glassnode

@glassnode

World leading onchain & financial metrics, charts, data & insights for #Bitcoin & digital assets. http://insights.glassnode.com http://t.me/glassnode

$BTC Market Pulse is a newsletter we’ve been developing over the past 6 months. Unlike Week On-Chain, which often explores novel concepts, Market Pulse delivers a repeatable, digestible framework that covers all sides of the market - designed to enhance real-world strategy. 🧵👇

It’s shaping up to be another strong week for #Bitcoin spot ETF inflows. As of yesterday, institutional investors have already added ~20K $BTC - extending the streak of net positive flows to 7 consecutive weeks.

Yesterday saw another wave of ancient coins move on-chain, with 3.9k BTC aged over 10 years becoming active. This follows the 80k BTC that moved on July 4, 2025. Such activity from long-dormant supply often reflects internal reallocation, custodial shifts, or in some cases…

The sharp rally from $110k to $117k created an on-chain air gap or a low-density accumulation zone. Since the $122.6k ATH, price has held above it. If support fails, history shows such gaps can still evolve into bottom formation zones.

Rising WETH borrow rates on Aave made the stETH leverage loop unprofitable, triggering unwinds that imbalanced the ETH/stETH pool and depegged stETH, contributing to ETH sell pressure. Additionally, a growing validator exit queue adds friction to arbitrage, slowing peg recovery.

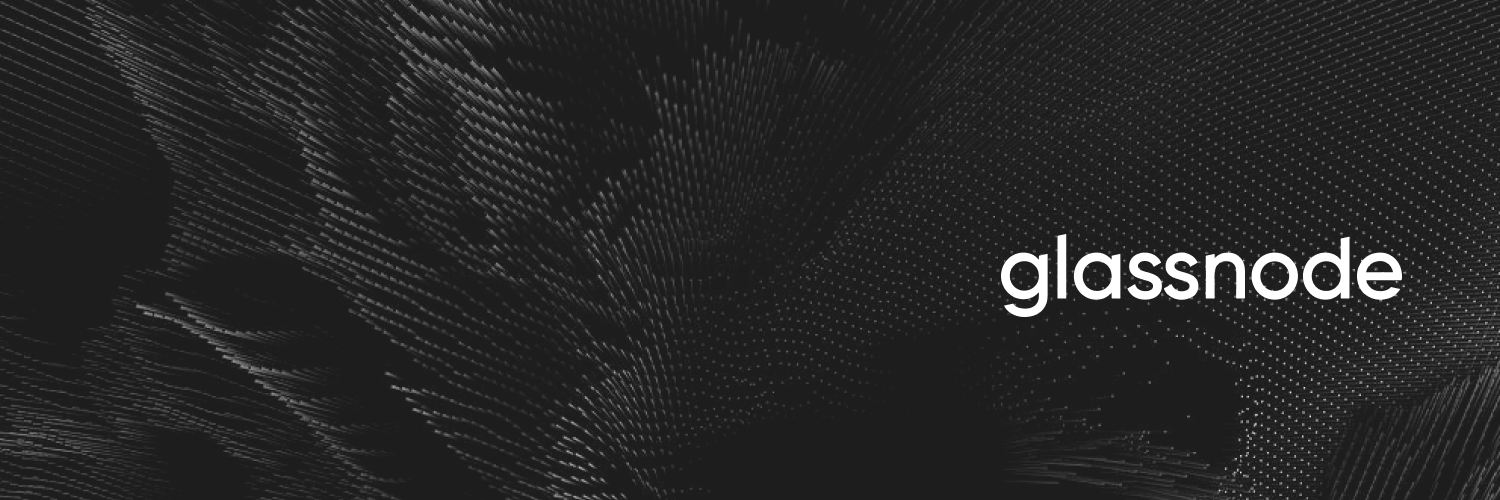

Altcoins are showing broad strength following #Bitcoin’s lead, but surging open interest across the sector suggests speculative froth may be building, raising the risk of sharper volatility ahead. Discover more in the latest Week On-Chain below👇 glassno.de/4o927B4

Glassnode now supports tokenized stocks - bringing full on-chain analytics to blockchain-based equities like $AAPLX, $GOOGLX, $TSLAX & more. Track metrics like Cost Basis, Realized Price & Holder Composition across traditional names - available in Glassnode Studio Asset List.

