Joe Raymond

@joekraymond

Investor | Writer

No better exercise IMO than looking at every stock in your investable universe. Especially if early in your career. As Alan Hathway told Robert Caro, “Turn every page. Never assume anything. Turn every goddamned page.” Another great read from @RockwoodNotes

Another detail I found interesting is in one of the Rockwood & Co. Moody’s manuals, it shares a page with Douglas Oil Company of California. Jay Pritzker ends up on the BoD of Douglas Oil in 1957. Made me wonder if he was just flipping through every page of Moody’s just like…

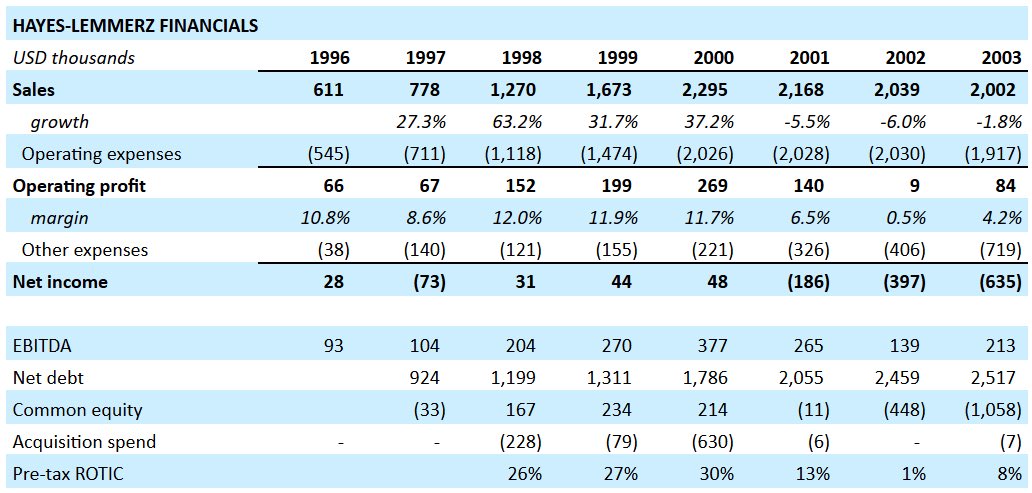

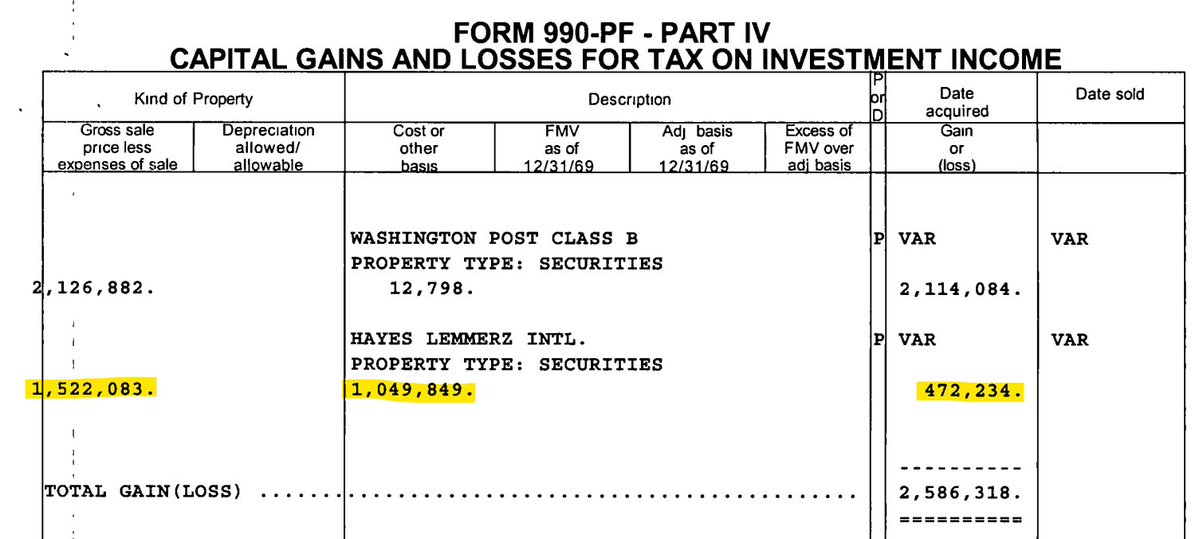

Charlie Munger liked cigar butts more than people give him credit for. He made 45% in a year in his personal account on Hays Lemmerz – a messy bankruptcy "deep value" situation. Link in bio for the story.

