definikola

@definikola

DeFi research and risk management at @BlockAnalitica. prev: @DeFiSaver. Writing about the latest developments in DeFi.

Introducing the first risk-adjusted yield dashboard in DeFi, powered by @BlockAnalitica. Find the highest DeFi risk vs return based on: - Market risk - Liquidity risk Soon: - Lindiness, Settlement risk, Oracle risk, audits, etc.

Introducing Sphere Risk Scores! 🔮 A go-to dashboard for risk-adjusted yields in DeFi. Use Sphere Risk Scores to: - Explore risk vs return for all major stablecoins on mainnet ✅ - Find pools tailored to your risk profile ✅ - Create a robust starting point for yield farming ✅…

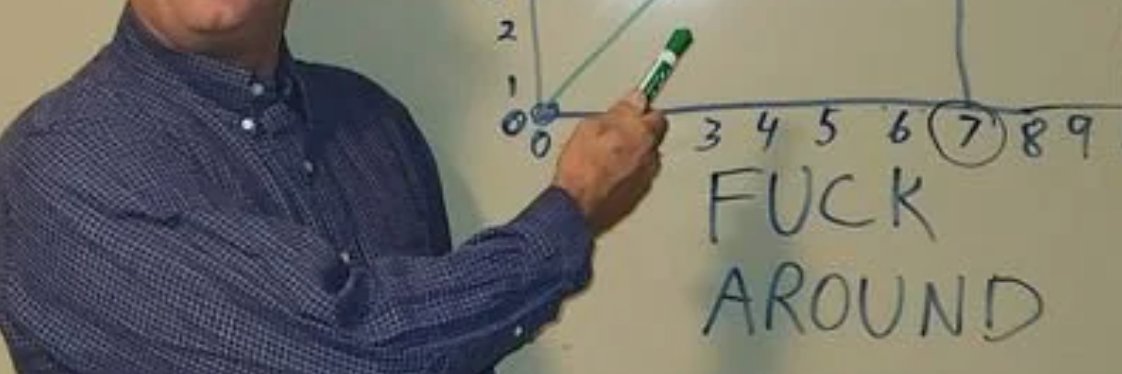

still waiting for someone to build this

Why is there no (public) USD vault in DeFi that does only looping with sUSDS, sUSDe, sGHO, and other yield-bearing stables (and their PTs) yet? Too much of a concentration/management risk?

No, we have blockchain at home. Blockchain at home:

So PayPal's head of crypto leaves and now the company is replicating blockchain benefits (seamless cross border payments) by linking the largest fintechs together instead of using blockchain

There is a list of questions by the Ethena Risk Committee left unanswered regarding @HyperliquidX from the initial proposal to onboard it as a hedging venue for USDe. Main concerns being lack of transparency around admin permissions to adjust key parameters within exchange, and…

Just noticed that @ethena_labs isn't using Hyperliquid for USDE delta-neutral positions. Why not?

not hinting anything

previous largest divergence? October 22nd, 2024

DeFi is finally welcoming projects aiming to bring under-collateralized loans. - @3janexyz - is a credit line machine offering a streamlined UX with 1-click deposit to get USD3 yield bearing token. - @WildcatFi - is taking an infra-oriented approach, providing contracts to…

Missed the one that started it all - @SkyEcosystem. Total SKY buyback: $88m (~1b of $SKY) Total USDS spent on buyback: $66.8m (~3% of total supply) Net ~$21m profit. info.sky.money/buyback Anyway, I remember early Maker discussions about buyback (+burn at the time) mechanism…

Total buyback from protocols (Including profit for holding) : Hype : $1.2B Ray : $190M Jupiter : $28M Aave : $20M Pump : $19M ETHFI : $3.4M Syrup : $735K (Est 20% of Q2 Rev) Rollbit : $870M (Unverifiable) Note: Latest price is 19/7/2025. Let me know in the comment if I have…

perps - short-term betting onchain leverage (lending venues) - mid-to-long term positions (lower max leverage although more stable rates)

Much cheaper now to build leverage on chain than on Perps

funding rates spiking while DeFi moves more slowly would be interesting to see if funding spike persists long enough so the stablecoin rates in DeFi start to converge, as it has been the case historically

Markets seem to be quicker in pricing the cost of capital on the higher-leverage venues like perpetual futures exchanges, than lending venues in DeFi. Historically, benchmark stablecoin borrow rate on DeFi lending protocols has shown to lag a bit behind benchmark funding rate,…

think the amount of privately managed "funds" in DeFi is greatly underdiscussed BD people of useful DeFi trading and yield apps, role your sleeves, those guys are quietly making some good profits

It's not hard to see the loans (smart debt) becoming the deepest AMM pools in the long run. A lot more demand for borrowing than for pure DEX LP-ing. Total *stablecoin* borrow amount on major DeFi lending protocols on Mainnet is hitting ATH each day and is now over $11b.…

Here's a $10M swap via Cowswap routing $6.2M alone from Fluid's smart debt pools of USDC-USDT because Fluid has the deepest pools in the ecosystem entirely made out of debt. The goal is to power the major forex market of future by Fluid's smart debt, allowing users to borrow…

was a matter of time for wallets to start providing those kinds of services (also, expecting way more @HyperliquidX alternative UIs to come) thoughts?

Introducing: Phantom Perps 👻 ♾️ Go long or short in just a few taps. 100+ markets. Up to 40x leverage. All in your pocket. Powered by @HyperliquidX

The number of new yield-bearing "stablecoins" promoting marginally higher APYs with significantly higher risk is kind of getting out of hand

Not just finding the best borrowing rates, but also: - Net APYs - Estimate unwinding price impact - Estimate rate (utilization) impact due to size - Compare liquidation points Dashboard: sphere.blockanalitica.com/borrow

Let's say I want to deposit ETH or sUSDe to borrow USDC or USDT. Is there an overview site for borrowing rates?