Fiscal.ai (formerly FinChat)

@fiscal_ai

The future of investment research is here. Fundamental research platform for global equities, powered by AI.

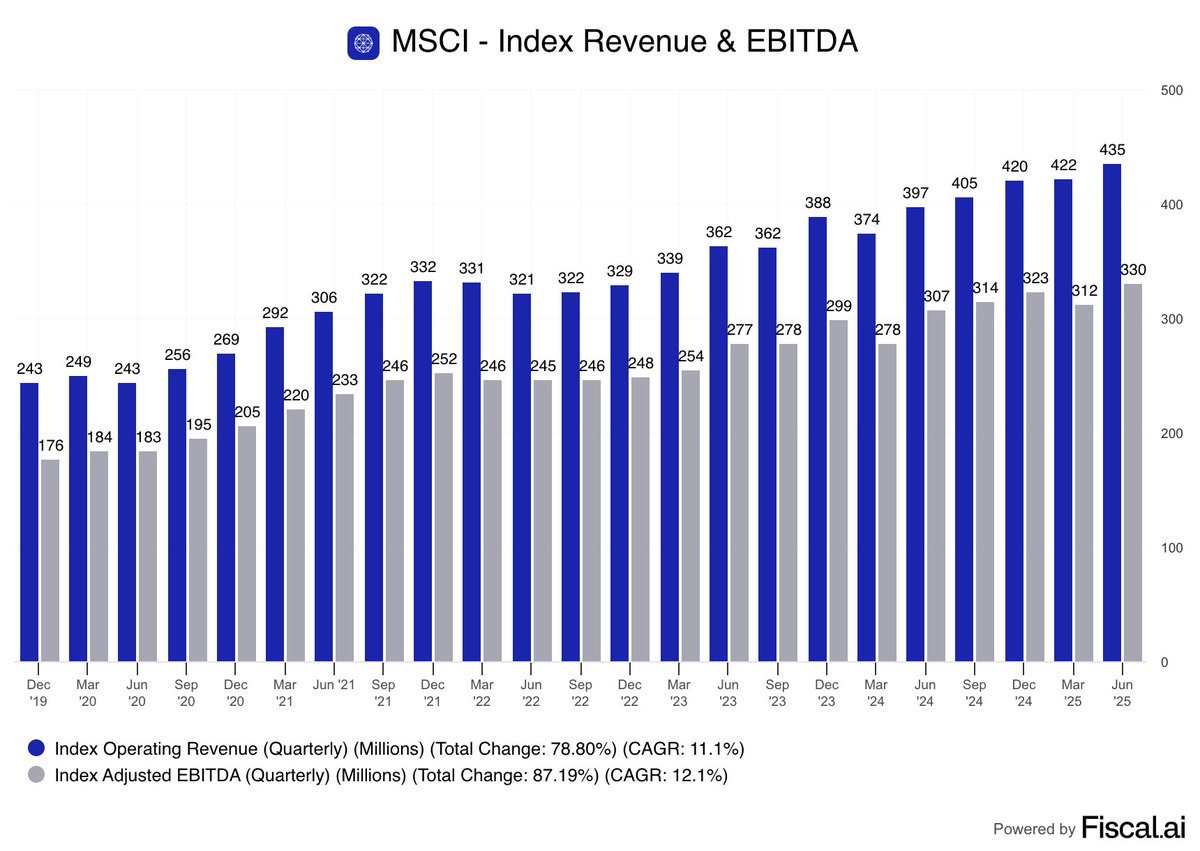

MSCI generates a whopping 76% adj. EBITDA margins from its Index business. What a cash cow. $MSCI

