Eric Nuttall

@ericnuttall

Father of 3, husband, & energy investor. Proponent of the Canadian energy patch & occasional market commentator. http://bit.ly/2ukaOCr

Is the "twilight of shale" here and what does it mean for the oil market? Hear what the #1 shale company on the planet is saying on the topic in our Ninepoint Energy Strategies weekly update.

Saudi Arabia’s compliance to all OPEC agreements under the leadership of HRH Abdulaziz bin Salman has been exemplary. For a journalist today to suggest otherwise is in my opinion nothing but sour grapes.

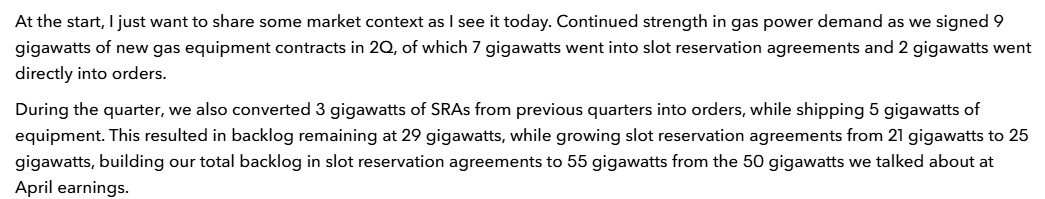

GE Vernova: 55GW in backlog/reservations = ~8Bcf/d in implied future natural gas demand growth. Brutal month (-19%) with disappointing cooling demand + private rig ramp, but the real story is 13Bcf/d of LNG demand growth + 6+Bcf/d in power demand and marginal cost of supply $4+.

Why "we remain bullish"™️ on oil and natural gas, a lookback at the 1H/25, and most importantly our view on where we go from here:

With years of demand growth ahead, peak non-OPEC production forecasted in ~ 3 years, and soon normalized OPEC spare capacity, we see meaningful upside in companies with long-dated reserves who continue to compound ~10% annual share buybacks, yet who remain deeply out of favour.

Inventory levels in key OECD countries like the US remain very low, supportive of price until the Fall:

US oil production needs ~440 active rigs to stay flat, with each rig = ~10,300Bbl/d of annual production. $60WTI implies a rig count of 320 (source: Bernstein) = 1.2MM Bbl/d of annualized losses from current levels over a year. The next oil bull market is sooner than you think!

We believe that the OPEC+ member voluntary cut will be fully unwound by September, resulting in the near full normalization of OPEC spare capacity (~2MM Bbl/d). With the twilight of US shale, Saudi Arabia's influence on the oil market going forward is enormous. Will and intent!

With a 45% decline rate for US shale (Bernstein) and a 5.5% decline rate for OPEC (Aramco), it will not take much to balance the market next year, at which point US shale is in chronic plateau/decline and OPEC spare capacity has been normalized. "We remain bullish"™️ medium term!

"We remain bullish" on oil over the medium and long term while cautious over the next few quarters as $60WTI or lower will be required to balance the market and prevent historic inventory builds due to the imminent full return of OPEC barrels:

With the full unwind of the OPEC+ voluntary deal likely by October, resulting in meaningful inventory builds beginning in Q4/25, short-cycle US shale HAS to be the balancing factor. The question then is...at what price? Dallas Fed Survey would suggest $50-$60WTI.

Why do we remain cautious on oil in the short-term? 🛢️Global oil inventories have grown by 272MM Bbls YTD vs. 33MM Bbls last year and 64MM Bbls 5 year average – Source: Kpler 🛢️Total global oil stocks YTD have risen by 199MM Bbls (9.77BN Bbls to 9.97BN Bbls) vs. 45MM Bbls last…

We need US shale production to fall to balance the market. At $65WTI it is not going to fall. That is a problem, given the magnitude of forecasted inventory builds once Summer ends and into 2026. Coterra for example was going to drop rigs at $60WTI…not anymore!

2 things feel like high probabilities at the moment: 🛢️Kharg Island is safe 🛢️US oil sanction enforcement on Iran is highly unlikely Meanwhile, Saudi and UAE exports have and will increasingly rise, while shale production is not falling at $70+WTI.

This morning I wrote to CDN oil producers encouraging them to use today’s spike to protect their Q4 and 1H/26 free cashflow (and buybacks) with hedges. Happily National Bank hedging desk reports an extremely active day! As of now, large inventory builds post-Summer still likely.

An especially well deserved shoutout to @CroftHelima, the "Queen of geopolitical risk analysis" who has been warning the energy market for months about last night's increasing likelihood.