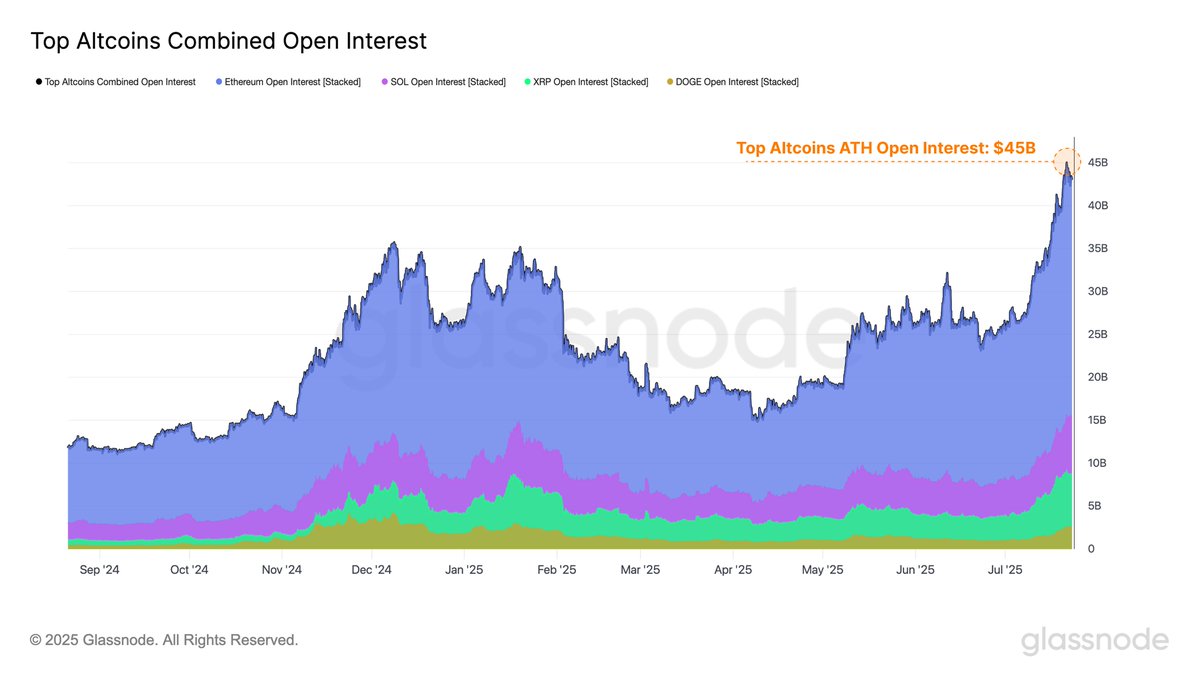

$SUI futures open interest remains near its all-time high at ~$1.2B, making it the 6th largest crypto asset by futures OI.

#Bitcoin dominance fell from 63.76% to 60.78% over the past week - a 2.98 percentage point drop. One of the sharpest weekly declines this year, as capital rotated into altcoins.