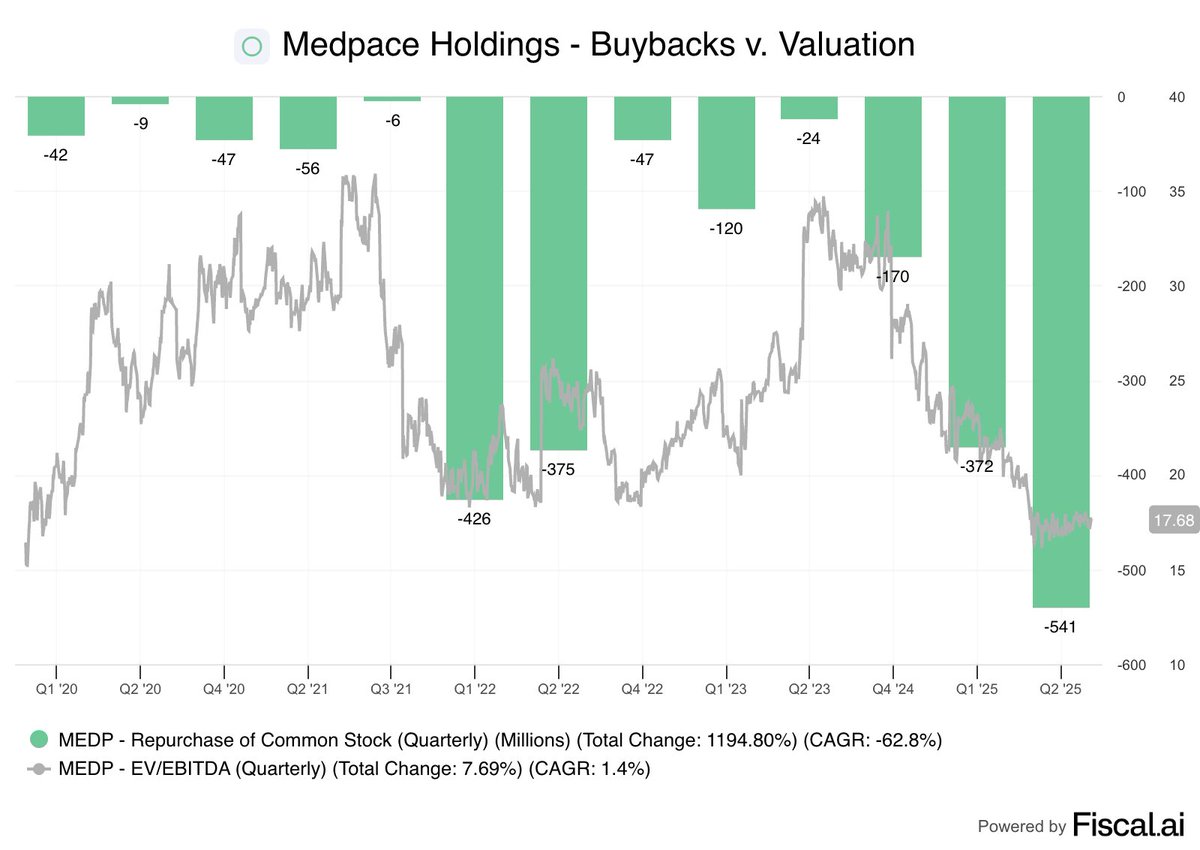

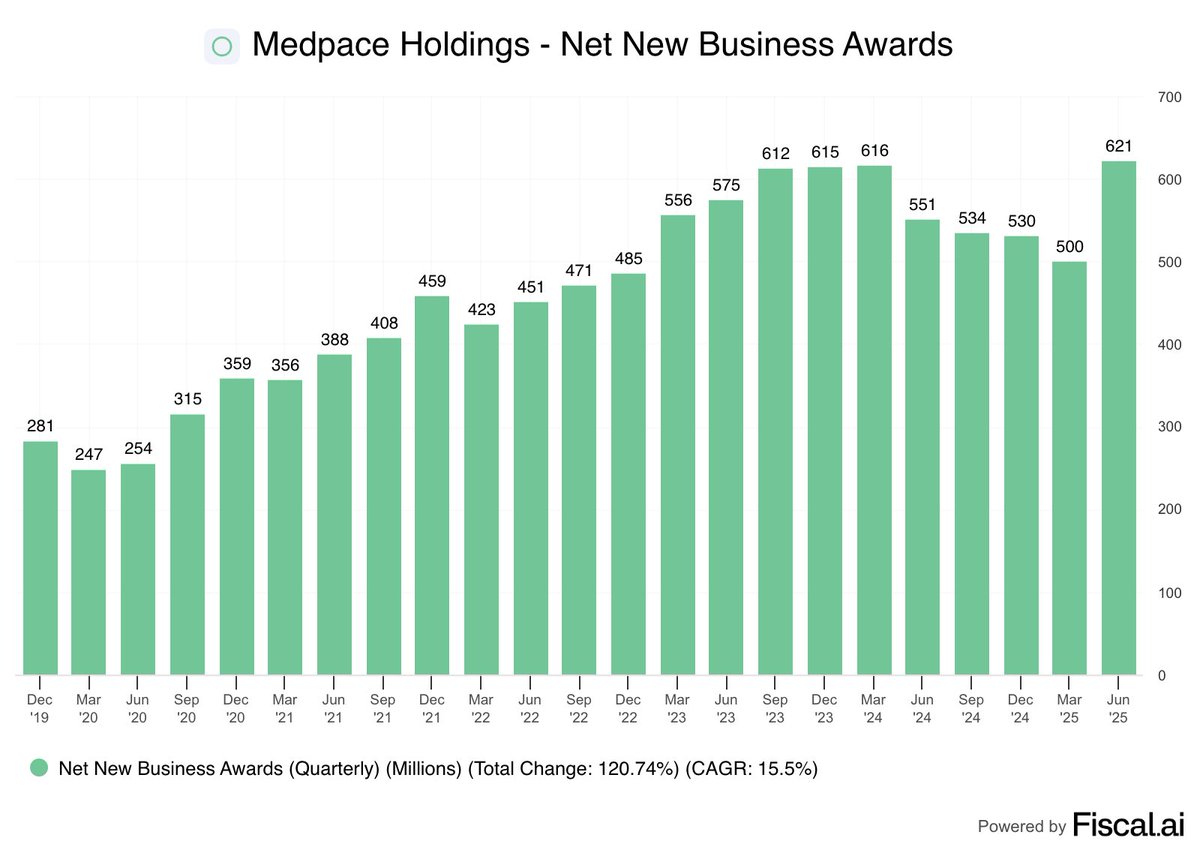

Last quarter, Medpace spent $541 million on buybacks at their lowest valuation in 5 years. That was equivalent to 6% of their market cap. Today $MEDP jumped 55%. Talk about well timed buybacks.

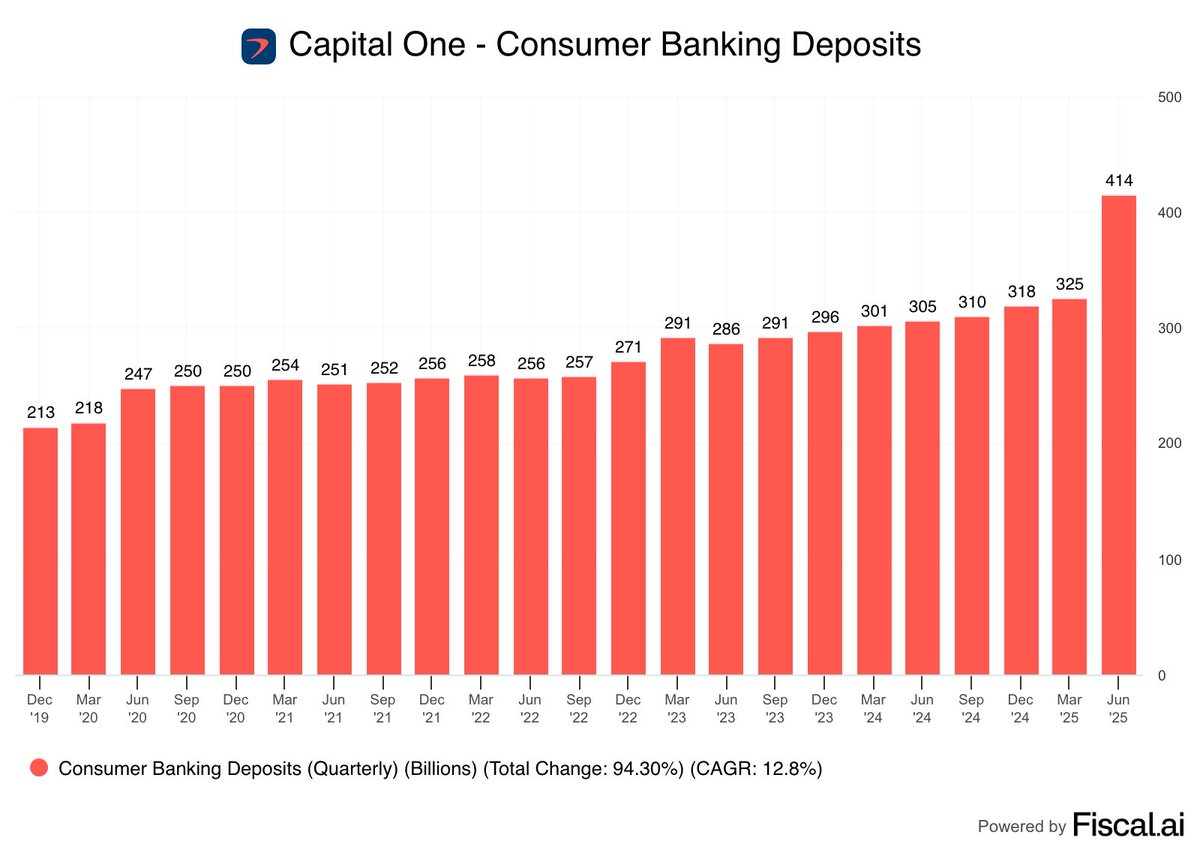

Capital One completed its acquisition of Discover this quarter. Combined, Capital One is now the 6th largest bank in the U.S. by deposits. $COF

