Randy Dunham

@itmrandy

equities trader ~ head of TTI Accelerator @howtoswingtrade ~ sharing what I know on Substack !

Kyna Kosling (@KayKlingson) is the creator of The Trading Resource Hub, a one-stop show for swing traders, which has received praise from @FranVezz, @jfsrevg, @stockbasereport, @drmansipd, @alphatrends, and any many others. In her first public video appearance, we discuss…

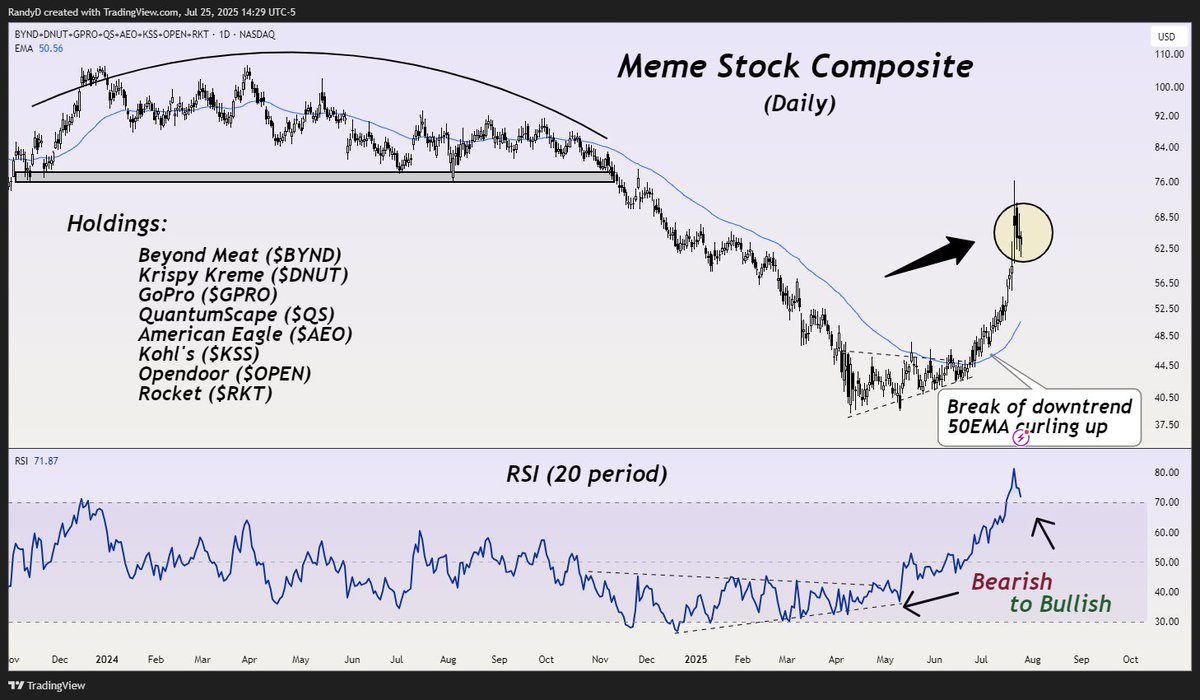

Meme stocks are ripping again. I'm getting 2021 nostalgia. Tickers used: $BYND (Consumer defensive) $DNUT (Consumer defensive) $GPRO (Technology) $QS (Consumer cyclical) $AEO (Consumer cyclical) $KSS (Consumer cyclical) $OPEN (Real estate) $RKT (Financials)

