Endowment Eddie

@endowment_eddie

Investment generalist seeking elite asset managers. Unlimited time horizon.

Scariest place in venture isn’t the megafunds. It’s the GPs spinning out of megafunds raising $40-100M. Minimal right to win, can’t really lead, not yet aware that your seed friends change when you don’t have the brand/follow-on checkbook. Founder/operating experience is ~2…

Omada ($OMDA) and Mountain ($MNTN) are key for the 🦄 bell curve. - Trade at $1-2B cap/in line with IPO - $170-225M rev, dece growth (28-38%) Bar supposedly >$5B cap, at least $3-400 ARR to IPO. More 🦄 look like OMDA or MNTN than Figma. CEOs/GPs should be keeping tabs.

Partner attribution isn’t the right question. LPs obsess over who led it, split attribution, etc. The details don’t matter. The goal of VC is the flywheel effect of seeing and winning great deals. So it doesn’t matter who sourced it. It matters who wins the founder reference.

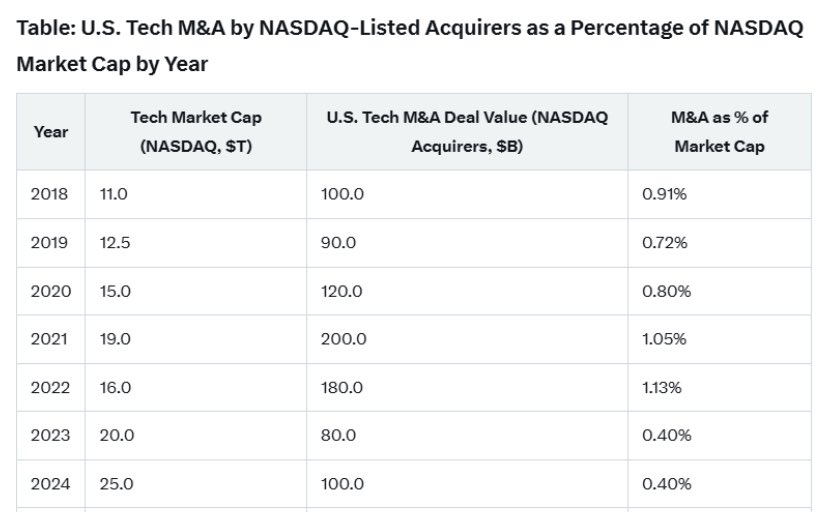

Public tech has spent ~1% of market cap annually on M&A but that was cut in half in ‘23/24. Nasdaq has total market cap of ~$30T. We should be looking at $2-300B. Good news - we’re approaching that runrate through 1H2025 on the back of Wiz and the return of M&A in the $200M-5B…

Someone bring the Justice Department a compass and a map

ServiceNow's $2.85 billion planned acquisition of artificial intelligence firm Moveworks is facing an in-depth antitrust review by the US Justice Department bloomberg.com/news/articles/…

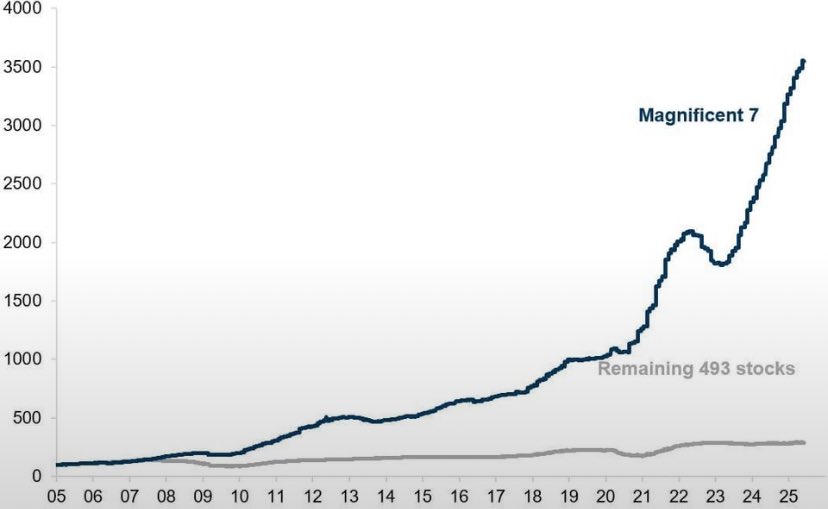

Comparing software buyout and venture to the S&P or Mag7 with hindsight misses the broader point—you should have owned and should continue to own US technology. This beta drives it all. Our deficit to GDP, employment picture, and global leadership are not driven by the S&P 493.

“Privates have underperformed publics” in reality is “the median PE fund underperformed the Mag 7”.

Did "say it", I just quoted it from this @TheEthanDing article substack.com/home/post/p-16…. The part above is "quotable" but I am not sure I fully buy into the "wrapper theory . The second part of the quote is what mattered. These companies did an amazing job of taking mind share…

When you say privates haven’t kept up with publics, you should really say privates haven’t kept up with the Mag 7. There are 493 other S&P companies that have barely gone anywhere. If you want to hold 7 stocks, go for it. PEVC v. R2000/S&P493 is a diff story. Source: Goldman

“Harvey isn’t some breakthrough in legal AI—it’s ChatGPT with a law costume. Lovable isn’t revolutionizing code—it’s Claude with pretty buttons.” - @rodriscoll on @twentyminutevc Not enough people talking about this.

Looking forward to @robgo ‘s next post. Seed has the highest dispersion of returns in the highest dispersion asset class. Large GPs can be price insensitive. @ycombinator has a ROFR on exceptional talent. Median seed returns will disappoint big. nextview.vc/blog/a-crisis-…

In 10 years, the US government will be $55-60 trillion in debt (which will be 7-7.5 times government revenue) because there will be $25-30 trillion of additional borrowing. That amounts to about $425,000 of debt per American family. When I calculate the supply and demand for…

I’m all for Invest America but it better stay tied to the S&P. Had it been in place over the last decade, it would have been grifted to shreds by both sides.

You know what makes you sound really smart yet is entirely useless? Be a specialist in lagging financial indicators.

Biotech market fundamentals are looking grim despite great science: - As of Q2, there were 161 biotechs trading at negative EV (16b of cap, 27b of cash). - No IPOs in Q2, which was the first time in 15 years - H1’25 financing down 16% by volume and 18% by total proceeds

Can pretty much mark my words on this Until America makes housing affordable for the next generation, the trend towards socialism will continue Doesn’t matter how much panicking, educating or donating to alternative candidates we do

Are they running circles? ScaleAI and Character remain standalone businesses. Can you block [extremely] high paid hires? FTC/DOJ might struggle to prove Sherman/Clayton/FTC Acts have been violated.

Feels like Silicon Valley is running circles around Trump’s antitrust regulators right now. Assume the FTC and DOJ know that they can review non control transactions.