jakob.btc

@jakob_btc

Founder & CEO/CTO @HermeticaFi | ex-Kraken, Forbes 30u30

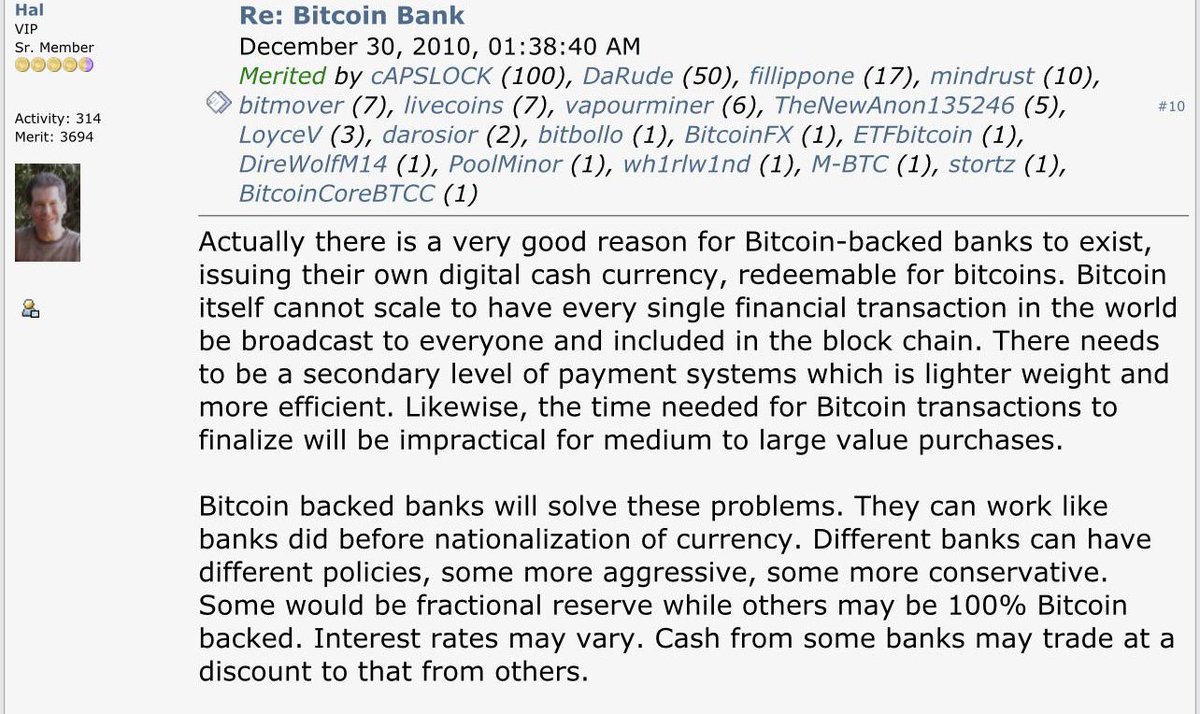

Hal Finney described a future where banks issue digital cash backed 1:1 by Bitcoin. Today, we have the first Bitcoin bank @HermeticaFi.🧵

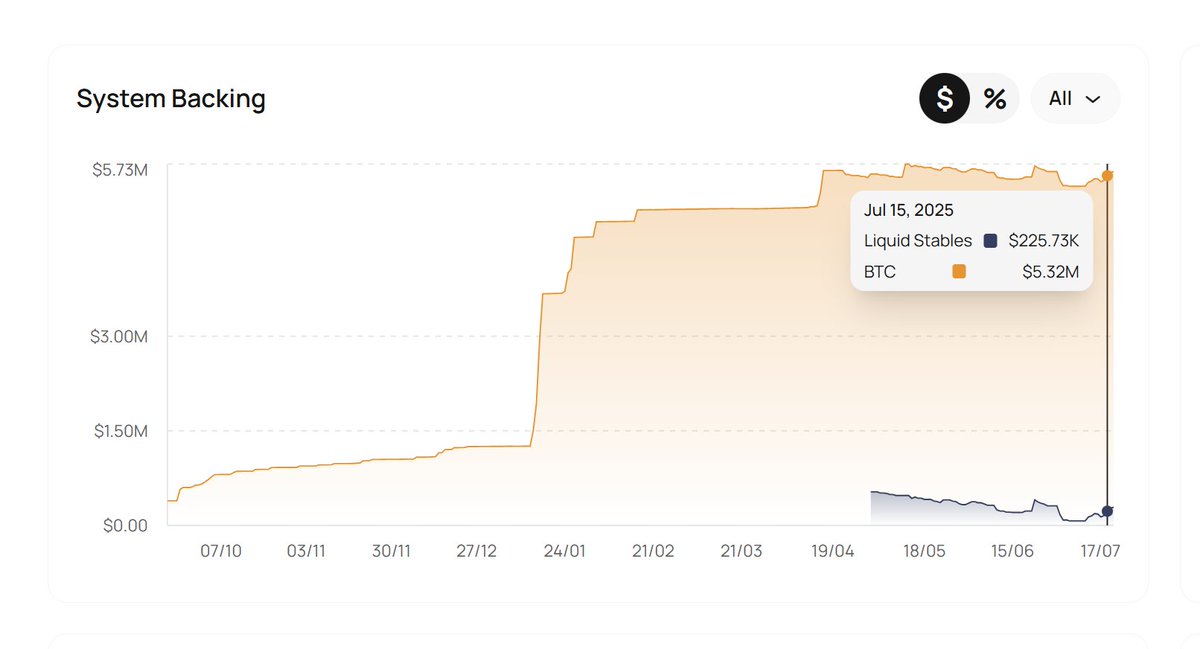

USDh is fully backed by Bitcoin. Every $1 USDh you hold represents $1 of Bitcoin locked in the system. Swapping to USDh means you stay in Bitcoin, just in a stable form. You’re protecting profits without leaving the Bitcoin network.