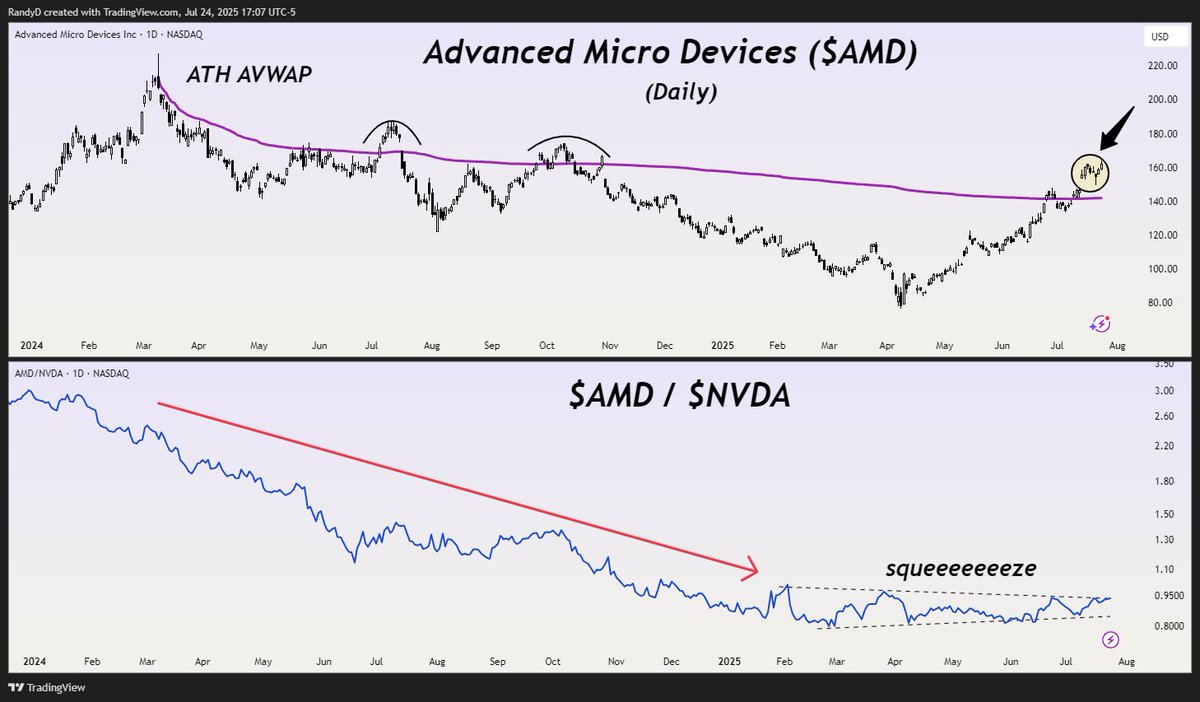

Advanced Micro Devices ( $AMD ) is ripping into earnings. Trading above its all-time high AVWAP with an interesting relative setup relative to Nvidia ( $NVDA ).

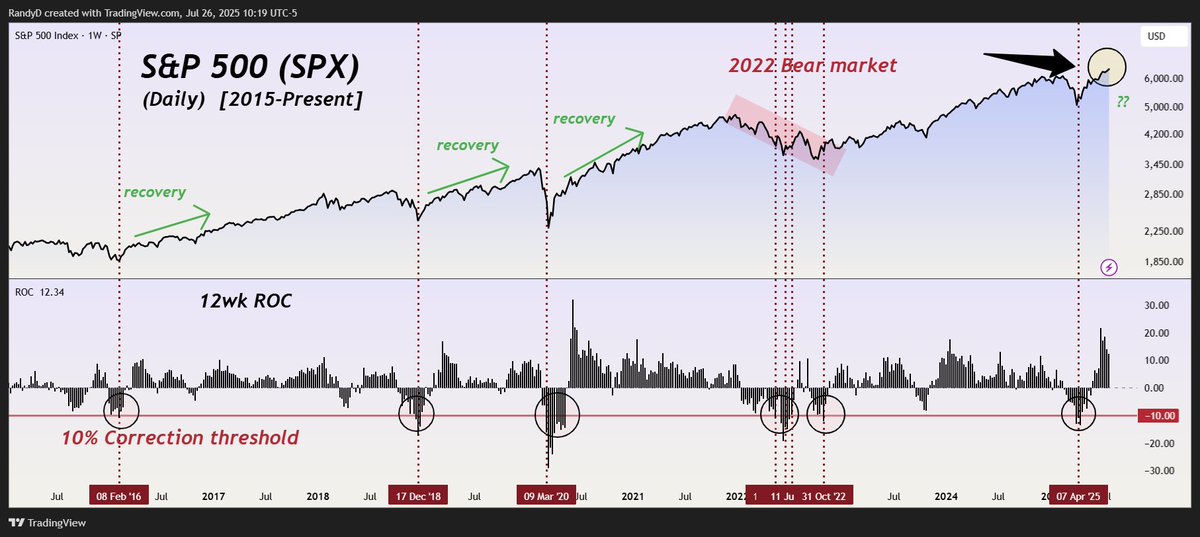

Seeing a lot more bearish commentary on $SPY lately. I understand the 'gone up too fast' take, but this is what usually happens following a -10% correction. Historically, post-correction moves are often bullish (outside of bear markets). I like the summer chop narrative, but…

Equal-weight indices at ATHs is big!

