fxevolution

@fxevolution

🚀 20,000+ traders learn from my free weekly strategies. Want in? 👉 https://bit.ly/3szUHie

The Buffett Indicator isn’t the single “holy grail” it once was… Yet today it reads 220% — one of the highest readings in history. You can debate the tool. You can’t debate how stretched this market is.

We’re in the 7th inning stretch of this short covering game. Hi/Lo short interest shows just how far this move has gone. When the last shorts tap out… who becomes the buyer?

Hey guys no new video today but most of the levels stay the same. As always we will have the weekend video though. Have a great Friday 💪.

$TSLA Q2 results: 📉 Revenue -12% YoY to $22.5B 📉 EPS $0.40 (below est. $0.42) 📉 Deliveries -14% YoY to 384K 🚗 Operating margin slashed 42% “Rough quarters” warned by Musk, robotaxis & Optimus in focus Deep dive: declining core auto + pivot to software/AI. Risk vs.…

FINRA margin debt just hit a new high: $1.007 trillion. That’s above 2021’s peak. More leverage = more fragility. Doesn’t mean crash… But when the tide turns, it turns fast.

Here comes the froth 👇 Barclays Equity Euphoria Index is back at the “top of the range.” Every spike to this level since 2021 has marked **local tops or volatility windows**. Are we there again? Watch positioning — not headlines.

$GOOGL Q2 snapshot: 🔍 Search: +12% ☁️ Cloud: +32% 📺 YouTube: +13% 🧠 Subscriptions/Devices: +20% 📡 Network: -1% 🧪 Other Bets: +2% Price is up almost 2% after hours. Take a look at these beautiful charts breaking it down. Source: fiscal.ai

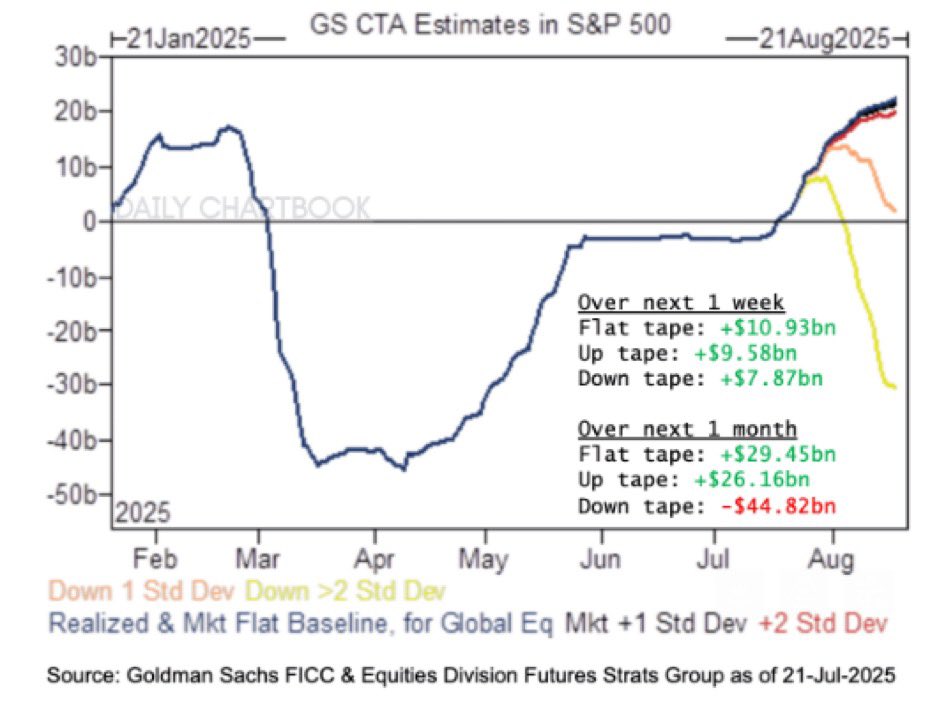

CTAs are programmed to keep buying as long as the tape doesn’t crack. 🔹 Flat = +$10.9B next week 🔹 Up = +$9.5B 🔹 Down = +$7.87B It’s trend-following with teeth. And in all scenarios they want to buy this week. But a deep pullback flips the script: -$44B outflows possible…

Defensives (healthcare, utilities, staples) now make up just 17% of the S&P 500 — the lowest share since 2000. At the peak of the last bubble, the market said “we don’t need safety.” Until it did. Source: Bank of America

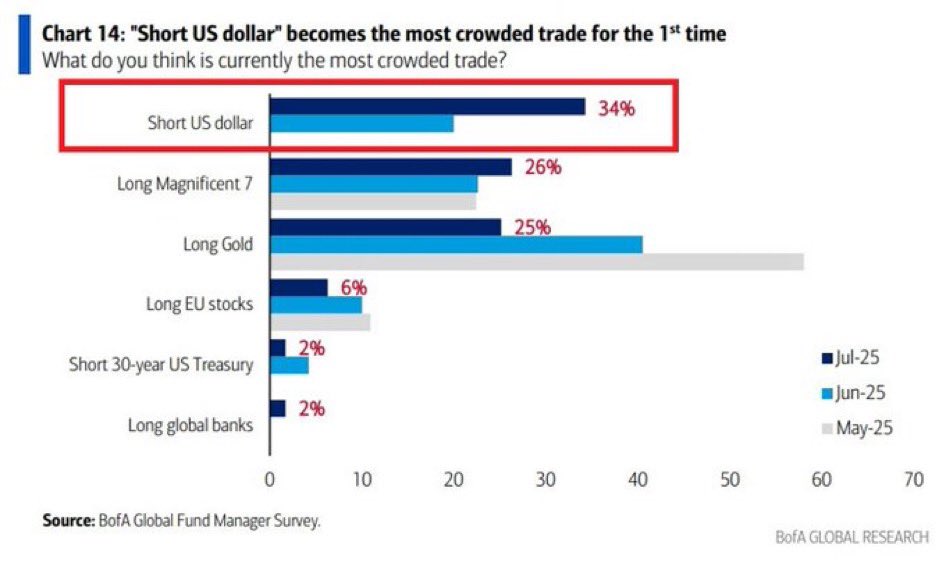

The most crowded trade in the world right now? Shorting the US dollar. More crowded than long Magnificent 7 or gold. When positioning stacks up like this, the market doesn’t need a reason to snap back.

The "line of death" has been reached. 70% of all options right now written are calls. and Wallets holding 10,000 + $BTC are actually starting to accumulate again! What exactly is going on, we break it down in Today's latest video: 👇👇👇👇

$GOOGL is still the cheapest MAG 7 stock based on at least fundamentals. It's the unknown Government risk which continues to hold it back.

Bitcoin has touched the same resistance line every halving cycle. Now nicknamed the "Line of Death" • 2017: Top formed • 2021: Top formed • 2025: Pattern retest underway Each prior touch marked a multi-year cycle high. The data suggests the pattern isn’t broken yet. The…

The SP500 has officially entered into the "chop zone" based on previous historical studies. The question now is will it be the same again or different this time? Source: Ned Davis Research