David S. Mitchell

@dsmitch28

@dsmitch28.bsky.social tax/regulatory policy @equitablegrowth. alum: @AspenFSP @SenSherrodBrown @GeorgetownLaw @PrincetonSPIA @TuftsUniversity. Opinions my own

In the upcoming tax policy debate, we can (sadly!) expect confusing jargon & suspect economic claims re: “small business” Qs abound: What is a pass-through? Did 199A deduction help create jobs? Are mom & pop stores overtaxed? This week @equitablegrowth is providing answers! 🧵

The House budget framework was clear: no new deficit spending in the One Big Beautiful Bill. The Senate’s version adds $651 billion to the deficit — and that’s before interest costs, which nearly double the total. That’s not fiscal responsibility. It’s not what we agreed to.…

The House budget framework was clear: no new deficit spending in the One Big Beautiful Bill. The Senate’s version adds $651 billion to the deficit — and that’s before interest costs, which nearly double the total. That’s not fiscal responsibility. It’s not what we agreed to.…

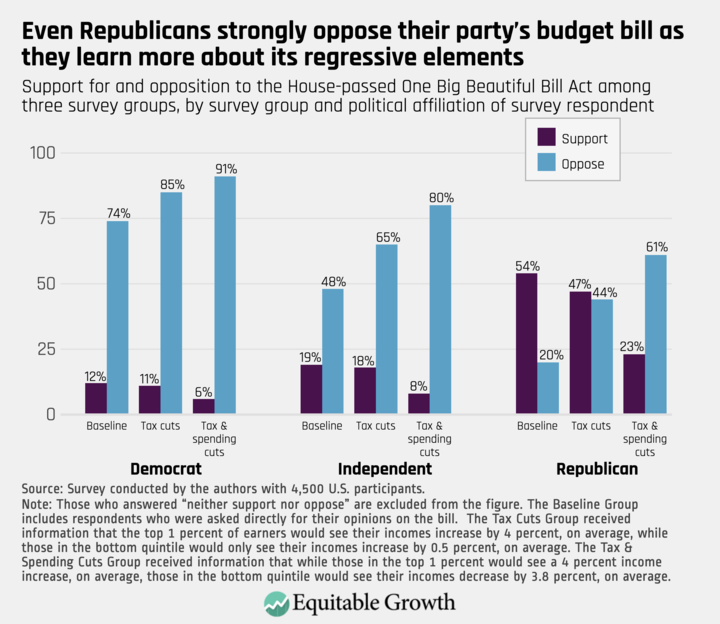

Why are Republicans working nights on a holiday week to ram thru an unvetted bill? Maybe b/c the more American people learn abt the bill, particularly the lopsided costs & benefits, the less they like it. Even true among Rs' own voters. h/t @Jacob_S_Hacker @equitablegrowth

Latest from @jctgov: The richest 0.1% (≈200K households earning an average of $2 million+/year) will get an average tax cut worth $308,763 in 2027. jct.gov/publications/2… This is not "pro-growth"! Just a hand-out that worsens economic inequality and the deficit.

"This bill will make 60% of the country poorer so we can shrink the economy by 4.6% over the next 30 years" is one heck of an accomplishment.

We estimate the Senate-passed reconciliation bill increases primary deficits by $3.1 trillion over 10 years. The dynamic cost, including changes to the economy, is larger at $3.5 trillion. GDP falls by 0.3 in 10 years and falls by 4.6 in 30 years. budgetmodel.wharton.upenn.edu/issues/2025/7/…