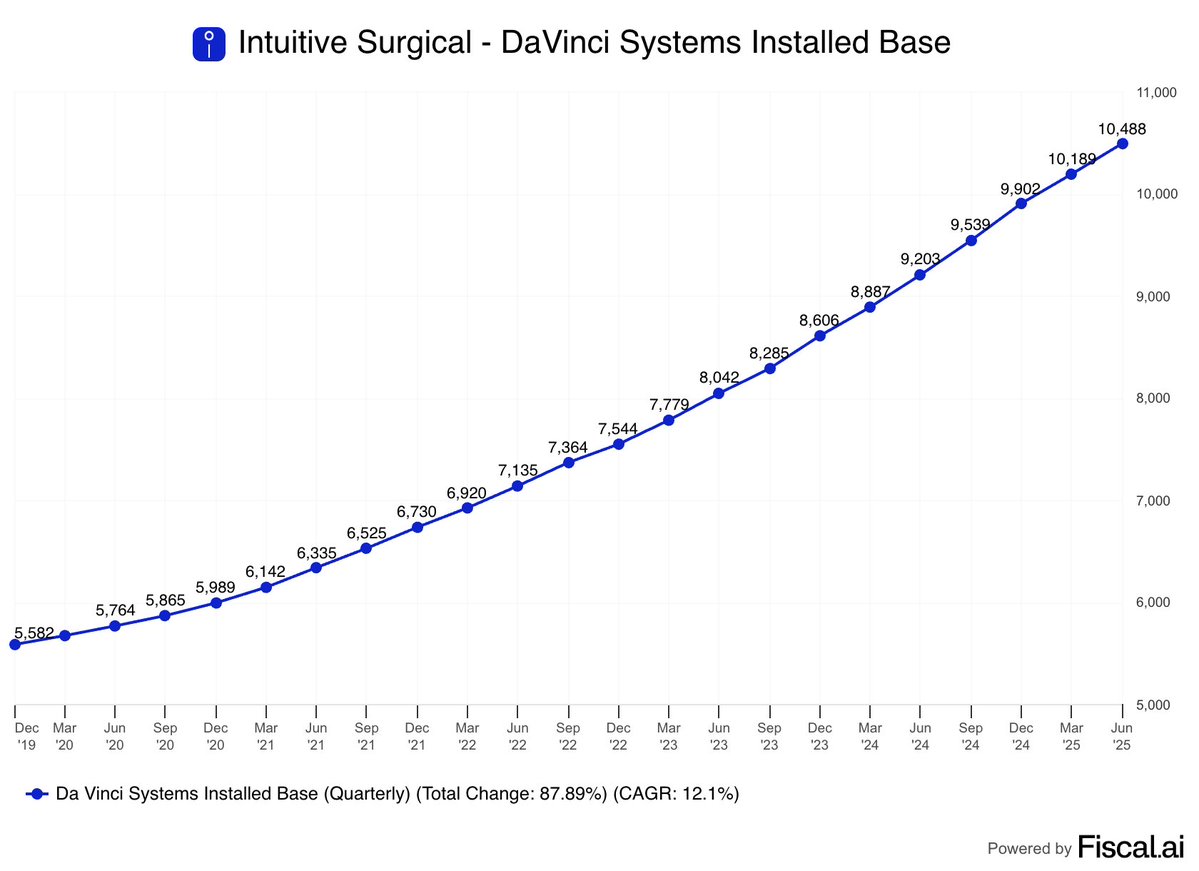

Intuitive Surgical has grown its installed base of DaVinci Systems at a 12% CAGR since 2019. $ISRG

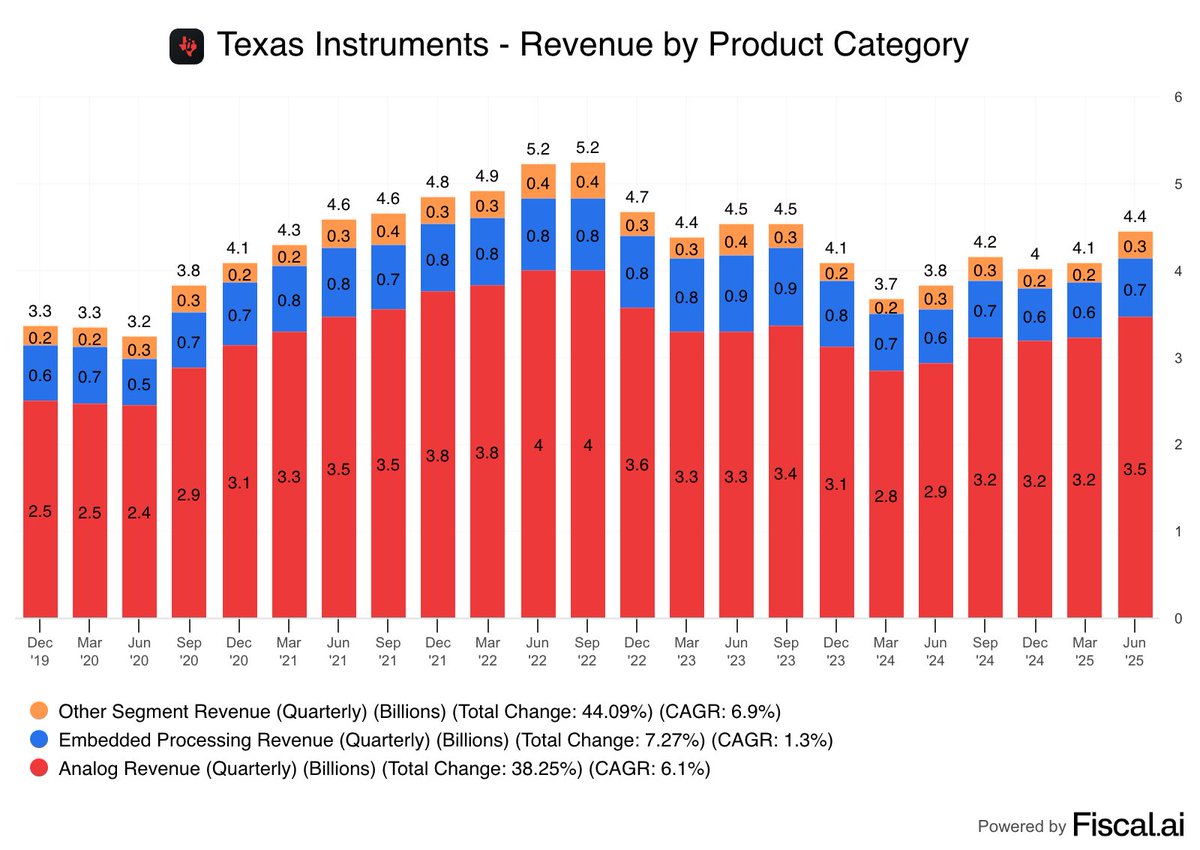

Texas Instruments Q1 Report Revenue +16% Net Income +15% EPS +16% Analog +18% Embedded Processing +10% Other +14% $TXN: -7.6% AH

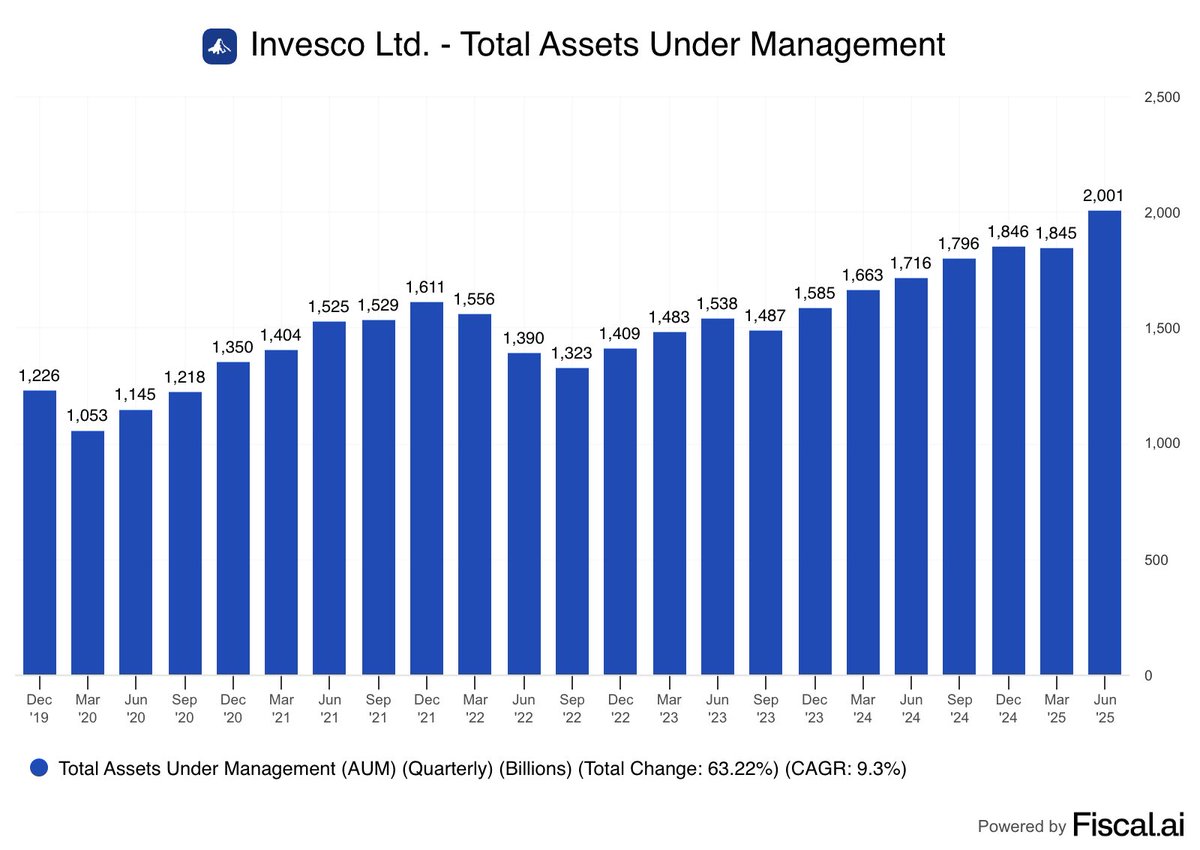

Invesco just crossed $2 trillion in Total Assets Under Management. That's up 17% compared to a year ago. $IVZ: +4.3% today