Don't let them fool you. Market breadth is not declining. As a matter of fact.. The equal weight S&P 500 and NASDAQ are trading at all-time highs today. Your risk is not being long (enough).

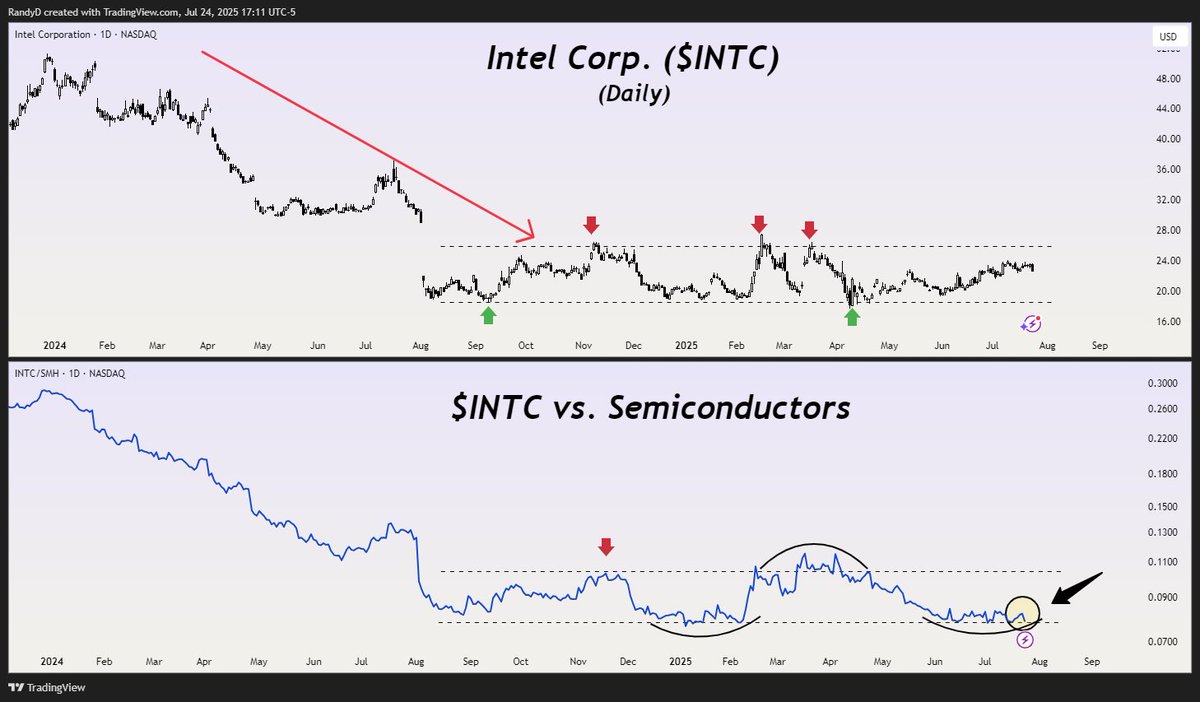

Intel ( $INTC ) trading near the bottom of it's relative range compared to broader semiconductors ( $SMH ).