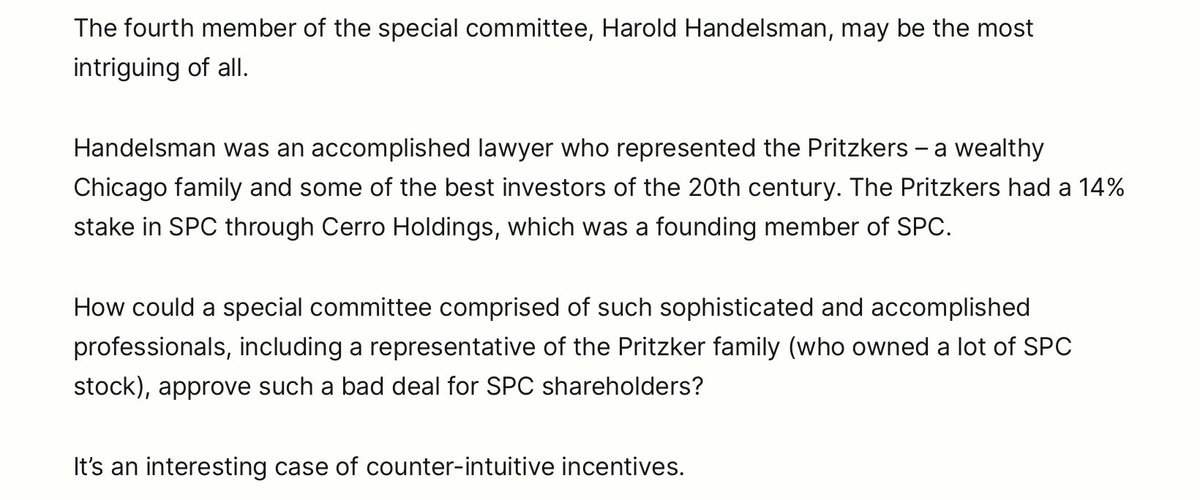

Nine figure payday. Secretive billionaires, skewed incentives, long legal battle, 10-figure award, life-changing fees. A little-known Pritzker story. Link in bio.

Fun first entry from @RockwoodNotes The Pritzker family is fascinating. So many great stories and lessons to learn. Excited to see what comes next.

First article is out. Free for all to read. I cover the life of Nicholas Pritzker, which I consider central to understanding the Pritzker story. He immigrated, gritted his way to be the family’s first attorney, and established an ethos that defined the family for generations.

This is a very compelling and entertaining case study. Many great investments are like stumbling onto something you realize is a worthy puzzle, then doing the work to put it all together. Joe is a young and sharp investor also, well worth a follow.

My first case study. Lost shareholders, genealogy reports, betrayal, activism, appraisal rights. 20% a year for 23 years in a stock nobody’s heard of. Link in bio.

Best thing I read this month. An incredble tale of what it takes to get ahead in this business. Y'all gotta check this out.

My first case study. Lost shareholders, genealogy reports, betrayal, activism, appraisal rights. 20% a year for 23 years in a stock nobody’s heard of. Link in bio.

Great case study: Best Lock Joe is a sharp investor and a good friend. He’s gonna be putting out some first-rate content. You should give him a follow and subscribe to his site.

My first case study. Lost shareholders, genealogy reports, betrayal, activism, appraisal rights. 20% a year for 23 years in a stock nobody’s heard of. Link in bio.