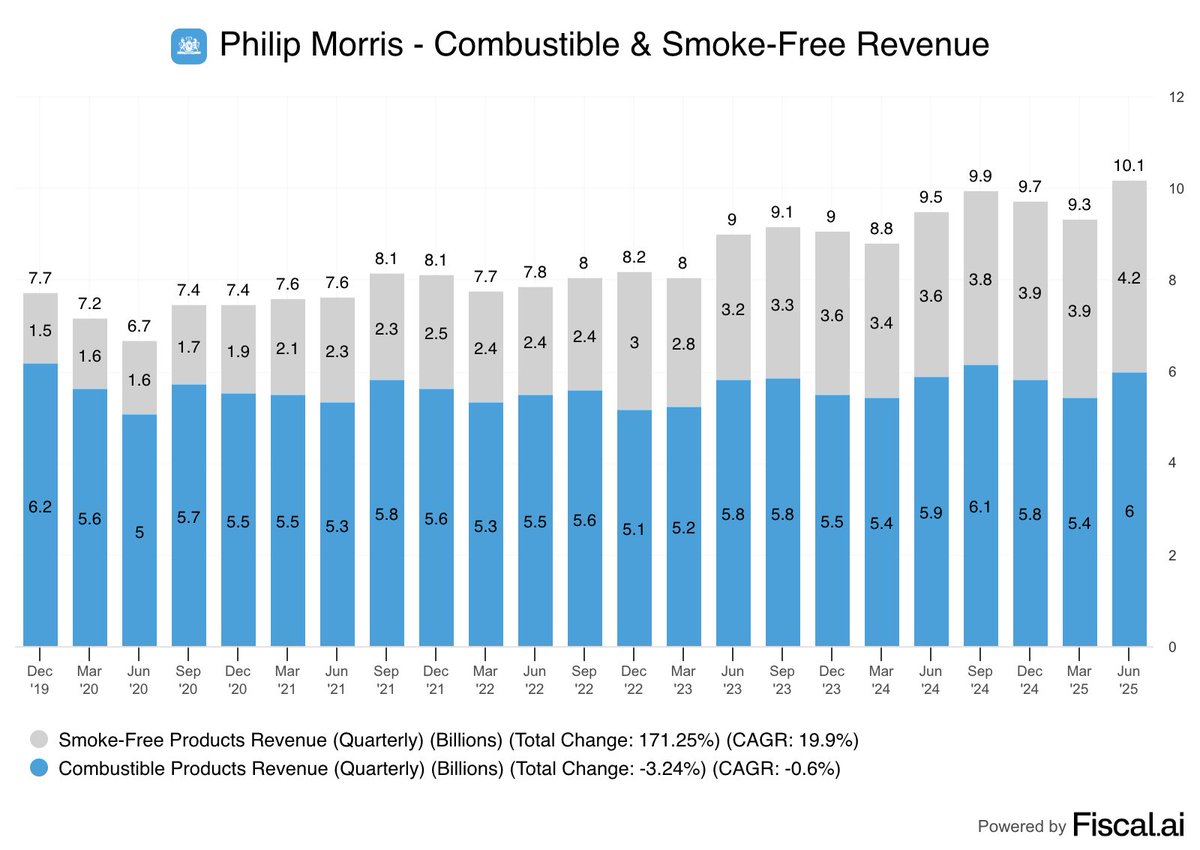

Philip Morris International crossed $10 billion in total revenue this quarter, up 7% compared to last year. 41% of that revenue now comes from Smoke-Free products. $PM

D.R. Horton just reported its lowest average selling price since 2021. Its average home price is now down more than 12% over the last 3 years. $DHI

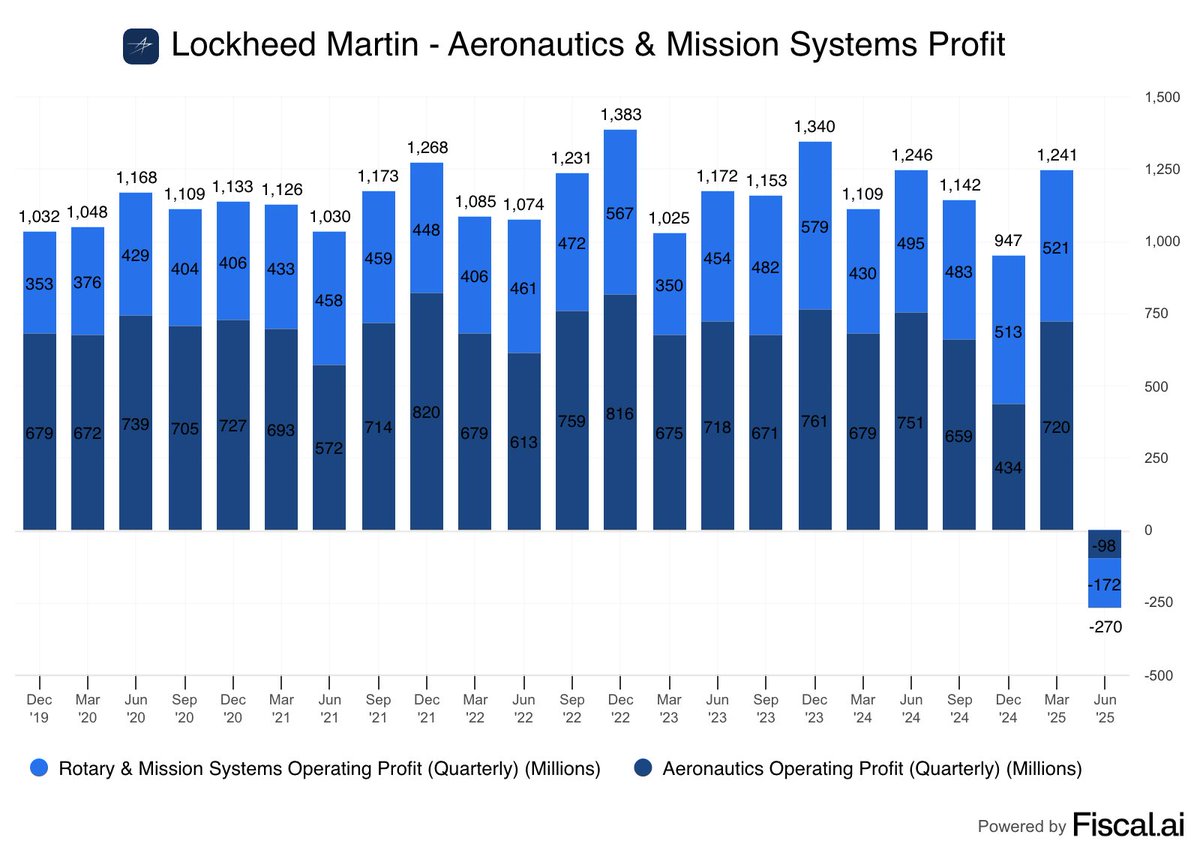

Lockheed Martin just reported its first unprofitable quarter in more than a decade for its two largest divisions. $LMT: -9.1%