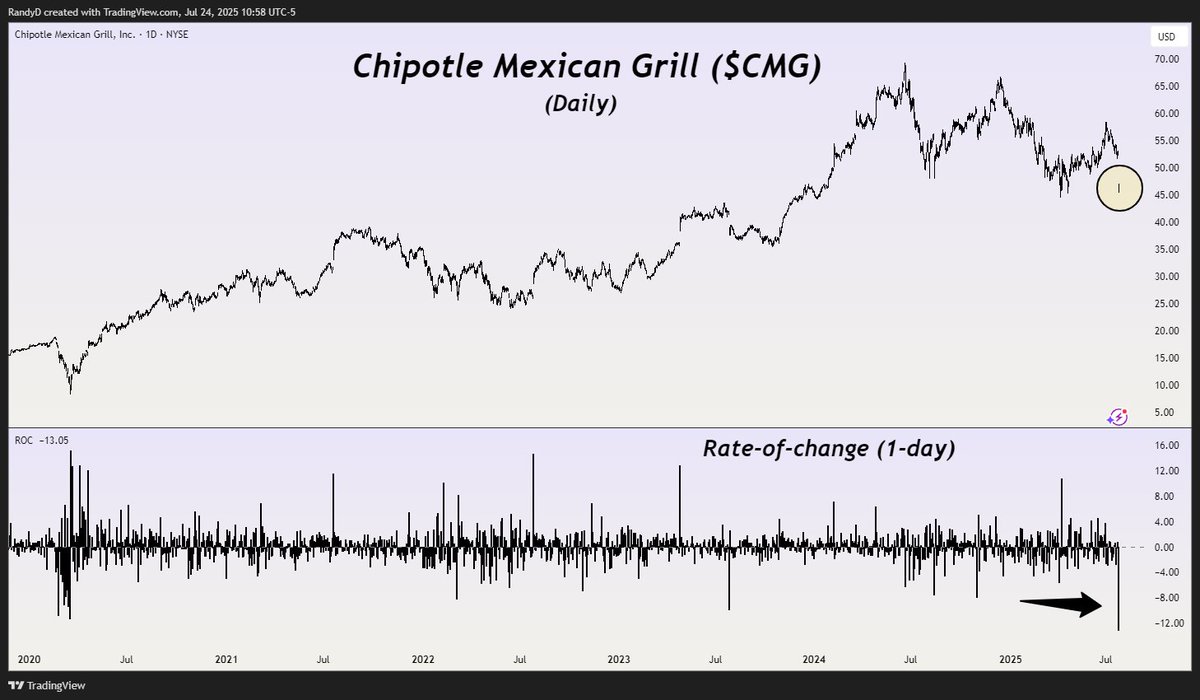

Chipotle ( $CMG ) having it's worst day in 5 years. Bring back the honey chicken 😫

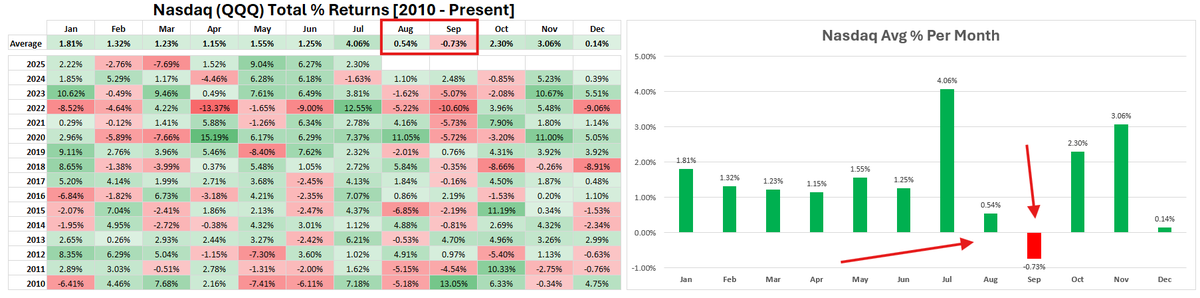

Nasdaq's ( $QQQ ) weakest stretch is almost here. Historically, August & September are dull for stocks.

Google ( $GOOG ) has earnings after market close. This name has led the rest of the MAG-7 stocks since April but is at an interesting spot.