I remember dial-up internet screeching to load a page. I remember buying on eBay in 2002, refreshing endlessly to see if I’d been outbid. I remember the first iPhone. I’ve seen every wave of tech start rough, then reshape the world. Bitcoin is no different. GM.

A healthy community doesn’t just agree. It asks the right questions. SIP-031 didn’t pass because everyone said yes. It passed because some said not yet, challenged the assumptions, and demanded tighter logic. If it had passed unanimously on day one, I’d be worried.

When BTC runs, your unit count stays the same, but your economic position changes. That delta is purchasing power, the ability to exchange BTC for more goods, services, or future assets than before. There is no native way to lock that in. You either stay exposed to volatility…

gm to the network of minds strengthening Bitcoin’s foundation every day.

BTCfi will matter more to you once you stop seeing Bitcoin as just an asset and start seeing it as an economy. An economy needs stablecoins for payments, credit markets for capital formation, and infrastructure for productive use. That's what we're building.

You’re not just trading against crypto natives anymore. You’re trading against desks hedging options, rebalancing daily, and deploying billions. They don’t care about your token’s roadmap. They care about basis, vol, and liquidity. This is their market now too.

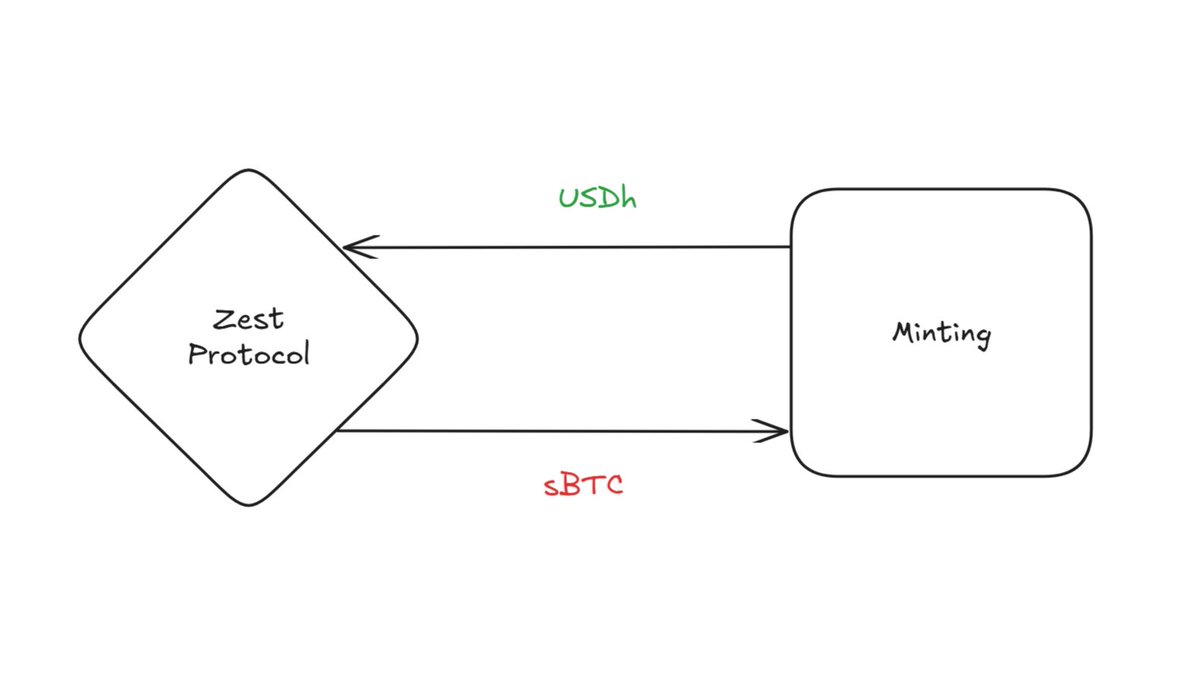

The core vision for USDh was simple. Allow Bitcoiners to: ◾ Swap BTC into a dollar-pegged, yield-bearing form of Bitcoin ◾ Borrow it against BTC on native credit markets like @ZestProtocol Around those rails, a thousand other use cases naturally emerge.

Showing up is the first win of the day. No matter what comes next, you already started strong. gm.

The top of the stack only holds if the base is solid. You can’t hide cracks behind a UI. Truth compounds from the bottom up.

A protocol is code. A community is the human coordination layer that ensures the code lives long enough to matter. The strength of a community isn’t in its size. It’s in its capacity to test ideas, expose risk, and correct failure early and honestly. That’s what keeps a system…

There was a time when all Bitcoin had was a whitepaper, some lines of code, and a few people who believed. @Stacks carried forward the same instinct to build the tech and the community first, prove it in the open, and let time filter the noise. That foundation matters.

Waking up with purpose, eyes on the long game, feet on the ground. gm.

USDh is the bridge between CeFi and DeFi. Protocols like @ZestProtocol and @GraniteBTC no longer rely on shallow DEX pools for liquidations. They now route directly through @HermeticaFi’s contracts, minting USDh with sBTC at size, instantly. This structure has quietly scaled…

Pain is the best teacher, but only if you're honest enough to listen and humble enough to learn.