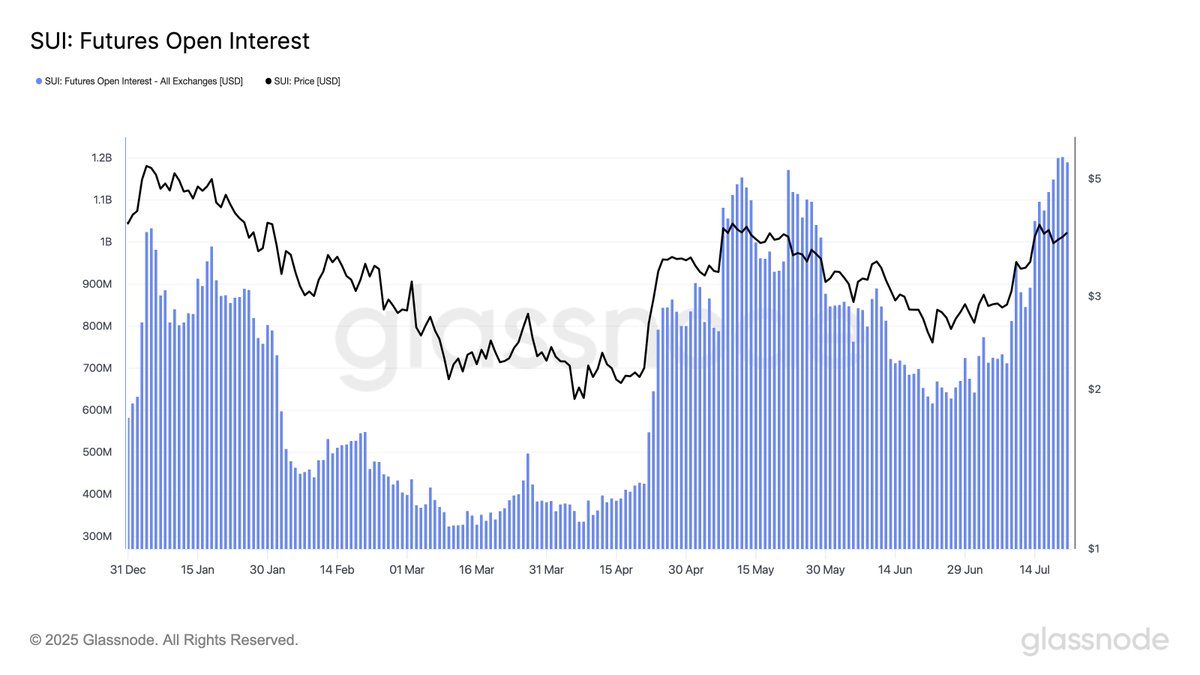

Last week, #Ethereum spot ETFs saw inflows of over 588K $ETH - nearly 17x the historical average and more than double the previous record.

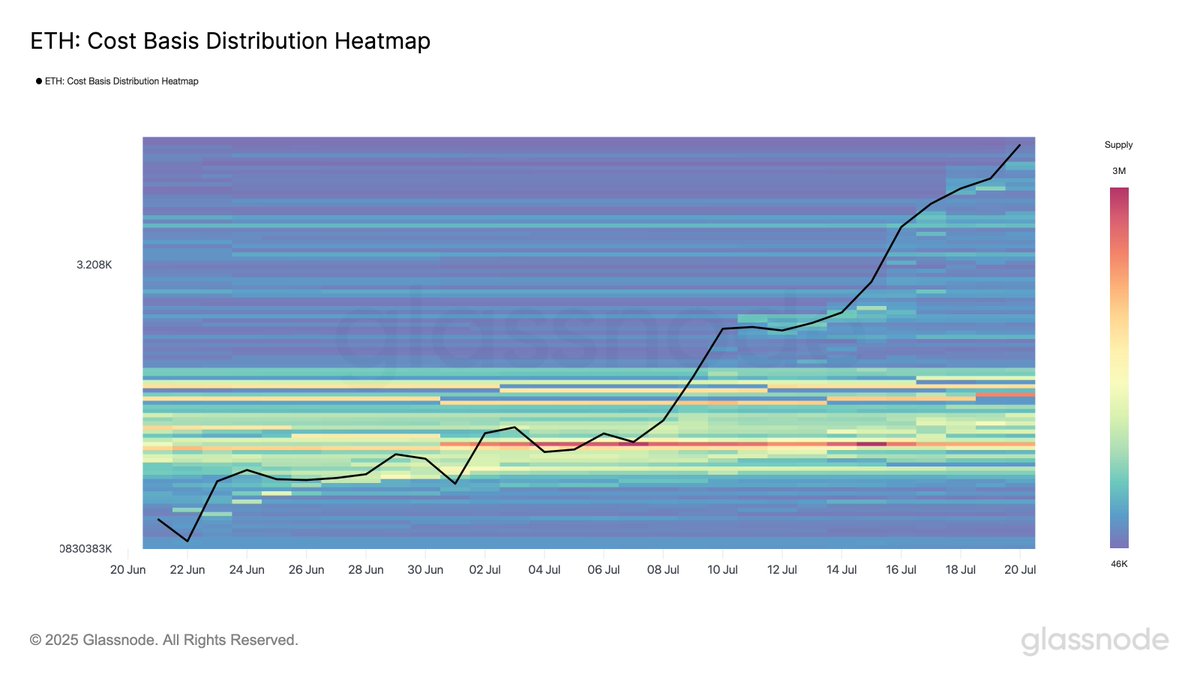

$ETH Cost Basis Distribution Heatmap shows profit-taking from buyers around $2,520 - visible in the fading red band from around July 1. But they still hold nearly 2M ETH. Takeaways: 1) strategic profit taking, 2) expecting more upside, 3) new demand is absorbing supply.

