J. P. Mayall

@jpmayall

Founder of the first Bitcoin ETF in Latin America. B3: QBTC11

Bitcoin as Validation of the Regression Theorem: An Austrian Synthesis with Szabo and Ammous By J. P. Mayall Introduction At the intersection of Austrian economics and digital innovations, Bitcoin represents a phenomenon that challenges and simultaneously corroborates…

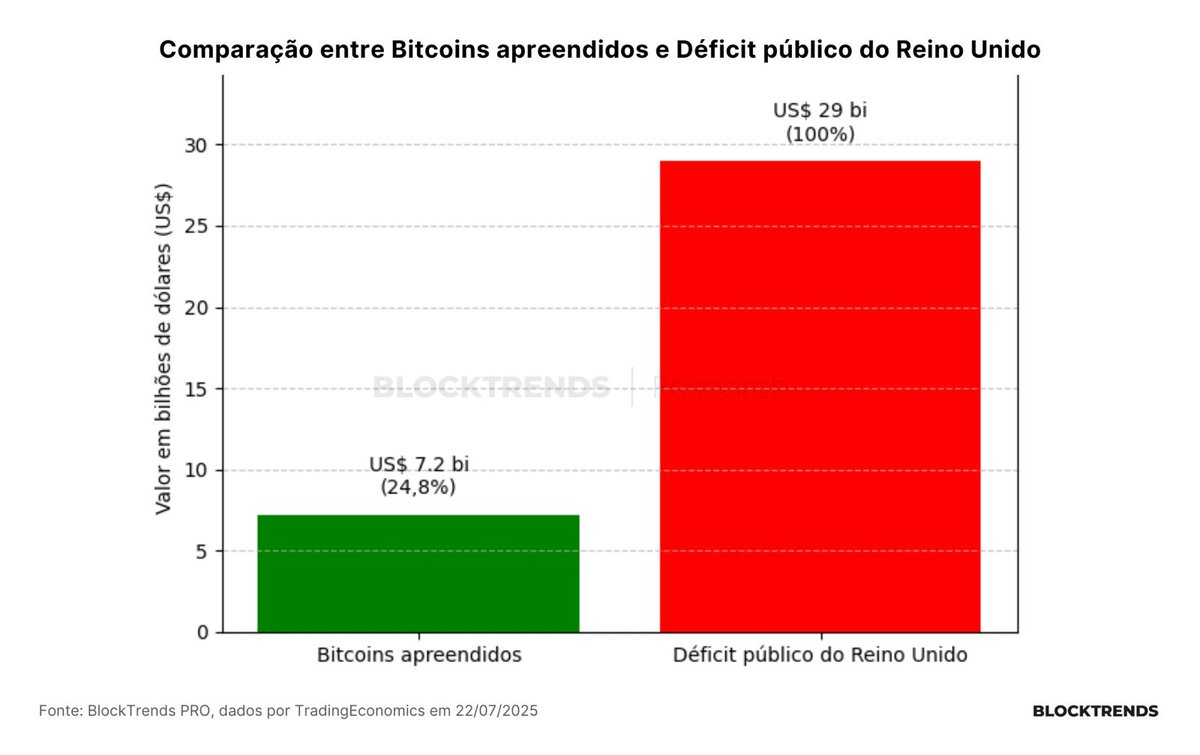

This is the most striking example of fiscal dominance I've ever seen. Brrrr! 444

Trump vs. Powell - This could be a skit on SNL 😂😂😂

Based on Grok 4 prediction, Bitcoin will reach $444K on April 4, 2026. 🤯 Murray Rudd’s supply and demand study, Bitcoin is expected to reach around $444K by June 2026. 👀

Monero lost -45.44% against Bitcoin over 11 years (per Poloniex). It needs to rise +288% to reach BTC price from May 2014 and +1,181% to reach August 2017. Monero does not violate Mises regression theorem but fails Menger's saleability criterion. Still, I understand why many…

Carl Menger's concept of marketability (vendabilidade), introduced in his 1871 book Principles of Economics, describes how easily a good can be exchanged for others with minimal loss of value, low transaction costs, and wide acceptance. This is essentially the same as liquidity,…

The GENIUS Act opens the door for Tether and Circle to bring USDT and USDC into the global market, which will help export Yankee inflation and boost demand for U.S. Treasury bonds, but there’s one asset that will benefit the most.

While the argument that Monero fixes the supposed flaws of Bitcoin as a medium of exchange may sound innovative to someone who just discovered the asset, probably yesterday morning given the inexperienced tone and omission of market history, it ignores fundamental principles of…

You can now redeem the actual Bitcoin spot from the Fidelity Bitcoin ETF. Soon, all ETFs, including BlackRock's, will follow suit. Wild.

Bitcoin como Validação do Teorema da Regressão: Uma Síntese Austríaca com Szabo e Ammous. Este ensaio é um convite para reavaliar o dinheiro — não como instrumento de controle, mas como expressão da criatividade humana em mercados livres. Por @jpmayall

Chancellor on brink of second bailout disaster: Selling off Bitcoin’s bailout potential, joining Germany’s ‘we-sold-too-soon’ hall of shame! UK Chancellor Rachel Reeves, a Keynesian economist from the Labour Party, plans to sell $7B in seized Bitcoin to plug budget gaps. As a…

Chief Risk Officer da Blind Asset Management em relação ao iBov e B.

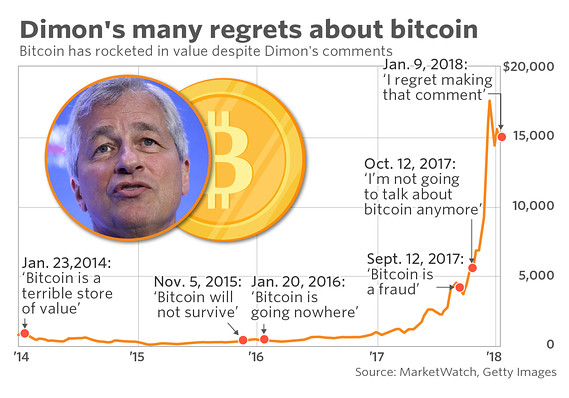

First they ignore you, then they laugh at you, then they fight you, then you win. 2025: JPMorgan Considers Accepting Bitcoin as Loan Collateral.

This essay is an invitation to reevaluate money not as an instrument of control, but as an expression of human creativity in free markets.

Bitcoin as Validation of the Regression Theorem: An Austrian Synthesis with Szabo and Ammous By J. P. Mayall Introduction At the intersection of Austrian economics and digital innovations, Bitcoin represents a phenomenon that challenges and simultaneously corroborates…