each generation built on limitations of the prior generations #learnbiotechinvesting #BiotechPrometheus

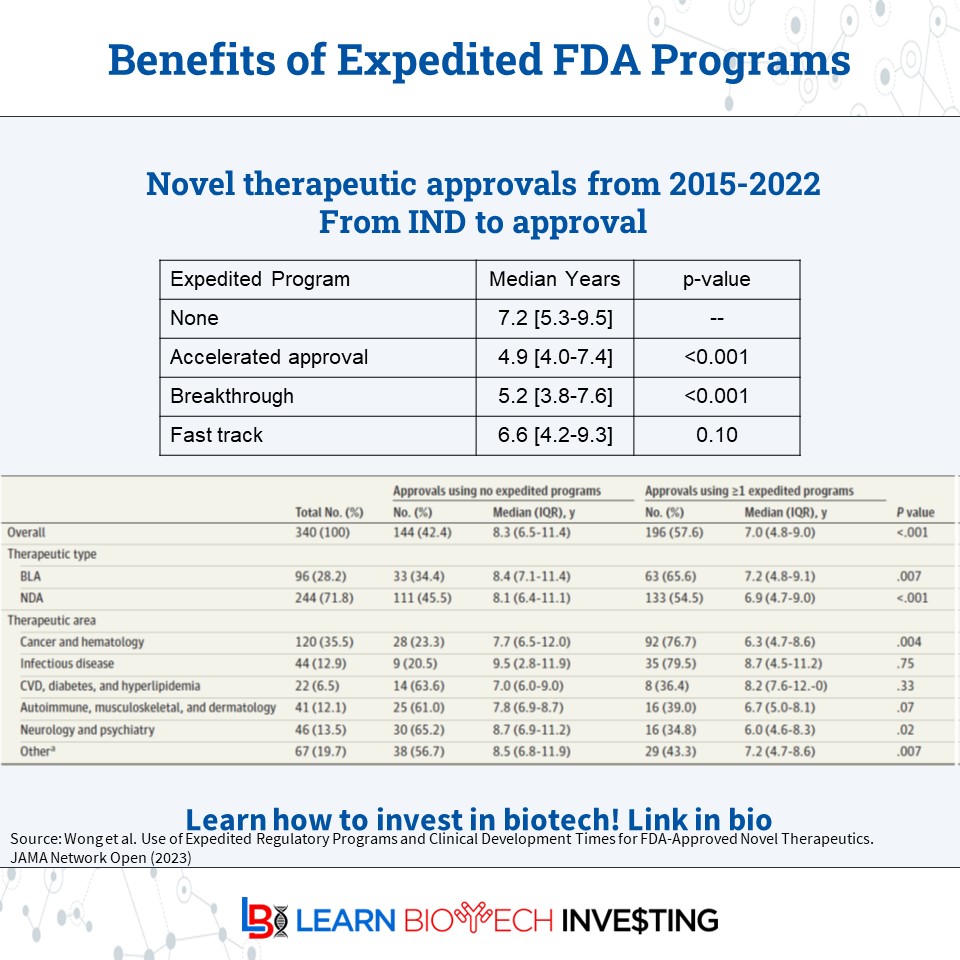

How much time do FDA expedited designations save? Accelerated approval and Breakthrough status save a statistically significant amount of time. But Fast track does not Investors should keep this in mind #learnbiotechinvesting #biotech #investing #BiotechPrometheus