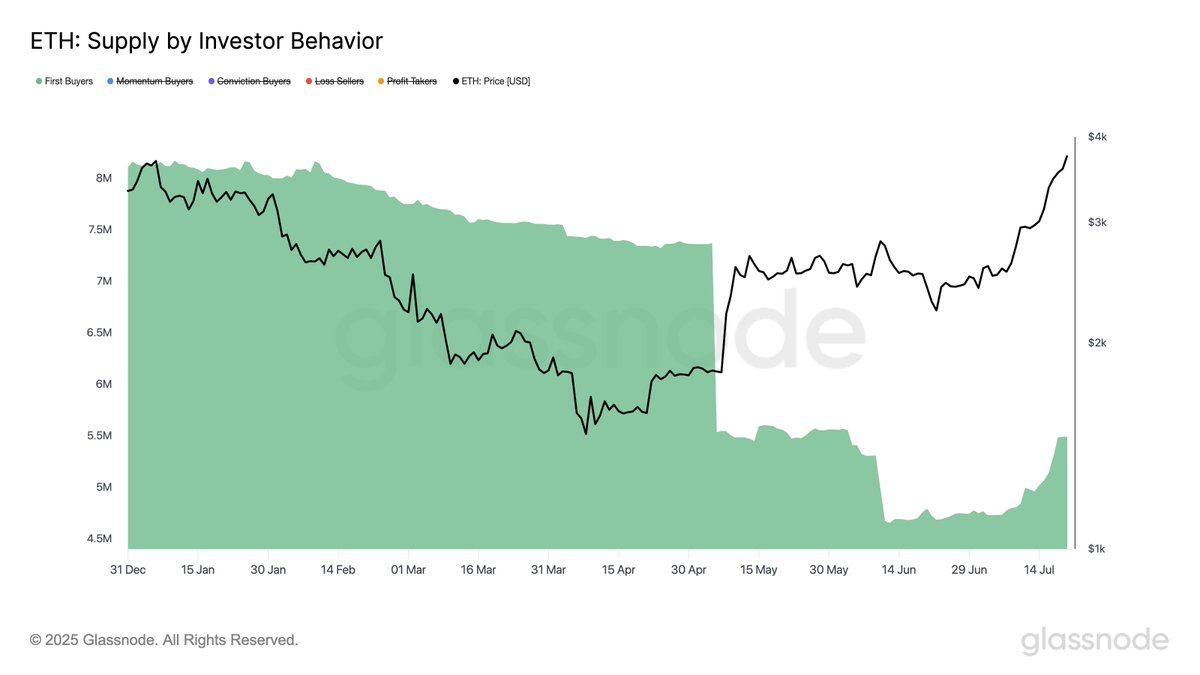

We’re seeing the first signs of a trend reversal in $ETH buyer behavior. Since early July, the supply held by first-time buyers has increased by ~16%, suggesting renewed interest and inflows from fresh market participants.