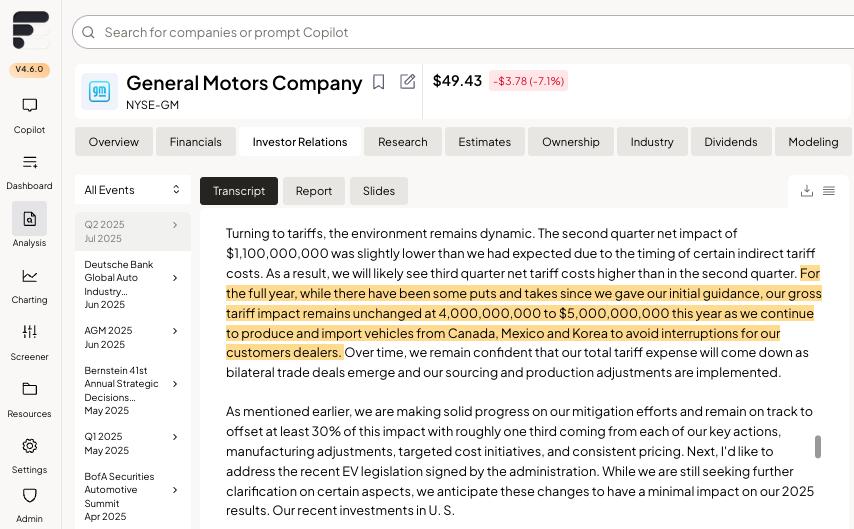

General Motors is projecting a $4 to $5 billion impact from tariffs for the full year. $GM: -7% today

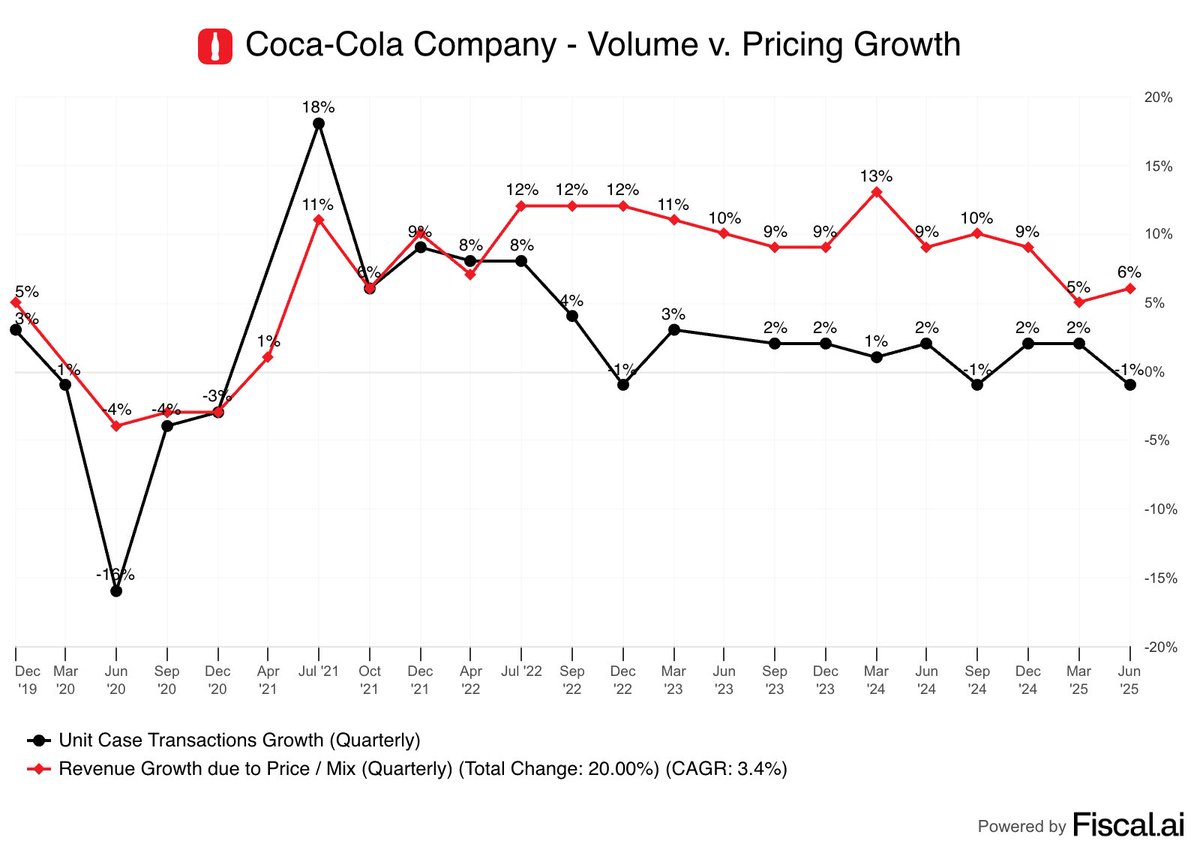

Coca-Cola has now reported 17 consecutive quarters of more than 5% revenue growth from price/mix. Looks like the 140 year old company still has some pricing power. $KO

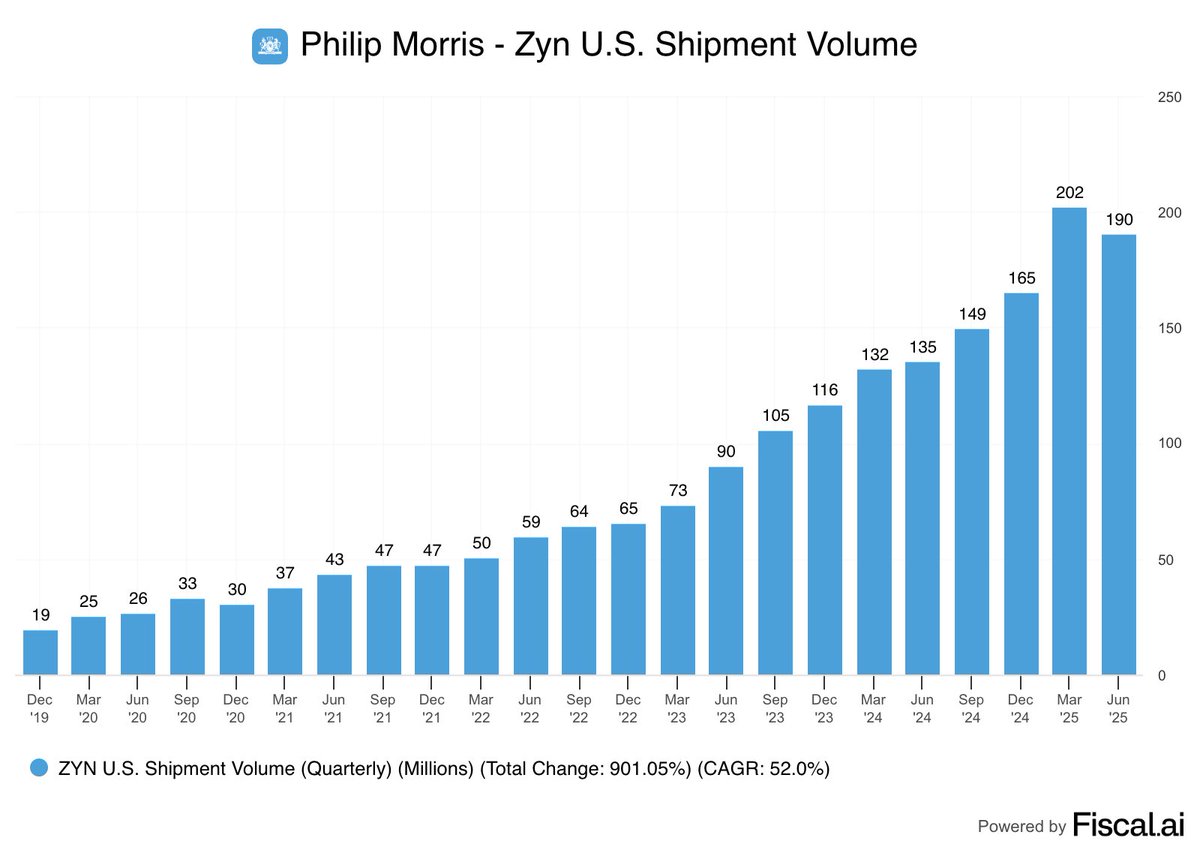

Zyn volumes declined sequentially for the first time in nearly 5 years. $PM: -8% today

Medpace Holdings, a contract research organization, just reported $621 million in net new business awards, an all-time record for the company. The stock is up 40% after hours. $MEDP