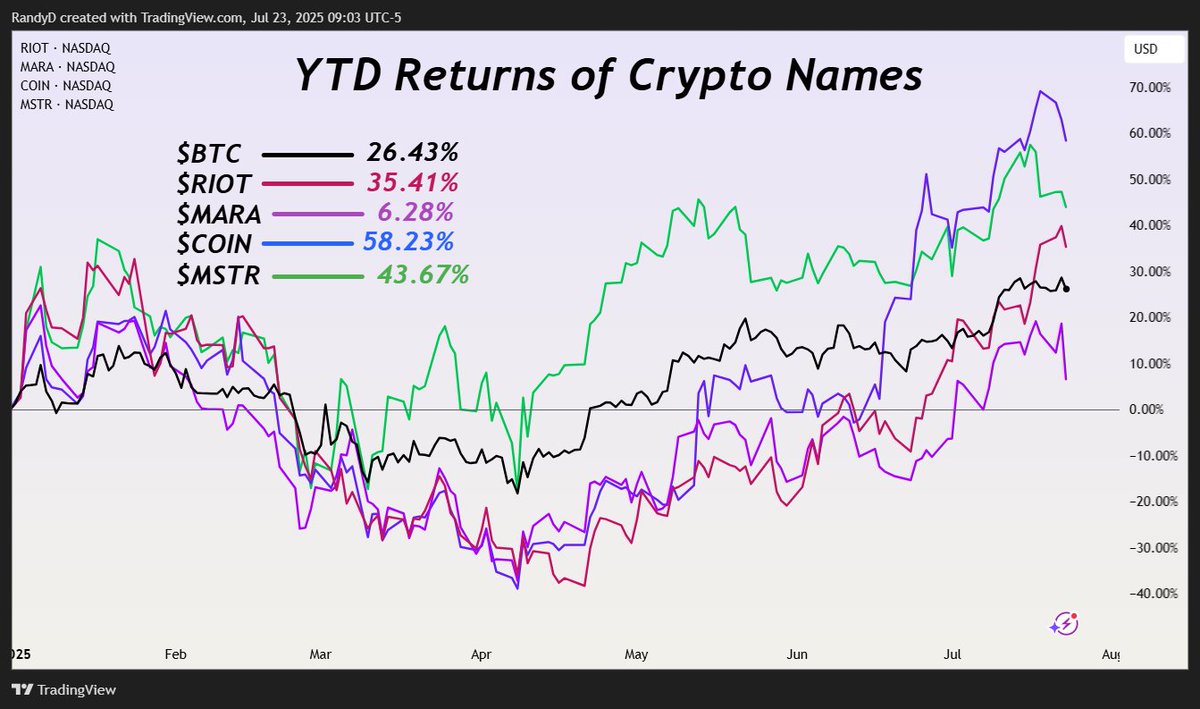

Not all crypto exposure is created equal ( $RIOT, $MARA, $COIN, $MSTR ). got to pick your spots

3/10 rage bait

I may not own any Bitcoin, but I have a lot more money in gold and silver mining stocks than many Bitcoin whales have in Bitcoin. Bitcoin is up 27% so far in 2025, while the $GDX is up 61%. Have fun staying poor, Bitcoiners!

The US Money Supply grew 4.5% over the last year, the biggest YoY increase since July 2022. After a brief hiatus, money printing is back.

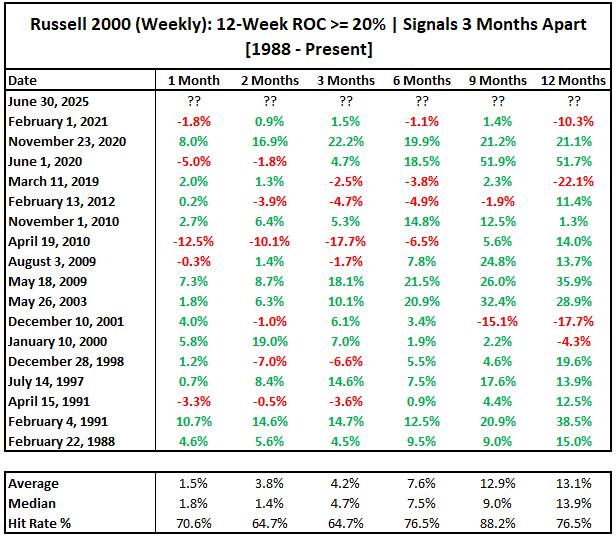

Russell 2000 ( $IWM ) is up 20%+ in just 12 weeks. Historically, that sets up a 1-year return that is nearly double the 10-year average. (13.1% vs 7.28%) strong momentum = strong follow through

A 3-5% pullback in S&P ( $SPY ) and Nasdaq ( $QQQ ) next week would be healthy imo 🤷♂️