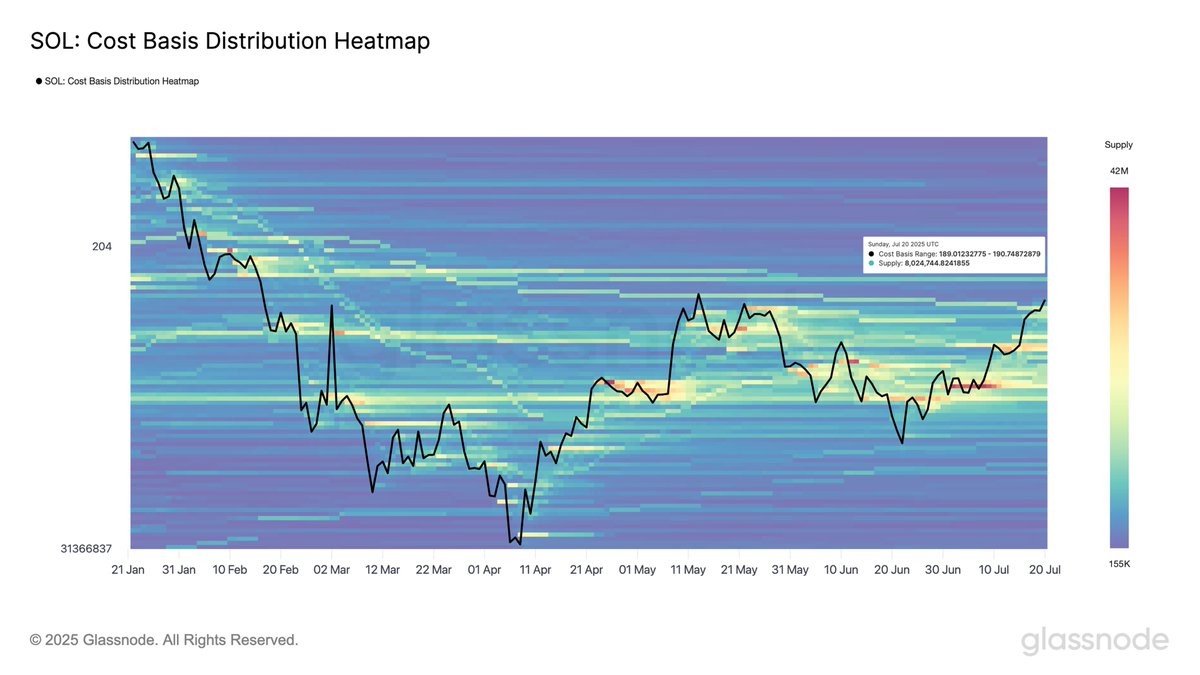

The next major resistance for $SOL may sit around $190, where investors have accumulated over 8M SOL. Above this level, supply becomes less dense - suggesting that, if demand persists, the uptrend could accelerate due to reduced overhead resistance.

All major #Bitcoin cohorts by wallet size are back in near-perfect accumulation mode. Even >10K BTC whales are participating at levels last seen in Dec 2024. The alignment across wallet sizes suggests broad-based conviction behind the current $BTC uptrend.

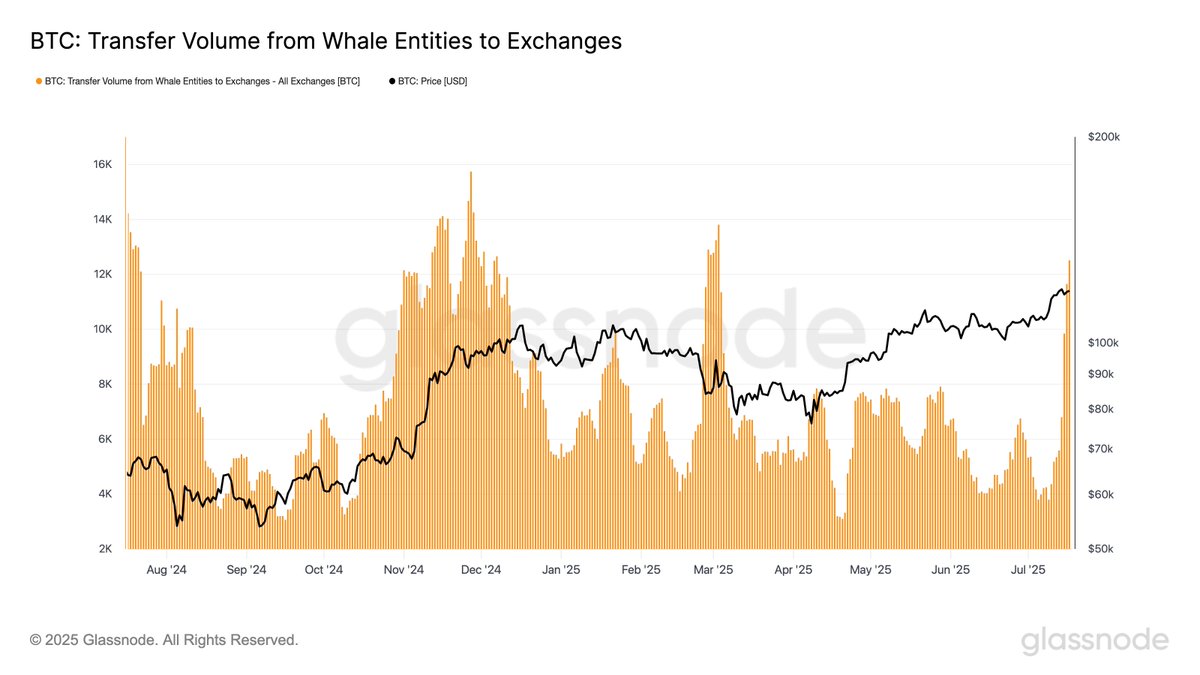

Transfers from #Bitcoin whales to exchanges are accelerating. The 7D SMA is approaching ~12K $BTC - among the highest volumes this year, and comparable to the spike in early Nov '24. Still below last year’s peak, but likely signals rising profit taking or capital rotation.

$BTC touched +1 Standard Deviation (SD) above the Short-Term Holder cost basis (~$120k), a level that has historically acted as resistance during strong momentum phases. If this trend continues, the next resistance is at +2 SD - around $136k: glassno.de/3GQ96ha

$ETH sentiment flipped from capitulation to belief in Q2 2025, per the NUPL metric. This means NUPL reliably signaled the bottom - ahead of #ETH’s price rebound and ETF inflows. More insights in Charting Crypto Q3 by @CoinbaseInsto & Glassnode: glassno.de/4nVMVH0