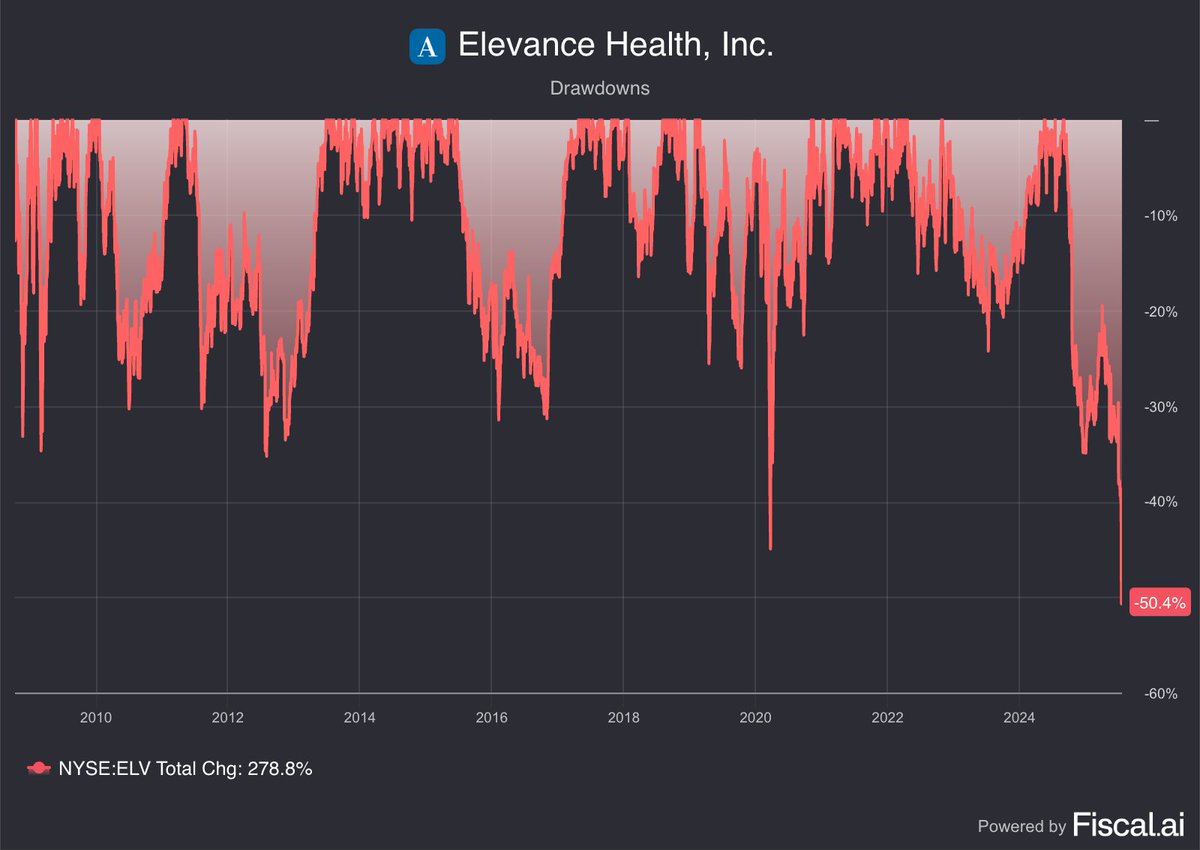

Elevance Health -- the 2nd largest US health insurance company -- is in its largest drawdown since the GFC. Down 50.4%. $ELV

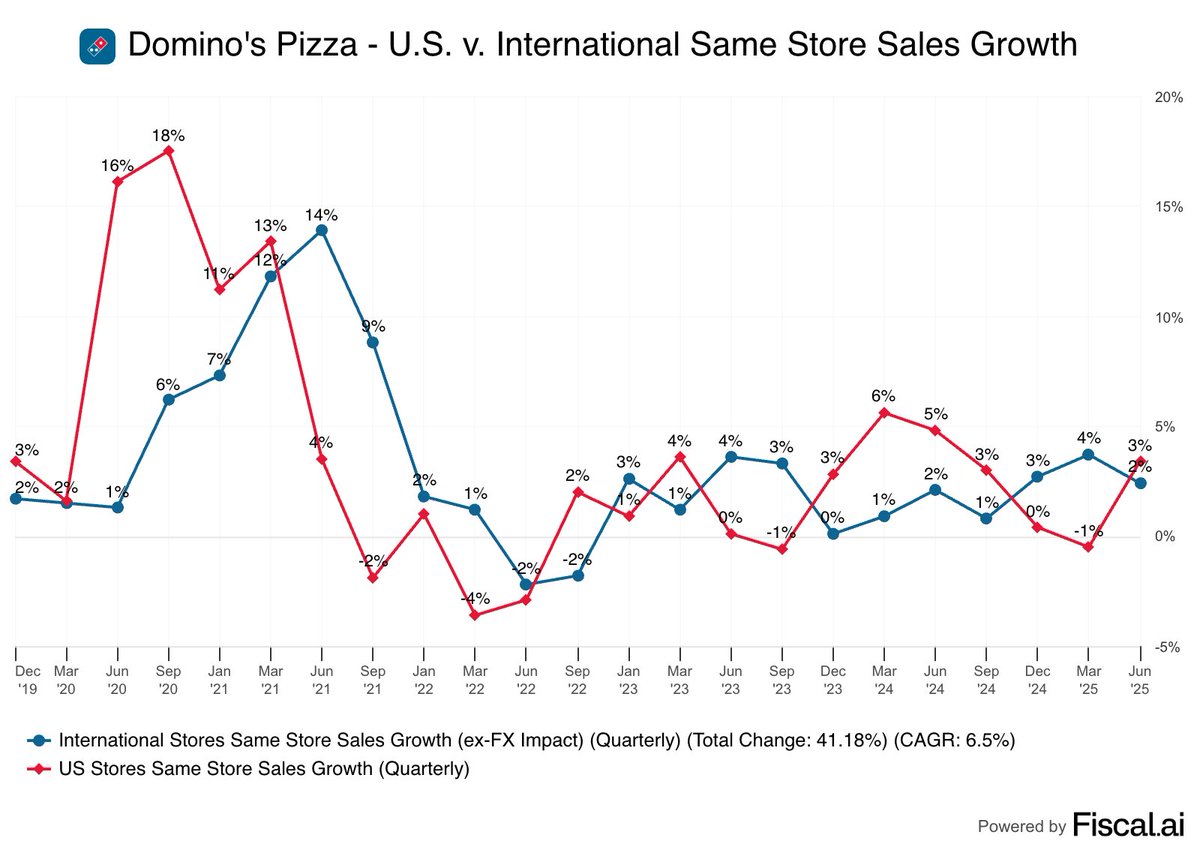

“Internationally, we continued to grow despite macro challenges. In the U.S., both delivery and carryout grew, driving meaningful market share gain." - Domino's CEO, Russell Weiner $DPZ: -2.6%

