David Jeong

@davidyjeong

ceo @tread_fi, ex-vp quant research @morganstanley, comp sci @uwaterloo

Who's who of Order Book Depth Charts Understanding the players behind the liquidity posted on LOBs 🧵

every project founding team should be on an episode of deal or not deal for the followers to know what they’re really about

technical analysis is the horoscopes of trading, but when stuff like this happens, i can only whip out the tarot cards

in no other asset class do traders have to figure out which exchange to send their order just choose: what, how much, when and we figure out the nuanced: how to best trade the order for our upcoming DEX product, we are partnering with OKX DEX to provide the best routing tools…

MEV protection and transaction simulation are two of the most requested features on our DEX API and we've heard your requests! With the Onchain Gateway Broadcast Transaction API, your transactions are now proactively shielded from malicious MEV exploits. With the Transaction…

$185M+ volume in a single day. $100M+ avg daily volume. The best traders are finding us, and they're staying. app.tread.fi

if you understand that the korean stock market is the biggest retail % vs institutional in the world AND crypto perps don't exist in korea then you can begin to understand why korea runs spot and therefore crypto prices 🇰🇷 koreatimes.co.kr/economy/202311…

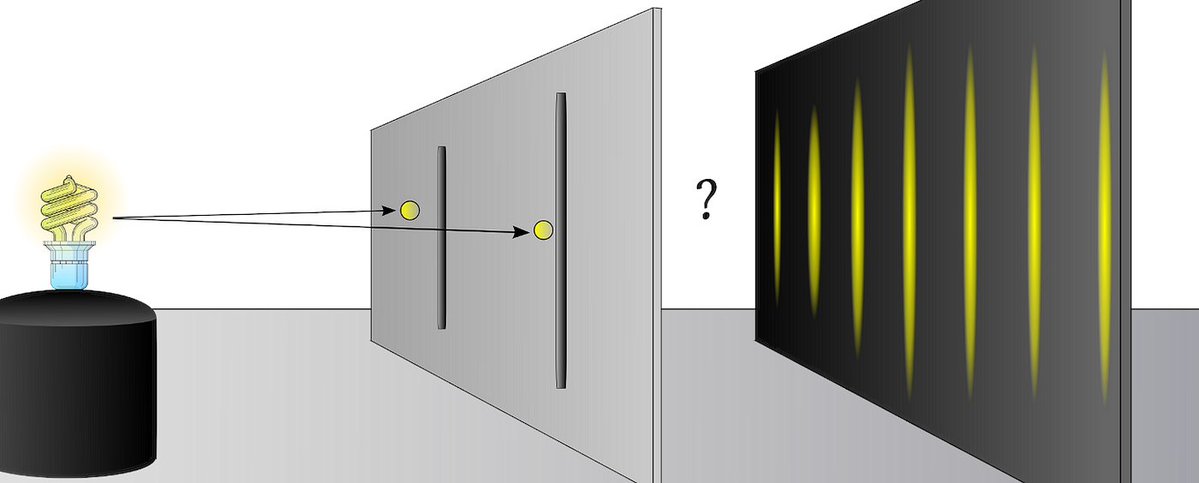

a market order is a particle, one guaranteed result a VWAP is a wave, a range of results the main difference is, you always pay taker fees + slippage on market orders

chatGPT agrees with me too much, leading me to become arrogant what's a good preprompt, so it tells me if I am doing something stupid

Behind your every order. tread's engine, in a microsecond duel for the best fill.

Execution costs = Fees + Spreads + Slippage That should be your all in cost of trading. Not just "zero" fees --> best.. Unless you have no brain. Retardio

Today I decided to compare major Exchanges and Perp DEXs, specifically their trading fees To make things easier, I used a $1M trade volume as the baseline so you can better estimate your potential costs: • Hyperliquid - $450 • Lighter - $0 • DyDX - $450 • GMX - $500 •…

this is so bullish for spot crypto offered in 401k and ROTH IRAs

So fucking annoyed about $GLXY Wanted to buy some w my pension right at the lows, even sold some nasdaq for it... then realised pension provider doesn't offer it Wanted to full port my fiancee's pension into it too right at the lows.... her provider doesn't offer it either…

If you worry less about slippage and fees, you can - make bigger bets on majors - trade alt-coins with size - trade more frequently without getting chipped to 0 by fees

You won't find many trading terminals with as much volume as us. Hedge funds trust us to execute $100M+ of volume daily. Worried about slippage? Don't use market or limit orders. Be like them and use VWAPs and POV based orders. app.tread.fi