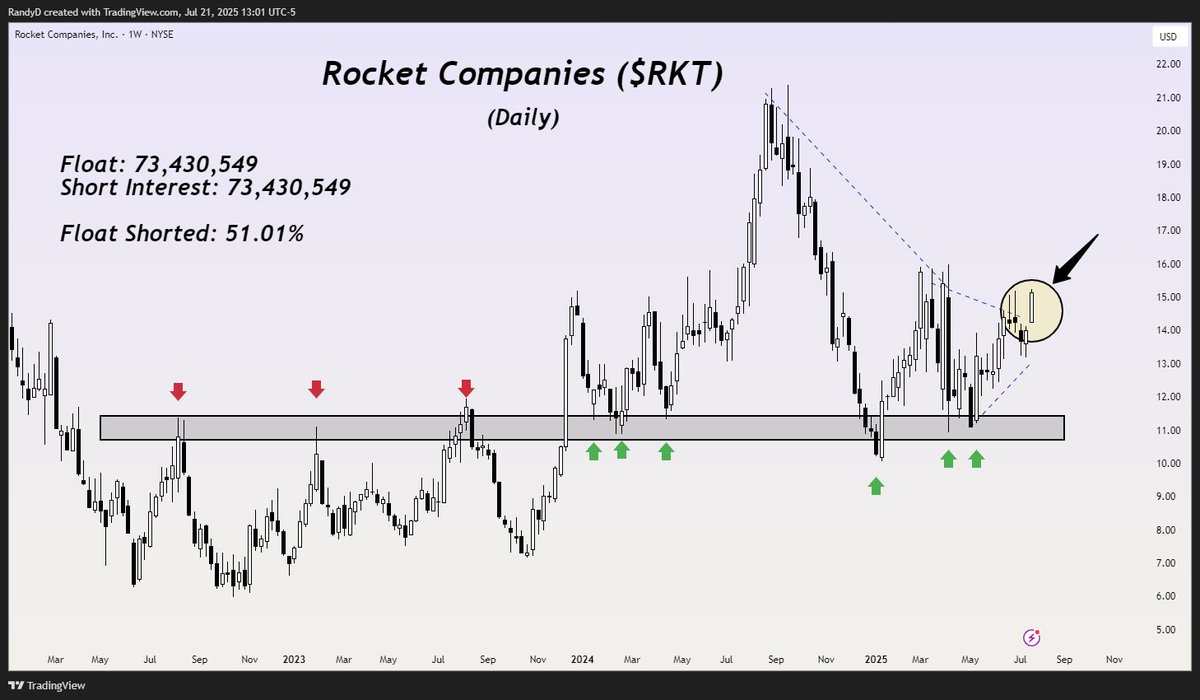

$RKT has a 51% short float. It's one of the most shorted stocks in the market...with a liquid options chain👀

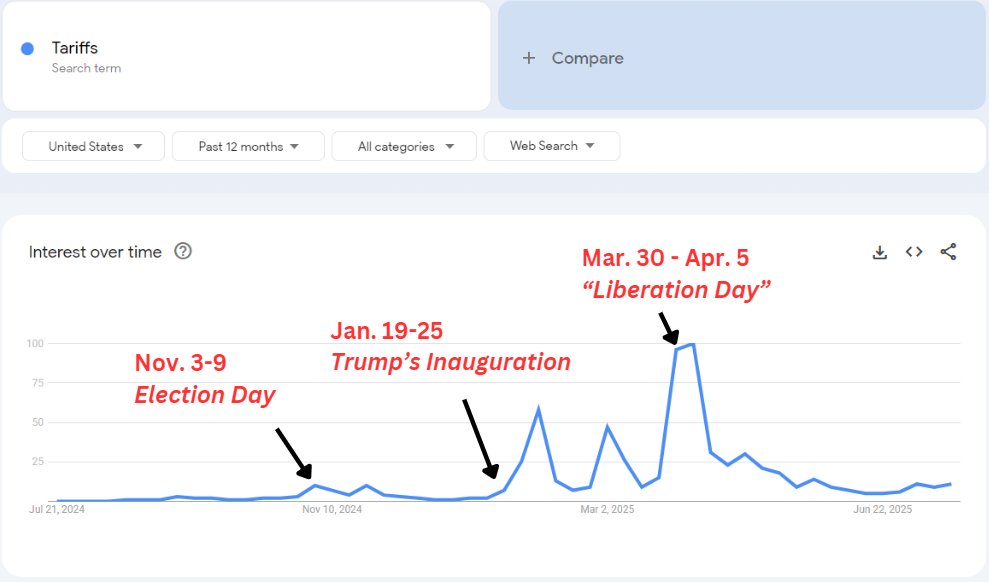

Interest in 'tariffs' has vanished since Liberation Day. Google Trends shows searches have collapsed all the way back to Election Day levels.

😂 😂

S&P 500: 2008 vs. 2025🚨 No trickery, just an overlay of both years. Scary?

I'm just going to come out and say it...summer ends after July 4th 😆