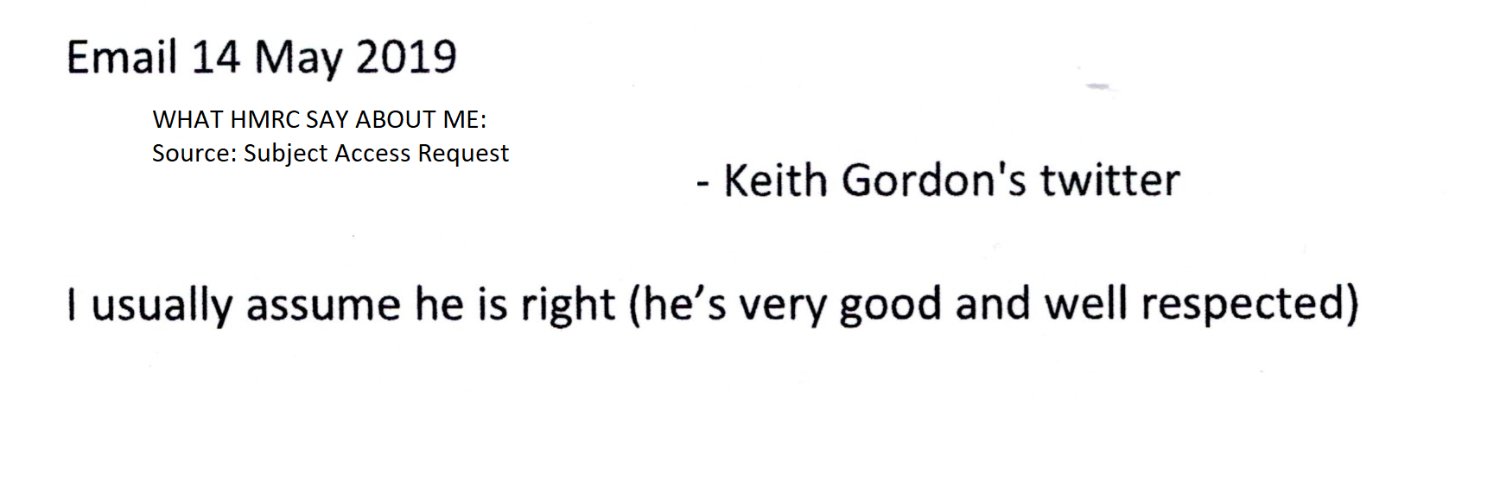

Keith M Gordon

@keithmgordon

A tax barrister who tweets occasionally on tax-related matters. All tweets written in a personal capacity. Even in deserving cases no advice given via Twitter

I have enjoyed not looking at X/Twitter for the past few weeks. I propose repeating the exercise indefinitely. Please assume that I will NOT see your posts (even if I am tagged in).

Just had a call from 02039057921 purporting to be from @virginmedia. I'm 99.9% sure it was a scam (and the caller would not wait 15 secs for me to be "ready to take his call" which undermined the alleged urgency of his call). Is there a way this activity can be blocked? #phishing

Who has priority at a zebra crossing in this situation?

I understand that the UT has issued a decision in the IR35 challenge against Adrian Chiles. I shall read the decision in the course of the day. Plenty of time to digest it ahead of my talk on IR35 cases at the end of next week. stepevents.org/event/a22f5c60… gov.uk/tax-and-chance…

Echoing the sentiments in this obit to the late Nuala Brice. She was an absolute delight to appear before - the epitome of judicial integrity. lawgazette.co.uk/obituary-dr-nu…

I think polling station staff need to be (re)trained on how to check voter ID. My wife & I were checked as we entered the polling station. Fine. At the desk, the clerk asked had we been checked as we entered and, when we said yes, that was considered sufficient.

This article contains HMRC's statement that they "noted" the s684 power in their evidence provided to Lord Morse. I infer that this means a footnote rather than anything clear. Anyone who has studied Lord Denning's judgment in the Shoe Lane Car Park case will recognise the point.

The latest element to #LoanChargeScandal, #s684 notices, highlighted in @MoneyTelegraph article. Thank you to @charlotte_giff and all featured.

I have just learned of the death last week of one of my early mentors, Sir Stephen Oliver, the first President of the Tax Chamber of the First-tier Tribunal. He will be much missed by the tax community and my condolences to his wife and wider family. RIP

We’re very concerned about #HMRC’s use of s.684 notices, the latest way they’re retrospectively pursue people mis-sold remuneration schemes. This is not using ‘normal’ powers as specified by the Morse Review, so it undermines a key recommendation & is another abuse of power.

While one can sympathise with the problem @HMRCgovuk are trying to address, the #LoanCharge as a solution has proven to be futile for @HMRCgovuk. The Morse review has made little difference. It is time to return to the drawing board, wipe the slate clean and start over. /ends

My thoughts as expressed to @NickFerrariLBC this morning on the "Angela Rayner" property tax story (or non-story). youtu.be/2bNZTpsiRhs

And as if by magic, the following pops up. LCAG's letter to Lord Morse on the (mis)use of s684(7A)(b).