docs.google.com/document/d/15b… It’s a starting point

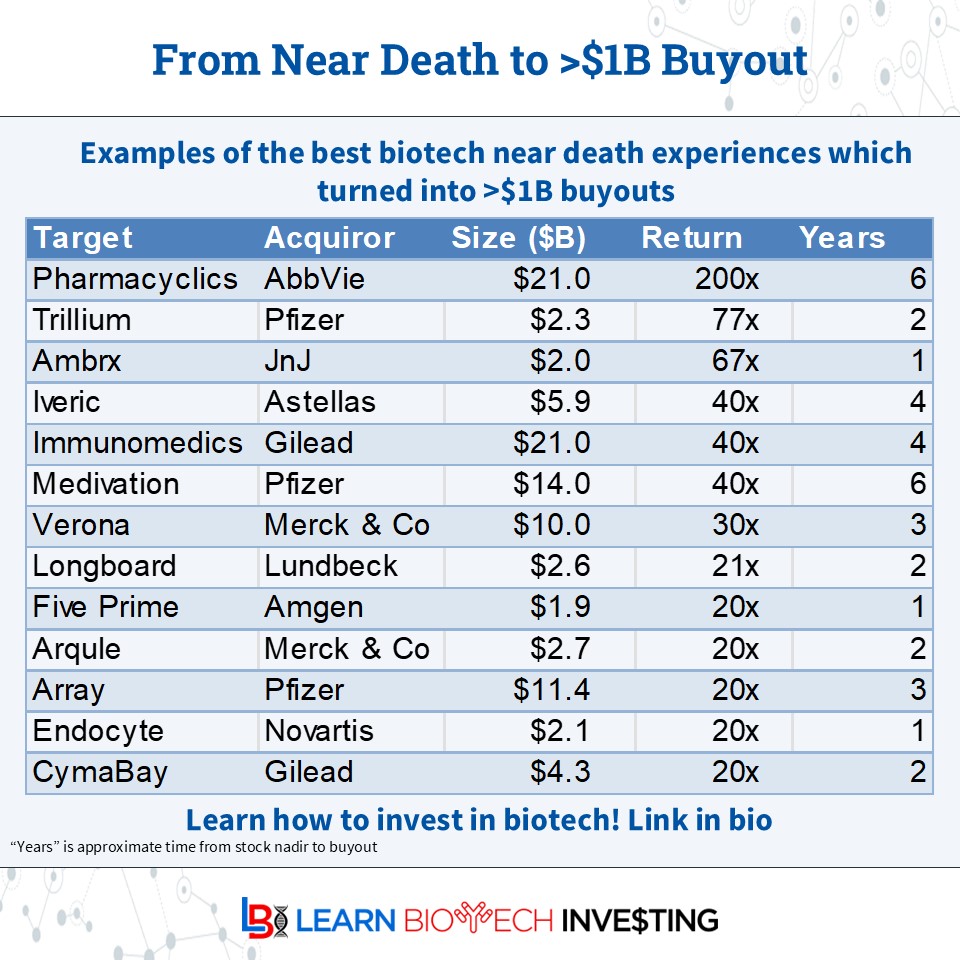

A reason to love #biotech: a company approaching the end (low stock price; near "death") can generate >20x return in a few, or even 1 year! Though these deals are few & far between, here are some examples: Adding $VRNA/$MRK #learnbiotechinvesting #investing #BiotechPrometheus

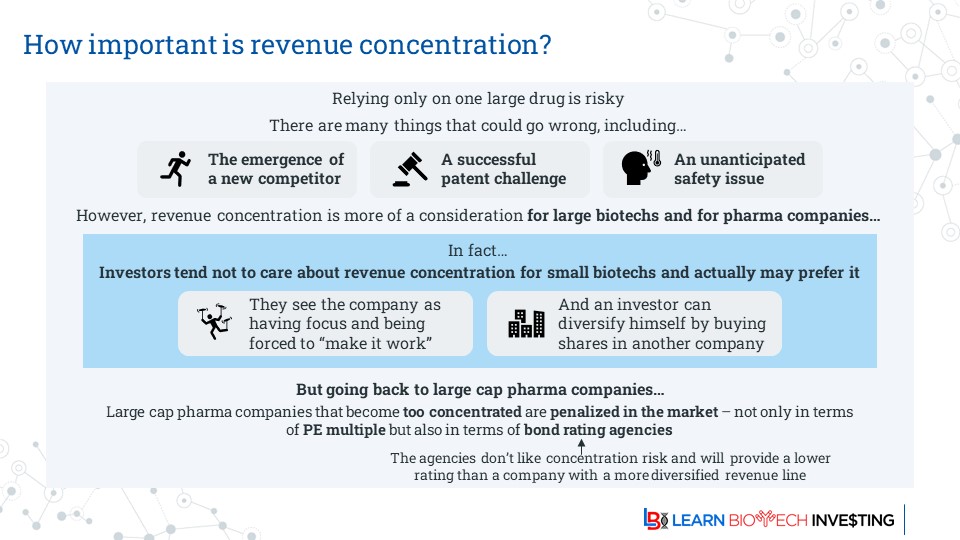

Do people agree with this difference between mature pharma and fledgling biotech? Pharma is penalized for revenue concentration, but biotech is rewarded (or not penalized) for it. #Investors will diversify themselves #learnbiotechinvesting #biotech #investing #BiotechPrometheus