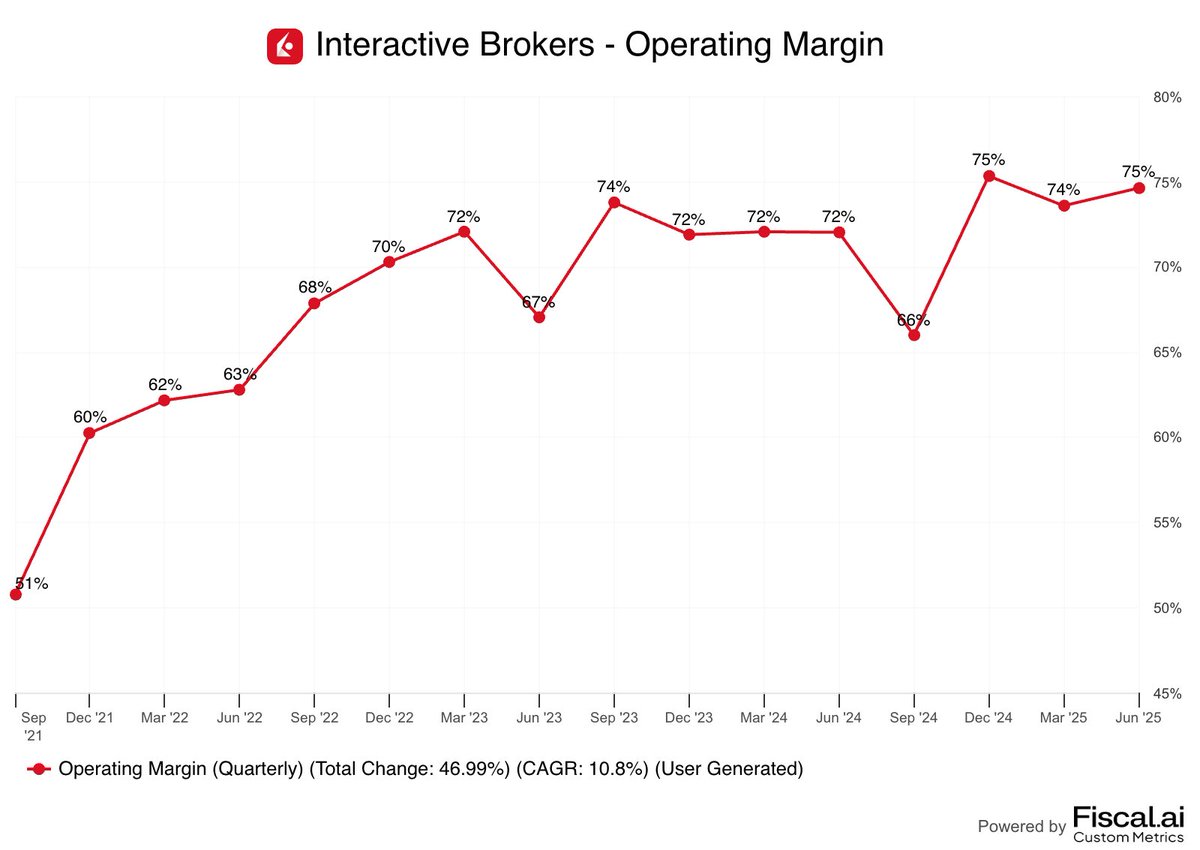

Interactive Brokers reported 75% operating margins this quarter. How many other companies are able to maintain operating margins above 70%? $IBKR

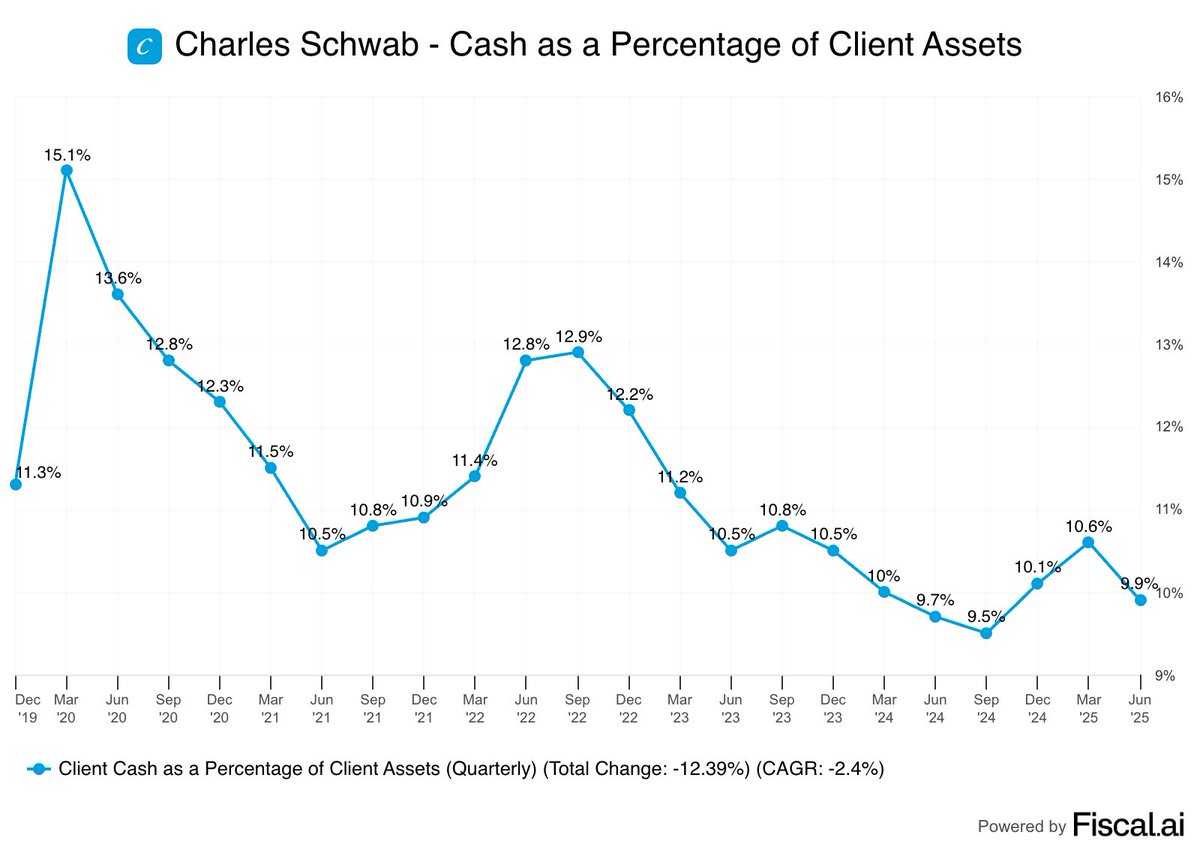

Cash as a percentage of client assets stood at 9.9% this quarter for Charles Schwab. That's near an all-time low for the brokerage giant. $SCHW

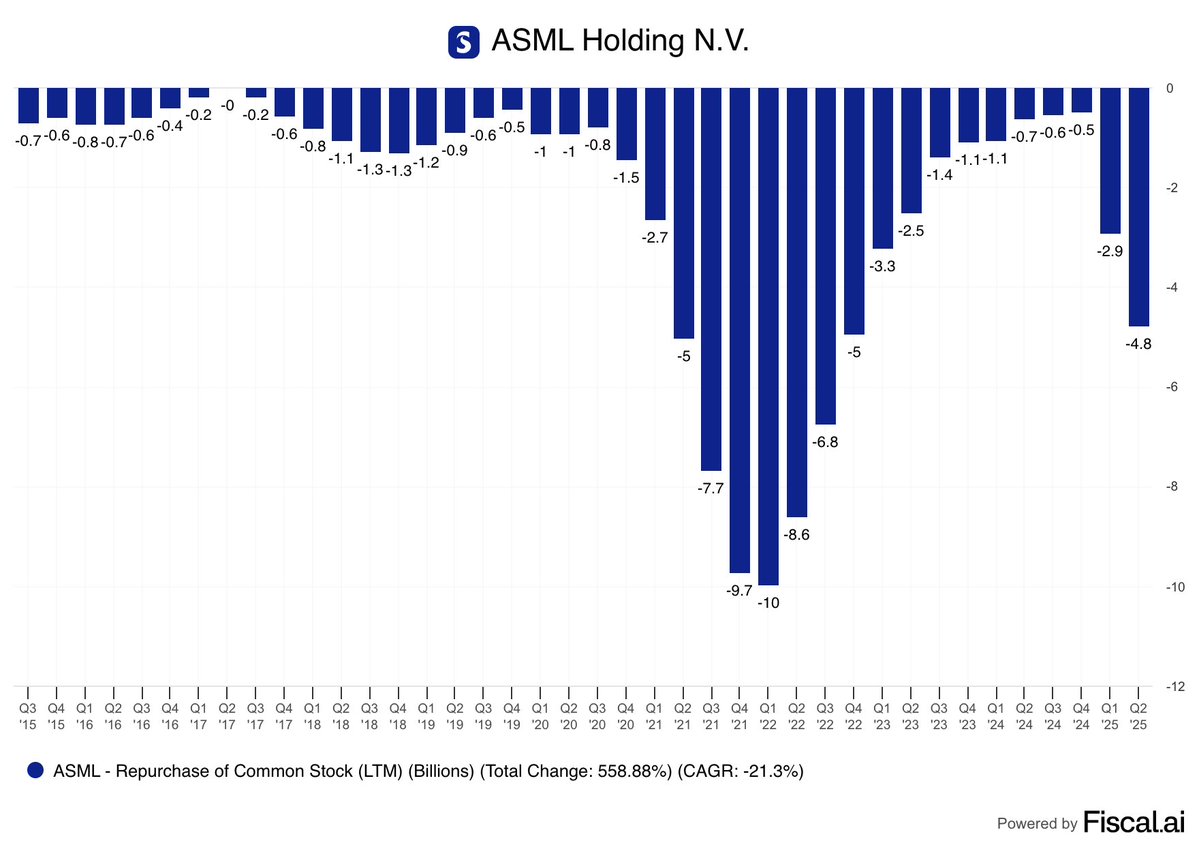

ASML is beginning to ramp up its share buybacks. They've spent ~1.6% of their current market cap on repurchases over just the last two quarters. $ASML

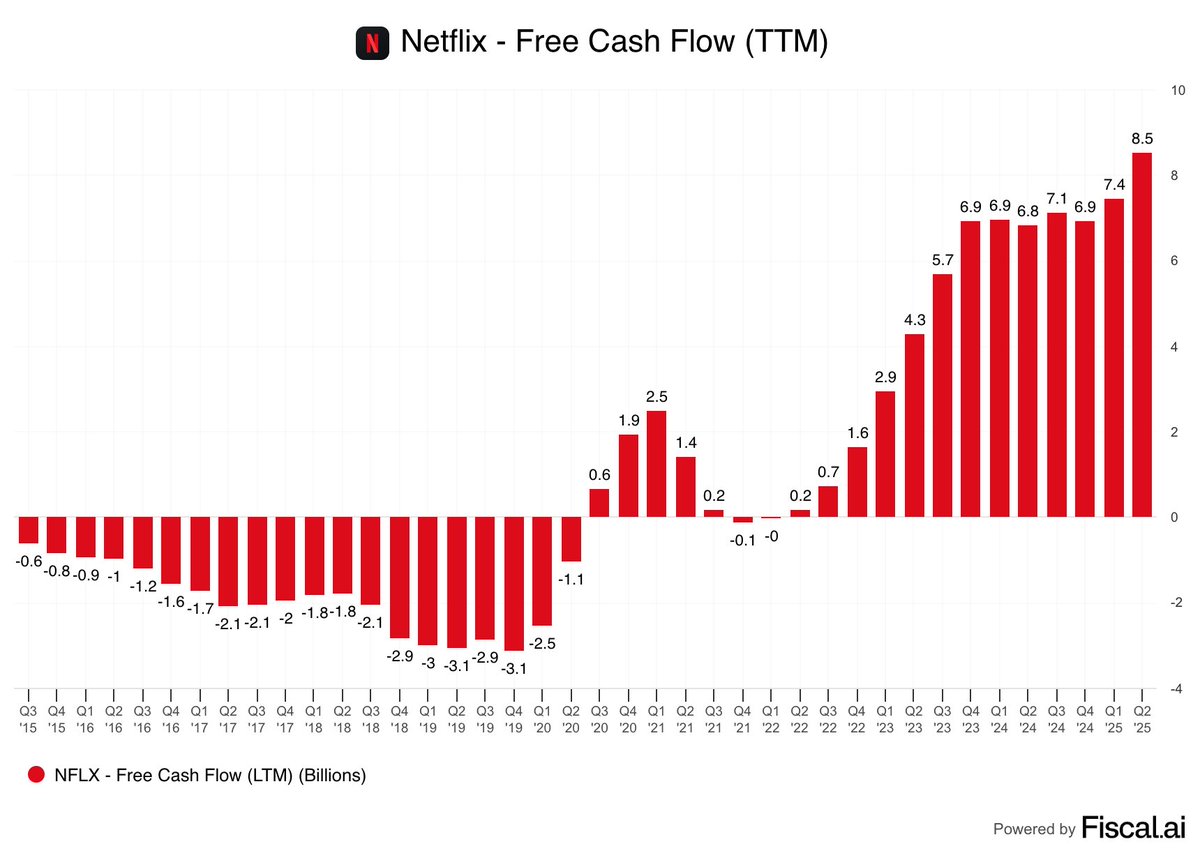

Netflix has generated $8.5B in free cash flow over the last 12 months. Can any other streaming companies catch Netflix at this point? $NFLX

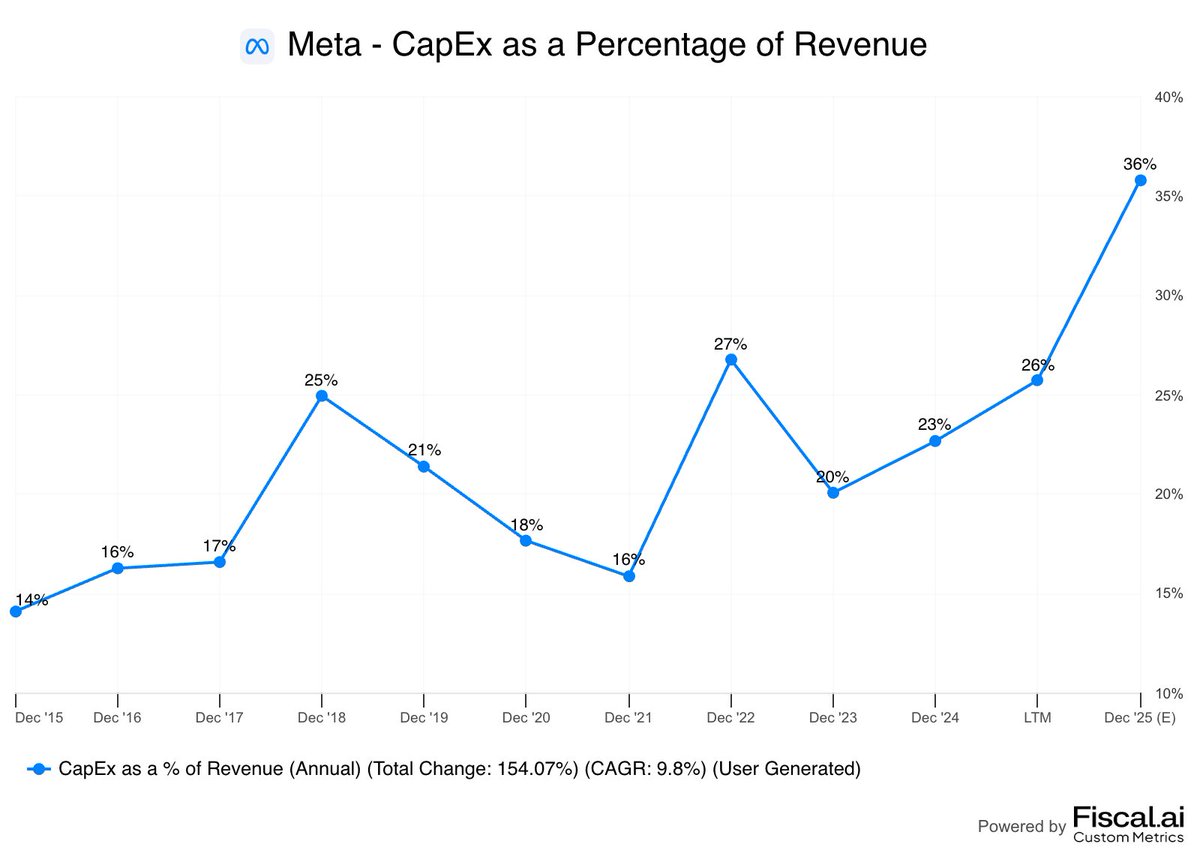

Meta is set to spend 36% of its revenue on CapEx this year, according to consensus estimates. That's up from just 14% a decade ago. $META